Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 24, 2019

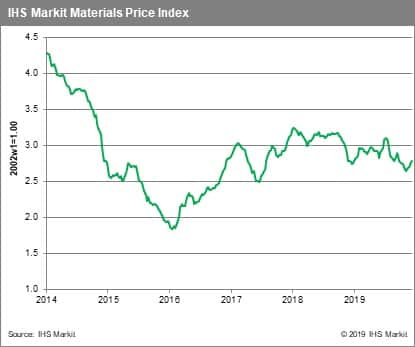

Weekly Pricing Pulse: Commodities continue rising as headwinds clear

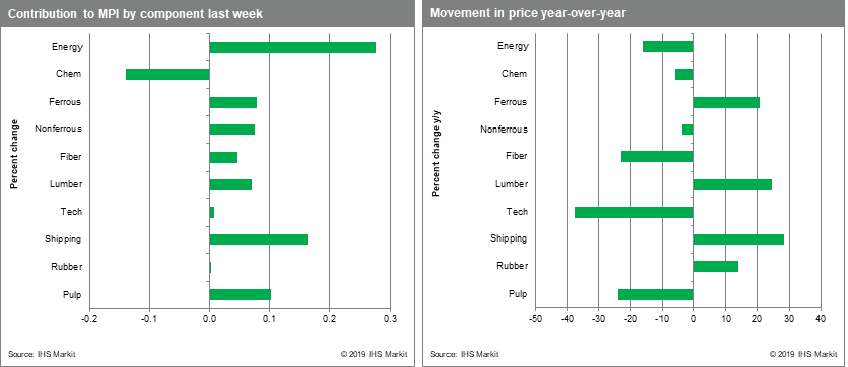

Commodity prices, as measured by our Materials Price Index (MPI), rose 0.7% last week with nine of the index's ten sub-components moving higher. Some clarity on trade issues, (the USMCA appears headed for a ratification in early 2020, a formal "Phase-One" trade agreement between the US and China seems close, and Brexit will happen in January), and improving manufacturing data, have cleared some of the headwinds facing commodity markets. The net effect is guarded optimism for early 2020 that has been reflected in pricing for the past month.

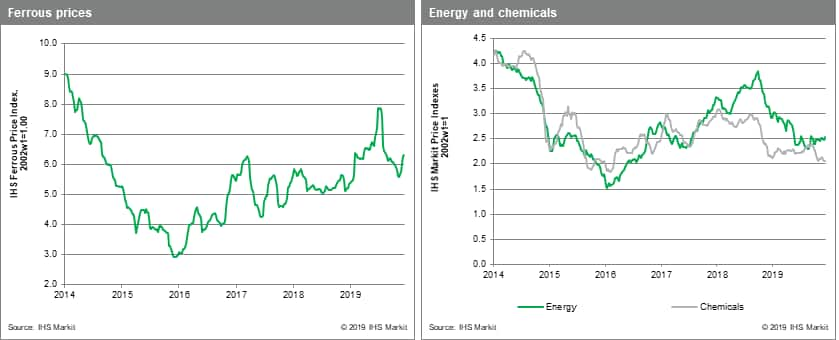

Energy prices rose 1.5% last week supported by oil and natural gas prices. Gas rose 3.1%, rebounding after an 8.0% fall the previous week on warmer weather. Oil prices rose 1.9% on better demand expectations and on prospects that the Vienna Alliance group of producers will cut production as agreed. Non-ferrous metals prices rose 0.9% on higher copper and nickel prices. Copper briefly hit $6,200 last week, the highest point since the April, on signs of improving industrial activity worldwide. Fiber prices, particularly exposed to Chinese manufacturing, have also enjoyed the recent US-China détente and rose 0.9% last week. Chemical prices were the only component of the MPI to fall last week, declining 0.8%, because of weakness in ethylene and propylene markets. US ethylene prices, in particular, have plunged, dropping 32.9% in three weeks on the restart of capacity along the US gulf coast.

Recession fears were pervasive during the middle of 2019. Manufacturing growth slowed, even contracting in many parts of the world. The US-China trade war escalated. And the yield curve inverted. Despite waves of disappointing news, the global economy seems to have dodged a recession, in large measure because policymakers have been quick to react. Manufacturing activity appears to be rebounding and, with most central banks loosening policy, financial conditions have eased considerably. Recession fears have thus abated, with prospects for improving manufacturing activity creating a picture of a glass half full for 2020. How much momentum manufacturing really has will not be apparent until March after the extended holiday season. In contrast to this past summer, however, the atmosphere in markets is not discouraging.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-rising-headwinds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-rising-headwinds.html&text=Weekly+Pricing+Pulse%3a+Commodities+continue+rising+as+headwinds+clear+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-rising-headwinds.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities continue rising as headwinds clear | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-rising-headwinds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+continue+rising+as+headwinds+clear+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-rising-headwinds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}