Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2023

Weekly Pricing Pulse: Commodities down as energy crisis recedes

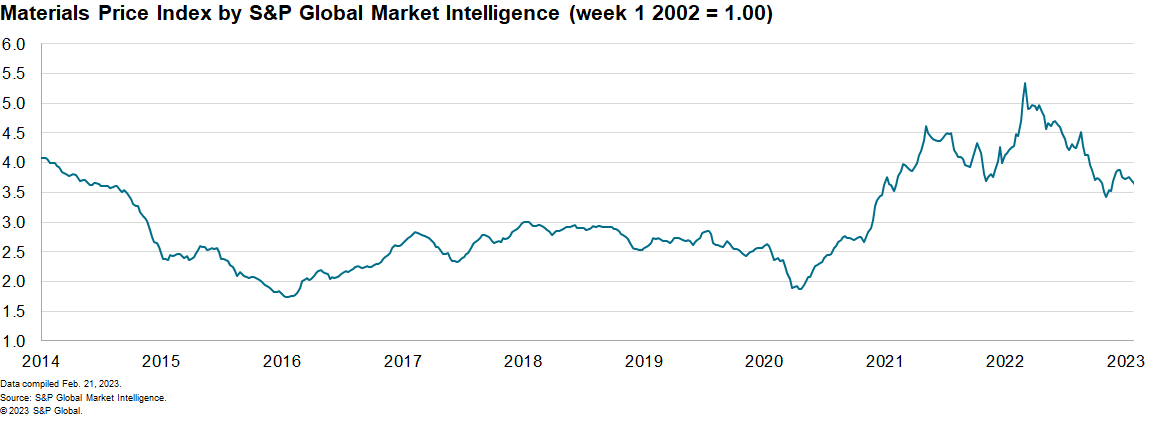

The Material Price Index (MPI) by S&P Global Market Intelligence fell 1.9% last week, its fourth consecutive decline. The decrease was broad with eight of the ten subcomponents down. The MPI now sits 21% lower year on year (y/y). Prices, however, remain far higher (40%) than the pre-pandemic levels of the fourth quarter 2019.

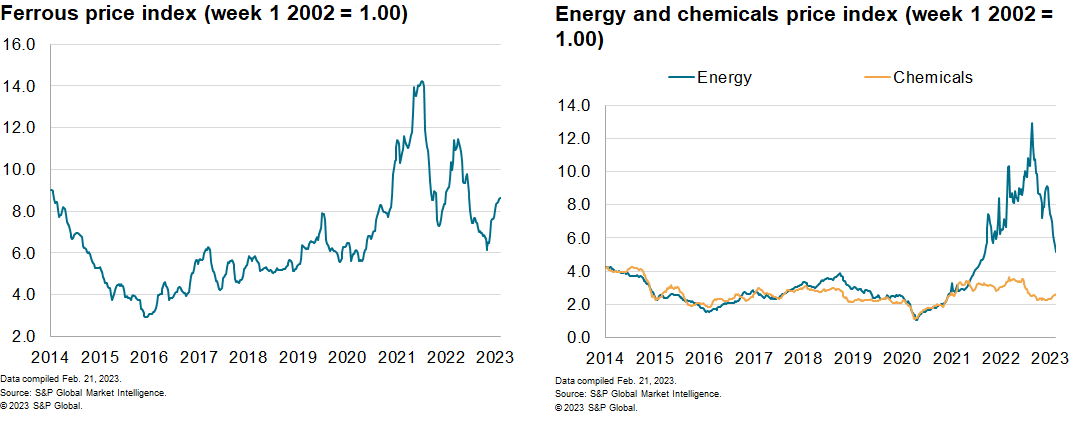

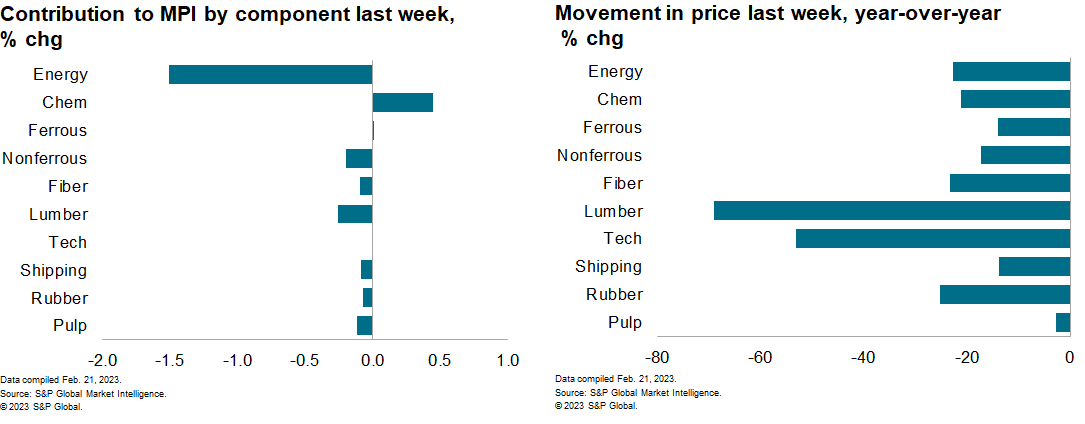

Falling energy prices were the major driver of last week's decline in the MPI. The energy sub-index posted a 6.8% decrease, with both natural gas and coal prices sliding. Spot prices of Liquefied Natural Gas (LNG) in Europe stood at $15/MMBTu last week, having peaked at a record $70/MMBTu in August 2022. A combination of milder-than-average winter temperatures, a strong inventory build, and successful replacement of Russian supplies have caused this significant downward price correction. Lower natural gas prices are driving down energy costs across commodity markets and helping to ease overall producer price inflation. Thermal coal prices in Asia also tumbled last week, falling below $200/MMBtu for the first time in fourteen months. Weaker demand from mainland China, where industrial output is comparatively low, remains the major reason for this decline. Elsewhere, lumber prices weakened once more down 12% last week following a similar decline the week before. Weak demand from US housebuilding is the primary driver of the downward price trajectory in lumber markets.

Markets continue to grapple with mixed signals on global economic growth with traders again taking a bearish view last week. Particular attention was paid to US retail sales figures which surged 3.0% in January, following a 1.1% decline in December that was unrevised. January's rise was broad-based and exceeded expectations and was taken as a sign that central banks will continue to implement aggressive interest rate rises in 2023. In the US, S&P Global Market Intelligence expect two more quarter-point rate hikes to bring the policy rate to a peak of 5.00-5.25% in May. In addition, Chinese growth signals remain weak compared to pre-pandemic levels and this, combined with falling energy costs for producers, will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-as-energy-crisis-recedes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-as-energy-crisis-recedes.html&text=Weekly+Pricing+Pulse%3a+Commodities+down+as+energy+crisis+recedes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-as-energy-crisis-recedes.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities down as energy crisis recedes | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-as-energy-crisis-recedes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+down+as+energy+crisis+recedes+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-as-energy-crisis-recedes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}