Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 03, 2020

Weekly Pricing Pulse: Commodities focus on the partial relaxation of COVID-19 restrictions

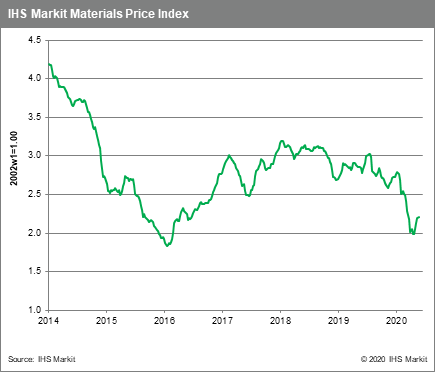

Commodity prices rose for a fourth consecutive week last week but slower, chalking up a 0.7% weekly gain as measured by our Materials Price Index (MPI). While trade tensions and civil unrest have increased in past month, commodity markets continue to register that the worst is over.

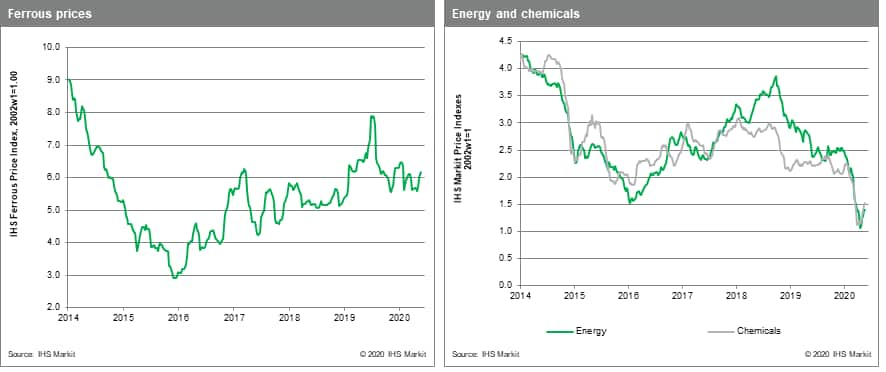

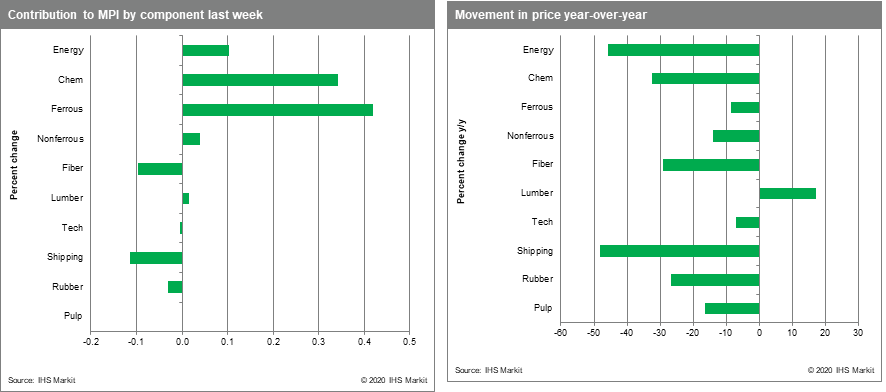

The chemical sub-index carried the MPI higher during a week of relatively low volatility. Ethylene and benzene prices rose 5.4% and 3.0%, respectively, again with greater price strength in Asian markets as buyers there built inventories given the strength of North Asian demand. That being said, European chemical prices have pushed higher over the past five weeks, just not with the same strength as seen in Asia. Energy prices ticked up 1.0%, with crude oil price gains finally slowing after weeks of double-digit growth keyed to production cuts by major producers. LNG prices, however, fell again last week, dropping 5.6%. Gas prices as measured in the MPI are down by more than 15% since the end-April. Rising inventories, cheap oil and the northern hemisphere summer now underway are all hitting LNG prices hard. Ferrous prices rose 1.0% as COVID-19-related supply disruptions in Brazil lifted the benchmark iron ore price back above $100 /Mt last week. Fiber prices fell 1.6% on persisting demand weakness. As with LNG, fiber prices have fallen since the late-April and are down 25.1% in the year to date (YTD). DRAMs fell 0.8% because of softness in memory demand, the tenth consecutive weekly fall in the sub-index. Strong gains in the first quarter, however, mean DRAM prices are still up 4.2% YTD.

Last week was most notable for what did not happen in markets. While fresh data remained downbeat, the increasingly tough rhetoric between the US and China did not see the breakdown of the phase one trade agreement and the imposition of even higher tariffs that markets feared. Actions by the Trump Administration changing the status of Hong Kong in US trade law may yet have serious implications for bi-lateral trade, but for the moment, markets were allowed to focus on just the COVID-19 pandemic and the hopeful signs of economies restarting.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-partial-relaxatition-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-partial-relaxatition-covid19.html&text=Weekly+Pricing+Pulse%3a+Commodities+focus+on+the+partial+relaxation+of+COVID-19+restrictions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-partial-relaxatition-covid19.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities focus on the partial relaxation of COVID-19 restrictions | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-partial-relaxatition-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+focus+on+the+partial+relaxation+of+COVID-19+restrictions+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-partial-relaxatition-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}