Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 23, 2020

Weekly Pricing Pulse: Commodities mirror equities with back to back weekly gains

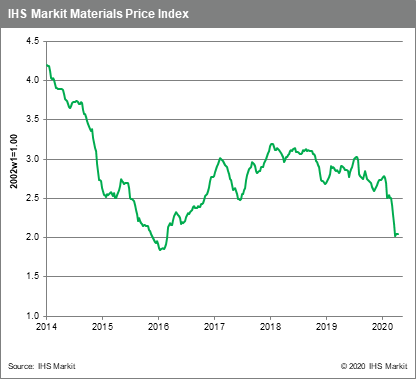

Markets continued to present a glass half full view of conditions last week, as reflected by a 1.0% rise in commodity prices according to our Materials Price Index (MPI). While this was the second consecutive weekly rise in index, five of the MPI's ten components fell on the week, indicating a fair amount of uncertainty about the near future remains in markets in spite of the guarded optimism being displayed recently.

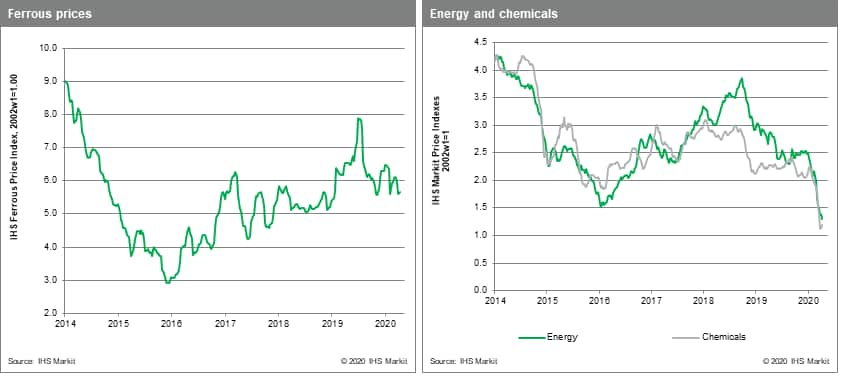

Chemicals prices saw a large gain last week, rising 6.0%. The increase was driven largely by a 20.0% surge in Asian propylene prices, which were tied to demand for personal protective equipment (PPE) linked to global shortages. Benzene prices also rose, 10.0%, due to stronger demand from China for styrene and phenol derivatives. Ethylene prices, in contrast, fell 6.6% on weak demand and oversupply globally. Non-ferrous metals rose 2.1% last week, the best week for base metals in six months. A spate of mine closures worldwide are raising concerns about metal supplies. Lumber prices rose 9.4%, a second consecutive strong weekly gain, driven by some capacity closures and better market sentiment. Ferrous prices rose 1.1% as Chinese blast furnace operating rates hit their pre-COVID-19 12-month average of 80.5%. Furthermore, Vale lowered its 2020 guidance for iron ore production 30 MMt lending support to ore prices. Energy prices having rebounded 0.8%, fell 4.6% last week as oil prices dropped 9.4%, despite the near-10 Mbbl/d production cut announced by the industry. IHS Markit Energy estimates crude oil demand loss will peak in April at 21 Mbbl/d, highlighting the imbalance still present in the market. Thermal coal prices fell 5.1% as global power demand remains subdued coupled with higher renewables generation.

A slow return to work, first in Asia and now haltingly in Europe is creating a degree of optimism in commodity markets that the worst is either over or very near. This change can be seen in some data, which are now hinting that a bottom is near. Daily volatility is easing, futures spreads in commodity markets are wide, and scrap discounts are narrowing, all of which may encourage bargain hunting buying. The cautionary note to these small pieces of good news is that uneven nature of the return to work globally, suggesting a start-stop pattern to a recovery during the second half of the year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-mirror-equities-gains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-mirror-equities-gains.html&text=Weekly+Pricing+Pulse%3a+Commodities+mirror+equities+with+back+to+back+weekly+gains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-mirror-equities-gains.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities mirror equities with back to back weekly gains | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-mirror-equities-gains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+mirror+equities+with+back+to+back+weekly+gains+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-mirror-equities-gains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}