Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 22, 2020

Weekly Pricing Pulse: Commodities move higher on restocking and trade-deal momentum

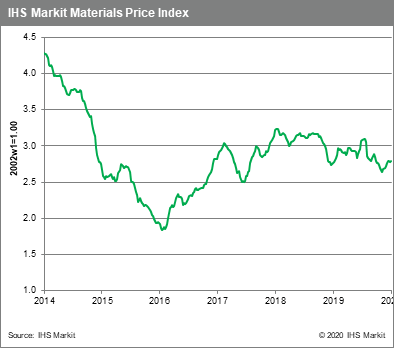

Commodity prices as measured by our Materials Price Index (MPI) rose 0.7% last week in a broad-based move. Like equity and bond markets, commodities are drawing on the positive momentum created from a US-China phase-one trade agreement, buying in Asia ahead of the Lunar New Year holiday and the US Senate's ratification of the USMCA, the replacement for NAFTA.

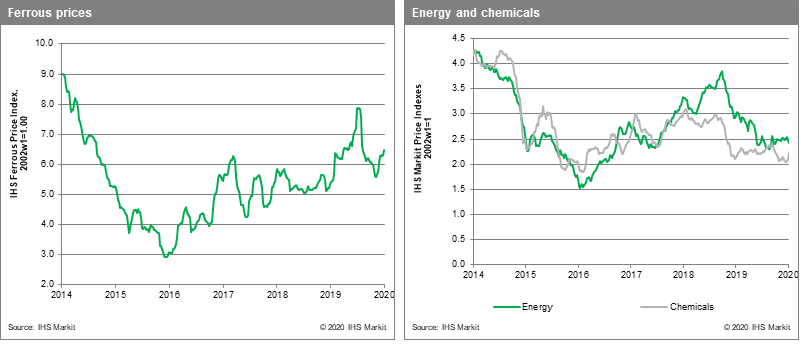

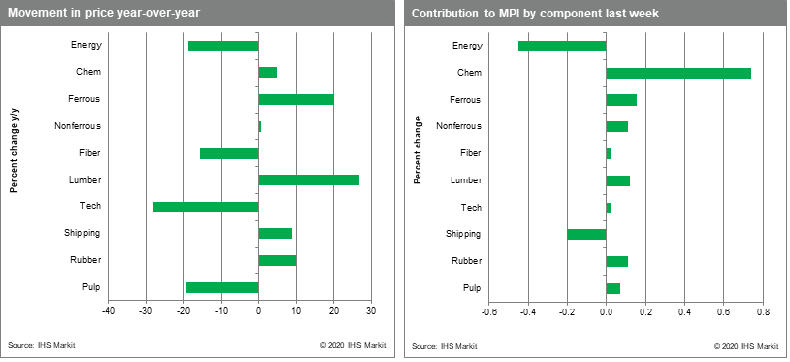

Chemicals rose 3.8%, due to propylene and ethylene are rising 6.4% and 3.7%, respectively. US ethylene however rose 15.2% following an 18.4% rise last week making up for losses sustained in December. Despite the two-week, 36.3% rise, US ethylene prices are bouncing along close a 20-year low. Ethylene also remains tight in Asia due to high demand and two major crackers being offline. Lumber, after a poor start to 2019 is one of the best performing commodities over the past six months. Lumber prices rose again last week, increasing 4.8% on the back of continuing firm housing demand and mill closures that represent around 18% of British Colombia's capacity. DRAMs also popped 5.3% on the announcement of the release of new gaming consoles at the end of 2020 and growing cloud investments. Energy prices fell 3.1% for the week, with oil falling 4.7% as the US hit a record 13 Mbbl/d of crude production and tensions in the Middle East eased. Gas prices also tumbled again, falling 7.5% mainly due to a 13.5% drop in Asian gas prices. Asian gas prices could soon drop below the $3/MMBtu level, as rising supply outpaces weak winter demand.

The mood in commodity markets has clearly improved since October given some clarity on trade and signs that global manufacturing activity is at least stabilizing. Challenges remain to be sure. Regionally, Europe's manufacturing sector continues to look fragile, while imbalances in the Chinese economy have yet to be fully addressed. Most important perhaps, are the contentious trade issues that were avoided in the phase-one US-China trade agreement have yet to be resolved. Still, for the moment, commodities markets have a decidedly glass half full view of the near-future that is lifting prices and imparting a degree of optimism for the new year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-move-higher-restocking-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-move-higher-restocking-trade.html&text=Weekly+Pricing+Pulse%3a+Commodities+move+higher+on+restocking+and+trade-deal+momentum+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-move-higher-restocking-trade.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities move higher on restocking and trade-deal momentum | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-move-higher-restocking-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+move+higher+on+restocking+and+trade-deal+momentum+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-move-higher-restocking-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}