Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 09, 2023

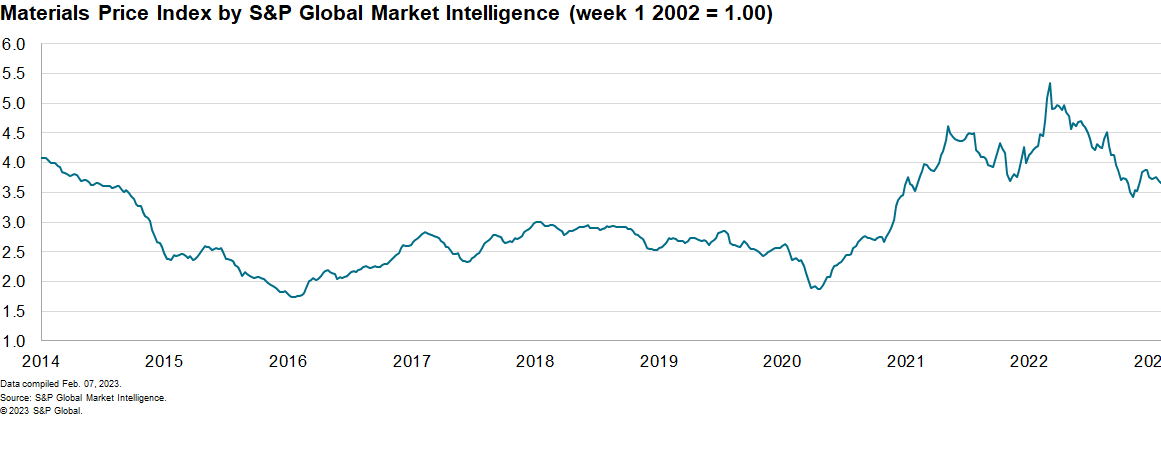

Weekly Pricing Pulse: Commodities down on bearish outlook

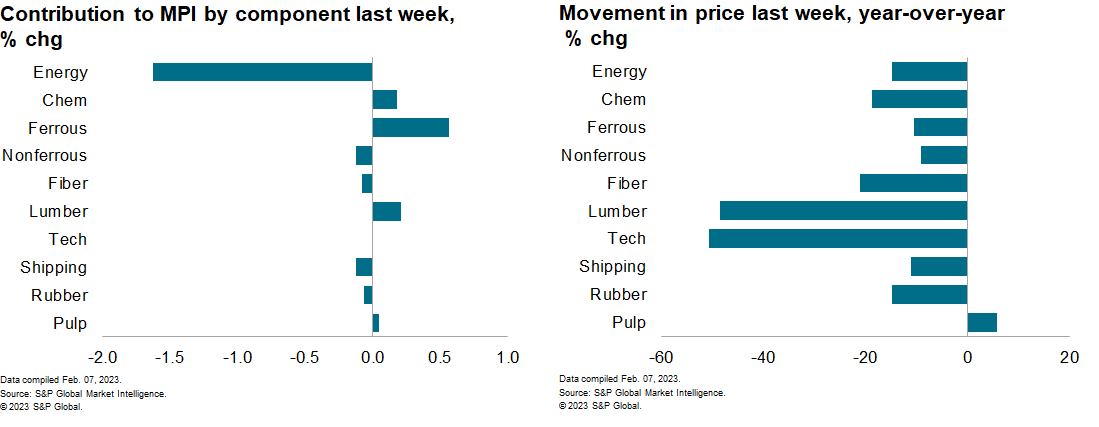

The Material Price Index (MPI) by S&P Global Market Intelligence fell 1% last week. The decrease was mixed with six of the ten subcomponents down. The MPI sits 15% lower year on year (y/y). Prices, however, remain far higher (45%) than the pre-pandemic levels of the fourth quarter 2019.

Falling energy prices were the major driver of last week's decline in the MPI. The energy sub-index posted a 6.7% decrease with US natural gas, coal and oil all experiencing significant price drops. Spot prices of Henry Hub natural gas, the US benchmark, fell to $2.41/MMBtu the lowest level since late 2020. This decline is a result of milder weather across the US which has resulted in power demand 2% below the five-year average, according to S&P Global. Supply conditions also improved with the Energy Information Administration reporting storage levels across the US were 6.7% higher than the five-year average. Brent Crude Oil prices dipped below $80/barrel last week after reports of a slow resumption of economic activity in mainland China after the Lunar New Year holiday. Soft economic activity in mainland China also weighed on natural rubber demand and caused prices to decline 2.5% last week. Elements of the MPI continue to show strength with lumber prices rising to $524 per thousand board feet, a four-month high after reports that new home sales in the US had increased 2.3% in December 2022 the first monthly rise since May 2022. This is unlikely to last as homebuilding will be constrained by higher mortgage rates in 2023.

Markets continue to grapple with mixed signals on global economic

growth with commodity traders taking a broadly bearish view last

week. The Federal Reserve, European Central Bank and Bank of

England all announced interest rate rises. The Federal Open Market

Committee (FOMC) raised the target for the federal funds rate by 25

basis points to a range of 4.50-4.75%, as expected. Meanwhile, the

ECB and Bank of England increased the headline rate by 50 basis

points. In the US, we expect two more quarter-point rate hikes to

bring the policy rate to a peak of 5.00-5.25% in May. However,

commodity markets also focused on strong jobs data in the US, with

unemployment declining 0.1 percentage points to 3.4%, believing

this has the potential to send inflation rates higher. In addition,

Chinese growth signals remain weak compared to pre-pandemic levels

and this will ultimately lead to lower commodity prices overall

this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-on-bearish-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-on-bearish-outlook.html&text=Weekly+Pricing+Pulse%3a+Commodities+down+on+bearish+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-on-bearish-outlook.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities down on bearish outlook | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-on-bearish-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+down+on+bearish+outlook+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-down-on-bearish-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}