Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 13, 2022

Weekly Pricing Pulse: Commodity markets continue to respond to recession fears

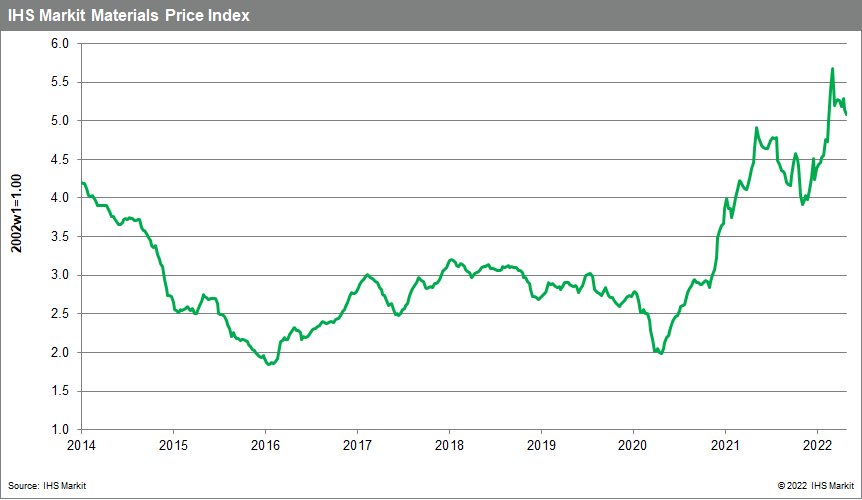

Our Materials Price Index (MPI) fell 2.4% last week, building on the 2% decline in the previous week. Prices declined in six of the ten subcomponents of the index, highlighting bearish sentiment around growing recession fears. Commodity prices, as measured by the MPI, are down 15.7% since their peak in early March, though they are still up 6.1% year-to-date.

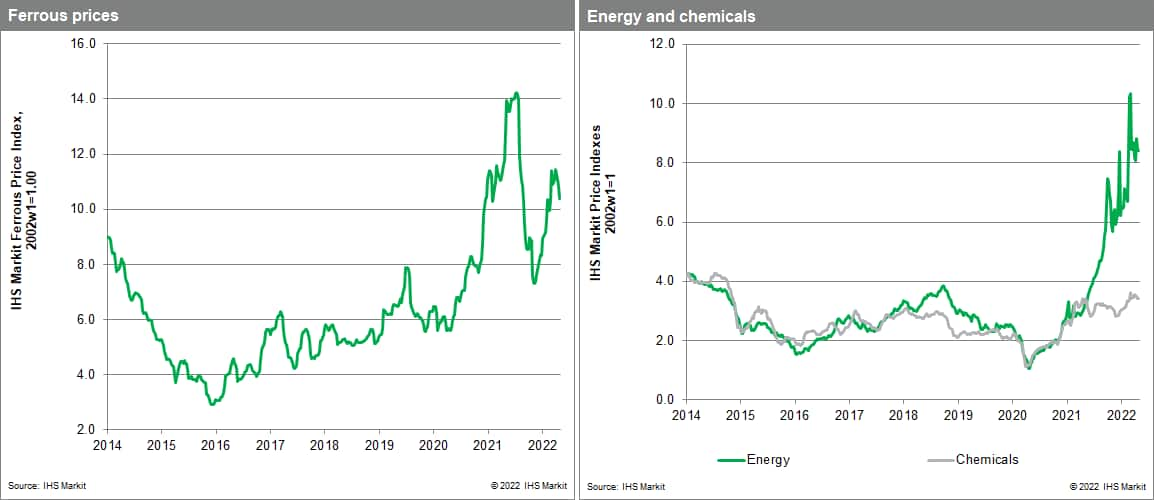

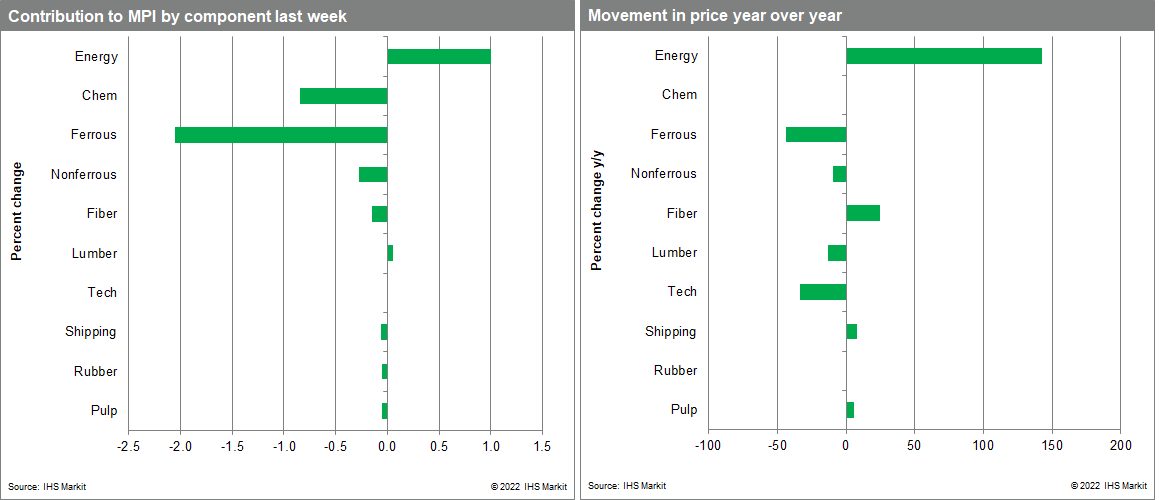

Ferrous metal and chemical prices were the two subcomponents with the sharpest declines. Ferrous metals fell 7.4% last week, driven by downward pricing pressure from iron ore. Iron ore prices dropped 10.7% last week, owing to weak steel demand from mainland China as steel inventories grow. Ferrous metals prices have generally turned lower since the first week of April as demand globally has deteriorated amidst uncertainty surrounding COVID-19, pandemic-related lockdowns, and weakened construction activity. Chemical prices fell 4.8% last week, owing to price declines in all its subcomponents. Benzene led the charge, with prices in all observed regions declining an average of 7.2%. Similarly, regional downward pricing pressure from the United States and Asia led propylene and ethylene prices to recede last week, dropping 4.2% and 2.6% respectively. In contrast to most commodities in the MPI, energy and lumber prices did see increases. Energy prices rose 3.4% last week due to strong natural gas prices in Europe and Asia. Both regions are scrambling for LNG imports to make up for the loss of Russian supply or dealing with the recent demand surge from seasonal temperature patterns. Lumber prices continue to show week-on-week volatility, rising 2.2% last week.

A seemingly weakened demand environment continues to weigh on commodity markets in 2022. Consumer sentiment reflects high inflation and economic uncertainty, becoming increasingly bearish. Evidence for this can be seen globally as personal spending in the United States slipped month-on-month in May and monthly retail sales in Germany declined year-on-year in May 2022. With fear of further economic deceleration still in the air, it is worth noting a potential light on the horizon. Looking at mainland China, the Caixin China General Manufacturing PMI by S&P Global crossed the threshold just slightly above a level of 50 in June from a level of 48.1 a month prior. Coupled with slight easing in backlogs and delivery times, this shift suggests easing cost pressures and a moderating inflationary environment in the coming months.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-recession-fears.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-recession-fears.html&text=Weekly+Pricing+Pulse%3a+Commodity+markets+continue+to+respond+to+recession+fears+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-recession-fears.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity markets continue to respond to recession fears | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-recession-fears.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+markets+continue+to+respond+to+recession+fears+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-recession-fears.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}