Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 31, 2019

Weekly Pricing Pulse: Commodities continue to mark time

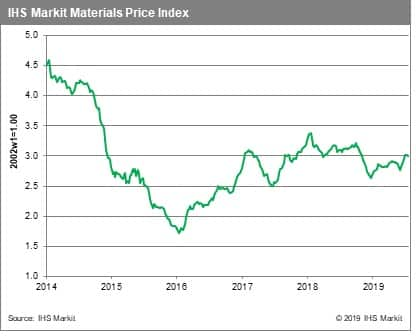

Bearish signals held sway in commodity markets last week with trading moving in a narrow range ahead of the US FOMC meeting on July 30-31. Prices, as measured by our Materials Price Index (MPI), fell 0.5% w/w, reversing the previous week's minor gain.

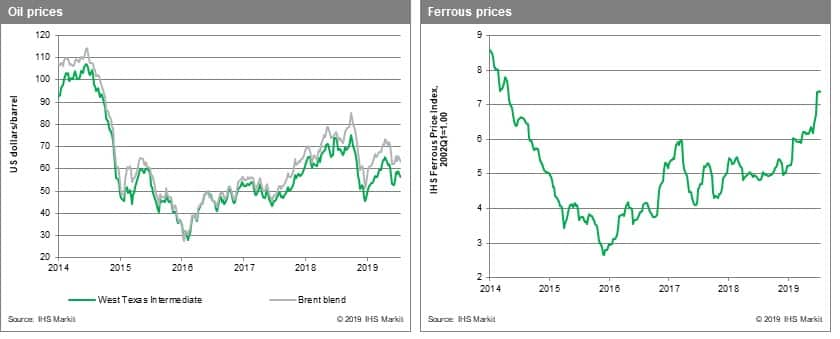

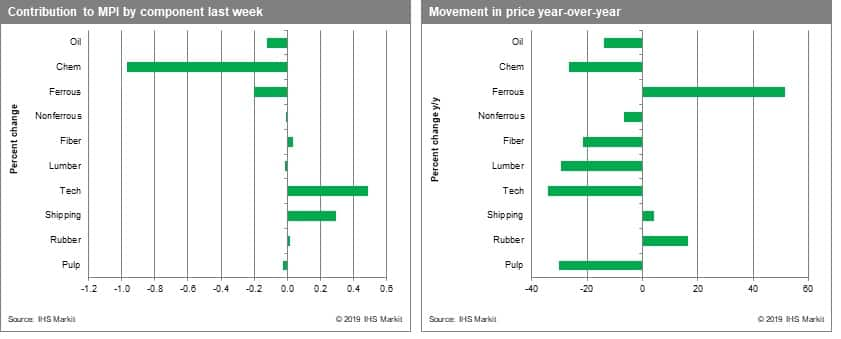

Demand concerns helped push crude oil down 0.5% last week, through price moves were confined to the slender band between $63-$65 /bbl they have established over the past six weeks. After supply disruption in the US four weeks ago that saw Chemicals prices jump 12.4%, Chemicals prices fell for a third week, dropping another 5.1%. Chemical prices have now essentially returned to the levels seen before the disruption. Ferrous prices also slipped, dropping 0.6% on news that Vale iron ore production is ramping up. Ore prices did pare back loses at week's end, however, on reports that some Chinese steel mills will not face environmentally mandated restrictions on production this Winter. DRAM prices bucked the general trend in markets last week, shooting up 9.1%. Japan-South-Korea trade tensions resulted in restrictions of exports of DRAMs to South Korea, a move that threatens supply chains for certain electronic components, spooking the market.

Worry about global demand and trade growth undercut markets last week. The combination of slower Q2 GDP growth in the US, a lackluster group of August flash Purchasing Manager Index reports, and the renewed discussion of Brexit with Boris Johnson becoming Prime Minister in the UK all helped to keep markets unsettled. All eyes will now turn to this week's Fed meeting and to signals about what additional support policymakers are likely to provide.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-to-mark-time.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-to-mark-time.html&text=Weekly+Pricing+Pulse%3a+Commodities+continue+to+mark+time+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-to-mark-time.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities continue to mark time | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-to-mark-time.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+continue+to+mark+time+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-continue-to-mark-time.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}