Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 15, 2018

Weekly Pricing Pulse: Commodity prices continue their fourth quarter slide

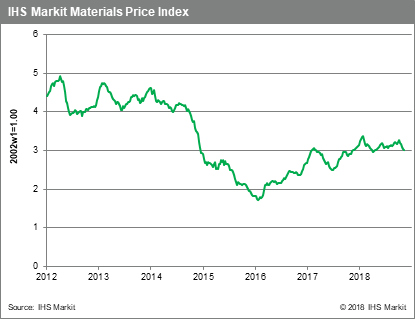

Global equities and currencies (vs. the USD) rose last week on the result of the US mid-term elections. Commodity prices as measured by IHS Markit's Material Price Index (MPI), however, continued their retreat, falling another 0.9%. The MPI has fallen in seven of the last eight weeks, and is now at its lowest level since November 2017.

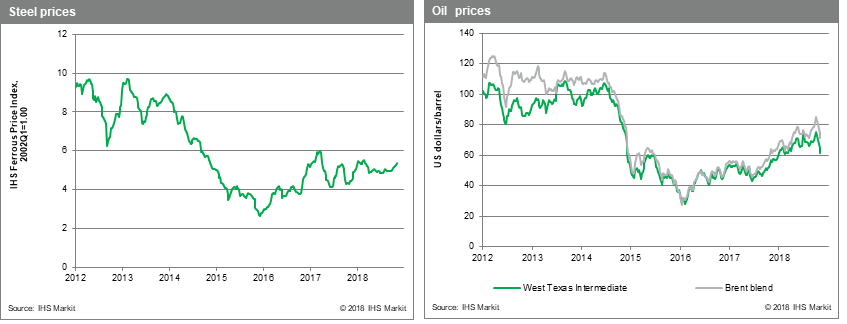

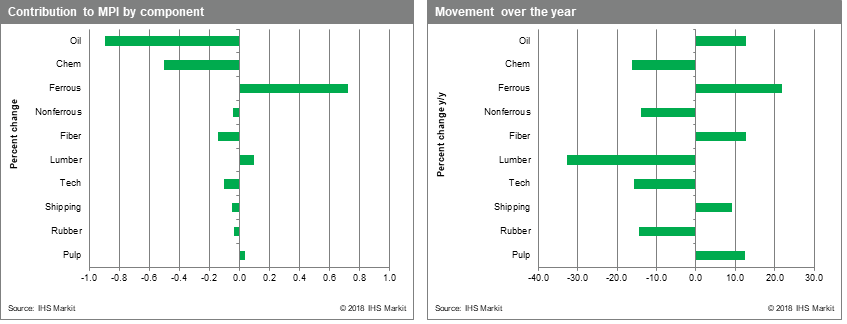

As has been the case in recent weeks, falling oil prices were the driving force behind the MPI's retreat. Crude prices fell 4.7%, with benchmark Brent blend slipping below $70/bbl. The MPI Chemicals index moved in step with oil, dropping 2.3%, its fifth consecutive weekly decline. Fiber prices also fell 2.1% w/w, as the weight of falling oil prices on synthetic fiber eclipsed strengthening cotton prices. After softening post-election, the dollar rebounded at the end of the week putting pressure on base metal prices already battered by concerns of weaker demand, especially in China. Ferrous prices rose again, increasing 2.9% w/w, driven by jumps in iron ore (up 2.4%) and scrap (up 4.1%). Rail issues and insufficient iron ore stocks in Port Hedland Australia lifted iron ore prices to fresh highs which provided cover for scrap price rises.

In addition to oil markets, tighter financial markets and slower Chinese growth have presented challenges to the commodity complex since January. The effect of both was in evidence last week. The US Federal Reserve did keep the Fed Funds rate unchanged during its November meeting, but strong US employment data coupled with the slow acceleration in wage growth makes a December rate hike a near-certainty. It is also important to remember that in addition to a higher policy rate, the long end of the yield curve is being affected by the Fed's efforts to reduce its balance sheet. For China, fresh data continues to highlight slower growth. Last week it was auto sales, with October's number down 13% y/y. Other data from cement production to rubber imports reinforce a picture of a slower growth in industrial activity, a pattern not expected to change through the end of the year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-slide.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-slide.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+their+fourth+quarter+slide+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-slide.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices continue their fourth quarter slide | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-slide.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+their+fourth+quarter+slide+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-slide.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}