Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 22, 2021

Weekly Global Market Summary Highlights: November 15-19, 2021

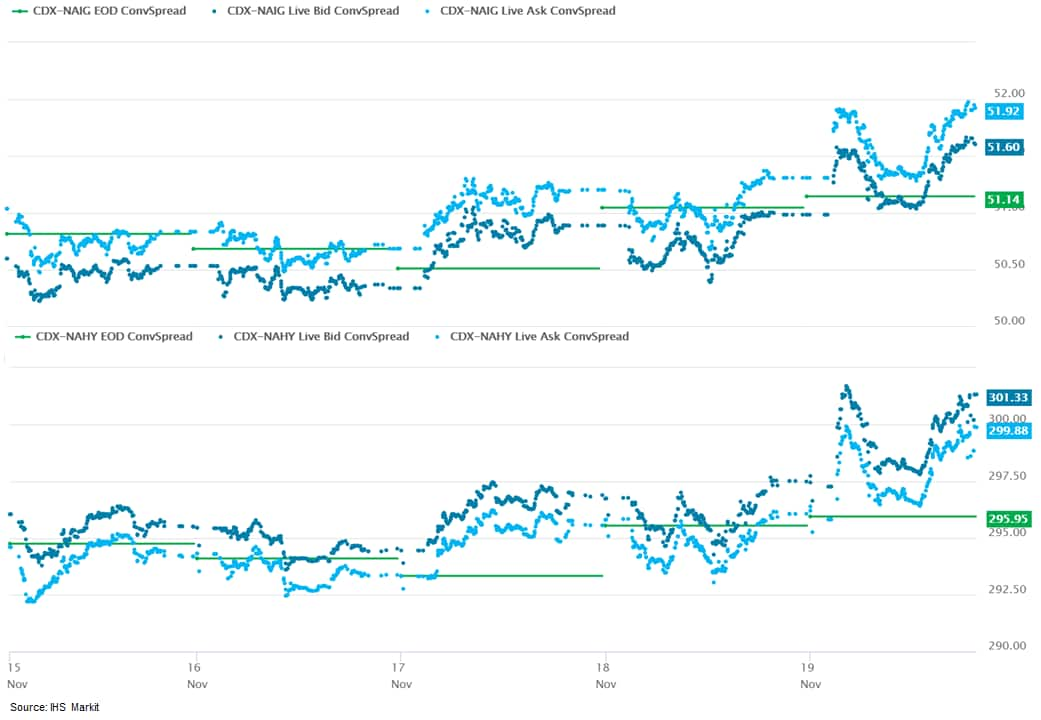

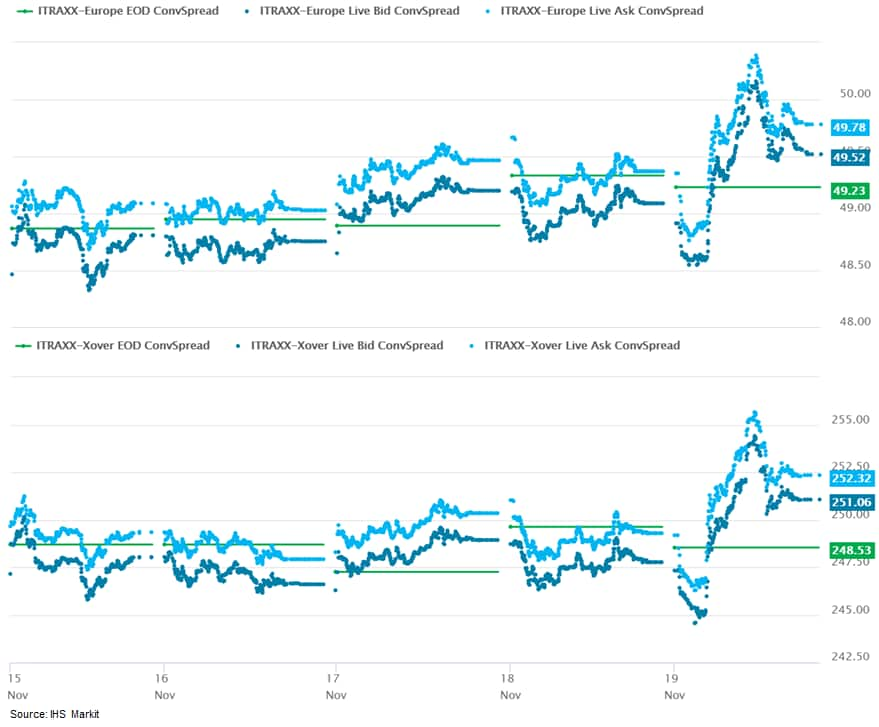

Major US, European, and APAC equity indices closed mixed on the week. US and benchmark European government bonds closed higher on the week. CDX-NA and European iTraxx closed modestly wider on the week across IG and high yield. The US dollar and natural gas closed higher, while oil, gold, silver, and copper were lower week-over-week.

Americas

Major US equity markets closed mixed on the week; Nasdaq +1.2%, S&P 500 +0.3%, DJIA -1.4%, and Russell 2000 -2.8% week-over-week.

10yr US govt bonds closed 1.55% yield and 30yr bonds 1.91% yield, which is -3bps week-over-week for both.

DXY US dollar index closed 96.03 (+0.9% WoW).

Gold closed $1,852 per troy oz (-0.9% WoW), silver closed $24.78 per troy oz (-2.2% WoW), and copper closed $4.41 per pound (-0.9% WoW).

Crude Oil closed $75.94 per barrel (-6.0% WoW) and natural gas closed $5.15 per mmbtu (+5.4% WoW).

CDX-NAIG closed 52bps and CDX-NAHY 301bps, which is +1bp and

+6bps week-over-week, respectively.

EMEA

Major European equity indices closed mixed on the week; Germany +0.4%, France +0.3%, Italy -1.4%, UK -1.7%, and Spain -3.6% week-over-week.

Major 10yr European government bonds closed sharply higher on the week; France closed -10bps, Italy -10bps, Germany -8bps, Spain -8bps, and UK -4bps week-over-week.

Brent Crude closed $78.89 per barrel (-4.0% WoW).

iTraxx-Europe closed 50bps and iTraxx-Xover 252bps, which is

+1bp and +3bps week-over-week, respectively.

APAC

Major APAC equity markets closed mixed on the week; Mainland China +0.6%, Japan +0.5%, South Korea +0.1%, Australia -0.6%, Hong Kong -1.1%, and India -1.7% week-over-week.

Monday, November 15, 2021

- After threatening a response to OPEC+'s schedule to stick to a

slower production increase, the US administration has suggested

several strategies to try to mitigate high oil prices but has

committed to none so far. There are no unilateral silver bullets,

or even clear good options, to the predicament that the Biden

Administration is attempting to target - high gasoline prices - but

the vocal rhetoric and recent spread of the oil intervention

conversation to the mainstream political discussion and Congress

mean that reversing course will be difficult. The options currently

being discussed or rumored to be under discussion include the

following (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst):

- Crude SPR release - most likely and least disruptive. A release would ease crude prices modestly and poses the least amount of political resistance. It would be even more impactful if paired with Jones Act waivers to move gasoline into PADD 1 from PADD 3.

- Gasoline export ban - highly disruptive and unpredictable fallout. Such a move could help ease pressure in the US and de-link US gasoline prices from the world. To work, it would need to be coupled with Jones Act waivers. It risks upending global and domestic gasoline markets in unpredictable ways.

- Crude export ban - highly disruptive and ultimately counter-productive. A crude export ban remains the worst possible option, as it would upend global oil supply chains, discourage domestic production, and ultimately add upward pressure on gasoline prices by squeezing global markets and Brent higher.

- Sanction waivers on Iran - less disruptive but highly unlikely. Allowing Iranian oil to flow would be the most impactful lever on global oil price formation, but such a measure remains unlikely at the current juncture, with negotiations set to restart on 29 November and the state of play yet to be determined.

- GM Defense is reportedly working on a prototype of a Hummer electric vehicle (EV) for the US military, in a project called "electric Light Reconnaissance Vehicle" (eLRV), according to a CNBC report. The report cites GM Defense president Steve duMont as saying about the potential project, "The Army's very excited about the fact that we're investing in this. The eLRV, that's the first purpose built from the ground up, you saw it today, it's our Hummer EV. Our Hummer EV is what we're going to base that vehicle on." CNBC reports that US Deputy Secretary of Defense Kathleen Hicks visited GM to learn about GM Defense's research and GM's EV plans. It reports that the eLRV will be based on the GMC Hummer EV, modified for military use, but keeping the frame and Ultium batteries. It is not expected to look very much like the consumer vehicle, either. CNBC cites GM Defense's vice-president of product development and advanced engineering as saying that the company plans to begin assembling eLRV prototypes for testing and evaluation in 2022. The report also notes that the project is in its early phases. The US Department of Defense has reportedly asked 10 companies for information about a potential EV, including an event in May 2021 where the Army evaluated off-road capability, defined some of its goals, and gathered information about possible solutions. Once the Army has gathered information, the next phase will be for detailed specifications for potential prototypes and then selection of two companies to produce them. (IHS Markit AutoIntelligence's Stephanie Brinley)

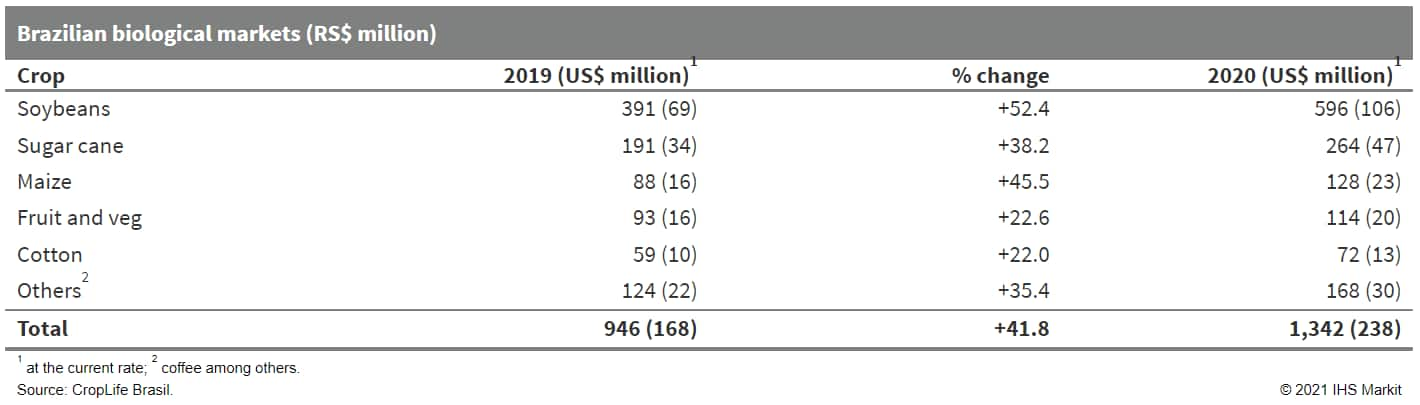

- The biological control market in Brazil is booming with

registration at record levels and the market growing at well into

double digits, Professor Dr Italo Delalibera Júnior, of University

of São Paulo (Esalq) Brazil told delegates at the Annual Biocontrol

Industry Meeting - ABIM 2021 last month. The professor cited

studies showing that Latin America was projected to have "by far"

the highest compound annual growth rate for the 2020-25 period.

"This is mainly to the expected entrance of biocontrol into row

crops and cereals in Brazil." Soybeans, sugar cane, fruit and

vegetables, coffee, and cotton hold some 86% of the current

biological market in Brazil, he added. (IHS Markit Crop Science's

Robert Birkett)

- The Brazilian biologicals market is expected to be worth some R$1,789 million (US$317 million) in 2021, according to industry association, CropLife Brasil. That would be a 33% rise on last year and an almost doubling in the two years since the R$946 million (US$168 million) market of 2019. Soybeans would account for 46% of this year's market.

- Biological products were to be applied to about 23 million ha in 2021, according to the Ministry of Agriculture. That is compared with a total planted area in the country of 77.4 million ha.

- Among fruit growers, adoption rates have been climbing strongly. In the two years to 2021, orange growers' adoption of biologicals has risen from 16% to 35%, while for banana growers, it has gone from 31% to 50%, for apples from 23% to 32%, for grapes from 21% to 29%, and papayas from 50% to 57%.

- The professor cited IHS Markit data that on farm produced

products for own use accounted for 22% of the 2019/20 market at 3.1

million ha. Such production has been greatly encouraged by

companies that offer kits with biological assets and substrates for

fermentation, in addition to equipment for installing

"biofactories" on properties. There is strong pressure for

regulation of on farm production, which should only serve those

growers with the capacity to establish well equipped biofactories,

with infrastructure and qualified personnel to meet control and

quality standards, the professor suggests.

- The US University of Michigan Consumer Sentiment Index sank 4.9

points from its October level to 66.8 in the preliminary November

reading—its lowest level since 2011. The decline was driven by

worsening views on both the present situation and the future. The

present situation index fell 4.5 points to 73.2, and the

expectations index declined 5.1 points to 62.8. (IHS Markit

Economists James

Bohnaker and William Magee)

- Elevated inflation remains the foremost drag on sentiment. According to the report, half of all families expected lower real incomes over the next year. The 12-month change in the consumer price index (CPI) in October was the fastest since 1990 at 6.2%, with highly visible consumer prices such as those for gasoline and food rising at even sharper rates. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.1 point to 4.9% to reach its highest level since 2008.

- Households in the bottom half of the income distribution were most affected by higher consumer prices. The index of sentiment for households earning below $100,000 per year declined 7.0 points, while that for households earning over $100,000 per year was unchanged.

- The indexes of buying conditions for large household durable goods, automobiles, and homes retreated as rising prices for those items were cited by respondents more frequently than any other time in more than 50 years.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the expectation for strong job and wage growth in the coming months, and the fact that healthy consumer balance sheets and excess savings will continue to support solid growth of consumer spending. Recent data on credit- and debit-card spending suggest that consumers are spending confidently in the early stages of the holiday shopping season. IHS Markit analysts expect that sentiment will track spending more closely as inflation subsides, although these may not align until next year.

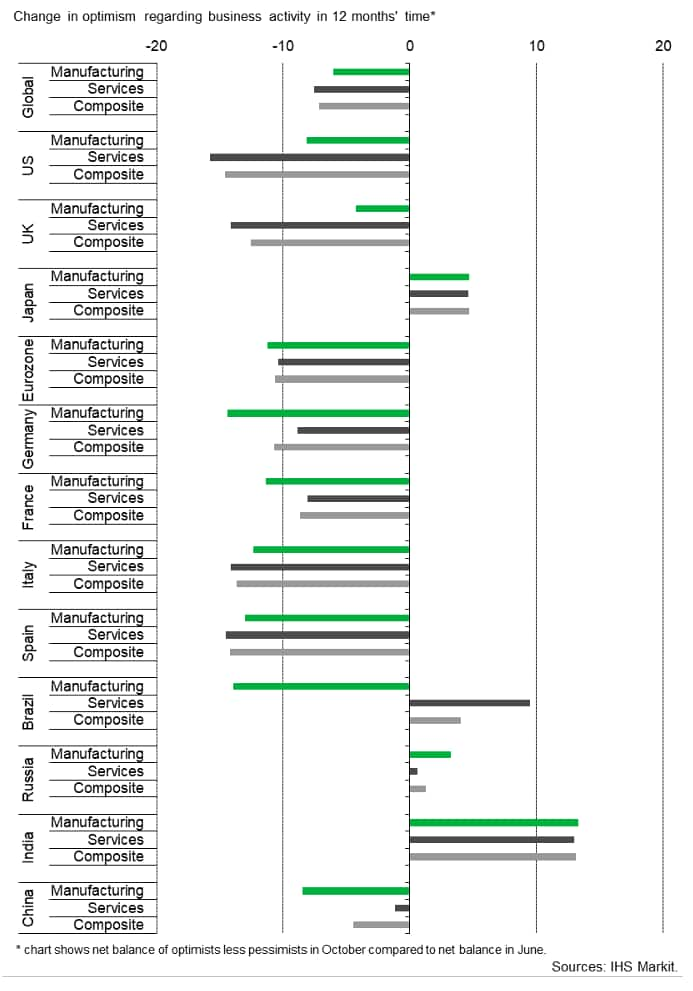

- October data from the Accenture/IHS Markit UK Business Outlook

survey - a tri-annual survey based on a panel of around 1,300

companies in the manufacturing and services sectors - indicated

that UK businesses remained confident of a recovery in activity

over the coming 12 months, but there was a steep loss of momentum

from earlier in the year. More than half of UK private sector firms

(56%) expect an increase in business activity during the year

ahead, compared to 11% that project a decline. Whilst falling

sharply from the level seen in the summer to a 12-month low, the

resulting net balance of +45% was higher than seen throughout much

of the last six years. (IHS Markit Economist David Owen)

Tuesday, November 16, 2021

- Total US retail trade and food services sales increased 1.7% in

October. Core retail sales growth was stronger than expected,

resulting in an upward revision of 0.5 percentage point to our

estimate for personal consumption expenditures (PCE) in the fourth

quarter, from 4.5% to 5.0%. (IHS Markit Economists James

Bohnaker and William Magee)

- Gasoline station sales surged 3.9% and were up 47% over 12 months. Gasoline consumption in the US has made a full recovery to pre-COVID-19 levels, and elevated pump prices are supporting nominal gasoline sales. Regular gas prices averaged $3.29/gallon in October, the highest monthly level since 2014.

- Sales at motor vehicle and parts dealers increased 1.8% in October, but the level of sales remained 10.5% lower than its April peak. Auto sales will not soon approach early-2021 levels as semiconductor chip shortages and high retail prices are expected to persist well into next year.

- Retail sales growth was highlighted by standouts including nonstore sales (up 4.0%), electronics and appliance stores (up 3.8%), and building materials stores (up 2.8%). Consumers remain settled into pandemic-era buying patterns, suggesting only a gradual rebalancing of spending toward services. Sales at food services and drinking places were unchanged (0.0%) as consumers remained somewhat cautious about dining out amid a declining yet elevated number of COVID-19 cases in October.

- The strength in retail sales in October reflects earlier-than-usual holiday shopping as it has been widely publicized that supply chain disruptions may result in product shortages and longer delivery times between Black Friday and Christmas. High prices for some goods and services are weighing on confidence, but consumer buying power remains solidly based.

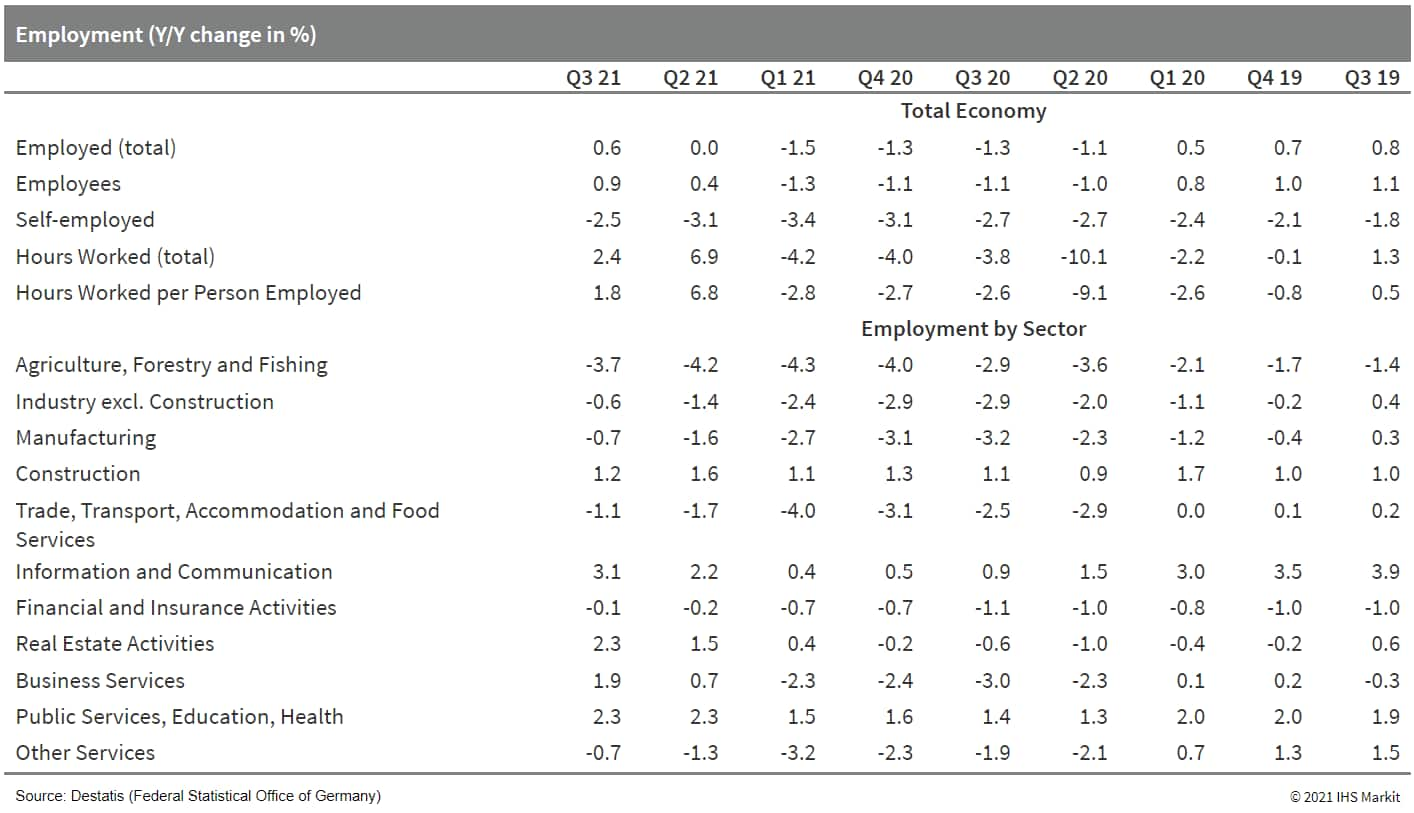

- Federal Statistical Office (FSO) data show that total German

employment increased by more than 0.3 million to 45.061 million in

the third quarter, exceeding the usual seasonal increase. In

conjunction with base effects, the year-on-year (y/y) change

improved further from 0.0% in the second quarter to 0.6%. This

compares with the cyclical trough in the first quarter of -1.5% y/y

and an average annual gain of 1.0% in 2010-19. The third-quarter

level remains about 0.8% below the level of end-2019 before the

pandemic broke out. (IHS Markit Economist Timo

Klein)

- In seasonally adjusted terms, employment increased by 169,000 or 0.38% quarter on quarter (q/q) in the third quarter. This almost doubles the growth pace of the previous quarter and also exceeds the average quarterly gain of 0.26% q/q during the past decade (2010-19). However, separate monthly data show that employment growth has slowed down progressively during July-September following an interim peak in June.

- The breakdown by major sector reveals that still only about one-half employ more people now than they did a year ago. Apart from construction, this pertains exclusively to the services sector, led by the information and communications sector and followed by public services/education/health and real estate activities. In contrast, the secular employment decline in agriculture persists, and the manufacturing sector has curtailed its annual employment losses but still employs less people than in late 2019 just prior to the pandemic.

- As expected, the ongoing economic rebound during the third quarter has depressed short-time work requirements markedly. Short-time work numbers had declined from February's interim peak of 3.4 million (having reached an absolute high of 6.0 million in April 2020) to 0.8 million in August. Progress may have stalled subsequently (September data not available yet) owing to mounting supply-chain disruptions.

- The third-quarter average of hours worked will have increased

even more sharply than employment during the latest quarter, even

if base effects have dampened the former's y/y increase from 6.9%

in the second quarter to 2.4% in the third quarter. Hours worked

per employee similarly had moderated from 6.8% y/y in the second

quarter to 1.8% y/y in the third quarter. In any case, Germany's

short-time work scheme once again has proven its usefulness in

preventing unnecessary unemployment and the loss of skilled

workers.

- With the Biden administration casting an eye on market

concentration in the food industry, a consumer group has released a

new report taking a swipe at the rise of supermarket supercenters

and the consolidation of food industry sales that can spell

problems for the consumer. (IHS Markit Food and Agricultural

Policy's Joan Murphy)

- In the new report, The Economic Cost of Food Monopolies: The Grocery Cartels, Food & Water Watch (FWW) looked at the market share of dominant companies across 55 grocery categories and calculated the top four companies in each food category.

- Four companies took in an estimated two-thirds of all grocery sales in 2019, the year before the pandemic hit, with Walmart taking 34.8%, Kroger at 13.9%, Costco at 12.2% and Albertson's Companies at 8.1%. All four combined gobbled up 69% of grocery sales, while the number of grocery stores nationwide declined from 1993 to 2019 by some 30%, the report said.

- One reason is the rise of the supercenters and warehouse chains, and report said the next trend of increasingly popular online shopping may be cornered by companies like Walmart and Instacart that can crowd out smaller players.

- FWW looked at a list of common food items, such as fresh vegetable side dishes, milk, beer, pasta, and breakfast cereals, and found more than 60% of the grocery categories in the study are "tight oligopolies/monopolies," leaving only eight as highly competitive.

- Tesla is looking to set new standards of production efficiency at its new car manufacturing plant in Grünheide (Germany), according to a Bloomberg report. Tesla CEO Elon Musk is targeting a production time per vehicle of 10 hours, which would set a new standard in European car manufacturing and this has already got rivals such as Volkswagen (VW) looking to improve their own levels of efficiency. VW CEO Herbert Diess has long admired Tesla for its methods and innovative approach to car building and has cited the new Tesla plant as a prime example of what his company needs to do to remain competitive as the industry speeds up electrification. Musk has been compared to Henry Ford in terms of the scale of innovation he wants Tesla to employ in order to improve car manufacturing efficiencies. Ford was famously the first to employ production line techniques for car making with the Model T, which modern car plants still use to this day, albeit with many improvements being made along the way, not least the use of robotic automation. While the technology that Tesla will use at its German facility is impressive and cutting-edge, it comes with some risk, as Musk himself acknowledges. He posted on Twitter last year when discussing the plant, "Lots of new technology will happen in Berlin, which means significant production risk." However, while that may be the case to an extent, a lot of the technology is already in use and has been proven at Tesla's plants in Shanghai and the company's original plant in Fremont (California, US). Tesla has already experienced some issues with its giant press machines; one of the machines at Fremont was involved in a minor fire, although this is also perhaps not that surprising given the fact they handle molten aluminum at temperatures of up to 850 degrees Celsius. The most difficult part of the manufacturing process is using these giant aluminum presses, as the alloy must enter the press at high speed so the temperature across the batch remains even. This is so the whole piece cools at the same rate and ensures the integrity of the structural piece being formed. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volvo Cars has signed a deal with navigation map service provider NavInfo for vehicle-to-everything (V2X) communication service in China, reports Gasgoo. NavInfo will provide compliance services for V2X platforms on all Volvo cars in the country for the next three years. The deal's price is dependent on the correlating vehicle sales of Volvo Cars during the contracting period. NavInfo is a navigation map service provider to global automakers including SAIC, BMW, Volkswagen Group, General Motors, Volvo, Toyota, and Nissan. In 2019, Beijing's municipal authority issued a temporary license plate for the testing of autonomous vehicles (AVs) to NavInfo. NavInfo reported that during the first half of 2021, its automotive traffic condition information service had covered over 300 cities in China and supported over 95% of the domestic highway information. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Wednesday, November 17, 2021

- With US President Joe Biden signing the $1.2-trillion

infrastructure bill on 15 November into law, IHS Markit analysts

say the electric vehicle (EV) industry is especially

well-positioned to benefit as funds will soon start flowing to a

variety of existing and new energy transition projects. (IHS Markit

Net-Zero Business Daily's Kevin Adler)

- The bill includes $5 billion to be granted to states to deploy EV charging stations in US and $2.5 billion in grants to public entities to deploy publicly available EV charging infrastructure (as well as hydrogen, propane, and natural gas fueling) 2022 through 2026.

- Biden has tapped former New Orleans Mayor Mitch Landrieu to oversee spending authorized by the legislation and co-chair a task force with National Economic Council Director Brian Deese "to prevent waste fraud and abuse" in the distribution of funds.

- IHS Markit estimates the investment will support the construction, maintenance, and operation of approximately 400,000 newly installed Level 2 AC (regular) and Level 3 DC fast chargers in the US between 2022 and 2026. Biden announced in the spring a goal of 500,000 charging units nationwide by 2030.

- "The Biden administration's investment isn't hyperbole and will have a significant impact on US electric vehicle charging supply," said Mark Boyadjis, IHS Markit global automotive technology lead. "However, even an investment at this scale will come up short against the rapid growth of electric cars hitting the road soon, pointing to a need for additional support from municipal, utility, and private investments to fill the gap."

- Honda, in partnership with SoftBank, is deploying 5G standalone (5G SA) and cellular vehicle-to-everything (V2X) communication systems to reduce collisions between pedestrians and vehicles. The companies will demonstrate three use cases by leveraging SoftBank's 5G SA experimental base station installed at Honda's Takasu Proving Ground in Japan and Honda's recognition technology. In the first case, the vehicle's on-board camera recognizes the risk of a pedestrian entering the roadway and sends an alert to the pedestrian's mobile device directly or via a mobile edge computing (MEC) server to reduce collisions involving pedestrians who are visible to vehicles. The second case uses high-speed data communications between the moving vehicle, pedestrians, and other vehicles to reduce collisions involving pedestrians who are not visible to vehicles. The third and final case involves moving vehicles sending information about areas with poor visibility to the MEC server, and if there is a pedestrian present, the MEC server sends an alert to the vehicle and the pedestrian. This will help reduce collisions involving pedestrians by sharing information about areas not visible to vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Uber is resuming its shared-rides service with the new product called UberX Share, reports Reuters. The new service, which allows multiple passengers to share a car travelling in the same direction, will start a pilot in Miami (Florida, US). The UberX Share service offers a 5% upfront discount and users can earn additional discounts in Uber credit, if another rider joins their trip. Uber had suspended its shared rides service, previously known as Uber Pool, in March 2020 in response to the COVID-19 virus pandemic. The new service also limits shared rides to a total of two passengers, who will sit in the back seat. UberX Share is aimed at reducing the previously high losses in the pooled rides segment. In July, Uber's rival Lyft announced its plans of resuming a shared-rides booking option in select US markets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

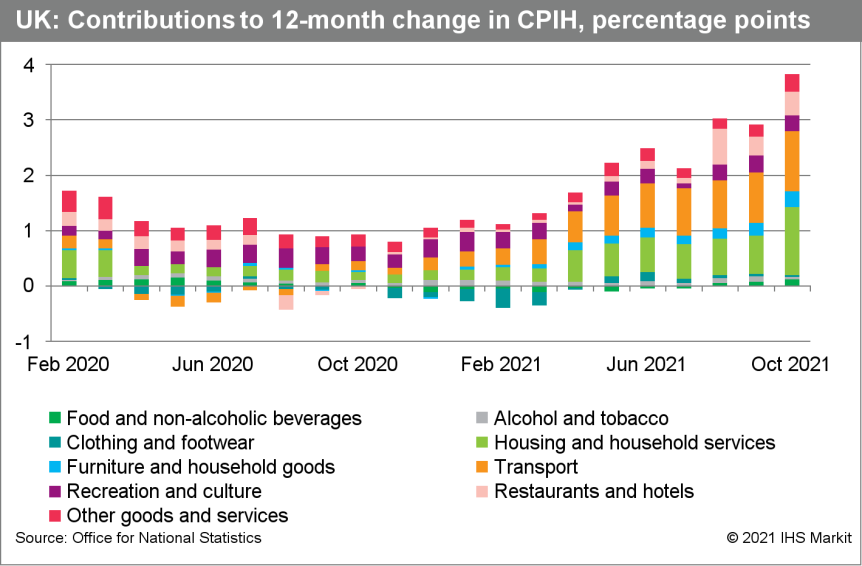

- The Office for National Statistics (ONS) has reported that the

UK's 12-month rate of consumer price index (CPI) inflation

increased from 3.1% in September to 4.2% in October, the highest

rate since November 2011. (IHS Markit Economist Raj

Badiani)

- The rate was above the Bank of England's (BoE) 2% target for inflation.

- During 2020, CPI inflation averaged 0.9%.

- Meanwhile, the CPI including owner occupiers' housing costs (the CPIH) rose by 3.8% in the 12 months to October, up from 2.9% in September.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 21.5% year on year (y/y), the seventh successive double-digit increase. This was in line with global crude oil prices rising by 107.9% y/y to average USD83.5 per barrel (pb) in October, the 10th successive y/y gain.

- In addition, gasoline (petrol) prices also rose by 25.4 pence y/y to 138.6 pence per litre, the highest price since September 2012.

- In addition, the ONS reported notably higher household energy bills after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Therefore, natural gas and electricity prices increased by 28.1% y/y and 18.8% y/y, respectively.

- Meanwhile, restaurant and café prices increased by 6.3% y/y in October, up from a gain of 5.0% y/y in September.

- Food prices rose at a brisker rate, increasing by 1.2% y/y in October from 0.8% y/y in September.

- A further rise in second-hand car prices occurred during October, of 22.8% y/y, because of the shortage of semiconductor chips disrupting production of new vehicles.

- All-services price inflation was 3.2% in October from 2.6% in September; for goods, it stood at 4.9%, up from 3.4% in the previous month.

- Core inflation, excluding energy, food, alcoholic beverages,

and tobacco prices, moved up to 3.4% in October from 2.9% in

September.

- Kenya's GDP accelerated by 10.2% year on year (y/y) during the

second quarter of 2021 from a 0.8% expansion during the first

quarter of the year. The bounce back in economic activity was

broad-based, apart from the agriculture, forestry, and fishing

sector, where output slowed by 0.9% y/y during the second quarter.

Severe drought conditions in the northern part of Kenya have been a

drag on the overall agricultural activity for most of 2021. (IHS

Markit Economist Thea

Fourie)

- Sectors recording the strongest growth during the second quarter of 2021 included education (up 67.5% y/y), information and communication (up 25.2% y/y), mining and quarrying (up 17.7% y/y) and professional services, administration, and support services (up 17.6% y/y). Wholesale and retail trade - accounting for 7.8% of GDP and a good gauge of household spending - improved by 9.5% y/y during the second quarter. Accommodation and food services - a gauge for tourism spending - rebounded by 9.1% y/y during the second quarter from a 48.7% y/y contraction recorded during the first quarter of the year.

- Latest statistics released by the Kenya National Bureau of Statistics (KNBS) shows that tourist arrivals to Kenya during July 2021 accounted for only 43% of the pre-pandemic total. Kenya's tourism industry remains susceptible to recurrent regional and global restrictions due to the slow rollout of the COVID-19 vaccine program in the country. Only 4.1% of the population has been fully vaccinated by November 2021.

- Remittance inflows to Kenya accelerated by 20.1% y/y during the first 10 months of 2021, latest statistics by the Central Bank of Kenya shows. Diaspora proceeds exceeded expectations and rose by 10.6% y/y during 2020.

Thursday, November 18, 2021

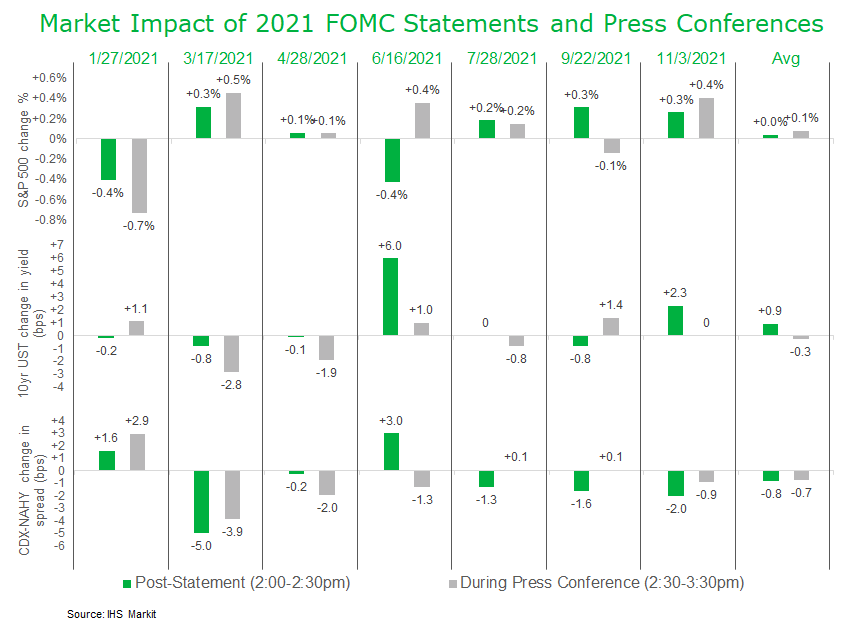

- The conclusion of FOMC meetings often drives substantial

repositioning and the below chart separates the market reaction to

the FOMC statement vs the press conference across the S&P 500,

10yr UST, and IHS Markit's CDX-NAHY. The data indicates that the

market direction post-statement reversed from positive to negative

only once this year across all three markets (during the Sept 22

meeting).

- The IHS Markit Maritime & Trade division provides a

real-time source for ship movements data and documents combined

with trade data and commodity movements. Research Signals has

tapped specifically into the Bill of Lading data, a source of

detailed import and export data that can provide timely information

on company economic activity measured by shipping trends. In total,

the team has introduced 48 factors derived from four underlying

import and export data items including shipping volume, shipping

weight, shipping value and total shipments, along with measures of

sector/industry relative shipping activities and the relationship

of shipping levels to sales. (IHS Markit Research Signals)

- Sector Relative Monthly Import Shipping Volume was a top performing factor in the US, with an average monthly spread of 0.26% between top and bottom ranked names, while Standardized Unexpected Quarterly Export Shipping Volume was a key contributor in Developed Europe (0.13%) and Developed Pacific (0.51%)

- Rank correlations between three representative Shipping factors and key style measures from the Research Signals factor library indicate very low commonality, demonstrating the uniqueness of this alternative data source and its added value to quantitative strategies

- In a portfolio application using two newly introduced factors, we screen for stocks with a strong link between imports and sales and demonstrate 1.9% annual outperformance since 2010 for those stocks with increasing imports relative to those with a decline.

- Weather-related demand remains the fundamental driver for gas

price volatility this winter, with extreme cold weather risk

potentially adding up to 30-50 Bcm of gas in total concentrated

between November and March. (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- Attention is focused on Russia as a traditional swing supplier in tight conditions, with European storage at roughly 72% of capacity, or 14% lower than the five-year average for this time of year. Yet given current storage levels, the supply levers from Russia or from more LNG imports would still be unlikely to completely counter the demand shocks of extremely cold weather.

- Cold weather in Asia would divert more LNG imports away from Europe, potentially up to 1.3 Bcm per month over the winter season, but also offset to a varying degree by gas-to-oil switching. US LNG exports are maxed out, and the US natural gas price is delinked from Europe and Asia.

- High coal prices through 2022 will likely help improve relative gas-fired generation economics in Europe, and act as a backstop on lower prices after winter. Gas demand in the power generation sector would rise until the power sector is balanced or when all potential coal plants have been displaced.

- German utility and trader RWE plans to spend about $7 billion

(€5 billion) a year to install wind, solar, batteries, flexible

generation, and hydrogen globally ahead of closures for its

profitable German nuclear and coal plants. (IHS Markit Net-Zero

Business Daily's Cristina Brooks)

- The company released its "growing green" investment strategy on 15 November, revealing how it will add up to 50 GW, or about 2.5 GW annually, of renewables and green solutions through 2030 in Europe, North America, and Asia, which it called "attractive markets."

- Almost all of the investment (90%) is going to renewable energy sources and batteries, currently operating only in Germany, the utility's CFO Michael Müller said. Its offshore wind capacity will triple from 2.4 to 8 GW, while growing its combined onshore wind and solar capacity from 7 to 20 GW.

- What remains of the investment will be used to grow RWE's flexible power supply in its traditional markets in Germany, Benelux, and Great Britain, where it operates many gas-fired power plants.

- RWE doesn't have much renewable capacity outside the West and Australia, but it was looking into offshore wind prospects in Japan, South Korea, and Taiwan alongside plans to grow its trading activities.

- Despite the renewable pledge, most of RWE's generation capacity in Europe and Turkey came from gas-fired and lignite coal power plants over the first three quarters of the year.

- Nuclear and coal-fired power plants boosted the company's third-quarter profits, thanks to high wholesale energy prices and less maintenance on its nuclear power plants. Its lignite coal-fired power plants in Germany recorded the biggest gain of all in meeting higher post-pandemic electricity demand.

- But RWE is being forced out of its most profitable segments in Germany as the country plans to phase out nuclear by 2022, following on from the 2011 Fukushima Daiichi disaster in Japan. Germany has pledged to phase out coal by 2038 at the latest.

- Rio Grande LNG has submitted an application to FERC in which it

explains how operation of a proposed carbon capture and storage

(CCS) system will enable it to capture and sequester at least 90%

of the CO2 emitted from its operations. (FERC Docket CP22-17) (IHS

Markit PointLogic's Kevin Adler)

- Rio Grande's application with FERC for the LNG project was approved in 2020. It is planned as five liquefaction trains with a total capacity of 27 million metric tons/annum, and four LNG storage tanks with a total of 720,000 cubic meters of capacity. The facility, located in the Brownsville Ship Channel in Cameron County, Texas, will have two LNG carrier loading berths. (FERC Docket CP16-454)

- In the new notice, Rio Grande says that construction of the LNG terminal might begin in Q1 2022, and that the first of the CCS installations would begin about nine months later, with each one being matched to construction of one of the LNG trains.

- "The carbon capture process, as detailed in the exhibits submitted herewith, removes CO2 from both the feed gas to be liquefied at the RGLNG Terminal and the exhaust flue gas from the main refrigerant compressor gas turbines central to the liquefaction process," Rio Grande LNG explained in its 17 November filing.

- "To provide context for this 90% reduction, according to the national net carbon dioxide equivalent (CO2e) emissions estimate in the Environmental Protection Agency's Inventory of U.S. Greenhouse Gas Emissions and Sinks, 5.769 billion metric tons of CO2e were emitted at the national level in 2019.

- As contemplated in the Authorization Order, the operational emissions of the RGLNG Terminal were assessed to potentially increase the annual CO2e emissions based on the 2017 levels by approximately 0.17 percent at the national level. Deploying CCS systems at the RGLNG Terminal that capture 90% or more of the CO2 means the RGLNG Terminal would potentially increase the annual CO2e emissions based on the 2019 national levels by approximately 0.0001 percent," it said.

- A Mainland China State Council executive meeting on 17 November

decided to introduce a targeted re-lending program with a quota of

CNY200 billion to support the clean and efficient use of coal. (IHS

Markit Economist Yating

Xu)

- According to the meeting, the re-lending program involves coal mining, coal processing, thermal power generation and coalbed methane development and utilization.

- Besides re-lending quota, policy support such as tax incentives, special government bonds, lowering the requirement of capital portion for green projects, accelerating the fixed-asset depreciation and trade-in policies will also be rolled out in the near future to promote the de-carbonization process.

- The planned CNY200 billion of re-lending quota is an increase of green loans on top of the structural decarbonization tools published by the central bank on 8 November.

- China's green loans are expected to increase faster in the fourth quarter and support related infrastructure investment. As of the end of third quarter 2021, total green loans rose by 16.3% year on year (y/y) with green infrastructure loans increasing by 17.1%, compared with 11.9% y/y growth of total credit.

Friday, November 19, 2021

- Apple is reportedly accelerating its efforts to develop an electric vehicle and focusing on creating a fully autonomous product rather than one with limited autonomous capabilities. Bloomberg reports that the company has made another shift in development and that in recent years, the tech company had been exploring simultaneous paths for a model with limited autonomous capabilities on steering and acceleration or a version with full autonomous capability. However, the report says that the latest leader on the project, Kevin Lynch, has engineers' concentration on the fully autonomous option. However, Bloomberg sources requested anonymity. Bloomberg reports that Apple's ideal car would have no steering wheel or pedals and the interior would be designed around hands-off driving. Apple has reportedly considered a design in which the infotainment would be in the middle of the vehicle for users to interact throughout the ride, and that it would be heavily integrated into Apple's other services and devices. Bloomberg reports that Apple has reached an undisclosed key milestone in achieving autonomy, that the company believes it has completed much of the core work on the processor it plans to use, and that the chip was developed by engineers who created processors for the iPhone, iPad, and Mac instead of within the car group. Apple is reportedly hiring engineers to test and develop safety functions, as well as more autonomy and car hardware engineers. The tech giant has also reportedly hired a climate system expert from Volvo Car, a manager from Daimler Trucks, battery systems engineers from Karma and others, a sensor engineer from General Motors' (GM's) Cruise, other engineers from Tesla, and safety engineers from Joyson Safety Systems. The report notes that Apple aims to launch an autonomous car in four years, which is faster than the five-to-seven-year timeline reported earlier. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) president Mark Reuss said that the company is looking to reduce the number of unique microcontroller units required in its vehicles by 95%, according to media reports. Automotive News quotes the executive as saying GM will streamline hardware and software advancements to help secure its semiconductor supply chain. Under the new strategy, GM hardware and software developers will draw from three families of chips, put together by partnerships between GM and various suppliers. Reuss was speaking during a Barclays Global Automotive and Mobility Tech Conference. The new strategy will be part of GM's efforts to double its revenue by 2030, including a greater proportion of the business being related to software services on vehicles. The change, Reuss reportedly said, could strengthen the flow of GM's semiconductors after the shortage. The company also expects its semiconductor requirements will more than double over the next several years. GM will consolidate core microprocessor chip purchases into three families, which will be co-developed, sourced, and built with leading semiconductor manufacturers. Reuss says the strategy should support electric vehicle, autonomous vehicle, and connected services growth. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chinese automaker Great Wall Motor has unveiled the first model from its Shalong brand. The new vehicle, a mid-sized sport sedan, features four LiDAR sensors provided by Huawei. As well as the LiDAR sensors, the model, called the Jijialong, is also equipped with 11 cameras, 5-millimeter wave radars, and 12 ultrasonic radars. The vehicle has a 115-kWh battery that provides a maximum driving range of 802 kilometers under the China Light-Vehicle Test Cycle. Great Wall says that the Jijialong is able to receive up to 450 kW of charging power, which allows it to add 401 kilometers of range in 10 minutes. According to Great Wall, the first batch of 101 units of the Jijialong can now be reserved at CNY488,000 (USD76,441). Deliveries of the model are expected to begin in the first half of 2022. This electric sports sedan, which many would describe as a type of 'muscle car', is another effort by Great Wall to please younger consumers with a unique-looking model. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Turkish central bank has cut its main policy rate for the

third time in three months, this time by 100 basis points. The

one-week repo rate now stands at 15%, well below the prevailing

annual rate of both headline and core inflation. Although we

anticipate that this will be the end of the cutting cycle, risks

remain substantial that the bank could cut yet again in December.

The rate cutting is having a negative impact on lira stability,

inflation, and the inflow of foreign capital. (IHS Markit Economist

Andrew

Birch)

- The Monetary Policy Committee of the Central Bank of the Republic of Turkey (TCMB) cut its main policy rate, the one-week repo rate, by 100 basis points at its regularly scheduled, monthly meeting on 18 November. The cut was the third in three months, bringing the rate down from 19% prior to the September meeting to 15% currently.

- The rate cut was in line with IHS Markit expectations, as well as with consensus opinion. In the days prior to the meeting TCMB officials had been highlighting the deceleration of core inflation from September and October (see Turkey: 4 November 2021: Turkish annual consumer, producer price inflation continue to rise in October, increasing instability risks), preparing markets for a subsequent rate cut.

- In its press release alongside the move, the TCMB once again pointed to what it claims will be a "transitory effect" of supply-side impacts - supply constraints, higher food and energy prices, administrative price changes - on inflation as a reason for its easing of monetary policy. The TCMB is also concerned about restimulating commercial and consumer loans, according to its press release.

- With the most recent rate cut, the one-week repo rate now stands almost 500 basis points below the prevailing, annual rate of consumer price inflation. Although the TCMB has focused attention on the core inflation rate as the guiding principal of its monetary policy, the main policy rate is now 182 basis points below even that prevailing annual rate.

- In anticipation of the rate cut, the lira was depreciating sharply. From 12 November to immediately prior to the rate decision, the lira depreciated by 4.9% against the US dollar. In the immediate post-decision trading, the lira fell to TRY10.976/USD1 prior to a modest rally late in the day, down by another 3%.

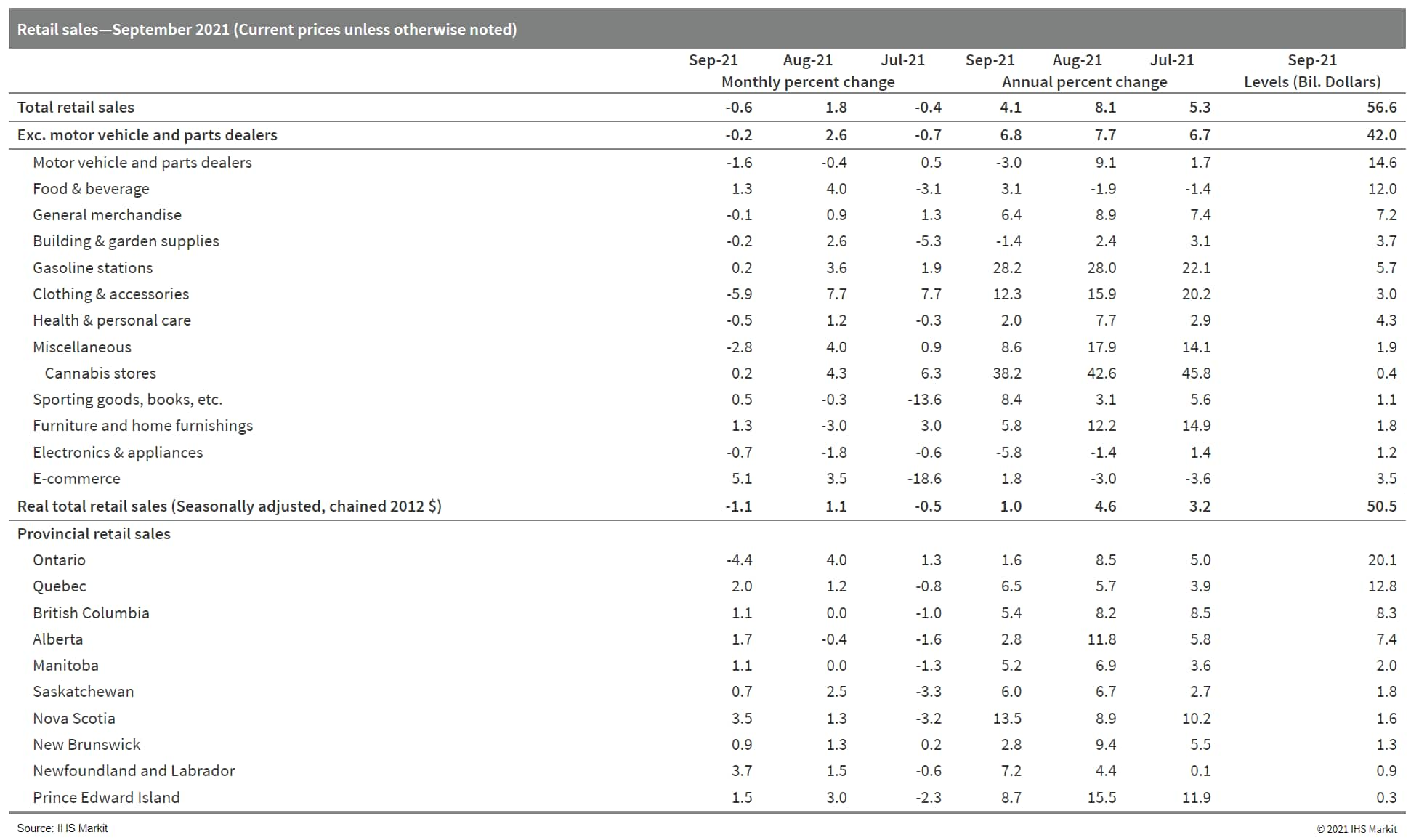

- Canada's September retail sales fell 0.6% month on month (m/m)

to $56.6 billion, which is substantially better than the advance

estimate of a 1.9% m/m contraction. The sales gain in August was

revised down to 1.8% m/m. (IHS Markit Economist Evan Andrade)

- Excluding vehicle and gasoline station sales, the core retail group still slipped 0.3% m/m.

- Retail volumes, which exclude price effects, decreased 1.1% m/m.

- Statistics Canada's advance estimate for October calls for a gain of 1.0% m/m, based on a 50% response rate.

- Sales at new car dealerships fell 2.8% m/m, while the 6.3% m/m jump in used-car dealership sales provided a slight offset. This suggests that the semiconductor shortage is putting pressure on new car inventory and that consumer demand for vehicles has remained relatively stable. With a downward revision to August sales as well, motor vehicle and parts dealer sales are now 3.0% below sales from September 2020.

- Weakness extended beyond autos, as sales for 7 of 11 product categories declined from the previous month. Clothing store sales dipped after recording strong growth over the summer months. Miscellaneous store sales also declined after four months of improvement. Electronics and appliances sales have not experienced a positive print since March, as supply chain issues may be hurting the available stock at these stores as well.

- The strongest gain was in food and beverage store sales, but

this was mostly due to higher prices.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-22-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-22-2021.html&text=Weekly+Global+Market+Summary+Highlights%3a+November+15-19%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-22-2021.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: November 15-19, 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-22-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+November+15-19%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-november-22-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}