Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 08, 2020

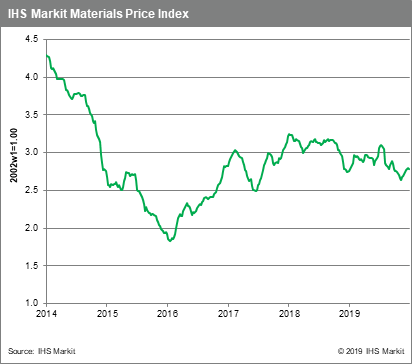

Weekly Pricing Pulse: Commodities dip slightly on gas price volatility

Having risen for six consecutive weeks, our Materials Price Index (MPI) fell 0.3% last week, primarily because of a massive drop in European gas prices. The US killing of Iranian General Qasem Soleimani shook markets in Friday as possible fall-out was digested, with oil and gold prices both moving higher on the news.

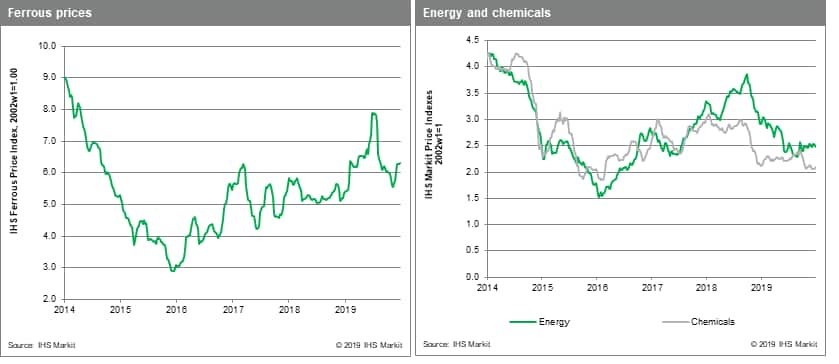

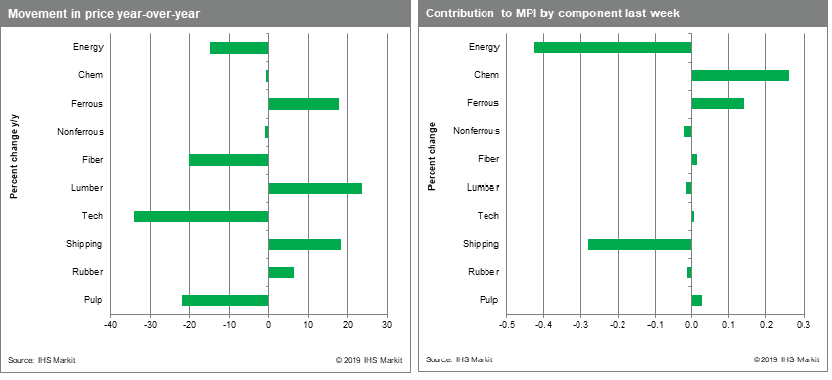

Energy prices fell 1.9% last week on declines in all three components of the energy sub-index. Coal prices dropped 2.3%, oil prices for the week retreated 0.4%, while gas prices plunged 11.1%. The outlier was clearly gas, which dropped sharply lower due to an 18.5% fall in European prices following the agreement between Russia's Gazprom and Ukraine's Naftogaz that guarantees the flow of gas to Europe for five years. Coal prices still look lacklustre and are re-approaching three-year lows. Oil prices fell last week, though they have since rallied 5% following the attack on General Soleimani. With Iran and the US trading threats, volatility in energy prices is expected in the short-term. Bulk freight prices fell 5.9% on increasing capesize capacity following the end-2019 rush to retrofit scrubbers before new IMO 2020 pollution regulations kicked in last week. Rubber prices fell 0.5%, their second week of declines following a ten-week, 18.8% surge. Chemicals prices moved 1.5% higher last week driven by strength in propylene prices in Asia and Europe on tighter supply.

The killing of General Soleimani brings Middle East tensions back to the forefront for markets. Oil and gold prices rose in response, with oil briefly topping $70 /bbl and gold $1,580 /troy oz. Volatility will remain high as markets brace for a possible Iranian reaction.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-dip-slightly-gas-price.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-dip-slightly-gas-price.html&text=Weekly+Pricing+Pulse%3a+Commodities+dip+slightly+on+gas+price+volatility+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-dip-slightly-gas-price.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities dip slightly on gas price volatility | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-dip-slightly-gas-price.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+dip+slightly+on+gas+price+volatility+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-dip-slightly-gas-price.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}