Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2024

Week Ahead Economic Preview: Week of 8 July 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US, China inflation, UK GDP and Fed comments in view

Inflation data due from the US and mainland China are in the spotlight, alongside monthly UK GDP data in the coming week. Additionally, Fed Powell's testimony will be watched for potential insights into the US monetary policy outlook. Central bank meetings are also set to unfold in New Zealand, South Korea and Malaysia. The June S&P Global Investment Manager Index will meanwhile offer insights into financial market sentiment, and the Global Business Outlook survey will reveal corporate expectations for the year ahead.

Updated US CPI will shed light on whether further progress has been made in the Fed's fight against inflation, with early PMI releases for June having alluded to easing output price inflation midway through 2024. The current consensus is for CPI to rise just 0.1% on the month after a flat reading in May, which would take the annual rate down from 3.3% to 3.1%, and for the core to hold at 0.2% (keeping the annual core rate unchanged at 3.45). Any surprise to the downside is expected to provide a boost for risk sentiment, which we will be tracking via the July Investment Manager Index (IMI). Additionally, Fed chair Jerome Powell is slated for further appearances with his testimony to the US Senate. Insights into the monetary policy outlook will again be sought with Fed appearances through the week.

Inflation and factory gate prices in mainland China will also be closely watched in the new week for the signs of rising prices, notably in the manufacturing sector, after annual CPI inflation came in at just 0.3% in May. This comes after the Caixin China General Manufacturing PMI showed that input prices rose at the fastest pace since June 2022, resulting in the first increase in output prices in the year-to-date. Mainland China's trade numbers will also be released over the weekend, against a mixed backdrop of goods export growth according to PMI indications. Globally, exports fell for the first time in three months according to findings from the Global Manufacturing PMI, though exports from China have now risen throughout the past six months.

Finally, the UK publishes GDP data for May, albeit having been preceded by PMI readings outlining a slowing of growth in the two months to June. Prior data showed GDP up 0.7% in the three months to April.

Global growth dips on political uncertainty

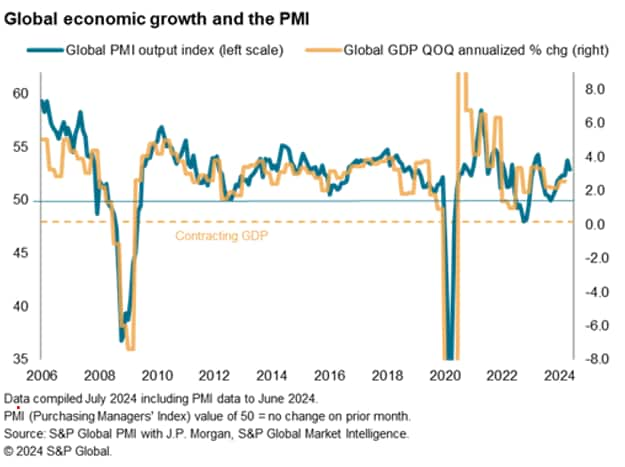

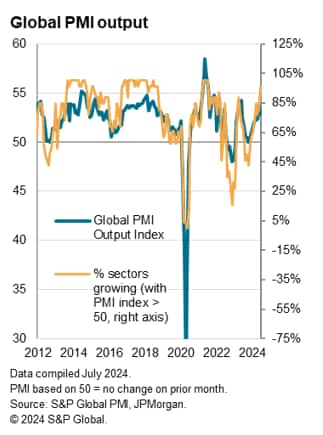

Global economic growth slowed in June but remained the second-strongest seen for just over a year, according to PMI data, pointing to a further robust expansion in the second quarter of 2024 after the slowdown seen in late 2023. The headline JPMorgan PMI, covering manufacturing and services in over 40 economies, fell from 53.7 in May to 52.9. June saw a further slight acceleration of growth in the US, bucking a broader developed world slowdown, while India continued to lead the emerging markets by a wide margin.

Although losing some momentum, it was encouraging to see the global expansion become more broad-based, with all 26 sub-sectors covered by the PMI reporting stable or rising output for the first time in three years.

However, business expectations for the year ahead fell to the lowest for seven months, in part linked to political uncertainty surrounding elections in India, the UK and France, as well as upcoming presidential election in the US. Some of this slowdown may be temporary, depending on election outcomes, but the pull-back in sentiment is a reminder of how the political environment could curb economic growth in the second half of the year.

Key diary events

Monday 8 Jul

Japan Current Account (May)

Australia Home Loans (May)

Germany Trade (May)

Canada Average Hourly Wages (Jun)

United States Consumer Inflation Expectations (Jun)

United Kingdom KPMG/REC Report on Jobs* (Jun)

Tuesday 9 Jul

Australia Westpac, NAB Confidence Indices (Jun)

Taiwan Trade (Jun)

Mexico Inflation (Jun)

Mexico Consumer Confidence (Jun)

United States Fed Powell Testimony

S&P Global Investment Manager Index* (Jul)

Wednesday 10 Jul

South Korea Unemployment Rate (Jun)

Japan PPI (Jun)

China (Mainland) CPI, PPI (Jun)

New Zealand RBNZ Interest Rate Decision

Norway Inflation (Jun)

Turkey Industrial Production (May)

Italy Industrial Production (May)

Brazil Inflation (Jun)

United States Wholesale Inventories (May)

S&P Global Business Outlook* (Jun)

Thursday 11 Jul

Japan Machinery Orders (May)

South Korea BoK Interest Rate Decision

China (Mainland) M2, New Yuan Loans, Loan Growth (Jun)

Germany Inflation (Jun, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (May)

Brazil Retail Sales (May)

United States CPI (Jun)

United States Monthly Budget Statement (Jun)

Friday 12 Jul

Singapore GDP (Q2, adv.)

Japan Industrial Production (May, final)

France Inflation (Jun, final)

India Industrial Production (May)

India Inflation (Jun)

Mexico Industrial Production (May)

United States PPI (Jun)

United UoM Sentiment (Jul, prelim)

Brazil Business Confidence (Jul)

Global GEP Supply Chain Volatility Index* (Jun)

Saturday 13 Jul

China (Mainland) Trade (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed Powell testimony, US CPI, UoM sentiment, Brazil and Mexico inflation

Data highlights in the fresh week include US inflation via the CPI, for which the consensus points to a further easing of inflationary pressures in June. This follows the release of US PMI data which showed companies' selling prices rising at a slower pace compared to May, notably cooling in the service sector. US producer price data are also released on Friday.

Additionally, Fed Chair Jerome Powell is scheduled to give his semi-annual testimony on monetary policy on July 9 to the Senate Banking Committee. Insights into the interest rate outlook remain in focus, especially after the Fed chair hinted at progress on inflation in his early July speech, but kept quiet on when they are likely to move.

EMEA: UK output, Germany trade, inflation

The UK publishes GDP data for May. This follows indications of another solid expansion in economy activity according to the S&P Global UK PMI for May, albeit at a slower pace compared to April with a further slowing noted in June. With price rises also intensifying in June, the latest PMI data offer some conflicting signals to policymakers waiting to lower rates. Rate setter will also be keen to assess the updated recruitment industry survey data, which is watched closely by the Bank of England for changing labour market conditions.

APAC: RBNZ, BoK, BNM meetings, China CPI, PPI and trade data

In APAC, central bank meetings in New Zealand, South Korea and Malaysia unfold in the week, though no surprises are expected. Instead, the focus may be with economic data, the highlights being trade and inflation figures due from mainland China. In particular, the PPI reading will be watched for further signs of attempting to close the gap with CPI especially after the Caixin China General Manufacturing PMI data indicated rising price pressures.

June Investment Manager Index, Supply Chain Volatility Index and Global Business Outlook Survey

Views on the US equity market will be sought with the June S&P Global Investment Manager Index amidst new highs observed for US equity indices in the week. Risk sentiment, expected returns, sector preferences and near-term market drivers will all be assessed.

Additionally, the latest Global Supply Chain Volatility Index will be updated on Friday for insights into how supply chains are faring midway through 2024, and S&P Global releases its thrice-yearly Business Outlook Survey, the largest forward-looking poll of its kind.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-july-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-july-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+8+July+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-july-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 8 July 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-july-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+8+July+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-july-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}