Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 17, 2022

Weekly Pricing Pulse: Commodity price growth returns

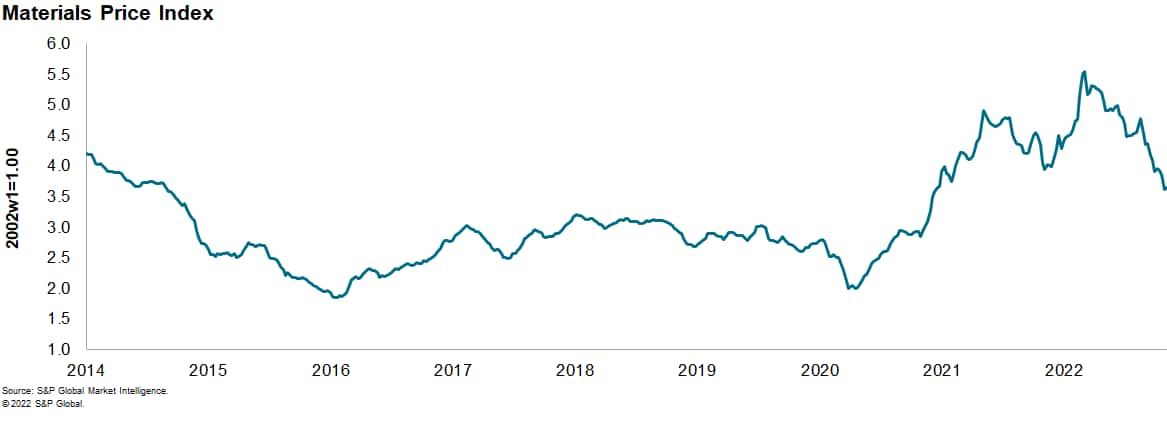

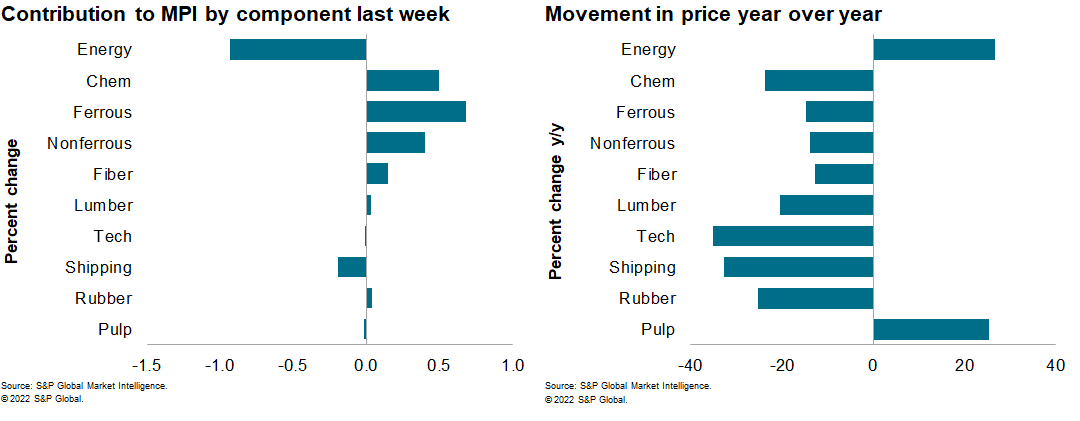

Our Materials Price Index (MPI) increased 0.6% last week, the first rise since early October. The increase was mixed with six out of ten subcomponents rising. Despite last week's price uptick, the MPI remains 35% lower than its all-time high established back in early March. However, commodity prices, as measured by the MPI, remain 29% higher than the pre-pandemic level in January 2020.

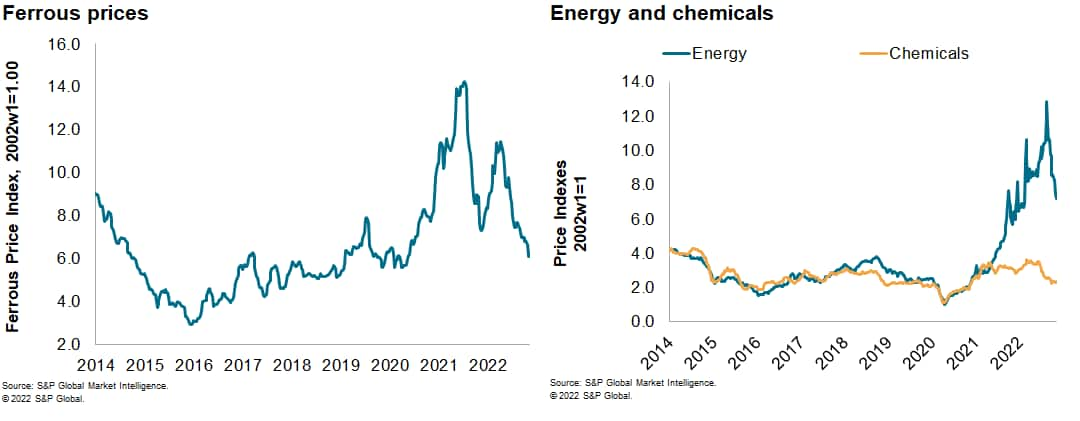

A jump in industrial metal prices was the largest contributor to the MPI's rebound last week. The nonferrous metal sub-index rose 4.7%, the largest weekly increase since late February. Every metal in the sub-index from aluminum to zinc registered an increase. Tin prices experienced a particularly strong rise to $21,147/tonne, up from a low of $17,697/tonne the previous week. Tin prices on average increased 10% last week which was the largest seven day increase since May 2021. Industrial metal prices were reacting to the news that mainland China have relaxed some of its COVID-19 quarantine policies. Officials will stop recording secondary contacts which could significantly reduce the number of people having to quarantine in the future. This news improved the outlook for a host of commodities but particularly aided industrial metals since mainland China is the main source of demand.

Despite the positive news on China's COVID policy, prospects for slower global demand continue to weigh on commodity prices. That said, last week's US inflation data boosted market sentiment. Consumer price inflation remains very high, but the latest report showed some indications of easing conditions. The 12-month change in the CPI declined 0.5 percentage point to 7.7% in October and was down from a four-decade high of 9.1% in June. The 12-month change in the core CPI eased 0.3 percentage points to 6.3% in October, also down from a four-decade high of 6.6% in September. The report reinforced our expectation that the Federal Reserve (Fed) will continue to hike rates but at a slower pace as it assesses the impact of cumulative rate hikes on squelching inflation. We expect a Fed rate hike of 50 basis points in December and markets agreed. However, with weak demand expected to dominate price movement in the near-term lower commodity prices are expected, albeit the pace of decline is likely to slow in line with moderating monetary policy.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-growth-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-growth-returns.html&text=Weekly+Pricing+Pulse%3a+Commodity+price+growth+returns+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-growth-returns.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity price growth returns | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-growth-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+price+growth+returns+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-growth-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}