Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 08, 2020

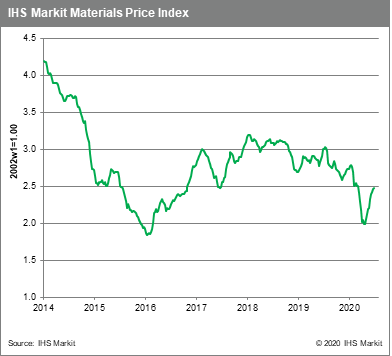

Weekly Pricing Pulse: Commodities V-shaped recovery continues

The gradual return to 'normal' around the world is fuelling optimism about materials demand and has sparked a rally in commodity prices. Highlighting this change, our Materials Price Index (MPI) increased another 0.7% last week, its ninth consecutive gain stretching back to early May. Despite worsening COVID-19 case counts in some regions, local control measures are being preferred to economically more damaging nationwide lockdowns. The change in containment strategies plus the general success in controlling the virus in Asia and Europe is resulting in an uptick in air and road travel, and retail sales, which are now complementing the partial resumption of manufacturing and construction activity. This improvement in final sales is essential for materials prices as strengthening underlying demand will prevent inventory builds along the supply-chain.

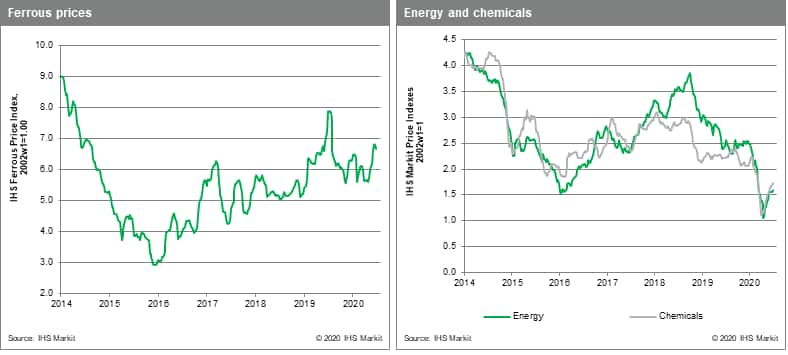

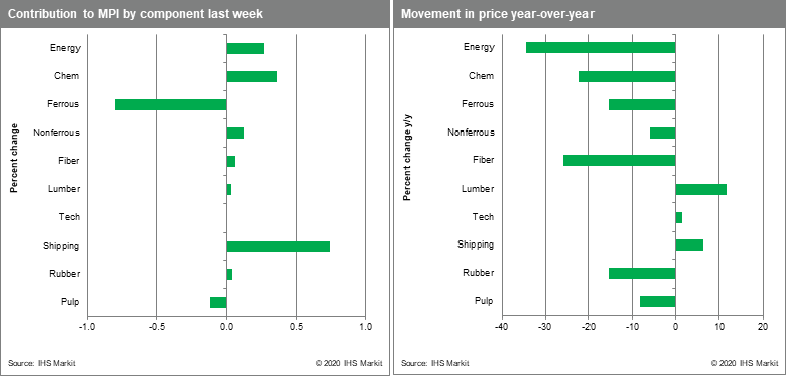

Within the MPI, the bulk freight sub-index continued its recent surge, rising 18.4% due to record high weekly shipments of iron ore from Australia. The energy index also pushed higher, increasing 2.6% last week due to a 4.3% rise in crude oil and a 4.1% rise in LNG prices. Crude prices rose on the news of a 7.3 Mbbl drawdown in US inventories and production discipline by OPEC members -- June OPEC production of 22.7 Mbbl/d was the lowest since May 1991. Strengthening oil and gas prices helped push the MPI's chemical index up another 2.1%. Non-ferrous metals rose 1.3%, chiefly on the coattails of continuing gains in copper prices, which have risen some 30% since March on improving Chinese demand and ongoing COVID-19 related supply issues in South America. In contrast to the general rise in commodities last week, ferrous prices fell 1.9% last week as steel demand from China eased due to the onset of the wet season in Southern Provinces, which typically stymies construction activity. Chinese iron ore inventories also ticked up for the first time in many weeks bringing prices below $100 /Mt briefly.

The recent strength in commodity prices and in global equities at the very least confirms that the worst of the global recession has past. This good news is tempered by the fact that the shock to the global economy has been profound with the disruptions to labor markets alone suggesting a more prolonged recovery. Rising COVID-19 infections rates in several countries are also raising the risk of a "W" shaped profile in economic activity. In short, IHS Markit continues to see the recovery as a hard slog, albeit conceding the bounce we are now seeing in many markets. The test for commodities will come later this year after the inventory restocking now taking place concludes and supply disruptions no longer hide excess capacity. Our suspicion is that physical demand will not be able to support the rally in prices much longer.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-vshaped-recovery-continues.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-vshaped-recovery-continues.html&text=Weekly+Pricing+Pulse%3a+Commodities+V-shaped+recovery+continues+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-vshaped-recovery-continues.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities V-shaped recovery continues | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-vshaped-recovery-continues.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+V-shaped+recovery+continues+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-vshaped-recovery-continues.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}