Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 03, 2019

Weekly Pricing Pulse: Commodities rise on US-China détente at G20

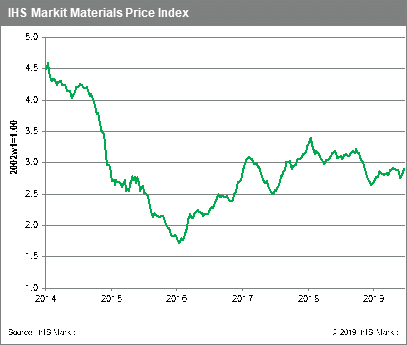

All eyes were focussed last week on the G-20 meeting in Osaka for news of a possible détente in the US-China trade negotiations. Market hopes were realized as President Trump and Chairman Xi agreed to resume trade talks. This helped to boost commodity prices 0.9% as measured by our Materials Price Index (MPI). Gains were broad-based with seven of the MPI's ten sub-components increasing. Improved sentiment has now lifted commodity prices for three straight weeks, returning prices to near their late April high.

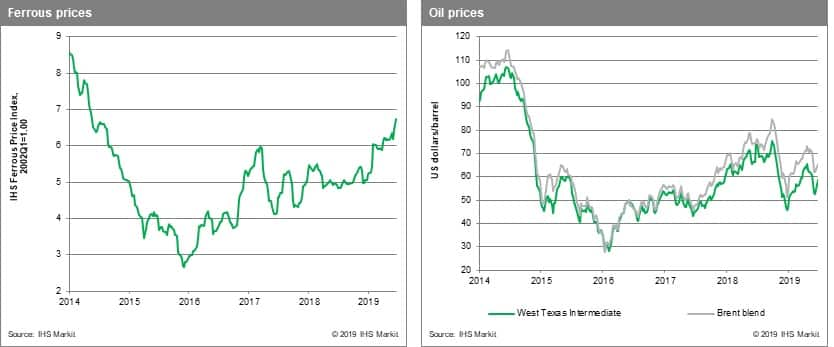

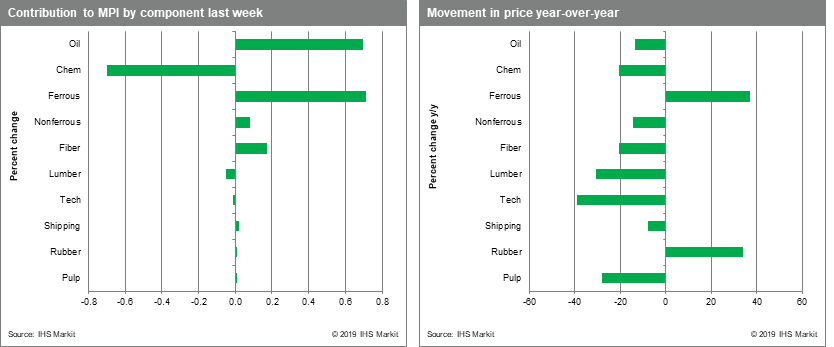

Oil prices rose a strong 4.1% on a large fall in US crude inventories and news that OPEC and Russia had agreed to extend production cuts for another 6-9 months. Non-ferrous metals prices rallied on the potential ratcheting down in trade tensions and a weaker US dollar. Fiber also posted strong gains, rising 3.3%. Ferrous prices rose 2.2% on the news of steel production cuts in China made to reduce air pollution. Chemicals were a notable exception to the general lift in commodities; prices fell 3.7%, a correction that followed large increases the previous two weeks.

Commodity, equity and bond markets all reacted positively to the G-20 summit, although gold did end the week above $1,400 tr/oz. In reality, the G20 meeting mimicked many of the events that took place in Buenos Aires in November, where the US ramped up tariff threats to China and other nations leading up to the meeting, before yielding, agreeing to talks, and declaring a truce. Therefore, whilst markets have hailed this as a de-escalation, the only progress achieved was the agreement to resume talks, which still leaves global trade at the mercy of politics with fundamentals still looking lacklustre.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-on-uschina-dtente-at-g20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-on-uschina-dtente-at-g20.html&text=Weekly+Pricing+Pulse%3a+Commodities+rise+on+US-China+d%c3%a9tente+at+G20+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-on-uschina-dtente-at-g20.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities rise on US-China détente at G20 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-on-uschina-dtente-at-g20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+rise+on+US-China+d%c3%a9tente+at+G20+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-on-uschina-dtente-at-g20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}