Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 19, 2020

Weekly Pricing Pulse: Commodities drop sharply as the global economy shuts down

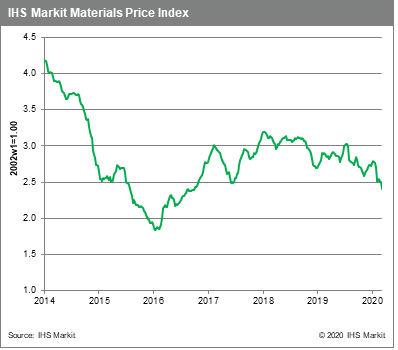

After holding fairly steady between mid-February and early March, commodity prices as measured by our Materials Price Index (MPI), fell 3.6% last week, with market volatility hitting levels last seen during the financial panic of 2008. Aggressive moves by policymakers designed to steady markets had the opposite effect, with investors viewing their actions as confirmation of their worst fears.

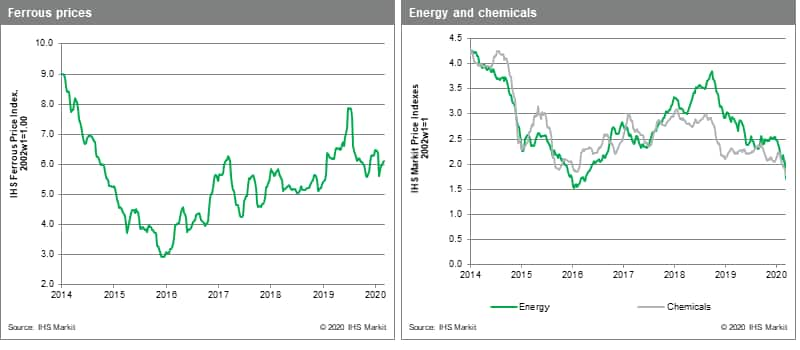

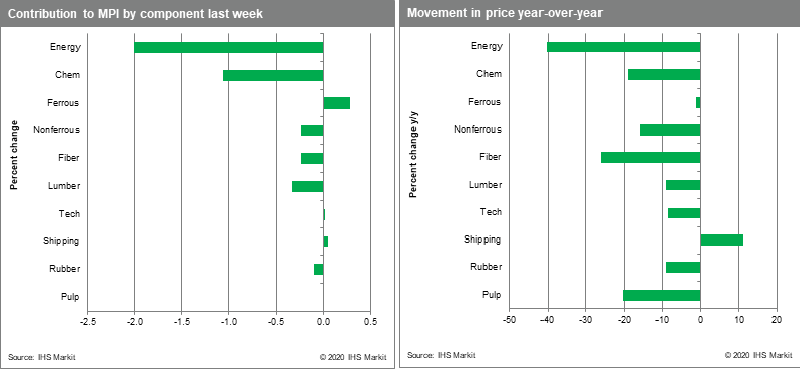

Energy led the MPI lower, with plunging oil prices dropping the MPI's energy sub-index 15.5% last week. A collateral effect of Saudi Aramco's announcement that it will boost crude production was a 150% week-on-week jump in VLCC charter rates. The MPI's freight index rose 1.5% primarily on the rebound in dry bulk charter rates. Chemical prices fell 5.7% due to collapse in oil prices and weaker global demand. Benzene fell 9.9%, ethylene 3.6%, and propylene 4.8% despite slower spot buying activity due to the uncertainty in markets. This relatively minor reaction compared to oil could spell more moves lower in the coming weeks. Lumber prices fell 11.5% last week on the justified fear that coronavirus quarantines will significantly reduce US spring home buying even with record low mortgage rates. Non-ferrous prices fell 2.5% with copper prices hitting a low of $5,386 /t last week, a price not seen since September 2016. DRAMs and Ferrous prices continue to show strength. DRAMs prices rose 4.1%, their third consecutive weekly rise. DRAMS appear to be an example of supply chain disruptions (or fear thereof) boosting prices, at least temporarily. Ferrous prices rose 0.8% with iron ore holding above $90 /t perhaps due to recovering activity in China and the promise of additional stimulus. Steel inventory, however, appears to be a record levels, again suggesting that the recent strength in iron ore prices may be temporary.

As COVID-19 spreads worldwide, markets have begun pricing in a global decline in economic activity on the scale of that witnessed in China during the past two months. Moreover, in looking forward past the worst of the crisis, markets also appear to be expecting a recovery that will have a more protracted "U" not "V" shaped profile. Commodity prices have fallen roughly 14% since mid-January and by nearly 20% from their 2019 peak last July. But they are still some 23% above their early 2016 low, suggesting there is potentially still a substantial downside remaining.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-drop-sharply-global-shuts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-drop-sharply-global-shuts.html&text=Weekly+Pricing+Pulse%3a+Commodities+drop+sharply+as+the+global+economy+shuts+down+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-drop-sharply-global-shuts.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities drop sharply as the global economy shuts down | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-drop-sharply-global-shuts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+drop+sharply+as+the+global+economy+shuts+down+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-drop-sharply-global-shuts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}