Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 07, 2023

Weekly Pricing Pulse: Commodities higher as contagion fears wane

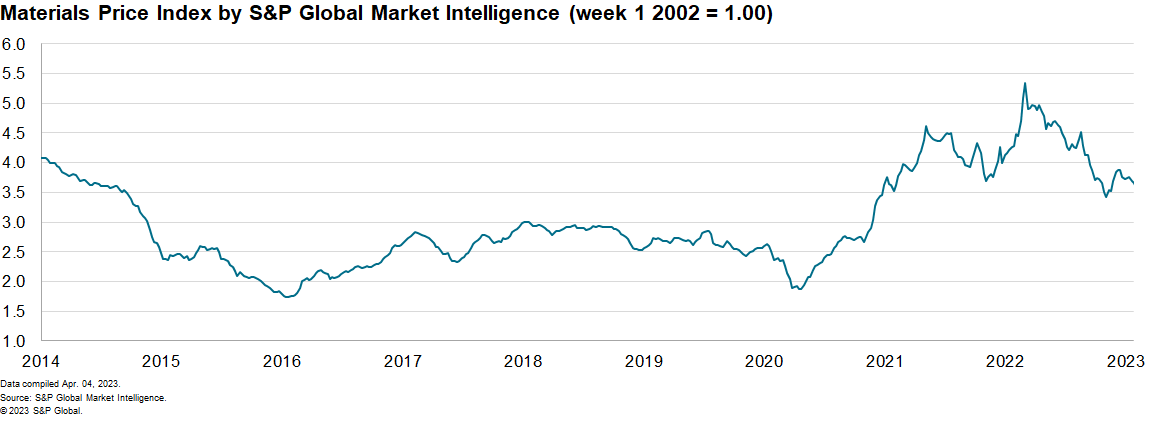

The Material Price Index (MPI) by S&P Global Market Intelligence increased 0.7% last week, a return to growth after two consecutive weekly declines. The increase was widespread with seven of the ten subcomponents rising. The MPI still sits 30% below its year ago level which was near the all-time peak.

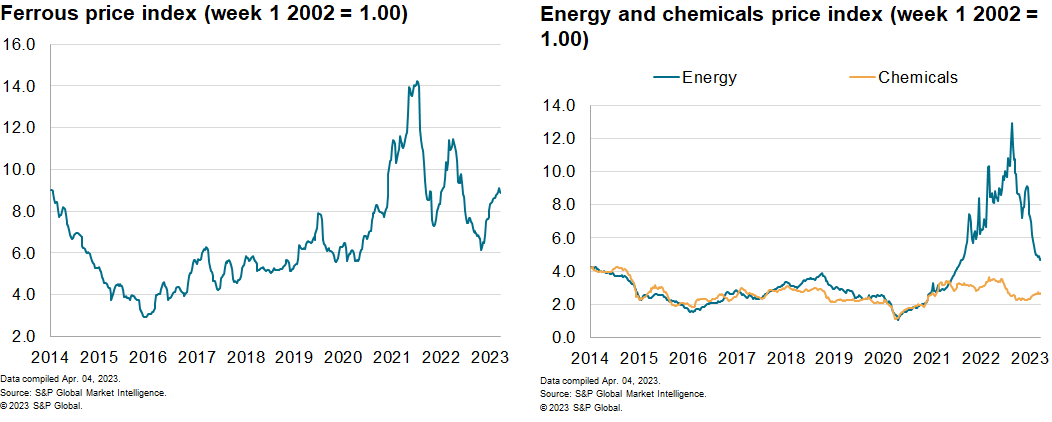

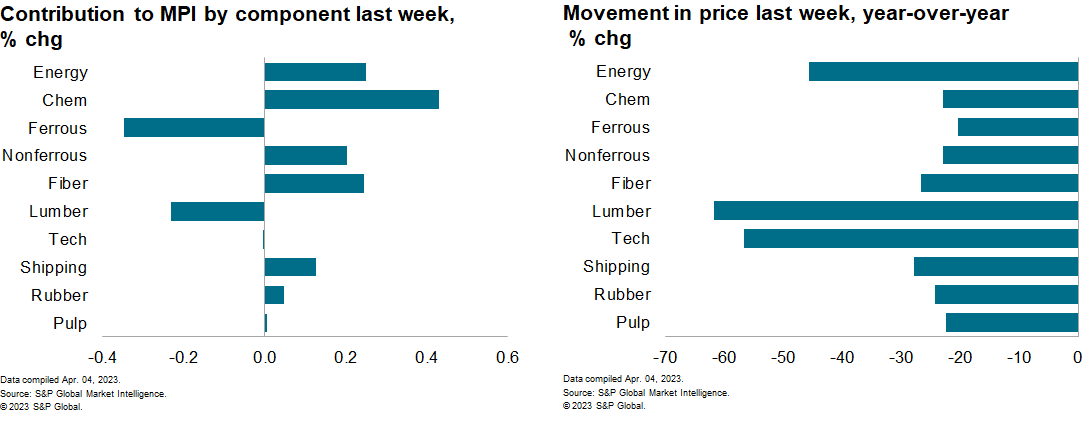

Rising oil prices were one of the major drivers of last week's increase in the MPI. The energy sub-index was up 1.3% with global oil prices jumping 5%. Brent Crude Oil, the international benchmark, climbed to $78/barrel up from a low of $70/barrel the week before. Oil traders concerns about the prospect of contagion spreading from the collapse of Silicon Valley Bank eased and this provided the upward impetus for prices last week. The surprise announcement by OPEC+ (2nd April) that it would make further production cuts starting in May, will provide further upside price pressure that will show up in next week's MPI. Stronger industrial metal prices also contributed to the MPI's upward movement last week. The nonferrous metal sub-index increased 2.2% with the highest price growth seen in tin markets. Tin climbed to $26,097/tonne, having been at $22,000/tonne in the middle of March as global supply issues mount. Peru's only tin mine was shut for six weeks from mid-January and that loss has tightened global supply. The prospect of an export ban by Indonesia has added further concern that supply issues will continue through 2023.

Markets continue to grapple with mixed signals on global economic growth, but sentiment improved last week. Bank shares remain under pressure following the collapse of Silicon Valley Bank, but the tech heavy Nasdaq Composite stock index returned its strongest quarter since 2020. This was partly driven by market expectations that central banks will now ease up on aggressive interest rate rises. However, core personal consumption expenditure (PCE) inflation remained stubbornly high in February, with the 12-month increase unchanged from December. This, in combination with strength in employment, income, and spending, suggests the Federal Reserve (Fed) may continue to tighten despite the recent turmoil in financial markets. This, combined with falling natural gas costs for producers, will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-higher-as-contagion-fears-wane.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-higher-as-contagion-fears-wane.html&text=Weekly+Pricing+Pulse%3a+Commodities+higher+as+contagion+fears+wane+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-higher-as-contagion-fears-wane.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities higher as contagion fears wane | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-higher-as-contagion-fears-wane.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+higher+as+contagion+fears+wane+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-higher-as-contagion-fears-wane.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}