Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 27, 2021

Weekly Global Market Summary Highlights: December 20-23, 2021

All major US and European equity indices closed higher on the week, while APAC was mixed. US and benchmark European government bonds closed sharply lower week-over-week. CDX-NA and European iTraxx closed tighter across IG and high yield on the week. The US dollar closed lower on week, while oil, natural gas, gold, silver, and copper closed higher week-over-week.

Americas

All major US equity markets closed higher on the week; Nasdaq +3.2%, Russell 2000 +3.1%, S&P 500 +2.3%, and DJIA +1.7% week-over-week.

10yr US govt bonds closed 1.50% yield and 30yr bonds 1.91% yield, which is -9bps week-over-week for both tenors.

DXY US dollar index closed 96.02 (-0.6% WoW).

Gold closed $1,812 per troy oz (+0.4% WoW), silver closed $22.94 per troy oz (+1.8% WoW), and copper closed $4.39 per pound (+2.3% WoW).

Crude Oil closed $73.79 per barrel (+4.3% WoW) and natural gas closed $3.73 per mmbtu (+1.1% WoW).

CDX-NAIG closed 50bps and CDX-NAHY 292bps, which is -3bps and

-16bps week-over-week, respectively.

EMEA

All major European equity indices closed higher; Spain +3.0%, France +2.6%, Italy +1.5%, Germany +1.4%, and UK +1.4% week-over-week.

10yr European government bonds closed lower on the week; Germany closed +13bps, France +15bps, UK +17bps, Spain +17bps, and Italy +19bps week-over-week.

Brent Crude closed $76.64 per barrel (+4.2% WoW).

iTraxx-Europe closed 48bps and iTraxx-Xover 244bps, which is

-2bps and -10bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed; Australia +1.7%, Japan +0.9%, India +0.5%, Hong Kong +0.1%, Mainland China -0.1%, and South Korea -0.2% week-over-week.

Monday, December 20, 2021

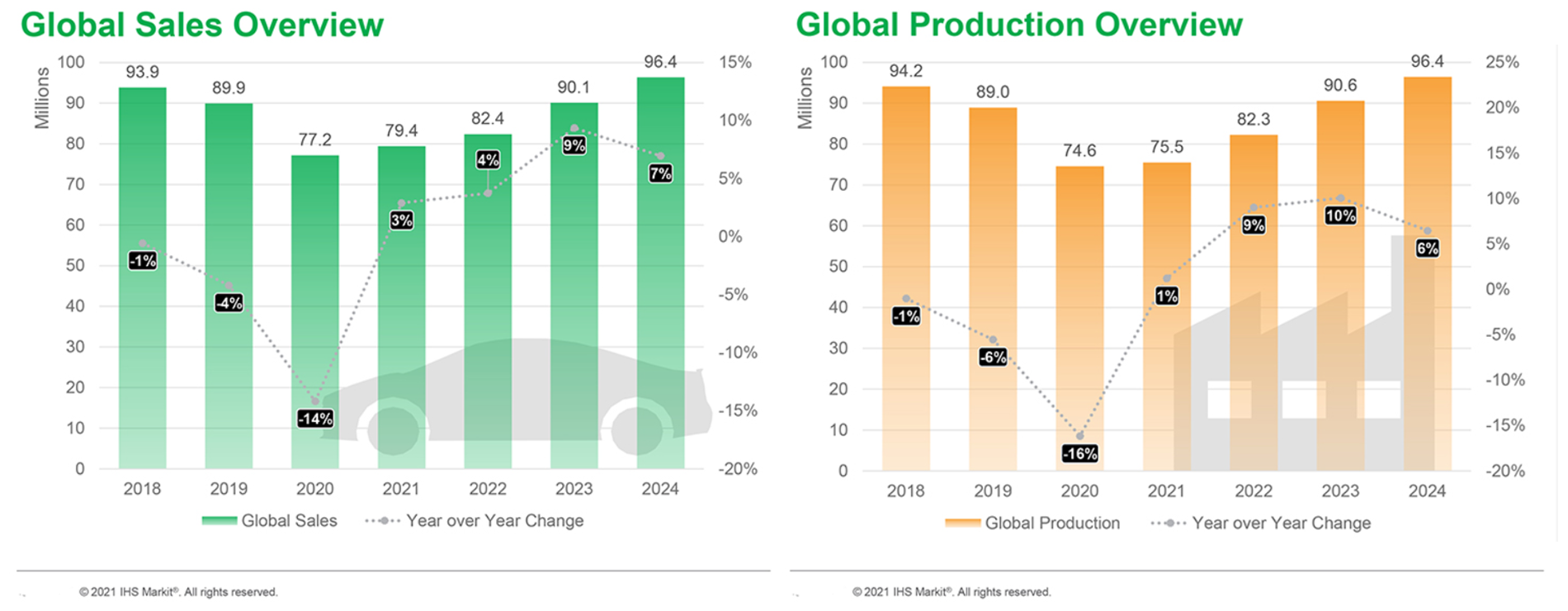

- IHS Markit forecasts global light-vehicle sales to increase

3.7% and production to increase 9.0% in 2022. Next year, global

light-vehicle sales and production volumes are forecast to still be

below the levels of 2019, as the recovery cycle from the COVID-19

pandemic has been held back by supply constraints and new virus

variants. Auto demand levels are expected to remain depressed on

the microchip shortage, as well as the race between vaccination

programs and new COVID-19 variants. Although the supply situation

is expected to improve through 2022, the ability to replenish

inventories may not come before 2024. IHS Markit expects the

semiconductor shortages and wider supply chain disruptions to

continue until 2023. IHS Markit projects light-vehicle sales

globally of nearly 79.4 million units in 2021. We forecast new

light-vehicle sales of nearly 82.4 million units globally in 2022

and auto industry demand to continue to be constrained next year as

the challenges in the semiconductor supply chain remain. Global

light-vehicle production is expected to be 75.5 million units in

2021, a paltry 1.2% improvement over levels in 2020. However, in

2022, IHS Markit forecasts a rebound in global light-vehicle

production of 9.0% to 82.3 million units. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

- The Indian union cabinet has approved a production-linked incentive scheme (PLI) worth over INR760 billion (USD9.9 billion) for production of semiconductors over the next six years, reports The Economic Times. Under the new scheme, called Programme for Development of Semiconductors and Display Manufacturing Ecosystem, over 20 semiconductor design, components manufacturing, and display fabrication units will be set up including one to two fabrication units for displays and 10 units each for designing and manufacturing components. The government will offer incentives to companies involved in the manufacturing of silicon semiconductor fabs, display fabs, compound semiconductors, silicon photonics, sensors fabs, semiconductor packaging, and semiconductor design. Additionally, the cabinet also approved a plan for the modernization and commercialization of the Semi-conductor Laboratory (SCL). The launch of the scheme comes at a time when automakers are struggling with the semiconductor shortage globally and have been forced to adjust production levels since several months ago. By localizing development and production, the Indian government aims to reduce dependence for such chips on other countries. (IHS Markit AutoIntelligence's Isha Sharma)

- US corn growers, furious about skyrocketing costs for phosphate

fertilizers, have accused leading domestic producer Mosaic with a

plot to derail foreign competitors with punishing trade

tariffs—a move they say handed the world's second largest

phosphate fertilizer producer undue influence over US fertilizer

supply and thus pricing. (IHS Markit Food and Agricultural Policy's

William Schulz)

- In a December 17 open letter to Mosaic executives, leaders of the National Corn Growers Association (NCGA) say Mosaic's petition to the US International Trade Commission (ITC) for countervailing duties (CVD) against fertilizer producers in Russia and Morocco was nothing more than a feigned act of corporate social responsibility.

- "Mosaic has almost single-handedly erected an insurmountable tariff barrier to keep its top competitors in Morocco and Russia out of the US phosphate market," reads the NCGA letter. "Thanks to Mosaic's petition, only 15 percent of phosphorous imports now come into the US without tariffs. And experts say that using [the Department of Commerce] and ITC to manipulate the supply curve does indeed dictate price to farmers."

- The NCGA is not alone in its price-gouging accusations. "The economic conditions of the fertilizer sector suggest market abuses are likely, and farmers are experiencing a price squeeze that is highly suspicious in its timing," the Family Farm Action Alliance said in a December 8 letter to the Department of Justice's Antitrust Division.

- But ITC investigated Mosaic's charge that foreign producers were competing unfairly by dumping low-cost phosphate fertilizer product on the US market and artificially lowering prices. In June, the agency issued a CVD on Moroccan and Russian phosphate fertilizer imports due to unfair foreign subsidies.

- "Based on the available pricing data obtained by the Commission … cumulated subject imports undersold the domestic like product in 16 of 52 quarterly comparisons with margins of underselling ranging from 0.1 percent to 13.0 percent and an average underselling margin of 2.8 percent," an ITC's report says. "Subject imports oversold the domestic like product in the remaining 36 instances with margins of overselling ranging from 0.1 and 11.2 percent and an average overselling margin of 4.0 percent."

- Supermarkets across Europe have pledged to remove beef products

that are linked to deforestation in Brazil from their stores. On 15

December, US activist group Mighty Earth announced that six

European supermarket chains will stop selling Brazilian beef

products after an investigation found that these products

contribute to the destruction of the Amazon rainforest. The most

far-going pledge came from Lidl Netherlands, which said it would

stop sales of all beef originating from South America in January

2022. Albert Heijn, the largest supermarket chain in the

Netherlands, said it will stop sourcing beef from Brazil entirely.

(IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Other supermarket chains made less dramatic moves and decided to focus on specific beef products. Sainsbury's UK said will stop sourcing its store brand corned beef from Brazil and highlighted that 90% of its beef is already sourced from the UK and Ireland. Auchan France will remove beef jerky products linked to Brazilian meat processor JBS from its shelves, while Carrefour Belgium and Delhaize will stop selling Jack Link's brand beef jerky.

- The withdrawals came after an investigation by Mighty Earth and Reporter Brasil, a Brazilian NGO, found that JBS indirectly sourced cows from illegally deforested areas, in a scheme known as "cattle laundering". In such schemes, cows are raised on illegally deforested land and then sold on to a legitimate farm before being sent to the slaughterhouse, to obscure the true origin of the cattle.

- In reaction, JBS said it has zero tolerance for illegal deforestation and has blocked more than 14,000 suppliers for failing to comply with its policies. The company said monitoring indirect suppliers - the ones before the final seller to the slaughterhouse - is a challenge for the entire sector, but it promised to set up a system capable of doing so by 2025.

- Baker Hughes has been awarded a contract by Santos to supply

turbomachinery equipment for the Moomba carbon capture and storage

(CCS) project (Moomba CCS), including gas turbine, compressors, and

heat recovery steam generator (HRSG). The project will serve a gas

processing plant and permanently store 1.7 million tons of carbon

dioxide (CO2) annually in depleted natural gas reservoirs in the

onshore Cooper Basin in South Australia. (IHS Markit Upstream Costs

and Technology's Kamila

Langklep)

- Specifically, Baker Hughes will provide PGT25+G4 aeroderivative gas turbine (nameplate power capacity of 34 MW), MCL compressor and BCL compressor, which will enable Santos to compress CO2 captured at Moomba CCS for transportation and subsequent injection for storage.

- Baker Hughes' broader carbon capture, utilization, and storage (CCUS) portfolio features advanced turbomachinery, solvent-based capture processes, well construction and management for CO2 storage, and advanced digital monitoring and industrial asset management solutions.

- The contract for Baker Hughes' technology lays a foundation for Santos' future objectives of decarbonizing natural gas, lowering emissions and ultimately producing hydrogen fuel using stored CO2. A final investment decision on the Moomba CCS project was reached in November 2021.

- During the third quarter of 2021, Argentina's seasonally

adjusted GDP increased by 4.1% q/q after decreasing by 0.9% q/q in

the previous quarter, according to the revised figures. On an

annual basis, GDP grew by 11.9% year on year in July-September on

the back of a low comparison base in the third quarter of 2020 when

GDP shrunk by 10.2% y/y because of COVID-19-related response

measures and extreme lockdown. (IHS Markit Economist Claudia

Wehbe)

- The estimate for the GDP deflator shows a rise of 54.1% y/y, while the private-sector consumption deflator increased at a slower rate of 50.1% y/y during the same period.

- By sector, the primary sector showed the only annual decline in the third quarter. All other sectors posted annual growth in the double digits, except for utilities, whose cost increases are controlled by the government, education, financial intermediation, and real estate and business services.

- Sectors with a severely depressed comparison base posted an annual growth rate over 25% y/y, such as construction, hospitality and restaurants, and non-profit and social services. Activity in the hospitality and restaurant sector was nearly half the size compared with the first half of 2018. Meanwhile, manufacturing gained 12.7% y/y.

- IHS Markit's forecast for 2021 has been adjusted upwards to 7.5%, expecting the sudden increase in public-sector spending to gain the population's trust before the November 2021 mid-term election to have a marginal bump in GDP in the last quarter of the year, paired with strong external demand for manufactured goods of agriculture origin. The economy is not projected to return to pre-pandemic levels until the second half of 2023.

Report was not published on Tuesday, December 21, 2021

Wednesday, December 22, 2021

- Turkey's Ministry of Treasury and Finance has deployed a new

program to shield depositors from lira volatility and discourage

further dollarization. President Recep Tayyip Erdoğan first

announced the new Foreign Currency-protected Turkish Lira Deposit

Account programme following a cabinet meeting on 20 December.

Households and banks holding time deposits ranging in maturity from

three to 12 months will be eligible to participate in the program.

The scheme will see the finance ministry remunerate depositors for

any amount that the lira depreciates above the prevailing central

bank policy rate at maturity. Depositors will not pay withholding

tax on the difference paid. Turkish broadcaster Habertürk reported

that Alpaslan Çakar, the head of the Banks Association of Turkey,

estimated that USD1-billion worth of foreign-currency deposits had

been converted into lira following Erdogan's announcement. (IHS

Markit Banking Risk's Alyssa

Grzelak)

- The introduction of quasi foreign-currency-indexed accounts backstopped by the Treasury will shift exchange rate risk from banks and households to the government, but many details of the program have yet to be worked out.

- For instance, it was not immediately clear if the difference between the exchange rate and the interest rate would be calculated based on the average prevailing policy rate and exchange rates or the end of period rates. The announcement also suggested that the ministry was 'working' to include Islamic banks in the scheme, suggesting that depositors at Islamic banks are not eligible at present.

- As of 9 December, Turkey's Banking Regulation and Supervision Agency (Bankacılık Düzenleme ve Denetleme Kurumu: BDDK) has reported that of the TRY5,435 billion (USD415.8 billion) of deposits in the banking sector, TRY3,489.7 billion were denominated in foreign currency. The cost of the program to the Treasury could therefore be substantial.

- Using the vague outline of the scheme provided so far, IHS Markit estimates that based on the current policy rate of 14% and the 55% depreciation of the lira since the start of the year (as of 20 December), the new program would have cost the Treasury up to USD86 billion had it been in place.

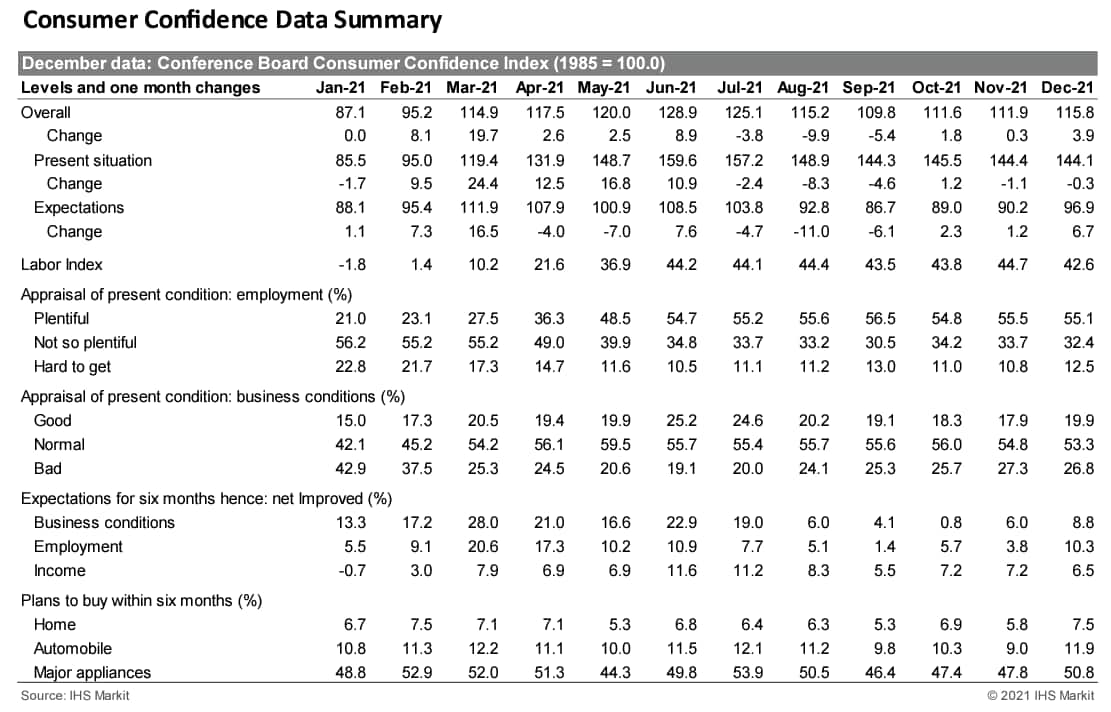

- The US Conference Board Consumer Confidence Index rose 3.9

points to 115.8 (1985=100) in December. November's reading was

revised up from 109.5 to 111.9. (IHS Markit Economists Akshat Goel

and William Magee)

- The index of views on the present situation edged down only 0.3 point to 144.1 in December, despite headwinds from continued price increases and the emergence of the Omicron variant.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) retreated from a multidecade high of 44.7 to 42.6.

- The expectations index rose 6.7 points to 96.9 with a higher proportion of consumers planning to buy homes, automobiles, major appliances, and vacations over the next six months.

- The expectations index was driven higher by optimism about business conditions and job prospects in the short term, with 26.7% of consumers expecting business conditions to improve, up from 25.6%. A smaller percentage (17.9%) expects business conditions to worsen, down from 19.6%.

- Consumers were also buoyant about their job prospects: 25.1% of consumers expect more jobs to be available in the coming months, up from 22.8%; 14.8% anticipate fewer jobs, down from 19.0%.

- Bottom line: Consumers are looking past the sudden spike in

COVID-19 cases and higher prices, but a continued upward trend on

both fronts could shatter confidence.

- The German Federal Statistical Office (FSO) has reported that

real monthly earnings in the whole economy (including employees in

the public sector, including bonus payments, and assuming for

analytical purposes that the employment structure of the previous

year has remained constant) declined to 0.0% year on year (y/y) in

the third quarter, down from 3.0% y/y in the second quarter but

still up from an interim low of -2.0% y/y in the first quarter.

These annual rates compare with an all-time low of -4.7% in the

second quarter of 2020, a series peak of 6.0% in the third quarter

of 1992, and a long-term (1992-2020) average of 0.4%. (IHS Markit

Economist Timo

Klein)

- Nominal wage growth softened much less in the third quarter, declining from the previous quarter's 5.5% y/y to 3.9% y/y. This owes to another sharp rise of consumer price inflation from 2.4% to 3.9%. Nominal wage growth of 3.9% remains well above its long-term average of 2.1%.

- The number of hours worked continued to have an important influence on monthly earnings. The number of people on short-time work schedules has been declining since March and hours worked thus increased by 1.7% y/y. Although this is down from the second quarter's 4.0% y/y, related to base effects, it remains a supportive factor for wages earned per month compared with the year-ago period. Note that government subsidies for short-time work are not classified as earnings as reported in these statistics (employees who are furloughed, i.e., effectively put on 0% short-time, are ignored altogether).

- The third-quarter breakdown for different types of employment shows that nominal wage growth (total: 3.9% y/y) was highest among full-time employees (4.1% y/y), followed by part-time workers (3.2%) and finally the holders of so-called mini jobs (1.5%).

- Denmark's The Lego Group plans to build its first carbon

neutral factory in Vietnam, the company announced this month. The

company intends to invest $1 billion in the factory, which will be

its 6th LEGO factory in the world and 2nd in Asia. Construction is

set to begin H2 2022 with a target startup in 2024, according to

the company. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- The LEGO Group has signed a memorandum of understanding (MoU) with Vietnam Singapore Industrial Park (VSIP) to build this factory on a 44-hectare site in Vietnam's Binh Duong Province.

- This carbon neutral factory will include solar roof panels, while a nearby solar energy project investment will be built by VSIP on behalf of The Lego Group. These together are expected to produce enough renewable energy to match 100% of the factory's annual energy requirements, said the Group.

- The factory will aim to meet a minimum of LEED (Leadership in Energy and Environmental Design) Gold, which it said covers all areas of sustainability including energy, water, and waste. The factory will be designed to accommodate electric vehicles and be outfitted with energy-efficient production equipment, the company said.

- Together with VSIP, The Lego Group intends to plant 50,000 trees in Vietnam to compensate for vegetation removed during construction.

- Before this project was announced, The Lego Group had in September 2020 committed to investing $400 million over three years to sustainability. In line with this, it debuted in June this year a prototype LEGO brick made using recycled plastic, specifically polyethylene terephthalate (PET) from discarded bottles. These are not expected to be near readiness for commercial production.

- As the state of California adds growing levels of energy

storage, GEM A-CAES LLC applied on December 1 with the California

Energy Commission for approval to construct, own and operate the

500-MW Gem Energy Storage Center, an Advanced Compressed Air Energy

Storage (A-CAES) facility in Kern County, California. (IHS Markit

PointLogic's Barry Cassell)

- The Gem Energy Storage Center will deploy proprietary Hydrostor technology consisting of five 100-MW all-electric air compressor and associated power turbine trains, underground compressed air storage cavern, aboveground support facilities and a 10.9-mile interconnection to Southern California Edison's (SCE) Whirlwind Substation.

- "Gem's primary goal is to be a state-of-the-art energy storage and reliability resource," the application noted. "Gem has been designed to deliver up energy and reliability services with no fossil fuel combustion or related air quality impacts. The project will be one of the first commercial applications of Hydrostor's A-CAES technology at this scale. Gem will combine dispatchable, operationally flexible, and efficient energy generation with state-of-the-art A-CAES technology to facilitate the integration of variable renewable energy on the grid and to meet California and regional needs for reliability services."

- The Gem project will be located on an approximately 71-acre project site in unincorporated Kern County, approximately one mile northeast of the community of Willow Springs and seven miles west of Rosamond.

- The main project elements include: five all-electric 100-MW air compressor and power generation turbine trains housed inside a turbine hall and compressor building; underground (approximately 2,000 feet deep) purpose-built compressed air storage cavern; approximately 31-acre by 50 feet deep (average) hydrostatic compensation surface reservoir with approximately 6 to 40-foot-high earthen berms and approximately 565 acre-feet capacity and floating cover to reduce evaporative loss; air conduit (sealed) to facilitate cyclic injection/storage of compressed air and release of compressed air for power generation; water conduit (sealed) to facilitate inflow/outflow of hydrostatic compensation water to/from the surface reservoir and underground storage cavern; aboveground heat exchangers and thermal storage equipment; and control house, electrical gallery and maintenance building connected to the turbine hall.

- "The Gem project will be designed to operate 24 hours per day, 7 days per week with an annual capacity factor of up to 85 percent," the application said. "The facility will typically cycle between Charging Mode (compression/energy storage) lasting approximately 14 hours and Discharging Mode (decompression/power production) lasting 8 hours at nameplate capacity."

- IHS Markit reports on new models expected to go on sale in the United States in 2022, looking at selected automakers and segments. In 2021, the introduction of new EVs and announcements by automakers of increased investments to accelerate the move to EVs have positioned the vehicle market's future as an electric one. In 2022, the availability of EV products is to continues to grow. Trends that will continue in 2022 include the preponderance of new-vehicle launches being in the utility vehicle categories, while few sports cars will be on the list. The EVs expected to be introduced in 2022 will be significant statements for most of the brands launching them, representing early manifestations of evolving EV strategies. In 2022, IHS Markit estimates about 60 models will be new generations or new introductions in the market. By comparison, about 50 such models went on sale in 2021. In 2023, the number of new EV programs arriving will spike again and we expect about 75 new or redesigned models to go on sale in the US. Based on IHS Markit's US regional segmentation, about 30 new CUVs will go on sale in the US market in 2022, encompassing all sizes and price classes. The forecast sees about 12 new cars arriving and four SUVs. Sales launches of sports cars are expected to reach nine in 2022, including exotic, low-volume vehicles such as the Maserati MC20, Lamborghini Huracan, and Ferrari 296 GTB. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Storage battery manufacturer Exide Industries announced yesterday (21 December) in filing to the Bombay Stock Exchange (BSE) that it will set up a greenfield multi-gigawatt lithium-ion cell manufacturing facility in India. The company's board of directors also approved to participate in the production-linked incentive scheme for national program on 'Advanced Chemistry Cell (ACC)' battery storage, issued by the Ministry of Heavy Industries in August 2021. The total outlay of the scheme is INR181 billion (USD2.4 billion) for five years. The latest move is in line with the Indian government's goal to support electric vehicle (EV) manufacturing as it seeks to increase the share of such vehicles in the country. The government has been working to put in place a supportive framework and is offering incentives to the manufacturers in this space. Exide Industries also seeks to benefit from the subsidy under the PLI scheme. (IHS Markit AutoIntelligence's Isha Sharma)

- Nigerian mobility tech startup Metro Africa Xpress (MAX) has raised USD31 million in a Series B funding round, reports TechCrunch. The latest funding round was co-led by Lightrock and Global Ventures with participation of existing investors Novastar Ventures and Proparco. The company plans to use the infused capital to enter more markets across Africa and extend vehicle financing credit to over 100,000 drivers in the next two years. It plans to launch operations in Ghana and Egypt by the end of the first quarter of 2022, and other additional markets in Francophone and East and Southern Africa by the end of the same year. MAX started its operations in 2015 as a delivery startup using motorcycles before venturing into ride hailing, and later into vehicle subscription and financing services. In 2019, the company started its electric mobility journey and currently provides two-, three-, and four-wheeler electric vehicles (EVs) to drivers through various leasing and financing options. MAX has installed charging stations in the cities of Lagos, Ibadan, and Akure, all in the south of Nigeria. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Thursday, December 23, 2021

- US personal income increased 0.4% in November while real

disposable personal income (DPI) decreased 0.2% amid higher

consumer prices. Underlying the increase in personal income, wage

and salary income increased 0.5% in November. Wage and salary

income has essentially recovered to its pre-pandemic trend, up

12.5% over the last two years. (IHS Markit Economists Kathleen

Navin and Gordon Greer III)

- Ongoing advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $223 billion (annual rate), roughly the same amount as in the previous four months. Fewer unemployment insurance payments under pandemic-era programs—which expired in early September—continued to act as a drag on income.

- Real personal consumption expenditures (PCE) were flat in November, as real PCE for goods declined 0.8% and real PCE for services increased 0.5%. The decline in real PCE for goods was close to our estimate, while the increase in real PCE for services was softer than we anticipated.

- Virus-sensitive categories, such as food services and accommodations, posted increases in November, suggesting concerns arising from news of the Omicron variant of COVID-19 were not yet a major factor in the November report.

- The PCE price index increased 0.6% in November, and its 12-month change was 5.7%. Excluding food and energy, for which prices rose strongly, the core PCE price index rose 0.5% in November and 4.7% over 12 months.

- The pandemic and elevated inflation remain headwinds for household spending, but personal income growth, rooted in strongly rising wages, is expected to support faster expansion in PCE in coming months.

- The US University of Michigan Consumer Sentiment Index rose 3.2

points from its November level to 70.6 in the final December

reading—recovering from the decade low it dropped to in

December. (IHS Markit Economists Akshat Goel and William Magee)

- The present situation index rose 0.6 point to 74.2 and the expectations index jumped 4.8 points to 68.3.

- The increase in consumer sentiment in December was driven by significant gains among households with incomes in the bottom half of the distribution. While the index of sentiment for households earning over $100,000 per year declined 2.1 points, that for households earning below $100,000 per year jumped 7.5 points. According to the report, the uptick in sentiment among the bottom half was the result of an expectation of a substantial increase in income in the year ahead.

- Elevated inflation remains the foremost drag on sentiment. At 6.8%, the 12-month increase in the consumer price index (CPI) in November was the fastest since 1982, with energy prices up a stunning 33.3%. The median expected one-year inflation rate in the University of Michigan survey edged down from 4.9%—its highest level since 2008—to 4.8%.

- The indexes of buying conditions for large household durable goods, automobiles, and homes improved in December but continue to be held back by high prices and limited inventories.

- Despite an improvement in sentiment this month, consumer sentiment remains low and underscores the downside risks related to a prolonged period of above-trend inflation. The emergence of the Omicron variant is another downside risk; according to the report, there were not enough data to capture the impact of the rapid spread of the Omicron variant. Uncontrolled spread of the Omicron variant and a continued increase in prices could sour consumer sentiment and depress spending.

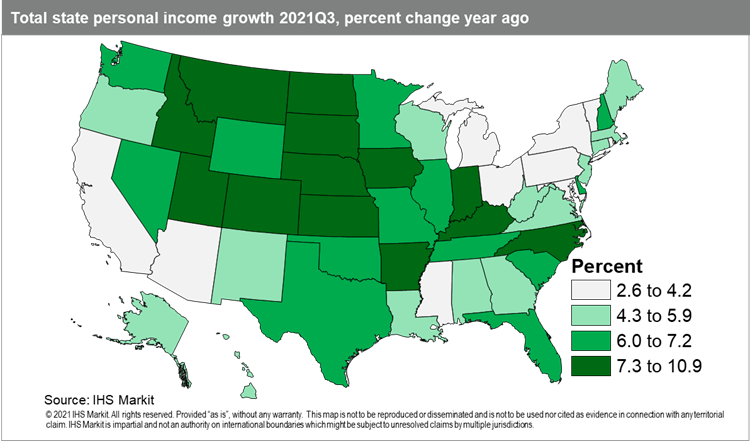

- In the third quarter of 2021, total state personal income

increased in 43 states, after historic losses during the previous

quarter. This resulted from sharp declines in transfer receipts

following an end to direct economic payments and reductions in

federally enhanced unemployment insurance payments. While transfer

payments continued to fall during the third quarter as states wound

down their enhanced UI programs the drop was much less severe, down

15.7% versus the 72.6% fall in the second quarter. Meanwhile, there

were notable expansions in net earnings and modest contributions

from dividends, interest, and rental income across the country as

state economic recoveries continued. On a state level, total

personal income growth was strongest in Kentucky, which added 6.7%

(annualized) thanks to a rise in earnings from the

healthcare/social assistance and transportation/warehousing

sectors. Close behind were Colorado (5.9%) and Utah (5.7%), with

gains driven by earnings in professional services and construction,

respectively. Among the eight states where personal income

contracted, the largest decline was in North Dakota, where personal

income fell by 4.3% (annualized), after experiencing the largest

drop in net earnings of any state due to a sharp contraction in

farm income. New Hampshire down -3.5%) and Vermont (down 1.9%) saw

the second and third worst income contractions during the third

quarter. New Hampshire saw the largest contraction in net earnings

during the quarter after a rapid contraction in the earnings for

the management of companies and enterprises. Vermont had the second

largest decline in transfer receipts, partly driven by the rapid

decline in unemployment insurance claims during the third quarter.

(IHS Markit Economist Alexander Minelli)

- Mainland China's provincial government of northeastern rust

belt province Heilongjiang held a meeting on 20 December that

called for "all-out" support to restore the province's real estate

industry, according to a report by Caixin, citing an announcement

previously published on the government website. Measures mentioned

included carrying out online sales campaigns for developers and

providing subsidies to home purchasers. However, the announcement

was reportedly removed from the website the day after it was

published. (IHS Markit Economist Yating

Xu)

- The local government of another northeastern province, Jilin, listed further stabilizing the real estate market as one of its main tasks for the first quarter of 2022 and vowed to encourage lower-level governments to subsidize property purchases and provide support to help rural residents buy homes in urban areas. Also, the local governments of Wuhu of Jiangsu Province and Guilin of Guangxi Province have rolled out polices encouraging residents to buy property.

- The recent moves to issue regional-level stimulus to boost housing purchases, provide financing support for mergers and acquisitions of developers, and ease mortgage policies, are aligned with the vow taken by top Chinese leaders at the Central Economic Work Conference in early December to promote the healthy development of the real estate sector.

- General Motors (GM) has announced plans to supply electrification components for electric vehicle (EV) conversion projects, commercial equipment, and marine applications. Some of the elements of the announcement have been announced previously. The aim of the plans is to generate revenue beyond new vehicle sales, as well as to create new business models. In a company statement, GM's vice-president of EV growth operations said, "GM has an established strategy, network of integrators and co-development agreements to apply an extensive array of components and solutions to a broad range of customers and use cases. As companies across many industries look to reduce their environmental impact, GM is uniquely positioned to serve as a leader not only through exciting new EVs across our brands, but through additional technology applications, and we look forward to bringing customers - existing and new - along with us on our zero-emissions journey." In the statement, GM provided a series of examples of its expected efforts, rather than a definitive list of products. Among these are Electronic Connect and Cruise eCrate packages, the aim of which is to enable customers to work with qualified installers to replace a vehicle's ICE with a fully electric propulsion system. The installers will work through GM's electric specialty vehicle modifier (eSVM) program. GM has been exploring this idea with previous proof-of-concepts including a Chevrolet S-10 pick-up conversion called E-10 Pickup, the K-5 Blazer-E, the eCOPO Camaro, and Project X. The most recent project is conversion of a 1972 El Camino SS, on which GM worked with Lingenfelter Performance Engineering. GM says the El Camino SS project is the first independent installation of the eCrate package, due to be launched in 2022. GM says that the new EV components business segment could create a total addressable market of USD20 billion by 2030, and the company looks to be part of that market. GM's plans are aggressive and could have a substantial impact on its revenue, as well as possibly help provide scale for some components and engineering developments. In addition to creating the revenue stream, these projects create opportunities for GM's engineering teams, including in integration, battery development, control units, and other areas, to expand their expertise and knowledge base. (IHS Markit AutoIntelligence's Stephanie Brinley)

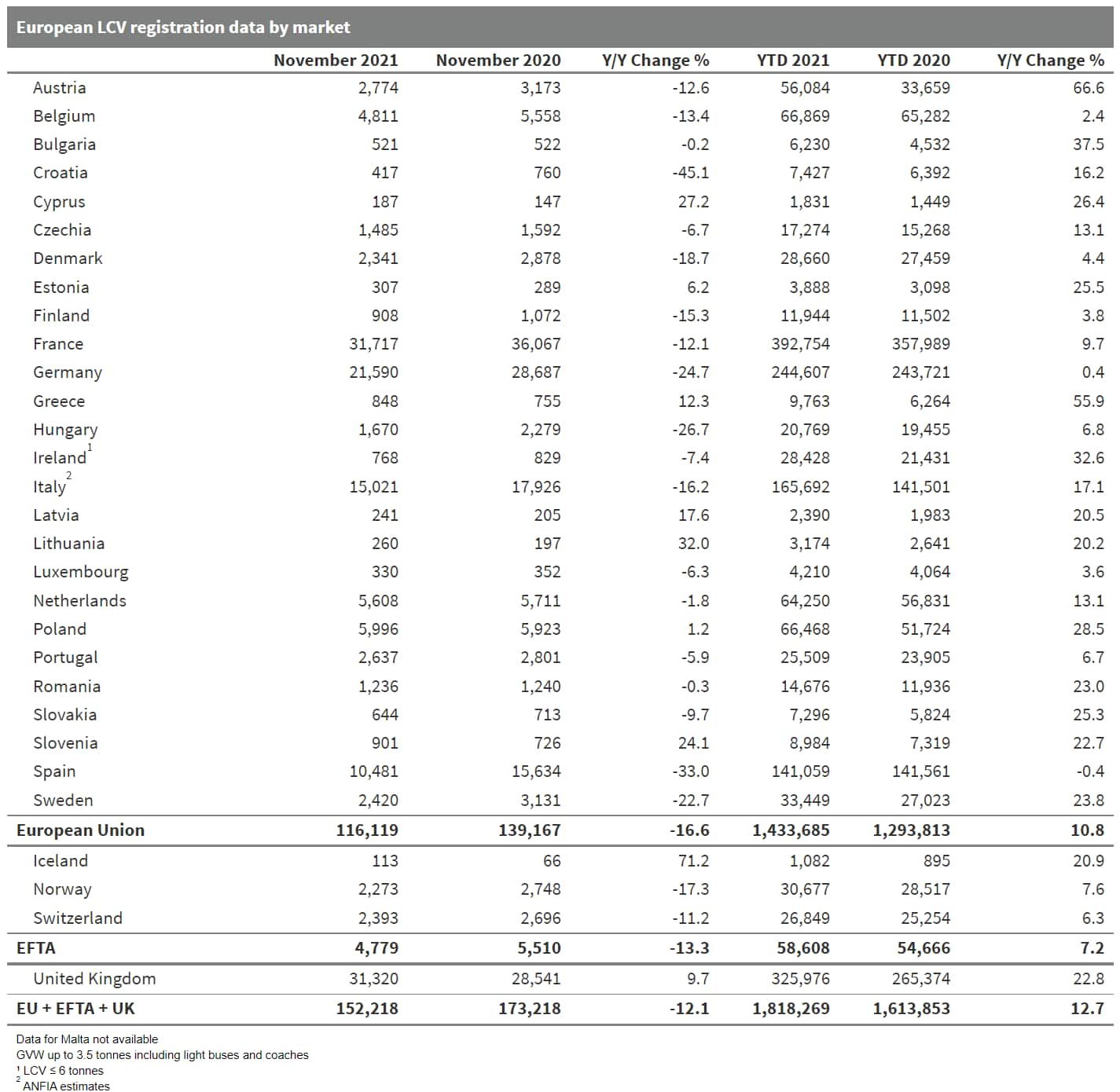

- Commercial vehicle (CV) registrations in the European Union (EU) have declined again during November, as the semiconductor shortage continues to drag on vehicle supply. According to data published by the European Automobile Manufacturers' Association (ACEA), sales of light commercial vehicles (LCVs) under 3.5 tons, medium and heavy commercial vehicles (MHCVs), and medium and heavy buses and coaches over 3.5 tons contracted by 14.7% year on year (y/y) to 142,480 units. Nevertheless, because of the low base during the first half of 2020 caused by coronavirus disease 2019 (COVID-19) virus lockdown measures, volumes remain up 11.5% y/y during the first 11 months of 2021. Volumes for this period now stand at 1,723,817 units. It has been another difficult month for the CV market in the EU. While growth in the first half of the year was underpinned by the low base of comparison due to lockdown measures to prevent the spread of COVID-19 virus the year before, there was a shift towards decline at this year's halfway point. The biggest drag has come from LCVs - like the passenger car category, stoppages have hit production at the manufacturing facilities of various OEMs throughout the year so far because of the semiconductor shortage. The rate of decline for LCVs has not been as great as for passenger cars, as automakers have diverted available components to some of their most profitable and high demand vehicles, which have included LCVs. Nevertheless, Ford, Stellantis and Renault Group are still among those that have had to manage their output during the past 12 months. IHS Markit currently anticipates that despite the disruptions to component supply and vehicle production, EU registration volumes of LCVs with a GVW of over 6 tons will grow by 8.8% y/y to under 1.51 million units, although this will still be down by around 9.5% compared to the performance recorded during 2019. While we anticipate 2022 will be flatter, gains will return in the coming years, with 2019 volumes being surpassed in 2024. (IHS Markit AutoIntelligence's Ian Fletcher)

- Indian Oil Corporation (IndianOil) has announced it will spend

INR9,2080 crore (USD1.2 billion) on a new crude oil pipeline system

of 17.5 million metric tons per year to connect Mundra, Gurjarat to

Panipat, Haryana in the north of India. As part of the project,

IndianOil will also build nine crude oil tanks of 370,000 barrels

each at Mundra. The project is expected to be completed in

synchronization with the commissioning of its Panipat refinery

expansion which is scheduled for completion in the second half of

2024. (IHS Markit Upstream Costs and Technology's Chris

Alexander)

- Siemens Gamesa along with Dominion Energy, has signed an agreement for the delivery of offshore 176 SG 14-222DD wind turbines and ten years of service for the 2.6GW Coastal Virginia Offshore Wind (CVOW) commercial project. The agreement is still subject to customary conditions including required governmental permitting, which is expected to be successfully closed by the first quarter 2023. This agreement has followed Siemens Gamesa was named to be the preferred turbine supplier for the CVOW commercial project in January 2020 and the conditional deal from May, when Dominion Energy signed up for the company's SG 14-222 DD after confirming the exact quantity of turbines to be deployed which was subject to site conditions. Installation of the wind farm is expected to begin off the coast of the Commonwealth of Virginia in 2024. The project is scheduled to be completed by 2026. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

Report was not published on Friday, December 24, 2021 in observance of the Christmas holiday

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-27-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-27-2021.html&text=Weekly+Global+Market+Summary+Highlights%3a+December+20-23%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-27-2021.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: December 20-23, 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-27-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+December+20-23%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-27-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}