Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 29, 2019

Weekly Pricing Pulse: Commodities hit by trade again

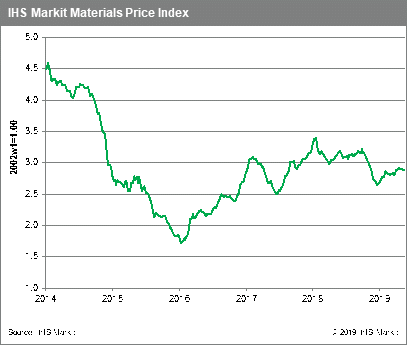

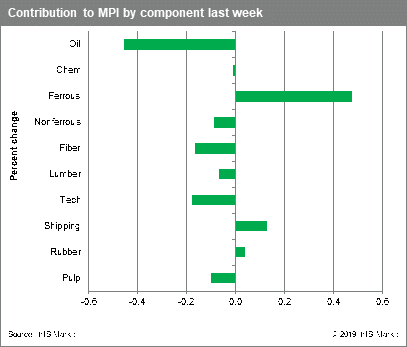

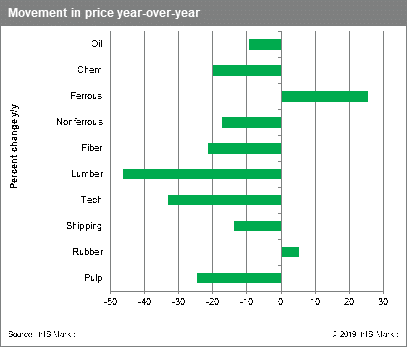

The negative sentiment surrounding trade continued to impact materials prices last week. Oil, non-ferrous metals and fibre prices all struggled under fears of weakening demand, pulling our Material Price Index (MPI) 0.4% lower.

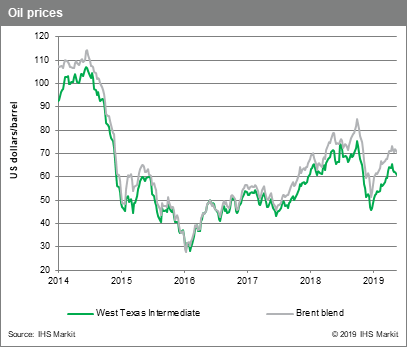

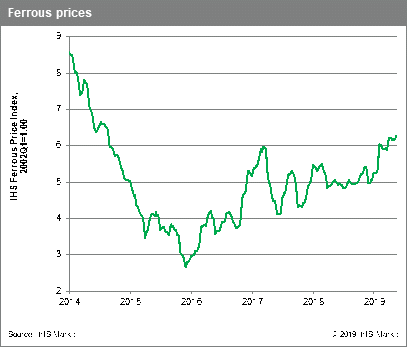

Although conflict in key oil producing regions is providing price support, Brent crude suffered a rout last week falling 6% to $68 /bbl as concerns over near-term oil demand growth and data showing higher US inventories took their toll. Non-ferrous metals prices, a recent bell-weather for trade-war sentiment, tumbled 1.4%, their ninth straight weekly decline. Fibre prices too, have struggled in the face of trade issues and fell 3.0%, their fifth consecutive weekly decline. In contrast, ferrous prices jumped 1.5% last week with spot iron ore prices exceeding $100 /t for the first time in five years. Iron ore shipments into China slowed to an 18-month low in April even as Chinese steel production hit a record level, pointing to a possible increase in demand for deep sea cargoes.

This past week, trade concerns were further stoked by the US saying that it was not ready to make a deal with China. This coincided with data released indicating Chinese industrial profits had fallen 3.7% y/y in April, a trend that began in November 2018, and in line with weak industrial production performance year-to-date. With supply-side issues in oil and ferrous markets stripped away, the fate of the MPI will remain tied to the swings in sentiment tied to trade.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-hit-trade-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-hit-trade-again.html&text=Weekly+Pricing+Pulse%3a+Commodities+hit+by+trade+again+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-hit-trade-again.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities hit by trade again | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-hit-trade-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+hit+by+trade+again+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-hit-trade-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}