Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 10, 2022

Weekly Global Market Summary Highlights: January 3-7, 2022

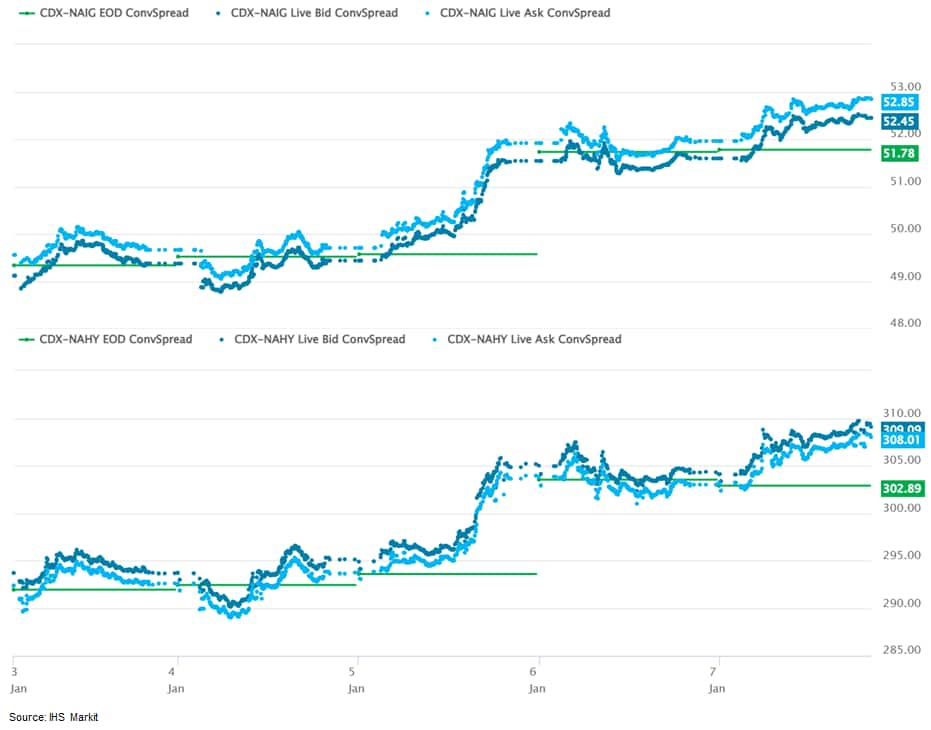

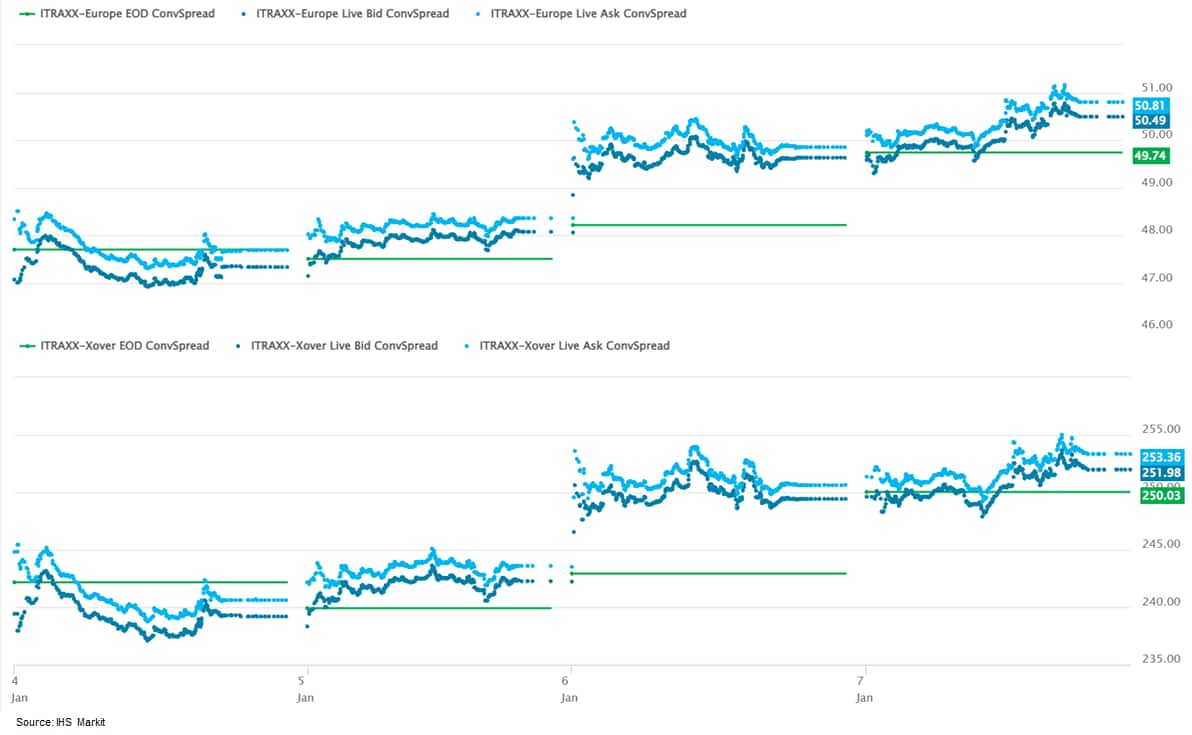

All major European equity indices closed higher on the week, major US indices were all lower, and APAC markets were mixed. US and benchmark European government bonds closed sharply lower on the week. European iTraxx and CDX-NA closed wider on the week across IG and high yield. Oil and natural gas closed higher, while the US dollar, gold, silver, and copper were lower week-over-week.

Americas

All major US equity markets closed lower on the week; DJIA -0.5%, S&P 500 -1.9%, Russell 2000 -2.9%, and Nasdaq -4.5% week-over-week.

10yr US govt bonds closed 1.77% yield and 30yr bonds 2.12% yield., which is +25bps and +21bps week-over-week, respectively.

DXY US dollar index closed 95.72 (-0.3% WoW).

Gold closed $1,797 per troy oz (-1.7% WoW), silver closed $22.41 per troy oz (-4.0% WoW), and copper closed $4.41 per pound (-1.2% WoW).

Crude Oil closed $78.90 per barrel (+4.9% WoW) and natural gas closed $3.73 per mmbtu (+4.8% WoW).

CDX-NAIG closed 53bps and CDX-NAHY 309bps, which is +3bps and

+17bps week-over-week, respectively.

EMEA

All major European equity indices closed higher on the week; UK +1.4%, Italy +1.0%, France +0.9%, Spain +0.4%, and Germany +0.4% week-over-week.

10yr European government bonds closed lower on the week; Spain closed +8bps, France +9bps, Germany +14bps, Italy +15bps, and UK +21bps week-over-week.

Brent Crude closed $81.75 per barrel (+5.1% WoW).

iTraxx-Europe closed 51bps and iTraxx-Xover 253bps, which is

+3bps and +11bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed on the week; India +2.6%, Hong Kong +0.4%, Australia +0.1%, South Korea -0.8%, Japan -1.1%, and Mainland China -1.7% week-over-week.

Monday, January 3, 2022

- EU exports of sparkling wine to the rest of the world have

fallen for the first time in ten years. On 31 December, the EU's

statistical office Eurostat published its updated figures for

sparkling wine and found that the bloc's exports dropped by 6%

between 2019 and 2020, from 528 million liters to 494 million

liters. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Eurostat explained that the COVID-19 pandemic significantly affected European wine trade after ten years of consecutive growth because many restaurants and bars were forced to close for a long period.

- Champagne was hit hardest by these lockdown measures, with EU sales of the French sparkling wine falling 20% in volume to 66 million liters from nearly 84 million liters the previous year, despite some pick-up in demand during the end-of-year holiday period. Producer group CIVC estimated earlier that their sales volume would drop by 18% and cause up to €1 billion in losses.

- Other types of sparkling wine were less affected by COVID-19 restrictions. Extra-EU sales of prosecco, by far the most exported EU sparkling wine, remained largely stable with 205 million liters compared to 207 million liters the year before. Cava, which is produced in Spain, even saw its exports increase by more than 10% to 58 million liters and replaced champagne as the second-most sold EU sparkling wine.

- Since 2010, the bloc's sparkling wine exports had consistently grown at an average rate of 8%, but CIVC now expects that COVID-19 will continue to weigh on demand for their products in the first half of 2022.

- Attorneys general from California, Minnesota, Iowa, Wyoming and

a dozen other states are backing USDA's effort to combat

consolidation in the meat industry, calling for aggressive action

to restore "competition and integrity" to livestock markets. (IHS

Markit Food and Agricultural Policy's JR Pegg)

- The state law enforcers contend weak enforcement of the Packers and Stockyards Act (P&SA) has contributed to consolidation in meat markets to the detriment of producers and consumers.

- Enacted in 1921, the P&SA was intended to ensure fairness in livestock and poultry markets, but critics say the law—and USDA's implementing regulations—have fallen short of that goal.

- "Structural changes in these markets, including increased concentration and changes in sales and marketing practices, have threatened producer viability, resulting in attrition, and reducing the number of producers participating in the livestock markets," the state attorneys general wrote in the December 22 letter to Agriculture Secretary Tom Vilsack. "We hope that with increased enforcement and government oversight, the purpose of the Packers and Stockyards Act can be fulfilled and return competition to these vital American markets."

- The letter echoes growing concern about the concentration of the beef, pork and poultry markets. The four largest beef packers controlled 25% of the market in the late 1970s, but now four firms─JBS, Tyson Foods, Cargill and National Beef─account for 85%. Similarly the top four pork packers now control 70% of the market up from 33% in 1976, and the four largest chicken processors' marketshare stands at 54%, up from 35% in 1986.

- India has deferred a proposed hike of its Goods and Services

Tax (GST) on textiles to 12%, maintaining the status quo of 5% for

now, India's Finance Minister Nirmala Sitharaman said in a press

conference late last week. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- Its 7% GST rate increase for textiles was expected to kick-in January 1, 2022, before a policy U-turn following an emergency GST Council meeting on December 31 last year.

- The Finance Minister said that the Council decided to maintain the 5% rate on textiles, recognizing an existing rate inversion problem which will be rationalized after review, according to national broadsheet The Hindu.

- This review is expected to be completed in February, meaning that the existing textiles rates will remain at least through Q1 this year.

- India's GST Council had planned to correct an "inverted duty structure in footwear and textiles sector", it said in a press release following its 45th GST Council Meeting in September 2021.

- The inversion refers to uneven tax rates applied on synthetic or manmade fibers and its downstream sectors - current GST on manmade fiber is 18%, yarns from the same fibers 12%, while finished fabrics and textiles made from these raw materials are taxed at 5%.

- States in India including Gujarat, West Bengal, Delhi, Rajasthan and Tamil Nadu had raised objections to the 12% GST hike, citing risks of job losses in the millions, factory closures in the hundreds of thousands, and foreign competition.

- India is a key producer of polyester, which is a synthetic fiber. The polyester sector is the biggest consumer of petrochemical feedstocks monoethylene glycol (MEG), purified terephthalic acid (PTA) and in turn its feedstock paraxylene (PX).

- The seasonally adjusted IHS Markit US Manufacturing Purchasing

Managers' Index™ (PMI™) posted 57.7 in December, down from 58.3 in

November but broadly in line with the earlier released 'flash'

estimate of 57.8. The improvement in the health of the US

manufacturing sector was the slowest in 2021 amid subdued output

and new order growth. Ongoing efforts to build safety stocks and a

severe deterioration in vendor performance, ordinarily signs of

improving conditions, continued to lift the headline PMI, however.

(IHS Markit Economist Chris

Williamson)

- An inability to source key inputs also weighed on new orders, which expanded at the softest rate for a year. Although some firms stated that demand was sustained at a strong pace, many suggested that customers were working through their stocks of goods before placing orders. The rise in foreign client demand was only marginal overall.

- Higher transportation and freight fees, alongside shortages of key items, led to a further marked increase in input costs during December. Although slowing to the softest for six months, the pace of increase remained among the quickest seen in the series history (since May 2007).

- US total construction spending rose 0.4% in November, below

expectations, but from levels of spending in September and October

that were revised higher. Core construction spending also rose 0.4%

in November following upward revisions to prior months. (IHS Markit

Economists Ben

Herzon and Lawrence Nelson)

- Firming costs and prices throughout the construction sector are boosting nominal construction spending generally. Furthermore, both total and core construction spending are benefitting from past (real) strength in the residential sector, although that source of strength is waning.

- Single-family housing permits peaked in January and have been generally moving lower since. While there were substantial gains over October and November, the level of single-family permits remained well below the January peak.

- This led to a slowing in the value of private residential construction put-in-place. Over the six months ending in November, private residential construction spending rose at a 9.0% average annual rate. This is down considerably from 24.4% average annualized growth over the prior six months.

- The recent jump in single-family permits will lead to renewed strength in residential structures spending, but this will be temporary, as permits are expected to turn lower beginning in December.

- Elsewhere in the construction report, private nonresidential structures rose 0.1% and public construction slipped 0.2% in November.

- Recent gains in private nonresidential construction have reflected strength in spending on commercial warehousing and manufacturing, two sectors that have benefited from recent very strong gains in demand for goods.

Tuesday, January 4, 2022

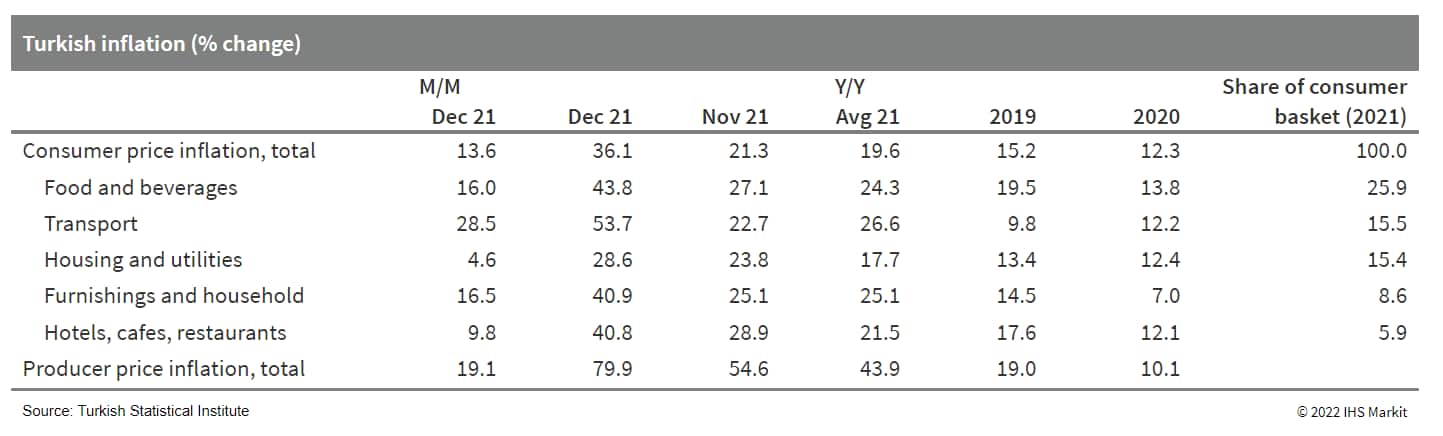

- Turkish inflation soared at the end of 2021, pushing end-year

consumer price growth to above 36%. The sharp depreciation of the

lira - it fell by over 90% against the US dollar in 2021 - was the

overriding impact on inflation. Recent central bank and government

efforts to boost demand for the lira may help to stabilize the

currency, but initial efforts have proven temporary. Given the

impact of lira losses on domestic prices, inflation will remain

extremely high in early 2022, forcing the central bank to pause its

rate cutting cycle. (IHS Markit Economist Andrew

Birch)

- The Turkish Statistical Institute (TurkStat) reported a surge of consumer price inflation in December, with prices jumping by 13.6% month on month (m/m). The end-month rise of prices pushed the end-2021 inflation rate to 36.1%; by far the highest such annual increase since September 2002, immediately following the country's banking crisis. With price growth rising sharply in the final quarter of the year, the annual average inflation rate for 2021 rose to nearly 20%.

- TurkStat also reported that annual "core" consumer price inflation, stripping out more volatile food and energy prices, also surged in December, reaching 31.9%. Şahap Kavcıoğlu, governor of the Central Bank of the Republic of Turkey (TCMB) has stated the core rate is guiding monetary policy decisions. President Recep Tayyip Erdoğan has claimed the core inflation rate would soon decelerate thanks to current interest-rate policies.

- Also in December, the annual producer price inflation rate skyrocketed to 79.9%. Even the annual average producer price inflation rate rose sharply in 2021, reaching nearly 44%, more than quadrupling the rise of prices the previous year.

- Although the December rate of inflation outstripped IHS Markit

expectations, TurkStat is likely still under-reporting price

growth. A local research group, ENAG, that uses a similar basket of

goods determined the actual rate of inflation in 2021 should have

been 82.8% at end-2021. Such outside observations are important to

digest, given that Erdoğan has directly replaced several top

TurkStat managers, raising questions regarding the agency's

independence.

- The City of New York (United States) has furthered an investment towards its target of an all-electric municipal fleet with the announcement of an order for 184 Ford Mustang Mach-E vehicles. According to the city's statement, the vehicles will be used by the New York Police Department (NYPD), New York City Sheriff's Office, the Department of Correction, the Department of Parks and Recreation, the Department of Environmental Protection, NYC Emergency Management, DCAS Police, and the Office of the Chief Medical Examiner. New York City said that it is due to receive its Mach-E vehicles by 30 June, and that they will replace current internal combustion engine (ICE) vehicles in the city's fleet. The city has ordered Mustang Mach-E GT versions, with 270 miles of range, focusing on the vehicle's 27 feet of cargo space for storing critical emergency and law enforcement gear. New York City also said that it will spend USD11.5 million on the initial orders and that the contract will remain in place for five years. It said that it operates a fleet of nearly 30,000 vehicles, with the NYPD operating more than 6,200 and the largest single group. The city is planning to purchase more than 1,250 electric vehicles (EVs) in 2022, as well as expand its charging infrastructure, including fixed charging stations and 180 solar carports and portable chargers. Technology website Engadget has also reported that the city has approved the option of buying up to 250 units of the Tesla Model 3 anytime over the next five years. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nearly three times more electric vehicle (EV) chargers need to

be installed each quarter along highway corridors or in publicly

accessible spots to meet US President Joe Biden's goal of having

500,000 charging ports in place by 2030, a National Renewable

Energy Laboratory (NREL) report found. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- Released 28 December, the report assessing the state of EV infrastructure across the US in the second quarter of 2021 said an average of 5,322 public EV ports had been installed in each quarter since 2020. But NREL researchers say approximately 14,706 new public installations will be required each quarter for the next nine years to meet the Biden administration's 2030 target.

- When comparing the current rate of deployment, "it is clear that the pace of installations will need to significantly increase," NREL researchers Abby Brown, Johanna Levene, Alexis Schayowitz, and Emily Klotz wrote.

- However, the US can meet Biden's 2030 charger goal much earlier than expected to coincide with surging demand, Mark Boyadjis, IHS Markit global automotive technology lead, told Net-Zero Business Daily 3 January. IHS Markit projects there will be 9.3 million EVs on US roads by 2026, up from 1.5 million EVs in 2020, he said.

- In fact, IHS Markit's automotive team projects an additional 600,000 charging units will be needed in public spaces and workplaces by 2026 to meet EV demand.

- According to NREL, the number of public EV ports in the US increased by 5,006 in Q2, bringing the total to 105,765 and representing a 5.0% increase since the first quarter of 2021.

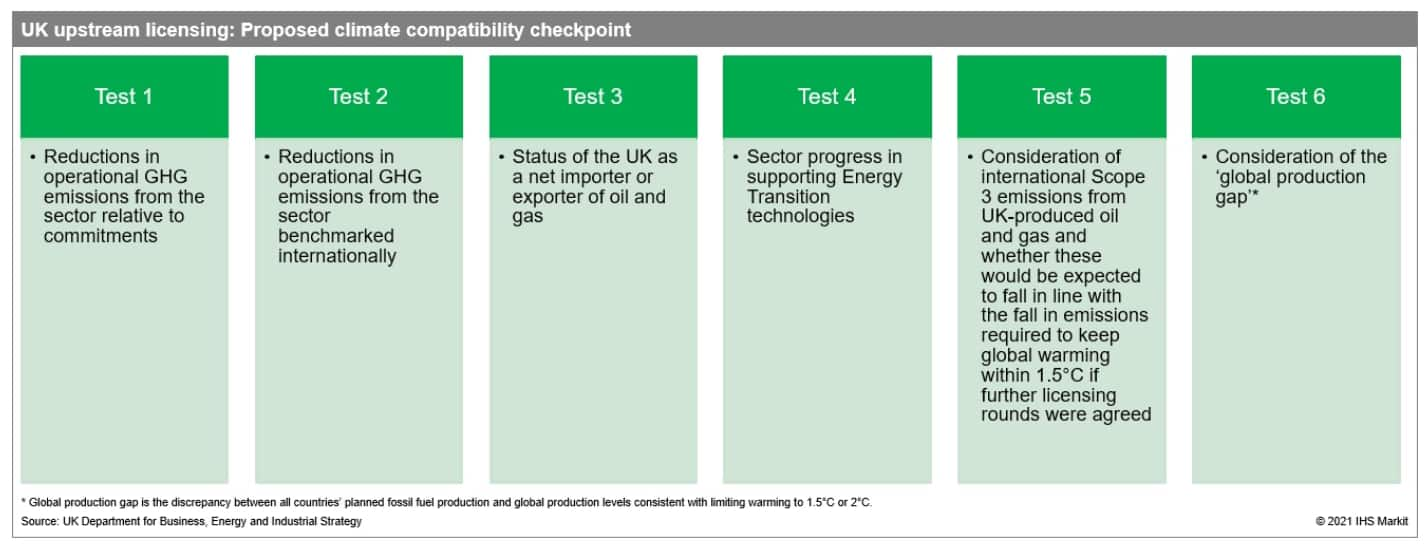

- In late December 2021, the UK government announced public

consultations on its draft climate compatibility checkpoint (the

checkpoint), a series of tests intended to align the existing

upstream licensing framework with the country's 2050 net-zero

emissions target. The proposed criteria range from operational

emissions to investment in low-carbon projects and is intended to

inform the Oil and Gas Authority (OGA)'s decision-making on new

licensing rounds. Public consultations will run through February

2022 and the checkpoint is expected to be finalized before the end

of the year, which is likely to delay any potential bid round until

2023. The checkpoint indicates the UK government's continued

efforts to bolster the oil and gas industry's social license to

operate even as political and public sentiment is shifting towards

a gradual phase-out of hydrocarbon production. The government has

developed the checkpoint as part of its ongoing regulatory overhaul

in the upstream sector, aimed at strengthening environmental

oversight and facilitating the energy transition in the industry.

(IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr

Chyzh)

- A tender for multiple renewable energy projects in Russia was

held in September 2021. A total of 2.63 GW of capacity was

awarded—1.85 GW for wind power and 0.78 GW for solar. This

represents the first tender within the framework of the second

government support program to stimulate clean energy growth in

Russia, the new so-called Capacity Supply Agreement (CSA 2.0) for

renewables procurement that went into effect in 2021. Completion of

the new capacities would represent an increase of nearly 40% in

Russia's existing renewable capacity; installed renewable capacity

in 2020 was about 4.3 GW: 1.7 GW of solar and 2.5 GW of wind. (IHS

Markit Executive Briefings: Climate and Cleantech's Andrew Bond, Anna

Galtsova, and Matthew

Sagers)

- Winning bidders were selected based on the lowest levelized cost of electricity (LCOE) generated. Previously, selection was made on the basis of lowest capex per unit of capacity. The government announced in 2020 that compensation would be adjusted, with successful bidders receiving payments under a contract-for-difference mechanism, by which the electricity provider is guaranteed a fixed return regardless of actual power prices.

- The main goal of renewables development in Russia is not decarbonization but manufacturing and technological development. The tender specified fairly high local content requirements, with onerous penalties for non-compliance, with further mandates on domestic manufacturing of the equipment utilized in development.

- Winning bids in the tender were surprisingly low. The prices offered by the bidders were not only low for Russia but low even by global standards. The bulk of the winning bids, for 1.391 GW of wind power, were awarded to Vetroparky FVR. This company is a JV between state-owned Rosnano and Finnish power company Fortum.

Wednesday, January 5, 2022

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 14-15 December, were released this afternoon. At that meeting, the Committee announced a revised plan to wind down bond purchases several months sooner than the original plan announced on 3 November. An earlier end to bond purchases, in the view of policymakers, creates more space for the Committee to begin to raise interest rates earlier than it previously anticipated might be appropriate. At this meeting, however, no changes were made to interest rates, including the target for the federal funds rate of a range of 0% to 0.25%. Discussion of economic developments and risks by policymakers at the December meeting support our expectation that the first increase in the federal funds rate target will occur between March and June, with May the most likely time for that move. At the December meeting, the FOMC held the first of what is likely to be several discussions regarding the size and composition of the Fed's balance sheet over the longer run. Elements of that discussion suggest that the Fed will begin to trim the size of its bond portfolio within several months of beginning to raise interest rates, and that the size of the Fed's portfolio will be reduced more quickly (in dollar terms) than during the previous episode of balance-sheet normalization, from 2017 to 2019. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Saudi Arabia's current account posted a surplus of SAR81.4

billion (USD22.2 billion), the highest in three years, according to

the Saudi Arabian Monetary Authority (SAMA). It compared with a

surplus equal to SAR32.7 billion in the second quarter and a small

deficit of SAR2.6 billion reported for the third quarter 2020. (IHS

Markit Economist Ralf

Wiegert)

- The oil export rebound is still ongoing. Oil shipments soared 93.9% on the year in the third quarter, pushing the annual rate for total exports 71.8% at the same time. The goods account reported a surplus at a post-pandemic high of SAR142 billion, roughly three times the size of the surplus in the third quarter a year ago. Goods imports rebounded as well, but their pace was more muted, at 19.3% in the third quarter following a decline of similar percent size in the third quarter 2020.

- Direct investment inflows, which had surged in the second quarter 2021 on the sale of Saudi Aramco's pipeline network, was down to SAR6.6 billion in the third quarter, roughly the same level as in the first quarter (SAR6.7 billion) but higher compared to the third quarter in 2020 (SAR4.1 billion). Direct investments remain below the ambitious targets spelled out in the Vision 2030.

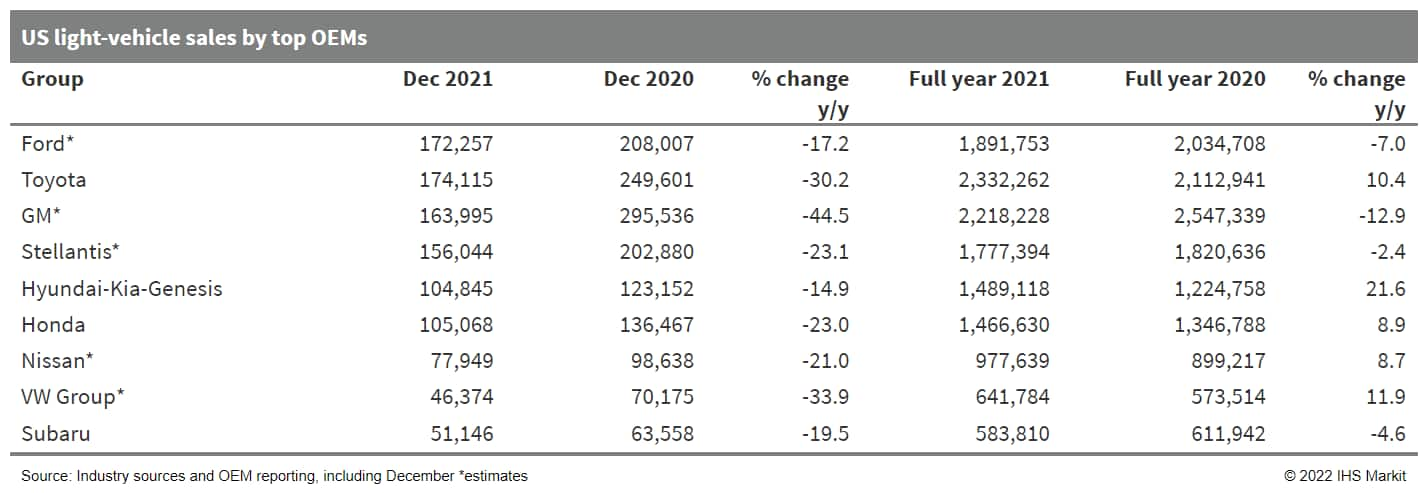

- The lack of inventory pushed US light-vehicle sales down by

24.6% y/y in December 2021; full-year sales are up 3.4%. Although

the pace of sales increased mildly for the third consecutive month,

demand continues to be subdued by new vehicle inventory

constraints. Sales in 2021 reflect the limited upside to demand

growth given current inventory conditions. December results reflect

low year-end clearance volume, a result of limited inventory, which

will continue to push against sales levels moving into 2022.

Overall, volume growth for 2022 is projected at an

inventory-limited 15.5 million units. The lack of inventory is

overcoming favorable consumer interest and buying conditions to

hold volume down. However, 2023 and 2024 are forecast to spike

again, as production recovers to help meet pent-up demand. (IHS

Markit AutoIntelligence's Stephanie

Brinley)

- Ford has announced it will increase production of the F-150 Lightning electric vehicle (EV) pick-up to 150,000 units per annum (upa) by mid-2023; a specific investment figure was not disclosed. In a statement released on 4 January 2022, the automaker said it is planning to increase production capacity for the Lightning from an earlier plan for 80,000 upa to 150,000 upa. Ford also announced that reservations will start being converted to orders on 6 January 2022. As there are more reservation holders than Ford can build trucks for the 2022 model year, Ford will invite them to place orders later for future model years. Although Ford has not specified an investment or said how the production increase will be implemented, the company says, "To deliver this latest increase, a small task force of employees from manufacturing, purchasing, strategy, product development and capacity planning are finding ways to quickly adapt and expand production of the groundbreaking pickup. Ford is working with key suppliers - as well as with its own manufacturing facilities Rawsonville Components Plant and Van Dyke Electric Powertrain Center - to find ways to increase capacity of electric vehicle parts, including battery cells, battery trays and electric drive systems." Ford also notes that more than 75% of its reservation holders are new to the Ford brand. (IHS Markit AutoIntelligence's Stephanie Brinley)

- On January 3, three affiliates of Montana-based Gallatin Power

filed notices with the Public Utilities Commission of Nevada of new

applications filed with the US Bureau of Land Management on 4,500

MW of new solar/battery projects. The company said it would seek

permits from the Commission for these projects once they clear

BLM's environmental review process. The notices were from (IHS

Markit PointLogic's Barry Cassell):

- Bonnie Clare Solar LLC - The Bonnie Clare Solar Project would consist of a 1,500-MW (ac) photovoltaic solar facility, a battery energy storage system and a 230 kV generation-tie line in Nye County, Nevada. The power line would interconnect this project to the proposed Amargosa Substation. The project site is on BLM-managed land about 10 miles northwest of Beatty in Nye County. The project would include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- Orken Solar LLC - It plans a 1,500-MW photovoltaic solar facility, a battery energy storage system and a 230-kV generation-tie line in Nye County, Nevada. The tie line would also run to the proposed Amargosa Substation. The project site is on BLM-managed land about 43 miles north-northwest of Pahrump in the Amargosa Valley. The project would also include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- American Glory Solar LLC - The American Glory Solar Project would consist of a 1,500-MW photovoltaic solar facility, a battery energy storage system and a 230-kV generation-tie line to the proposed Amargosa Substation in Esmerelda County, Nevada. The project site is on BLM-managed land about 5 miles north-northwest of Silver Peak. The project would also include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- Chinese regulators have issued additional requirements for foreign listings and share sales, but have not completely blocked access to US capital markets. The China Securities Regulatory Commission (CSRC) issued proposals on 24 December establishing tighter regulatory requirements for foreign share listings by Chinese firms. These extend domestic regulatory coverage to previously exempt Variable Interest Entities (VIEs) owned outside China. Firms now need to present the draft prospectus and relevant opinions from industry regulators within three days of filing application documents outside China or announcing a planned transaction internationally. CSRC will then sanction or block the planned deal, requesting additional clearances if appropriate. In parallel, on 27 December, the National Development and Reform Commission (NDRC) announced that Chinese firms operating in sectors where foreign investment is limited require specific clearance from regulators before undertaking international share listings. Additionally, the Cyberspace Administration of China completed a consultation on 13 December regarding further controls from a cybersecurity perspective, with final guidelines due shortly. The CSRC and NDRC guidelines are provisional and CSRC has solicited market feedback by 23 January. Although CSRC has stated that its new requirements do not apply retroactively to existing listings, uncompleted existing filings may be subject to them. (IHS Markit Country Risk's Brian Lawson, David Li, and Yating Xu)

- Ireland has brought in a minimum price for alcoholic drinks of

10 cents per gram of alcohol in a bid to curb alcohol consumption,

especially binge drinking, as well as delay the moment young people

start drinking. (IHS Markit Food and Agricultural Policy's Sara

Lewis)

- The new minimum unit pricing (MUP) law that took effect on 4 January will mainly affect sales in off-licenses, shops and supermarkets, particularly hard discounters, such as Aldi, rather than pubs or restaurants.

- The law brings a hefty price hike for some products, for example retailers now have to charge €7.40 for the cheapest 750 milliliter (ml) bottle of wine (12.5% alcohol) which previously could be found for under €5. The same size bottle of 14% wine cannot be sold for less than €8.28.

- Retailers have to ask at least €20.71 for a bottle of 37.5% sprits and €23.75 for 43% spirits. A 500ml can of beer now retails for a minimum €1.70.

- One of the biggest price rises will apply to slabs containing 24 cans of beer or cider, which will more than double in price, from under €20 to around €40.

- "In Aldi, the cheap larger, Galahad, was sold as low as 75 cents a can but must now cost €1.57. An 11% alcohol bottle of wine will need to cost at least €6.50 while a stronger 13.5% wine will cost €7.89 minimum," newspaper The Irish Examiner reported.

Thursday, January 6, 2022

- The year-on-year (y/y) rate of increase in the eurozone

producer price index (PPI) rose by almost two percentage points in

November 2021 to 23.7%, a new record high and above the market

consensus expectation (of 22.9%, according to Reuters' survey).

(IHS Markit Economist Ken

Wattret)

- Having risen for 12 months straight, the PPI inflation rate is now 14 percentage points above its prior peak, set back in 2008.

- Soaring energy prices were again key to November's elevated PPI inflation rate. On a y/y basis, the energy sub-index rose by 66%, triple the previous record high, again set in 2008.

- In month-on-month (m/m) terms, the energy index rose by 3.5%, following an unprecedented 18.6% increase in October. Soaring gas prices in Europe have been driving the recent surge, with a further increase likely to have occurred in December.

- The eurozone PPI inflation rate excluding energy also rose to a new record high in November, of 9.8%, up by 0.8 percentage point from October. The prior historical peak, set in 2011, was 4.2%.

- US employers announced 19,052 planned layoffs in December,

according to Challenger, Gray & Christmas—up 28.1% from the

lowest monthly reading on record in November. The total for

December is down 75% from the December 2020 reading. (IHS Markit

Economist Juan

Turcios)

- Last year, employers announced plans to cut 321,970 jobs. This was the lowest annual total on record and 86% lower than the 2,222,249 job cuts announced over 2020 (Challenger began tracking job-cut announcements in January 1993).

- With job-cut announcements hovering near historic lows, job openings near all-time highs, and the quits rate at a record high, the labor market appears to be tight and tilted in the favor of workers.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "Quits hit a new record in November with 4.5 million. Workers are leaving jobs in droves, particularly in-person jobs in Entertainment/Leisure, Health Care, and Transportation, according to the Department of Labor. This trend is likely to continue as we contend with the largest surge in COVID cases we've yet seen, spurred by Omicron."

- Last year, employers cited COVID-19 as a reason for 8,904 planned job cuts, with none citing COVID-19 as a reason in December. Since August, COVID-19 has been cited only a total of 954 times as a reason for planned job cuts despite the increase in cases that occurred first because of the Delta variant and the current wave of new infections brought on by the Omicron variant. Employers cited other reasons, including closing (69,648), restructuring (58,712), market conditions (54,160), and demand downturn (48,619) more frequently than COVID-19 as causes of job-cut announcements in 2021.

- In 2020, COVID-19 was the leading reason for announced job cuts, accounting for 1,109,656 announced job cuts. COVID-19 was the ninth-leading reason for job-cut announcements last year. Interestingly, vaccine refusal was the tenth-leading reason cited for job-cut announcements at a total of 7,634.

- Aerospace/defense announced 34,627 job cuts last year, the highest number of any industry. Rounding out the five sectors that reported the most job cuts last year are healthcare/products (31,997), services (28,650), telecommunications (25,543), and energy (21,537).

- Denmark aims to reach fully fossil-fuel-free domestic aviation

by 2030 while making sure that consumers have a domestic "green"

aviation option by 2025. Danish Prime Minister Mette Frederiksen

made the government's pledge in her annual speech on New Year's

Day. The Nordic state aims to get on track to reach economy-wide

net-zero emissions by 2050. Denmark's government in 2019 agreed to

increase the pace of decarbonization, vowing to slash its 1990

emissions not by 40% but by 70% by 2030. (IHS Markit Net-Zero

Business Daily's Cristina Brooks)

- But greener flight requires developing aviation technologies, as currently planes are only allowed to operate on a 50% sustainable aviation fuel (SAF) and fossil fuel blend, according to BP.

- The prime minister noted that Denmark's private sector and universities, like Aalborg University, are working to develop greener technologies and fuels for planes.

- The first SAF made from biogas, CO2, and hydrogen can be produced in Denmark and the Nordic countries by 2025, according to a 2019 University of Southern Denmark study.

- Denmark's public grant agency is funding the Energy Cluster Denmark consortium to commercialize SAF made from biomass.

- Last May Denmark notched an SAF "first" through Shell joint venture DCC & Shell Aviation.

- The SAF was made from "sustainably sourced, renewable waste" to allow airline Alsie Express to fly between the Danish cities of Sønderborg and Copenhagen. It was supplied as part of 2020 SAF supply agreement between Shell and Finnish refiner Neste.

- For now, however, the prevailing practice to decarbonize aviation in Denmark is to use offsets, Shell said.

- Dongfeng Honda, the joint venture (JV) between Dongfeng Motor Group and Honda, said it will build a new plant in China for new energy vehicle (NEV) production. The new plant, located in Wuhan, will have capacity for 120,000 units per annum (upa) when it is completed in 2024. The new plant in Wuhan will lay the foundation for Honda to accelerate its transition to electrification. Hybrid models have already accounted for 15% of Honda's Chinese sales in 2021. According to a company statement, a total of 233,801 Honda-branded hybrid vehicles were sold in the market last year, up 16% year on year (y/y). Both of Honda's JV, Dongfeng Honda and GAC Honda, see opportunities to hit new sales records in 2022 as Honda's hybrid product lines and all-new launches like the Integra and Breeze gain traction in China. In the NEV market, Honda has planned a series of electric vehicles (EVs) for China under its commitment to have a fully electrified product portfolio in China by 2030. By the end of 2025, the automaker will introduce 10 new Honda-branded EVs in China under its e:N series. (IHS Markit AutoIntelligence's Abby Chun Tu)

- At the CES 2022 show in Las Vegas (US), Peterbilt will showcase its first Model 579 equipped with Level 4 autonomous system Aurora Driver. According to a company statement, Aurora has added the new Model 579 to its heavy-duty test fleet, which is hauling freight for customers. Sterling Anderson, chief product officer and co-founder of Aurora, said, "Our partnership with PACCAR to co-develop self-driving Class 8 trucks builds on a deep technical foundation and years of collective expertise. The team is making progress as we prepare to launch Peterbilt's first autonomous trucks at scale. Together, we're building a product and business that will make our roads safer and our supply chains more efficient, and we're excited to share a glimpse into that future at CES." Aurora, which recently confirmed that it was going public through a merger with special-purpose acquisition company (SPAC) Reinvent, has developed an autonomous system called "Aurora Driver". Working with partners PACCAR and Volvo Group, it aims to launch its autonomous system in commercial service in heavy-duty trucks in late 2023 with robotaxis to follow a year later. In collaboration with PACCAR, it plans to launch a commercial pilot of autonomous trucks hauling goods for package delivery firm FedEx. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Friday, January 7, 2022

- US nonfarm payroll employment rose 199,000 in December, down

from prior months' gains and well below expectations. Civilian

employment, on the other hand, posted a solid gain (651,000),

outpacing a more modest increase in the civilian labor force

(168,000); the unemployment rate declined 0.3 percentage point to

3.9%. (IHS Markit Economists Ben

Herzon and Michael

Konidaris)

- The unemployment rate in December was below most estimates of the "natural rate" and only 0.4 percentage point above the pre-pandemic low of 3.5%, indicating that labor markets are, once again, tight and tightening.

- The current (tight) state of the labor market in large part reflects a continued depressed labor-force participation rate.

- While it has been moving unevenly higher in recent months, at 61.9%, the participation rate remains well below the February 2020 level of 63.4%. Were today's participation rate equal to that of February 2020, today's level of employment would imply an unemployment rate of 6.1%—a labor market with plenty of slack.

- Nevertheless, employers are competing for labor that is in short supply, and wage gains are firming. In December, average hourly earnings rose 0.6% and prior months' increases were revised higher. From March 2021 to December 2021, average hourly earnings rose at a 6.0% annual rate.

- The current rapid spread of the Omicron variant, moreover, has the potential to temporarily slow the recovery in labor-force participation and keep wage rates rising at rapid clip.

- Over the next few months, IHS Markit analysts assume that payroll gains firm only gradually while wage rates continue rising rapidly, implying solid growth of private wage-and-salary income.

- After expanding for the past 10 months, Canada's purchasing

managers' spending declined in December mainly because of the

negative impact of the Omicron variant and partly owing to British

Columbia's flood damage that negatively affected transportation

infrastructure. The Ivey Purchasing Managers' Index (PMI) plummeted

16.2 points to 45.0 in December, as purchasing managers pulled back

spending for the first time since January 2021. (IHS Markit

Economist Chul-Woo

Hong)

- Although the employment index continued to decrease for four consecutive months, down 4.5 points to 50.0, indicating no change in monthly employment, December's Labor Force Survey showed a solid net job gain of 54,700, led by the public sector.

- The inventories index fell 5.4 points to 49.6, showing a modest first decline in inventory spending since last December. Reflecting the intensified supply disruption, the supplier deliveries index dropped to 27.7, remaining at the second-lowest level following the massive plunge in the first month of the pandemic.

- After the sharp decline in the previous month, the price index slightly rebounded, partly because of the low exchange rate, putting modest upward pressure on inflation.

- All subindexes fell except the price index, which increased 2.6 points to 77.6.

- Given the reimposed regional restrictions, more affecting the service sector, ongoing supply disruption will likely weigh on purchasing managers' spending activity in the short term.

- There was another stronger-than-expected increase in eurozone

HICP inflation in December 2021. According to Eurostat's flash

estimate, it edged up from 4.9% to 5.0%, a new record high and

above the market consensus expectation (of 4.7%, according to

Reuters' survey). (IHS Markit Economist Ken

Wattret)

- That is the highest headline inflation rate since the eurozone's inception in 1999 by some distance - the prior peak in 2008 was 4.1%. The cumulative increase during 2021 was 5.3 percentage points, a record one-year rise, again by a large margin.

- Energy inflation moderated in December for the first time in seven months, although at 26.0% year on year (y/y) it still increased by more than 30 percentage points during 2021. Energy inflation contributed half (2.5 percentage points) of December's HICP inflation rate, down marginally from November's record 2.6-percentage-point contribution.

- Food inflation increased sharply to 3.2%, the highest rate since June 2020. This was driven mainly by unprocessed food inflation (up from 1.9% to 4.6%), which can be very volatile in winter months due to weather effects.

- The eurozone's core HICP inflation rate excluding energy, food, alcohol, and tobacco prices was stable in December at 2.6%, slightly above the market consensus expectation of 2.5%, and a record high. As expected, the two constituent parts of the core inflation rate diverged in December.

- Non-energy industrial goods (NEIG) inflation jumped from 2.4% to 2.9%, a record high. The strong upward trend during 2021 reflected various influences, including supply-side bottlenecks, and has further to go. The pre-pandemic rate of NEIG inflation back in February 2020 was just 0.5%.

- In contrast, services inflation slipped back from 2.7% to 2.4% in December, although it remained well above its pre-pandemic rate of 1.6%. The areas of services inflation most sensitive to the COVID-19 pandemic, such as restaurants and hotels, fell markedly in 2020 but rebounded during 2021 as economies reopened and consumer demand recovered strongly.

- The People's Bank of China (PBOC) has started to provide

low-cost loans to fund decarbonization activities via a scheme that

financial experts say could play a key role in helping the country

reach its climate goals. (IHS Markit Net-Zero Business Daily's Max

Lin)

- Under the carbon emissions reduction facility (CERF) launched 8 November, Chinese financial institutions licensed to operate nationwide can apply for PBOC funds to support their loans to clean energy, energy conservation, and environmental protection projects.

- Sun Guofeng, head of the Chinese central bank's monetary policy department, said 30 December that the first batch of funds totaling CNY 85.5 billion ($13.4 billion) were already distributed to lenders to back decarbonization projects that can cut CO2 emissions by 28.8 million metric tons. "The PBOC will continue … to help China reach the goals of reaching peak CO2 emissions by 2030 and carbon neutrality by 2060," Sun said during a press conference, citing the country's national targets.

- The central bank has not indicated an upper limit for the CERF funds. Based on the amount of domestic green loans, CCB Futures, a brokerage owned by state-controlled China Construction Bank, estimates that the PBOC could distribute CNY 1.26 trillion per year via the facility. Anhui-based Huaan Securities estimates the figure at CNY 1.8 trillion.

- In a research note published last September, the International Energy Agency said China—the world's largest GHG emitter—needs an annual investment of CNY 4 trillion in its energy sector alone to reach the 2030 climate target.

- Italy-based Repower Renewables has announced plans to build a 495 MW offshore wind farm around 70 kilometers off the eastern coast of Calabria, Italy. The project will feature 33 wind turbines, with an estimated capacity of 15 MW each. The company has submitted plans to the Ministry of Infrastructure and Transport Port Authority of Crotone for a 30-year concession to build and operate the wind farm. The wind turbines will be connected via 66 kV array cables and the electricity generated will be transported to shore through a 380 kV export cable. Repower is one of 64 developers who noted their expression of interest to build floating wind farms in Italy. The survey was carried out last year by Italy's Ministry of Ecological Transition. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- LG Electronics has developed new biometric recognition technology that enables car owners to turn on the ignition without using a key, according to a press release by Digi Times Asia. The technology identifies facial expressions along with finger movements leveraging the use of multiple in-car cameras. LG's authentication system, with the help of a first camera, identifies the user's specific body parts, and through a second camera automatically resets its viewing angles based on the data points of the first camera to capture the user's iris and other biometric features. This allows the user to start up the vehicles as well as adjust or control the vehicle through facial expressions and hand gestures. The technology also helps to detect whether a driver is drowsy or has a sudden illness by monitoring eyelids and facial movements. The press release adds that LG and its subsidiaries are working to ensure that more emphasis is placed on development through various patented technologies, including autonomous driving devices, automotive in-cabin foldable displays, and vehicle-to-everything (V2X) communications technologies. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai has signed a memorandum of understanding (MOU) with Singapore-based real-time 3D content developer and platform operator Unity to jointly design and build a new metaverse roadmap and platform for a meta-factory, according to a company press release. Under the MOU, the two parties aim to build a meta-factory concept, a digital twin of an actual factory supported by a metaverse platform. Hyundai will be able to virtually test-run a factory in order to compute the optimal plant operation, and plant managers will be able to handle problems without having to physically visit the plant, thanks to the advent of a meta-factory. The collaboration will also result in a real-time 3D and virtual platform that will reach a large number of Hyundai consumers, providing them with a more comprehensive range of services across sales, marketing, and customer experience, according to the automaker. Hyundai intends to implement the meta-factory concept first at the Hyundai Motor Global Innovation Center in Singapore (HMGICS), currently under construction. After construction of the physical center is completed by the end of this year, the automaker plans to open the virtual factory by 2025. Hyundai and Unity's collaboration at HMGICS will accelerate intelligent manufacturing innovation by merging artificial intelligence, 5G, and other advanced technologies into a next-generation smart factory platform. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-10-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-10-2022.html&text=Weekly+Global+Market+Summary+Highlights%3a+January+3-7%2c+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-10-2022.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: January 3-7, 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-10-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+January+3-7%2c+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-january-10-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}