Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 04, 2019

Weekly Pricing Pulse: Commodities fall on continued concerns about demand

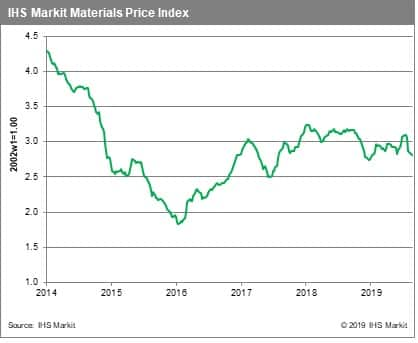

Commodity prices, as measured by our Materials Price Index (MPI), fell another 0.5% last week, their sixth consecutive weekly decline. Commodity prices have now moved to their lowest level since January. While US and Chinese policymakers dialled back on the harsh trade rhetoric of recent weeks and helped rally equity and bond markets, commodities continued to sag, on worries about demand.

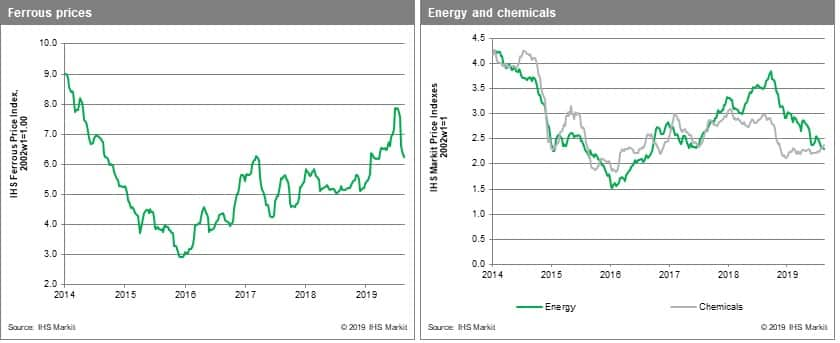

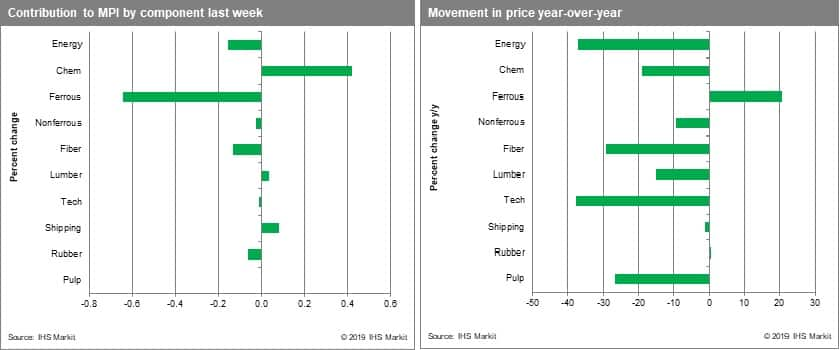

Iron ore prices fell again, dropping 1.7% for the week. Chinese iron ore port stocks rose 3.3% as weak demand, well stocked mills and falling finished steel prices discouraged buying. Chinese steel inventories stand 27% higher y/y, suggesting iron ore's recent rout may continue. Likewise, non-ferrous prices are suffering from disappointing Chinese demand and fell 0.3% last week, despite nickel rising 4.4%. Nickel prices have jumped by 50% since June on fear (now realized) that Indonesia would bring forward its proposed ban on nickel ore exports to the start of 2020. Fiber prices dipped 2.3% on falling demand and a softening cost base. The MPI's energy sub index slipped 0.9% on declines in both oil and coal prices as traders reduced long positions in expectation of continued volatility.

Attention in markets shifts to Europe this week. While the formation of a coalition government in Italy avoids a snap election there, Prime Minister Johnson's manoeuvring over Brexit has raised political tensions in the UK and made the possibly of a snap election before the end of October more likely. Sterling has already suffered in currency markets with a cascading effect likely to be felt in commodity markets. The question is, will policymakers step in to provide more stimulus? In particular, will events prompt the US Federal Reserve cut interest rates when it meets in two weeks?

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-fall-continued-concerns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-fall-continued-concerns.html&text=Weekly+Pricing+Pulse%3a+Commodities+fall+on+continued+concerns+about+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-fall-continued-concerns.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities fall on continued concerns about demand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-fall-continued-concerns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+fall+on+continued+concerns+about+demand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-fall-continued-concerns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}