Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 28, 2023

Weekly Pricing Pulse: Commodity markets calm as traders await Fed’s next move

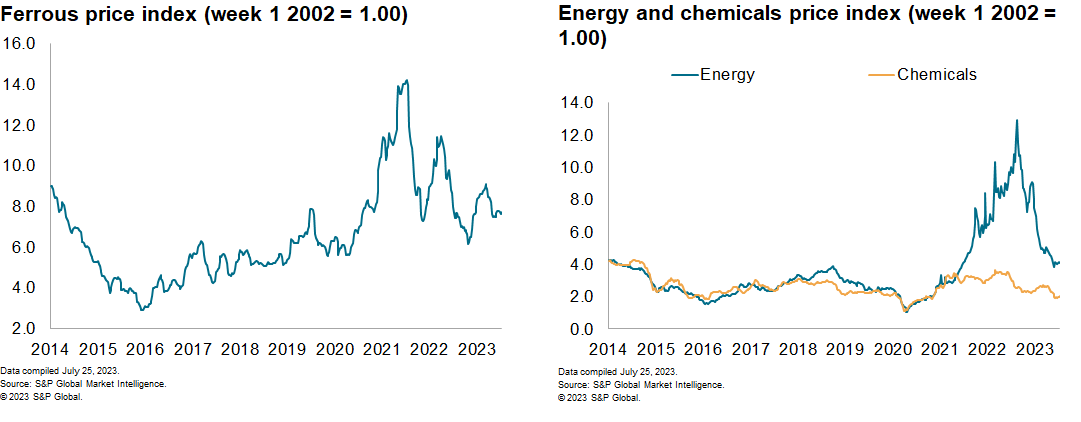

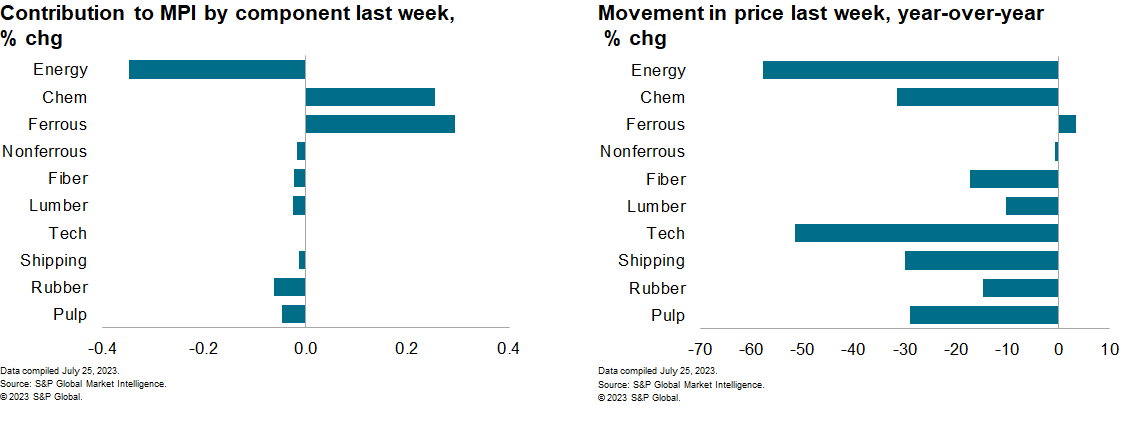

The Material Price Index (MPI) by S&P Global Market Intelligence was flat last week, following on from two consecutive weekly increases. Despite the lack of movement in the overall MPI at a headline level, there were small declines recorded in eight out of the ten subcomponents. And the story of this year has been declining prices with the index 28% lower than its year-ago level.

The energy sub-index recorded the most significant price move last week, falling 1.8%. Asian natural gas prices slipped to $10.60/MMBtu from $11.70/MMBtu the previous week. Weak demand was the major reason behind the price drop with disappointing Chinese growth continuing to weigh on sentiment. In addition, peak summer demand in southeast Asia is now over which created additional downward pressure on prices. Chemical markets displayed the most significant upward price move as the sub-index increased 1.2%. Europe was the pricing hotspot last week with propylene prices particularly strong. The summer heatwave in Europe has prompted fears that supply will be disrupted along the Rhine, the key transport node for chemicals on the continent. Water levels currently sit below five-year averages, and any further drop could result in significantly reduced cargo levels in the near term. This supply concern will provide upward price pressure on chemicals in the near term.

Market activity was muted last week as traders await the result of this week's Federal Open Market Committee (FOMC) meeting and the European Central Bank interest rate decision. In the US, seasonally adjusted initial claims for unemployment insurance fell 9,000 to 228,000 in the week ended July 15. In the United Kingdom, the Office for National Statistics (ONS) reports that the 12-month rate of increase in the UK's consumer price index (CPI) retreated to a 15-month low of 7.9% in June from 8.7% in May. Despite the better news on unemployment and inflation S&P Global Market Intelligence still expects further central bank action in the short term. Some degree of loosening in labor market conditions is required for inflation to fall to the Fed's target. Thus far, there is little evidence from initial or continuing claims that this is happening. And in the UK, still highly elevated core and service inflation pressures, alongside stubbornly robust wage growth, point to the BoE's Monetary Policy Committee (MPC) raising interest rates further. With no immediate end to central bank action in western economies, downward pressure on commodity prices remains significant. However, supply side tightening is beginning to have an impact and offset much of the price downside. The result is price stability over the second half of 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-calm-traders-await-fed.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-calm-traders-await-fed.html&text=Weekly+Pricing+Pulse%3a+Commodity+markets+calm+as+traders+await+Fed%e2%80%99s+next+move+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-calm-traders-await-fed.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity markets calm as traders await Fed’s next move | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-calm-traders-await-fed.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+markets+calm+as+traders+await+Fed%e2%80%99s+next+move+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-calm-traders-await-fed.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}