Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 20, 2021

Weekly Global Market Summary Highlights: December 13-20, 2021

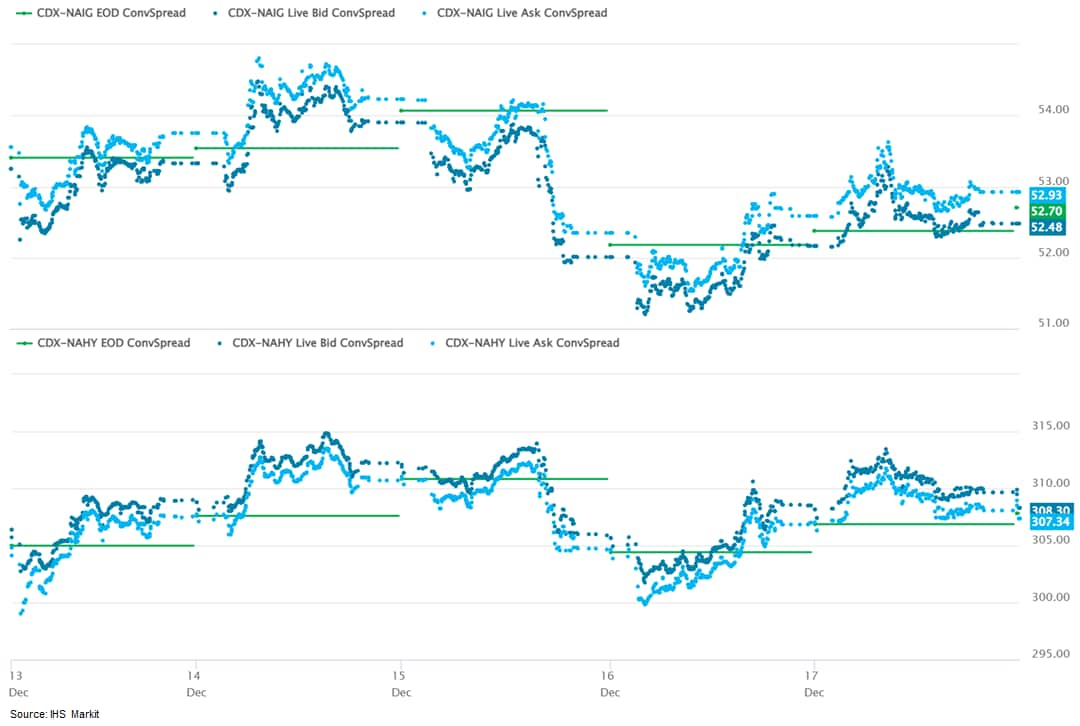

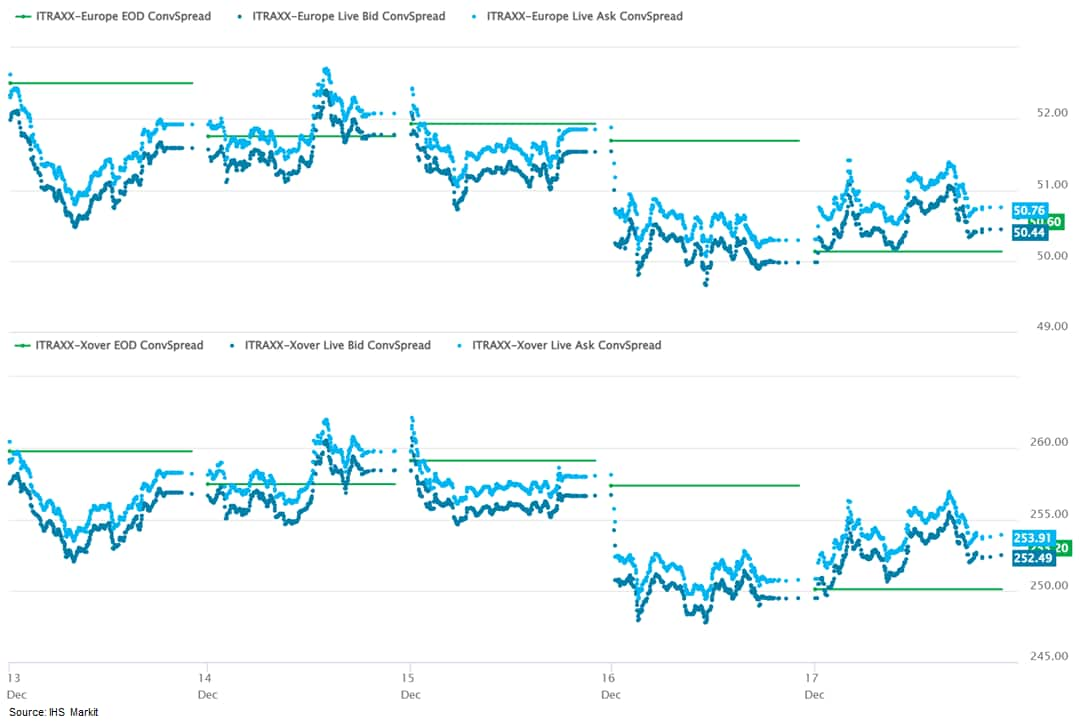

All major US and European equity indices closed lower on the week, while APAC markets were mixed. US government bonds closed higher on the week, while benchmark European bonds closed mixed. European iTraxx closed tighter on the week across IG and high yield, CDX-NAIG was flat, and CDX-NAHY was slightly wider on the week. The US dollar, gold, silver, and copper were higher on the week, while natural gas and oil were lower week-over-week.

Americas

All major US equity markets closed lower on the week; DJIA -1.7%, Russell 2000 -1.7%, S&P 500 -1.9%, and Nasdaq -2.9% week-over-week.

10yr US govt bonds closed 1.41% yield and 30yr bonds 1.81% yield, which is -8bps and -6bps week-over-week, respectively.

DXY US dollar index closed 96.57 (+0.5% WoW).

Gold closed $1,805 per troy oz (+1.1% WoW), silver closed $22.53 per troy oz (+1.5% WoW), and copper closed $4.30 per pound (+0.2% WoW).

Crude Oil closed $70.72 per barrel (-1.3% WoW) and natural gas closed $3.69 per mmbtu (-6.0% WoW).

CDX-NAIG closed 53bps and CDX-NAHY 308bps, which is flat and

+3bps week-over-week, respectively.

EMEA

All major European equity indices closed lower; UK -0.3%, Italy -0.4%, Spain -0.6%, Germany -0.6%, and France -0.9% week-over-week.

10yr European government bonds closed mixed on the week; Italy closed -4bps, Germany -3bps, France -2bps, Spain flat, and UK +2bps week-over-week.

Brent Crude closed $73.52 per barrel (-2.2% WoW).

iTraxx-Europe closed 51bps and iTraxx-Xover 253bps, which is

-1bp and -7bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed; Japan +0.4%, South Korea +0.2%, Australia -0.7%, Mainland China -0.9%, India -3.0%, and Hong Kong -3.3% week-over-week.

Monday, December 13, 2021

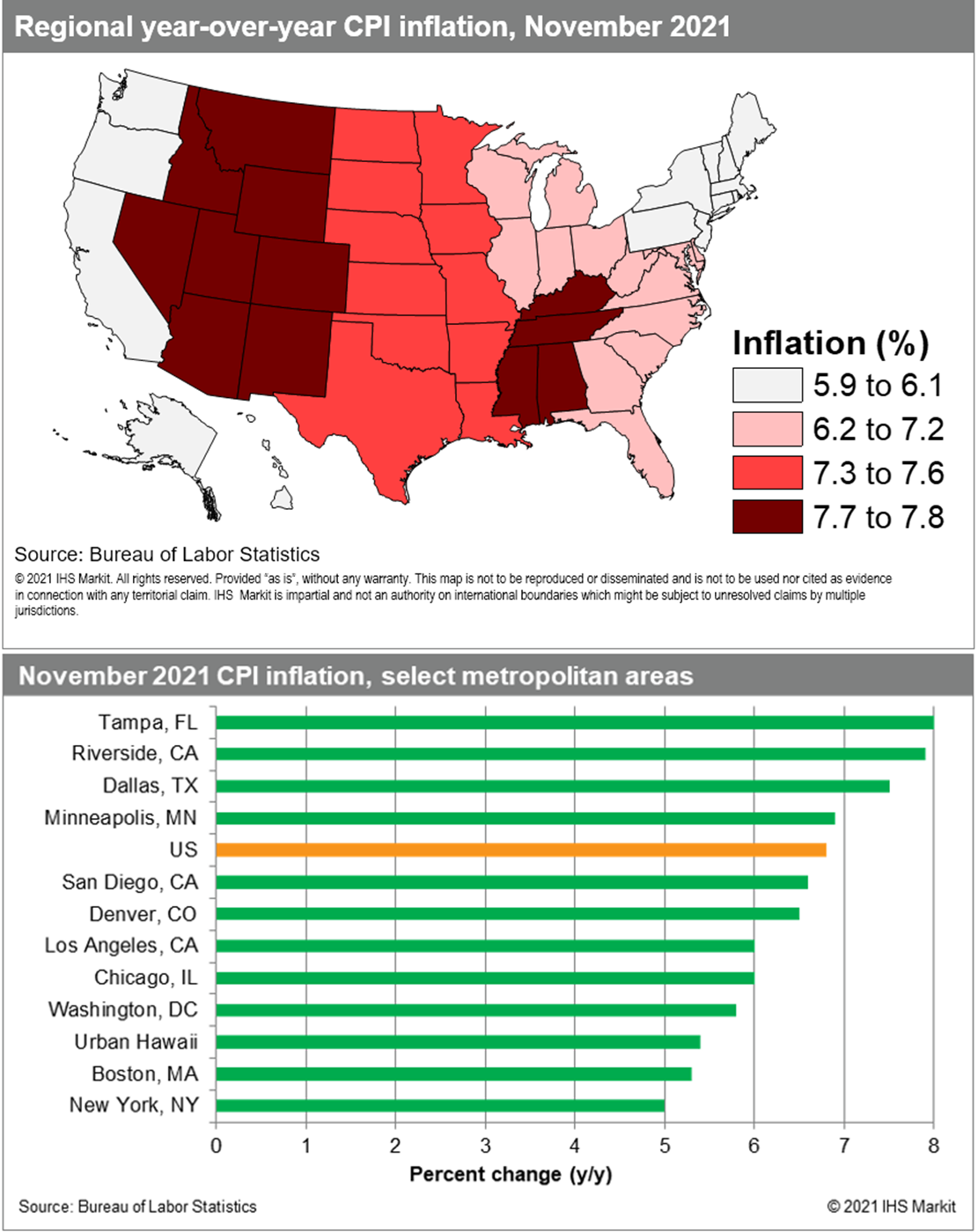

- The overall US Consumer Price Index (CPI) rose 6.8% year over

year (y/y) in November, the fastest pace since 1982. As they have

in recent months, supply chain disruptions and sharp increases in

food and energy prices continued to drive up consumer prices

nationwide. Excluding food and energy (which saw prices rise 6.1%

and 33.3% y/y, respectively), the core CPI rose 4.9% y/y in

November, with a 19.2% increase in transportation costs (excluding

gasoline) and a 3.8% rise in shelter prices driving topline growth.

(IHS Markit Economist Francis Hagarty)

- Regionally, prices rose most rapidly in the Plains and South. The East South Central region experienced the greatest surge, 7.8% y/y in November, with the Mountain and West North Central regions not far behind at 7.7% and 7.6%, respectively. The states in these regions are less densely populated than other parts of the country, and consequently their residents are among the most car-dependent for transportation given longer commuting distances and fewer public transit options. Because of this outsized car reliance compared with the rest of the country, transportation costs have above-average weights in the respective CPI baskets of these regions, meaning the 58% y/y surge in gas prices in November, and 18.4% jump in vehicle prices, also had an outsized impact.

- The Northeast and Pacific states saw lower CPI inflation than the nation overall in November. The consumer indices in these regions are less influenced by the steep rise in transportation costs and more heavily weighted toward services, which saw prices grow a more modest 3.8% y/y in November. Shelter costs increased less steeply than average in these areas as well, growing 3.1% in the Northeast and 2.3% y/y in the Pacific compared with the 3.8% increase seen nationally.

- Among the metropolitan areas with consumer prices indices

measured by the Bureau of Labor Statistics (BLS), recent CPI

inflation has been highest in fast-growing cities with competitive

housing markets, with Tampa, Riverside, and Dallas seeing

exceptional price level increases of at least 7.5% y/y in November.

Among the 12 metropolitan areas reported by the BLS in November,

these three cities also saw the largest rise in housing prices

compared with year-earlier levels. While November data is not

available for Atlanta and Phoenix, they had experienced similar

above-average CPI inflation through October, driven by sizable

increases in housing costs.

- The use of robotics in food and beverage manufacturing is

increasing. This is the observation of ING Bank in its article

'Robots extend reach in the food industry', based largely on

research by the International Federation of Robotics (IFR). The IFR

forecasts that new robot installations across all industries will

increase by 6% per year in the coming three years. (IHS Markit Food

and Agricultural Commodities' Julian Gale)

- Food manufacturing is expected to contribute to this growth. It is likely that not only the number but also the diversity of robots in food processing plants will become greater.

- The total global operational stock of robots grew by 8,600 in 2020, according to the latest data from the IFR. As a result of the continuous growth, robot stock has almost doubled since 2014. Most of the newly installed robots among food manufacturers in 2020 was destined for the EU (27%), China (26%) and the US (22%). While robots are becoming more common in food manufacturing, their presence is limited to a minority of businesses with, for example, only one in 10 food producers in the EU currently making use of robots.

- In 2020, food manufacturers in the US employed on average 89 robots per 10,000 employees, compared with 75 in the EU-27 in 2020. However, within the EU there are considerable differences between countries with robots being much more common in countries such as the Netherlands, Denmark, Sweden and Italy.

- The rise of robotics in the food industry is not limited to the industrial robots in food manufacturing. According to IFR data, more than 7,000 agricultural robots were sold in 2020, an increase of 3% compared with 2019. Within agriculture, milking robots are the biggest category but only a fraction of all cows in the world are milked this way. Moreover, there is a lot of activity around robots that can harvest fruit or vegetables.

- In a new guidance issued to US embassies on 10 December, the

Biden administration has outlined a policy that "rules out" US

government discussion or support of new unabated or partially

abated coal generation projects worldwide also restricts engagement

on some natural gas projects, and this has raised concern in the

LNG export industry. The guidance takes effect immediately. (IHS

Markit PointLogic's Kevin Adler)

- The message to the embassies describes the document as an interim guidance that builds on Biden's Executive Order 14008 on 27 January 2021 that "promotes ending international financing of carbon-intensive fossil-fuel based energy" and "intensifying international collaborations to drive innovation and deployment of clean energy technologies."

- "The Interim Guidance seems, on initial review, to be what we have been expecting since it was first announced right after the Inauguration—a tightening of the rules on fossil fuel engagement abroad with some limited exceptions," said Fred Hutchison, president of LNG Allies, in an email. "However, as is true with any broad guidance document, it is tough to judge how this will affect foreign LNG and natural gas infrastructure development until specific projects are brought forward for US government support."

- The LNG industry has benefited from government support such as loan guarantees for LNG import terminals and funding of feasibility studies in other countries to assess the use of natural gas to meet energy and environmental needs.

- The guidance covers any engagement in which US government expenditure is more than $250,000.

- Brazilian digital bank Nubank raised USD2.6 billion in its

initial public offering (IPO) in the New York Stock Exchange (NYSE)

on 8 December. Based on the result, Nubank would be valued by

stockholders at over USD41.5 billion, making it Latin America's

listed institution with the largest market capitalization.

According to the bank's founder, the proceeds will be used to

expand growth in the bank's branches in Mexico and Colombia. (IHS

Markit Banking Risk's

Alejandro Duran-Carrete)

- It is positive news for the Brazilian sector since it will increase competition and is likely to incentivize traditional banks to improve their digitalization strategy. However, the financial technology (fintech) sector is still at an early stage of development in Latin America and will face several challenges, especially from a regulatory and profitability standpoint, before representing a structural change to the region's banking sectors.

- Nubank has been rapidly growing in Brazil, benefiting from the large digitalization of financial customers in the country as well as from Brazil's rigid and expensive traditional banking sector.

- However, the bank has been struggling to generate substantial revenues - a relatively common feature in the fintech sphere - given its lack of credit penetration, focused almost only on credit cards. This has resulted in the bank mostly allocating its assets into securities (44.8% of its total assets as of end-2020), mostly Treasury notes, or interbank lending (18.5% of its total assets as of end-2020), which have generated low revenues. As a result, Nubank has been unable to become profitable since its creation in 2013.

- Additionally, traditional banks are likely to deter the entrance of new competitors through the acquisition of rising fintech banks or through the push for a tighter regulatory framework, as in the case of Argentina (see Argentina: 23 July 2021: Increasing tensions between banks and fintech to contain diversification within Argentine banking sector). These moves would result in either a segregated and small fintech sector or a banking sector similar to what IHS Markit has observed in the region, but with some digital services for operational improvement.

- China's Shaoxing City locked down its Shangyu District

unexpectedly on Dec. 10 to conduct large-scale COVID-19 tests,

sources told OPIS over the weekend. Shangyu District was locked

down last Friday, after Shaoxing City declared its highest level of

emergency Covid response on Thursday, said sources from nearby

Ningbo and Hangzhou cities. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- There are no known polyester or upstream plants in Shangyu District.

- Shaoxing City is home to Reignwood, a 3.2 million mt/yr purified terephthalic acid (PTA) producer. The company's main 1.4 million mt/yr unit shut on March 6 this year for maintenance, but never restarted. It also has three lines with 600,000 mt/yr each, but these have idled for years.

- Polyester plants based in Shaoxing City include Guxiandao, Hengming, Jiabao, Jinxin, Juxing, Luyu, Guxiandao, Rongsheng, Tiansheng and Yongsheng. These account for around 7% of China's total 62 million mt/yr production.

- Keqiao and Binhai Districts in Shaoxing host crucial downstream printing and dyeing mills. These have not been locked down, but are impacted by the city-wide emergency measures and could suffer logistical problems.

Tuesday, December 14, 2021

- US producer prices for final demand increased 0.8% in November

and rose 9.6% from a year earlier. All six major components scored

large gains, with trade and other services with the weakest gains

at 0.6%. Energy, up over 10.0% in just the past three months, led

the pack with a 2.6% increase. (IHS Markit Economist Michael

Montgomery)

- Final demand prices for services grew 0.7% in November, that component's largest gain since July. Transportation and warehousing prices climbed 1.9% but the October increase was revised lower. The other services complex as well as trade scored 0.6% gains.

- The rise in energy prices was dominated by natural gas with a 2.0% gain and gasoline up 7.3%; the gasoline spike partly came from rising when it normally falls. Oil and oil product price gains were mixed outside of gasoline. Since crude costs have fallen gasoline prices should fall in December, but that would be cold comfort to drivers who saw wholesale gas prices double that of a year earlier in November.

- Bottom line: Inflationary pressures persisted once again and will continue to persist so long as the supply chain is in shambles and energy and food prices are running wild. The price increases have become both chronic and large, with few companies deferring small increases to the end or middle of the year because the gains are no longer small. It will take more than a small change to break price expectations in business, but gains can slowly moderate.

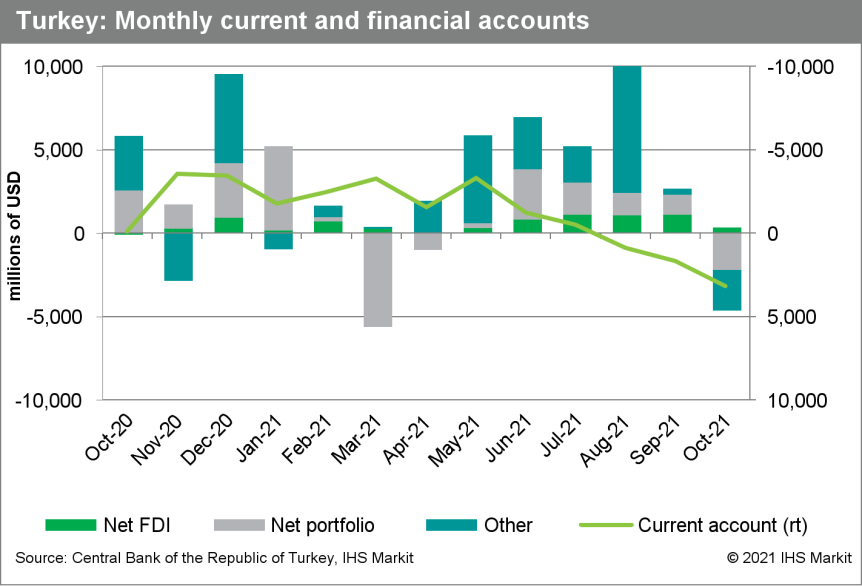

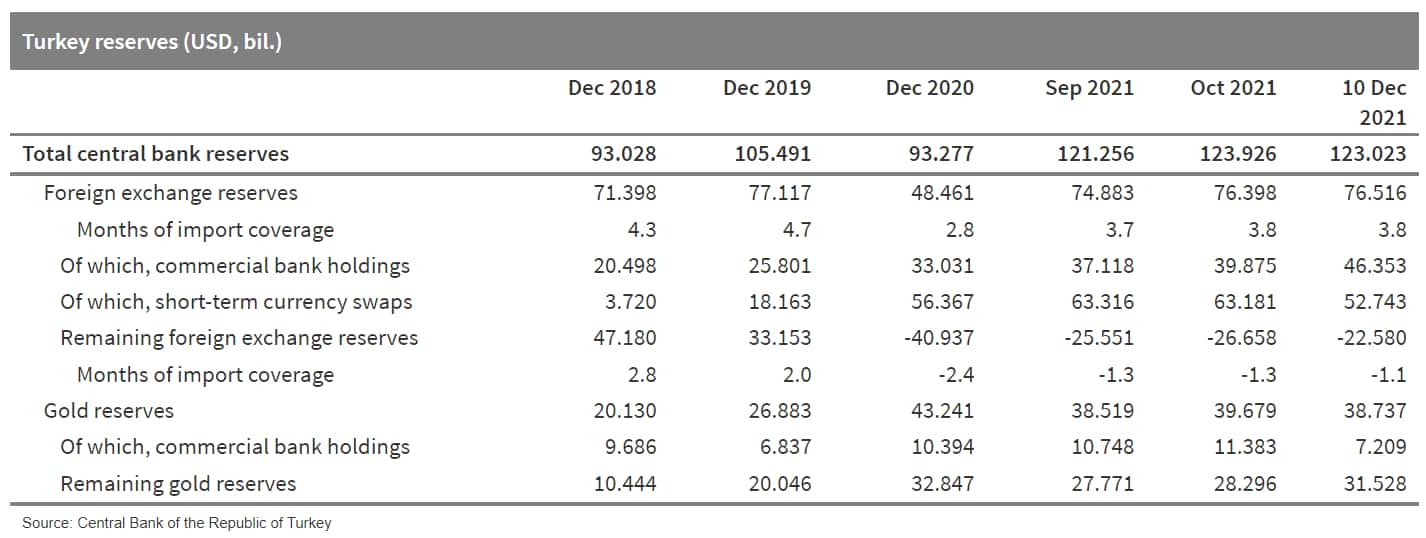

- The lira's sharp losses contributed to the largest

current-account surplus in a single month in Turkey. However, net

outflows of portfolio investment are putting downward pressure on

the currency, raising external financing questions and drawing down

foreign currency reserves. In 2022, the current account is expected

to move back into deficit, although it will be a smaller one than

previously assumed. Net portfolio outflows will persist as long as

rate cuts continue. (IHS Markit Economist Andrew

Birch)

- For the third consecutive month, Turkey posted a current-account surplus in October 2021 according to data from the Central Bank of the Republic of Turkey (TCMB). In October, the surplus of USD3.156 billion was the largest in a single month in the country's history.

- The sharp lira fall has improved Turkish export competitiveness, contributing to a 34.1% year-on-year (y/y) increase in merchandise trade growth in January-October 2021. Meanwhile, the recovery in tourism service exports in 2021 - although they remain well below pre-pandemic levels - led to a 61.9% y/y surge of total service exports in that same period.

- The historically large surplus in October cut the 10-month 2021 cumulative deficit to just USD8.426 billion, down more than USD20 billion from the same period a year earlier. Along with the improved merchandise and service balances, Turkey received net transfer inflows due to bilateral aid to support the TCMB in its efforts to stabilize the lira. Government net inward transfers reached nearly USD500 million, up from just USD65 million in 2020.

- In the financial account, however, Turkey's net portfolio

investments turned outward in October, reaching USD2.2 billion.

Portfolio investment was outward on a net basis for the first time

since April. The beginning of the TCMB's rate-cutting cycle at the

end of September prompted a sharp outflow of bank debt security

investments as returns on investments fell with the rate cuts. The

sharp lira losses in October reflected the shifting flow of net

capital.

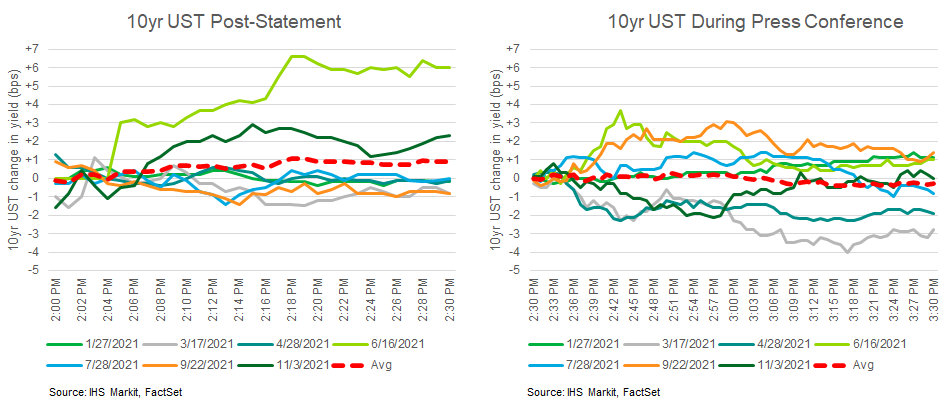

- The below graphs show the intraday reaction of 10yr US

government bonds to the FOMC post-meeting statement and Fed

Chairman Powell's press conference during each of the 2021 FOMC

Meetings. 10yr UST's rallied during the first 28 minutes of the 3

November press conference (dark green line) before changing course

to end the press conference lower after already selling off 2bps

post-statement.

- On December 14, Shell New Energies US LLC, a subsidiary of

Royal Dutch Shell plc, announced that it has signed an agreement to

buy 100% of Savion LLC, a utility-scale solar and energy storage

developer in the US, from Macquarie's Green Investment Group. (IHS

Markit PointLogic's Barry Cassell)

- "Savion's significant asset pipeline, highly experienced team, and proven success as a renewable energy project developer make it a compelling fit for Shell's growing integrated power business," said Wael Sawan, Integrated Gas and Renewables & Energy Solutions Director. "As one of the fastest-growing, lowest-cost renewable energy sources, solar power is a critical element of our renewables portfolio as we accelerate our drive to net zero."

- Savion specializes in developing solar power and energy storage projects and currently has more than 18 GW of solar power and battery storage under development for a variety of customers, including utilities and major commercial and industrial organizations. It has over 100 projects under development in 26 states. The acquisition is expected to close by year end.

- The Savion acquisition bolsters Shell's strategy to develop an integrated power business as it moves to become a net-zero emissions energy business by 2050. As part of this strategy, Shell aims to sell more than 560 terawatt hours of power globally per year by 2030, which us twice as much electricity as the company sells today.

- Savion's acquisition will expand Shell's existing solar and energy storage portfolio, where Shell holds interest in developers such as Silicon Ranch Corp. in the US. Savion is based in Kansas City, Missouri, and currently employs 126 staff.

- United Airlines has become the largest airline in the world to

invest in hydrogen-fueled electric engines that manufacturer

ZeroAvia is developing for regional aircraft that can carry fewer

than 100 passengers. (IHS Markit Net-Zero Business Daily's Amena

Saiyid)

- The Chicago-based airline's announcement came less than a fortnight after it demonstrated that sustainable aviation fuels made from woody waste and renewable feedstock can be used in commercial airplanes without any operational problems.

- Through a new equity stake in ZeroAvia, United said it had agreed to a conditional purchase of 100 aircraft engines known as ZA2000. These engines would be powered by 100% hydrogen fuel cells and capable of producing between 2,000 and 5,000 kilowatts of power with a 500-mile range.

- Hydrogen-electric engines use electricity created by a chemical reaction in a fuel cell to power an electric motor instead of burning a fossil fuel. Because no fuel is burned, there are no climate-harming emissions or carbon released into the atmosphere when the engines operate.

- United's aim is to retrofit its regional jet fleet with ZeroAvia's hydrogen powertrains as early as 2028, placing it squarely on its net-zero path. This includes plans to halve its carbon intensity compared with 2019 by 2035.

- Following US lawmakers' approval last month of USD7.5 billion in funding for a national network of electric vehicle (EV) chargers, US Joe Biden's administration released yesterday (13 December) an 'Electric Vehicle Charging Action Plan' for deploying the funds and enabling the process. According to a document released by the White House, the plan includes establishing a Joint Office of Energy and Transportation. The aim of the new office is to ensure the Department of Transportation (DOT) and the Department of Energy (DOE) work together on implementing the charging network plan and other electrification provisions in the administration's infrastructure law, as well as to co-ordinate the federal strategy and the provision of resources to states, communities, and industry. In addition, the White House intends to publish guidance and standards for states and local governments relative to EV charger deployment no later than 11 February 2022. The administration says that it is already working on the guidance, which will cover where states and cities need to "strategically deploy" EV charging stations as part of a national network on the highway system. The guidance will also cover where there is EV charging and where it is needed, including for the disadvantaged and rural communities, and the ensuring of smart connections to the electric grid. In addition, a new Advisory Committee on Electric Vehicles is to be appointed in the first quarter of 2022, after "convening a series of initial stakeholder meetings" to cover partnerships with state and local government, domestic manufacturing, equity and environmental justice, civil rights, and partnering with tribal communities and others. In addition, no later than 13 May 2022, the US administration intends to publish standards for EV chargers to ensure safety, reliability, and accessibility. The administration has a key target of ensuring that as much of the EV charging network as possible is produced in the US. To meet that goal, the DOT and the DOE have requested information from manufacturers, automakers, and labor representatives. The new plan includes further efforts to support US battery manufacturing, including on raw materials sourcing and recycling. The investment plan in a more-robust EV charging network is significant in terms of the amount of money involved, but also because the objectives include creating a network that is more consistent than currently. Developing the charging infrastructure necessary to support a transition to EVs is not something automakers are positioned to take on themselves, despite Tesla's Supercharger network. A robust system will need both public and private investment. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Volkswagen (VW) Group will create a new separate company to host its European battery business, and it will also invest EUR2 billion in its German battery hub which will be based in Salzgitter. The Salzgitter site, which already hosts VW's main battery R&D center and is the location for an already announced battery Gigafactory that is under construction, will be rolled into the new company which will be headquartered there. The company's scope will include 'developing new business models based around reusing discarded car batteries and recycling the valuable raw materials', in addition to battery production, R&D and raw material processing. The site will combine development, planning and production functions control in one location, and will thus become the VW Group's battery center. VW is making a clear investment in its future in the creation of this company with this announcement fleshing out the battery information from last week's planning round announcement. Europe's largest carmaker is looking to control the supply chain and value chain of the batteries that it is using in its massive ramp up in its electric vehicle (EV) range, with the automotive semiconductor supply shortage showing only too starkly how vulnerable OEMs are in terms of their reliance on outside suppliers and supply chain disruption. The aim is to create a futureproof structure and organization that VW has control over and which will act as the foundation to the company's BEV push. As previously announced, VW is planning to add four more Gigafactories in Europe by the end of 2030 to complement the two already announced in Salzgitter and Skellefteå. (IHS Markit AutoIntelligence's Tim Urquhart)

Wednesday, December 15, 2021

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (15 December). As widely expected, the Committee announced that it will accelerate the taper of its bond purchases according to a revised plan that will see purchases fall to zero in the second half of March 2022. It announced no change to interest rates but altered forward guidance for interest rates. Updated guidance, changes to the characterization of inflation—the word "transitory" was eliminated from the post-meeting statement—and revised forecasts suggest a majority of FOMC participants anticipate that it will become appropriate to raise the federal funds rate target around mid-2022, earlier than IHS Markit analysts' assumption for a September "lift-off." (IHS Markit Economists Ken Matheny and Lawrence Nelson)

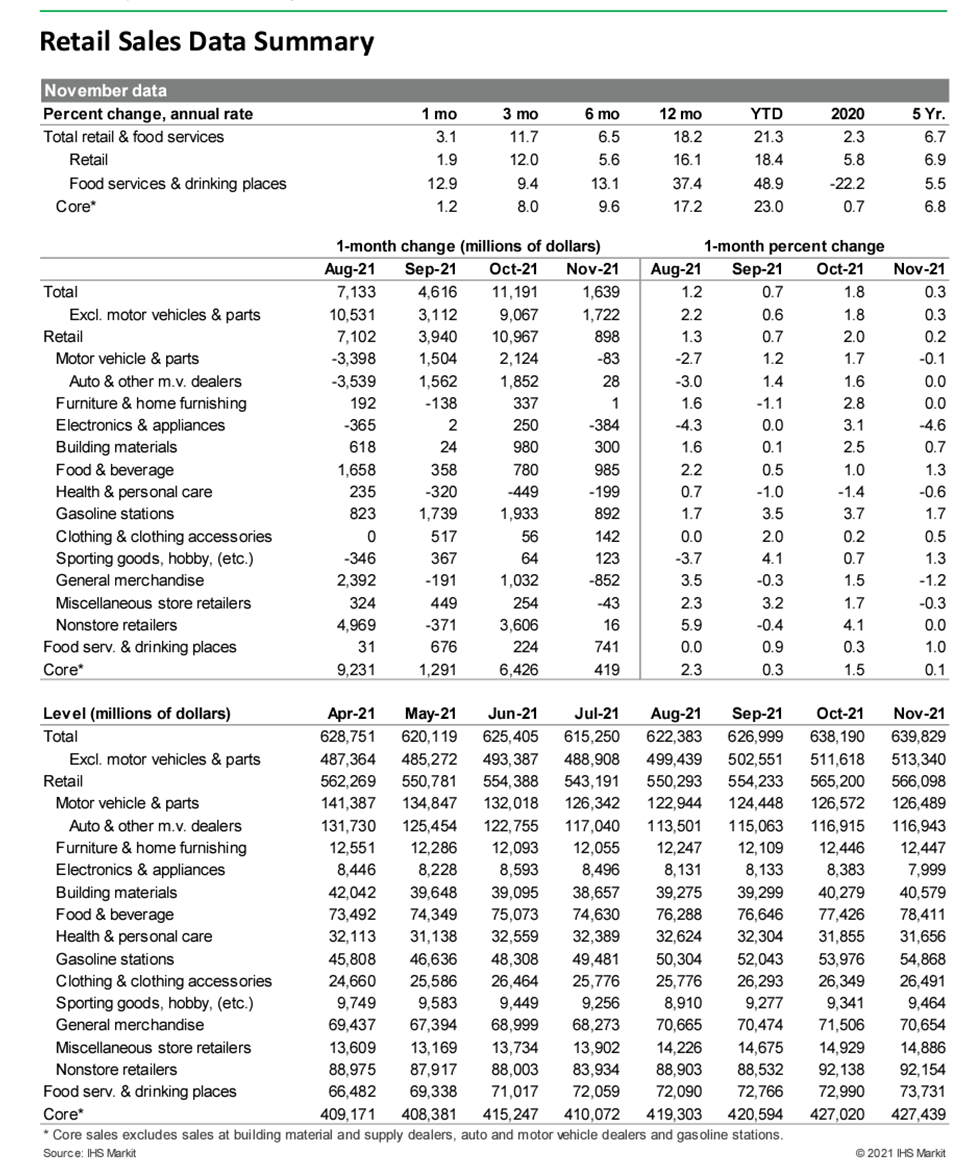

- US total retail trade and food services sales rose 0.3% in

November. Expectations were for a considerably larger gain.

Nonautomotive sales were also up 0.3% in November, while core sales

rose only 0.1%. (IHS Markit Economists Ben

Herzon and William Magee)

- Unexpected weakness in sales in November likely was due to early holiday shopping, as news reports of supply chain issues and delays in shipping probably shifted some sales that otherwise would have occurred in November forward into October.

- This likely occurred at electronics and appliance stores and general merchandise stores. Sales in both categories were solid in October (up 3.1% and up 1.5%, respectively) and weak in November (down 4.6% and down 1.2%).

- Another factor in play is a "renormalization" of the composition of consumer spending back toward services (away from goods). In recent forecasts, we have been assuming a slowing in spending on goods in the current timeframe; we may be seeing the leading edge of this renormalization now.

- There were some winners in this morning's report: gasoline stations (up 1.7%), food and beverage stores (up 1.3%), and the sporting-goods group of stores (up 1.3%).

- Both gasoline stations and grocery stores saw large price gains in November. These are categories of spending that generally are not deterred, in the short term, by firming prices—people need food and gasoline—helping to account for the strength in sales in November.

- Despite the soft report, most fundamentals (wages and net

worth) remain supportive of consumer spending, but weakness in

sentiment currently is a risk for the consumer sector.

- The Office for National Statistics (ONS) has reported that the

UK's 12-month rate of consumer price index (CPI) inflation

increased from 4.2% in October to 5.1% in November, the highest

rate since September 2011. (IHS Markit Economist Raj

Badiani)

- During 2020 and 2021, CPI inflation averaged 0.9% and an estimated 2.5%, respectively.

- Meanwhile, the CPI including owner-occupiers' housing costs (the CPIH) rose by 4.6% in the 12 months to November, up from 3.8% in October.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 28.5% year on year (y/y), the eighth successive double-digit increase. This was in line with global crude oil prices rising by 90% y/y to average USD81 per barrel (pb) in November, the 11th successive y/y gain.

- In addition, gasoline (petrol) prices also rose by 33.2 pence y/y to a historical high of 145.8 pence per liter.

- The ONS also reported a further rise in household energy bills during November after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Natural gas and electricity prices increased by 26.1% y/y and 18.8% y/y, respectively.

- Meanwhile, restaurant and café prices increased by 5.2% y/y in November, compared with a gain of 6.3% y/y in October.

- Food prices rose at a brisker rate, increasing by 2.4% y/y in November from 1.1% y/y in October.

- A further rise in second-hand car prices occurred during November, of 27.1% y/y, because of the shortage of semiconductor chips disrupting production of new vehicles.

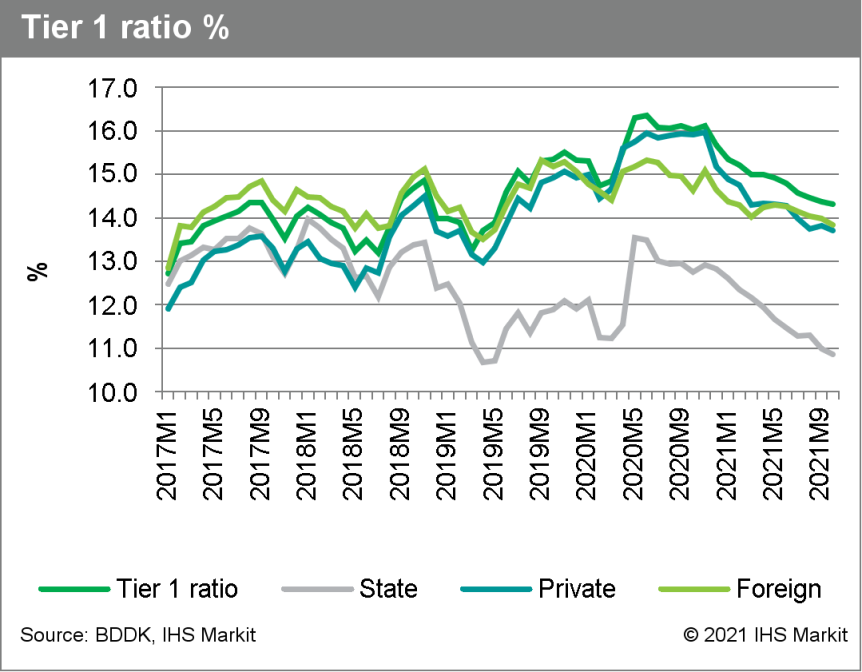

- Turkey's state-owned banks have hinted that they may need

TRY60-70 billion (USD4.2-5 billion) of additional capital to boost

lending to the economy and could need as much as TRY100 billion,

Ahval News reports. The comments were reportedly made during a

meeting between President Recep Tayyip Erdoğan, Turkey's finance

minister, and top bankers on Monday (13 December). The issue

regarding private and foreign-owned banks charging higher interest

rates was also reportedly discussed; state-owned banks are

currently offering loans to businesses at a rate of around 15.75%,

compared with a close to 20% rate charged by other banks. (IHS

Markit Banking Risk's Alyssa

Grzelak)

- After nearly eight years of above average credit growth, state-owned banks have been expanding loan books at a slower pace compared with private and foreign-owned banks for the last seven months.

- As noted previously, lower capital buffers, particularly lower tier-1 ratios, are weighing on state-owned banks' ability to maintain the kind of robust credit growth that has prevailed over the last five years.

- The average tier-1 ratio reported for state-owned banks by the Banking Regulation and Supervision Agency (Bankacılık Düzenleme ve Denetleme Kurumu: BDDK) was just below 11% - a more than 250-basis-point decline from just after the government's last round of capital injection in mid-2020. This also compared with a tier-1 ratio of about 14% that was reported for both private and foreign-owned banks.

- With profitability among the largest state-owned banks

remaining well below the sector average and capital buffers at a

smaller margin above requirements than private and foreign-owned

peers, IHS Markit assesses that another round of capital injection

is likely over the next six months.

- FDA's new report on 2020 sales of antimicrobials for

food-producing animals shows a 3% drop between 2019 and

2020—largely driven by a reduction in tetracycline

sales—and the drop amounts to a 38% decrease since 2015. There

are limitations to the data, FDA pointed out, as sales numbers do

not indicate how the drugs are actually used in animals. Because

the majority of antimicrobials used in animal feed are approved for

multiple indications, it is not entirely certain how the drugs are

administered. And the data collected on animal drug sales does not

indicate whether the drug is used; for example, a veterinarian may

purchase drugs but never actually administer them to animals. (IHS

Markit Food and Agricultural Policy's Joan Murphy)

- Published every year, the 49-page report charts the sales and distribution for FDA-approved antimicrobials by drug class, medical importance, route of administration, indication and dispensing status, as well as species-specific estimates.

- FDA views charting sales volume over time as a valuable indicator of market changes, even though it does not reflect actual usage of the medications. According to the report released on December 14, domestic sales of medically important antimicrobials approved for use in food-producing animals decreased by 3% from 2019 to 2020, and sales of tetracyclines, which represents the largest volume of domestic sales (3,948,745 kg in 2020), dropped by 4%.

- Last year's report showed an uptick in sales by 3% between 2018 and 2019 when the agency said it expected some increases as a large number of medically important antimicrobials were transitioned from over-the-counter status to requiring veterinary oversight at the beginning of 2017.

- In the new report, FDA breaks down sales and distribution by species, with 41% of the antimicrobials earmarked for cattle, 41% for swine, 12% for turkeys, 2% for chickens and 4% for other or unknown species.

- Tetracyclines accounted for 66% of antimicrobials funneled to food-producing animals, followed by penicillins at 13%, macrolides at 7%, sulfonamides at 5%, aminoglycosides at 5%, lincosamides at 2%, cephalosporins at less than 1%, and fluoroquinolones at less than 1%.

- Cattle received some 80% of cephalosporins, 57% of sulfonamides, 54% of aminoglycosides, and 43% of tetracyclines, FDA's report found. Swine received 87% of lincosamides and 42% of macrolides. And 64% of penicillins were intended for use in turkeys.

- Ford is launching a grocery delivery pilot in southwest Detroit (Michigan, US) using autonomous vehicles (AVs), according to a company statement. The pilot, which will run for six months, is expected to provide around 10,000 pounds of fresh food to mobility-challenged senior citizens living in the area. Ford will deploy autonomous shuttles that will run along a fixed route between the Southwest Detroit Ford Resource and Engagement Center, where grocery bags will be loaded and delivered to residents participating in the program. There will be a safety driver on board to monitor the shuttle. Residents of the Rio Vista Detroit Co-op Apartments senior living center will now receive their existing food deliveries from a complimentary program launched earlier this year by Ford Fund and Gleaners Community Food Bank. Joe Provenzano, mobility director of Ford Motor Company Fund, said, "We're constantly thinking about how to expand our reach in communities for those who don't have access to the most basic goods, like groceries or warm meals. Bringing Ford's mobility expertise together with local collaborations allows us to create innovative solutions that make communities stronger and people's lives better." Delivery services are an attractive option as one of many potential autonomous-vehicle business use cases. The expectation is that, eventually, being able to eliminate the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Iveco has signed a memorandum of understanding (MoU) with Air Liquide to develop hydrogen mobility in Europe, according to a company statement. The two companies will work towards a full partnership that will leverage the core competencies of both firms in developing hydrogen-powered medium and heavy commercial vehicle (MHCV) technology. The partners will allocate resources to study the roll-out of heavy-duty fuel-cell electric long-haul trucks coupled with the deployment of a network of renewable or low-carbon hydrogen refueling stations along the European highway network. (IHS Markit AutoIntelligence's Ian Fletcher)

Thursday, December 16, 2021

- The march to electrify buildings continues, as the New York

City Council on 15 December voted to institute a limit on emissions

from building operations for new buildings that will act as a de

facto ban on the use of heating oil and natural gas, say

proponents. (IHS Markit PointLogic's Kevin Adler)

- The bill, known as Local Law 97, passed by a vote of 40 to 7 (out of a total of 51 council members).

- It would limit CO2 emissions from new buildings to less than 25 kilograms of CO2 per million Btu. It takes effect for buildings under seven stories tall in 2023 and for taller buildings in 2027. For affordable housing, the two deadlines are 2026 and 2028.

- According to the NYC Mayor's Office of Sustainability, over 70% of the city's GHG emissions come from buildings. The city already requires private buildings over 50,000 square feet and public sector buildings over 10,000 square feet to report their energy and water consumption each year for public disclosure.

- Assuming Mayor Bill de Blasio signs the bill -- and he has been vocal in support of the law -- New York City will join San Jose, San Francisco, and Seattle with gas bans or partial bans.

- Exceptions are made for commercial kitchens, hospitals, laundromats, crematoriums, and a catch-all category of gas used "for emergency or standby power".

- During the prior day's press briefing, Federal Reserve Chair Jerome Powell reviewed the outcome of the 14-15 December meeting of the Federal Open Market Committee (FOMC), in which there was a unanimous vote to maintain the target range for the federal funds rate at 0% to ¼% and to accelerate the reduction of bond purchases according to a revised plan that will see purchases fall to zero in the second half of March. Chair Powell noted that the Committee was prepared to adjust the pace of asset purchases should the economy fail to evolve as anticipated. The more rapid reduction in asset purchases positions the FOMC to raise rates multiple times next year, sooner and more rapidly than we had previously anticipated. (IHS Markit Economists Lawrence Nelson's and Ken Matheny)

- The US housing market is ending the year on a solid note.

Housing starts jumped 11.8% (plus or minus 15.2%, not statistically

significant) in November to a 1.679 million annual rate—the

second-highest reading since January 2006. Single-family starts

soared 11.3% (plus or minus 15.8%, not statistically significant)

to a 1.173 million rate, and multifamily starts grew 12.9% to a

506,000-unit yearly rate, only the sixth time in the past 30 years

this category has crossed the 500,000 threshold. Year-to-date

housing starts through November were 24% higher than in 2019. (IHS

Markit Economist Patrick

Newport)

- Weather played a role. November was the seventh warmest and eighth driest November in the past 127 years, according to the National Oceanic and Atmospheric Administration (NOAA).

- Single-family housing permits rose 2.7% in November after a 3.3% October increase. Multifamily permits climbed 5.2% to a rock-solid 608,000-unit annual rate, the fourth time in the past 30 years this category crossed the 600,000 threshold. Total permits increased 3.6% to a 1.712 million rate.

- Builders are working on new units at a furious pace. The number of homes under construction increased to a seasonally adjusted 1.486 million in October. That is the highest total since December 1973 and partly explains why builders are finding it hard to locate labor and materials.

- Authorized but not started units are at a series high of 273,000 (data start in 2000).

- Despite steady declines from January through September and stiff headwinds (from soaring lumber and materials prices, labor shortages, a lack of skilled labor, a lack of buildable lots, and supply chain issues), total housing starts and single-family housing starts are on track for their strongest year since 2006. Multifamily starts will post their highest totals since 1986.

- The ECB has announced various changes following its December

policy meeting, including (IHS Markit Economist Ken

Wattret):

- In the first quarter of 2022, net asset purchases under the PEPP will be conducted at a slower pace than in the previous quarter.

- Net purchases under the PEPP will be discontinued at the end of March 2022.

- Net purchases under the PEPP could be resumed, if necessary, to counter negative shocks related to the pandemic.

- The reinvestment horizon for the PEPP will be extended until at least the end of 2024 (a year longer than previously).

- In the event of renewed pandemic-driven market fragmentation, PEPP reinvestments can be adjusted flexibly, including purchases of bonds issued by the Hellenic Republic "over and above rollovers of redemptions", to avoid impairment of monetary policy transmission.

- Monthly net purchases under the asset purchase programme (APP) will rise from EUR20 billion (USD22.7 billion) to EUR40 billion in the second quarter of 2022, and will then be EUR30 billion in the third quarter. From October 2022 onwards, net purchases will be maintained at a monthly pace of EUR20 billion for as long as necessary.

- The interest rates on the main refinancing operations and the marginal lending facility and the deposit facility are unchanged at 0.00%, 0.25%, and -0.50%, respectively.

- The headline and core HICP inflation projections have been revised up markedly for 2022, particularly the former, to 3.2% and 1.9%, respectively

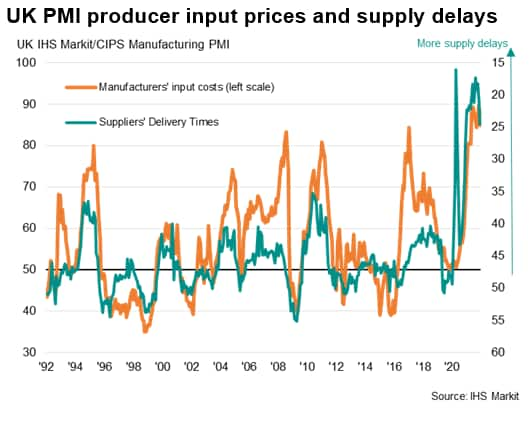

- The UK economy is ending 2021 on a disappointing note, with the

pace of growth slowing sharply in December as COVID-19 worries once

again disrupt business activity. The IHS Markit/CIPS composite PMI

output index, covering both services and manufacturing, fell from

57.6 in November to 53.2 in December, according to the early

'flash' reading, indicating the slowest rate of expansion since the

lockdowns at the start of the year. (IHS Markit Economist Chris

Williamson)

- Inflationary pressures meanwhile cooled during the month, albeit remaining elevated, attributable to the combination of the easing supply situation and weaker demand growth. Nevertheless, although down from November's record rate, the overall rate of input cost inflation measured in December was still the third highest in more than two-decades of survey history, with average prices charged for goods and services also rising at a rate unprecedented prior to September.

- The latest official data show consumer price inflation rising

to 5.1%, a breaching of the 5% level that the PMI data had signaled

ahead back in October. The latest PMI data are merely indicative of

the headline inflation rate falling to just under 5%.

- China's vehicle sales are expected to grow 5.4% year on year

(y/y) in 2022 to 27.5 million units, according to deputy

secretary-general of the China Association of Automobile

Manufacturers (CAAM), reports Gasgoo. The total vehicle sales will

include 23 million passenger vehicles (PVs), up 8% y/y, and 4.5

million commercial vehicles (CVs), down 6% y/y. In support of the

forecast, Chen cited predictions of China's GDP growth, efficient

prevention and control of the COVID-19 virus spread, and an

improvement in the semiconductor supply situation. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- The Chinese market's transition to electrification will further accelerate in 2022. According to CAAM data, new energy vehicle (NEV) sales accounted for 20.5% of total PV sales in November and 15.7% of total PV sales in the year to date (YTD). In addition, the market's shift towards EVs is driven by the increased availability of appealing EV models, rather than government subsidies.

- In the CV market, sales continued to deteriorate in November. High inventories of China V-compliant trucks remain the biggest drag on the CV market. OEMs' measures last year to clear China V-compliant trucks from inventories to prepare for the transition to the more-stringent China 6 emission standards have led to high volumes of unsold China V-compliant trucks in dealers' networks, which is dragging down sales of China 6-compliant models.

Friday, December 17, 2021

- As anticipated, the Turkish central bank cut its main policy

rates by 100 basis points on 16 December despite rising inflation

that is well above the current one-week repo rate. Predictably, the

lira's depreciation intensified immediately after the cut. Although

the central bank has indicated that this should be the last cut for

now, risks are high that President Recep Tayyip Erdoğan will force

more cuts. Already in crisis, lira losses would further intensify

should rate cuts continue, jeopardizing 2022 external obligations.

(IHS Markit Economist Andrew

Birch)

- As widely anticipated, the Central Bank of the Republic of Turkey (TCMB) cut its main policy rate, the one-week repo rate, by 100 basis points at its regularly scheduled, 16 December Monetary Policy Committee meeting. The rate now stands at 14.0%, down by 500 basis points since this current rate-cutting cycle began at the September meeting.

- Previously, TCMB Governor Şahap Kavcıoğlu had suggested that the room for further rate cutting was narrowing, leading IHS Markit to consider that this cut might have been smaller than the previous ones in the current cycle. However, since those comments, continuous rhetoric from President Recept Tayyip Erdoğan made clear that no such moderation in TCMB actions would occur in December.

- The TCMB continues to cut interest rates even as the prevailing rate of inflation remains far above the policy rate. In November, the headline consumer price inflation rate was 21.3%, now 730 basis points above the main policy rate. The core inflation rate - which, previously, Kavcıoğlu had suggested was the more important figure to consider in setting the rates - is now 360 basis points above the main policy rate, at 17.6% as of November.

- In its press release alongside the move, the Monetary Policy Committee of the TCMB stated that despite elevated inflation globally, in general, advanced economies were maintaining supportive monetary policy. The Committee ignores, however that across the emerging market economies, monetary policy has indeed begun to tighten across the board, leaving Turkey alone in moving the opposite direction.

- Once again, the Bank suggested that current inflationary pressures within Turkey were from "transitory effects of supply-side factors and factors beyond monetary policy' control". As such, the TCMB decided to make use of what it called the remaining room to make the rate cut. A narrowing current-account deficit, according to the Bank, would contribute to the slowdown of inflation in the first quarter 2022.

- The impact on the lira of the rate cuts in the face of rising

inflation and tightening monetary policy across the rest of the

emerging market world has been severe. Despite the clearly

telegraphed rate cut, the lira dropped by 3.9% against the US

dollar by the close of trading after the announcement, falling to

TRY15.23/USD1.00.

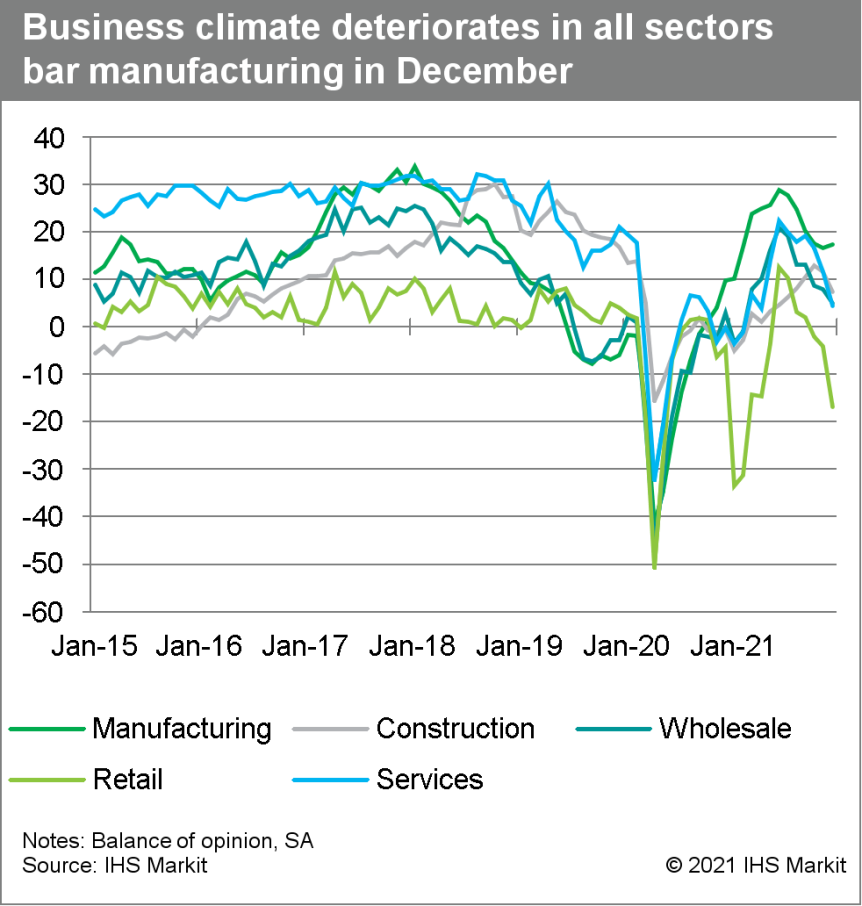

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has declined at a somewhat accelerated pace in December, from 96.6

in November to 94.7. This is the lowest level since February and

equally undershoots both the pre-pandemic level of February 2020

(96.4) and the long-term average of 97.1. The Ifo institute wryly

commented that "the German economy isn't getting any presents this

year". (IHS Markit Economist Timo

Klein)

- Business expectations have worsened only slightly less than the headline measure in December, slipping from 94.2 to an 11-month low of 92.6. This is nearly five points below the long-term average (97.5), although still well above the all-time low of 71.7 in April 2020. The retail and service sectors are the driving elements to the downside in December, although construction firms have also turned a lot more pessimistic about the next six months. Only the manufacturing sector has gone against the trend, for the second consecutive month, confirming that concerns about the persistence of supply chain issues seem to be easing somewhat. This makes itself felt in the automotive industry in particular.

- Meanwhile, the assessment of current conditions has worsened at its fastest pace since the initial pandemic shock in March-April 2020. It has fallen from 99.0 last month to a seven-month low of 96.9, which is almost even with its long-term average of 96.7 and now clearly below its pre-pandemic level of 99.1 in February 2020. Unlike expectations, the current situation index has declined across all sectors - only modestly so in manufacturing and construction, but quite sharply in the service sector and especially among retailers. This pattern is closely linked to the renewed tightening of administrative restrictions in an attempt to regain control over the pandemic. This has greatly reduced the access of unvaccinated people to most shops (except those for essential day-to-day needs) and services.

- Pulling current conditions and expectations together,

December's sectoral breakdown96 confirms that the retail sector has

experienced the sharpest drop in confidence towards the end of

2021. This is followed by services, which had already declined

quite strongly in November. The deterioration is more limited in

construction and the wholesale sector, while the overall

manufacturing climate has edged up for the first time since June as

companies have built up a considerable stock of orders and as they

appear to be seeing light at the end of the tunnel with respect to

supply chain bottlenecks.

- Adjusted for seasonal factors, the IHS Markit Flash US

Composite PMI Output Index posted 56.9 in December, down slightly

from 57.2 in November, but still signaling a strong rise in private

sector business activity. Although slower than rates seen earlier

in the year, the pace of output growth was faster than the historic

trend. (IHS Markit Economist Chris

Williamson)

- Supporting the upturn in activity was a quicker increase in new orders during December. The pace of expansion was the sharpest for five months, and largely driven by a faster rise in service sector new business. New order inflows to the manufacturing sector eased to the slowest since October 2020, however. Meanwhile, new export orders increased at the strongest pace since September.

- The seasonally adjusted IHS Markit Flash US Services PMI™ Business Activity Index fell to 57.5 in December, down slightly from 58.0 in November. The upturn in business activity remained sharp despite slowing to a three-month low as demand conditions strengthened at the end of the year. The pace of new business growth accelerated to the fastest for five months. Foreign client demand also rose.

- Operating conditions improved in December, as highlighted by the IHS Markit Flash US Manufacturing Purchasing Managers' Index™ (PMI™)1 posting at 57.8 in December, down from 58.3 in November. That said, the health of the sector improved at the slowest pace for a year as output growth remained subdued. The headline index is also continuing to reflect a severe deterioration in input delivery times, with longer supplier lead times ordinarily signaling a stronger sector performance.

- On December 17, New York Gov. Kathy Hochul announced a

framework for the state to achieve at least 10 GW of distributed

solar by 2030, enough to annually power nearly 700,000 homes. The

roadmap, submitted by the New York State Energy Research and

Development Authority (NYSERDA) and the New York State Department

of Public Service (DPS) to the state Public Service Commission for

public comment and approval, proposes a comprehensive strategy to

expand the state's NY-Sun initiative The plant will spur

approximately $4.4 billion in private investment and create 6,000

additional solar jobs across the state - including with the state's

first application of prevailing wage for solar projects between one

and five MW in size. This announcement supports the state's Climate

Leadership and Community Protection Act (Climate Act) mandate to

generate 70% of the state's electricity from renewables by 2030 as

part of a resilient and equitable transition to a clean energy

economy. The Roadmap proposes (IHS Markit PointLogic's Barry

Cassell):

- At least 1,600 MW of new solar capacity to benefit disadvantaged communities and low-to-moderate income New Yorkers, with an estimated $600 million in investments serving these communities;

- At least 450 MW to be built in the Consolidated Edison electric service area (covering New York City and parts of Westchester), increasing the installed solar capacity in this area to over 1 GW by the end of decade; and

- At least 560 MW to be advanced through the Long Island Power Authority.

- Motional has partnered with Uber Technologies to deliver food orders using autonomous vehicles (AVs) in California (US). According to a company statement, Motional will begin delivering meals from select restaurants on Uber's food delivery app Eats in Santa Monica in early 2022. Motional will deploy its next-generation electric Hyundai IONIQ 5-based robotaxi, which is capable of Level 4 autonomous functions, for the delivery service. Karl Iagnemma, president and CEO of Motional, said, "We're proud that our first delivery partner is Uber and are eager to begin using our trusted driverless technology to offer efficient and convenient deliveries to customers in California. We're confident this will be a successful collaboration with Uber and see many long-term opportunities for further deploying Motional's technology across the Uber platform." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Samsung Electronics has unveiled a line-up of automotive memory chips designed for next-generation autonomous electric vehicles (EVs), according to a company statement. This includes a 256-gigabyte (GB) PCIe Gen3 NVMe ball grid array (BGA) SSD, a 2GB GDDR6 DRAM, and a 2GB DDR4 DRAM for high-performance infotainment systems. The company has also launched a 2GB GDDR6 DRAM and a 128GB Universal Flash Storage (UFS) to support autonomous vehicle (AV) systems. These new automotive memory products are currently in mass production and meet the AEC-Q100 qualification - the global automotive reliability standard. Jinman Han, executive vice-president and head of memory global sales and marketing at Samsung Electronics, said, "With the recent proliferation of electric vehicles and the rapid advancement of infotainment and autonomous driving systems, the semiconductor automotive platform is facing a paradigm shift. What used to be a seven to eight-year replacement cycle is now being compressed into a three to four-year cycle, and at the same time, performance and capacity requirements are advancing to levels commonly found in servers. Samsung's reinforced lineup of memory solutions will act as a major catalyst in further accelerating the shift toward the 'Server on Wheels' era". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US Senate passed legislation to ban imports from China's

Xinjiang region over concerns about forced labor, part of

Washington's continued pushback against Beijing's treatment of its

Uyghur Muslim minority. The measure approved by the Senate had been

cleared earlier in the week by the US House of Representatives

after lawmakers agreed on a compromise that eliminated differences

between bills introduced in the two chambers. The compromise keeps

a provision creating a "rebuttable presumption" that all goods from

Xinjiang, where the Chinese government has set up a network of

detention camps for Uyghurs and other Muslim groups, were made with

forced labor, in order to bar such imports, Reuters states. The

measure now heads to President Joe Biden for his signature. (IHS

Markit Food and Agricultural Commodities' Hope Lee)

- Xinjiang, ranked fourth by per capita of arable land, is China's largest landed province/autonomous region, accounting for one-sixth of the country's land area, IHS Markit previously reported.

- Following over 50 years of cultivation, the state-owned Xinjiang Production and Construction Corps (the Corps) now owns large amount of arable land, with major crops including tomato, corn, cotton, wheat, walnuts, grapes, melons, chili, pears, apples, dates/jujube and goji. In 2020, the Corps had 1.4 million hectares of cultivated area, 2.2% up y/y; fruit 190,920 ha, 3.1% down y/y.

- The Corps' total fruit production was 4.65 million tons in 2020, 9.3% up y/y, according to the Corps' 2020 annual report.

- Grain sat top of the agricultural and food commodities at 2.41 million tons in 2020, 4.8% up y/y.

- Industrial tomatoes reached over two million tons while pears amounted to 520,000 tons, 34% up y/y, the fastest growth among main products.

- Cotton generated the second largest production at 2.13 million tons, 5.2% up y/y. The Corps contributed about 36.1% of national cotton production in 2020.

- It is noted that other privately owned entities or farmers also actively operate in the agriculture sector. However, it is known that the Corps contributes a big chunk of the agricultural activities.

- The sector also hires seasonal farm labor from other provinces

(i.e Sichuan and Henan) which have limited arable land and large

rural population.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-20-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-20-2021.html&text=Weekly+Global+Market+Summary+Highlights%3a+December+13-20%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-20-2021.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: December 13-20, 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-20-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+December+13-20%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-20-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}