Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 12, 2022

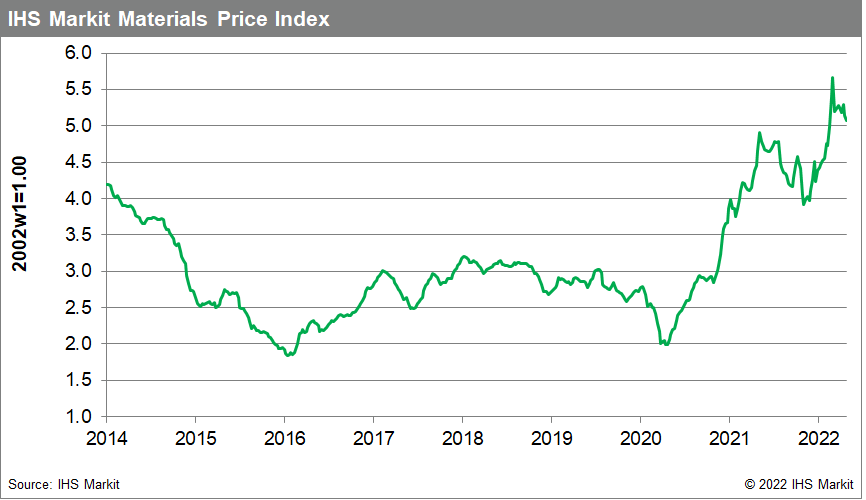

Weekly Pricing Pulse: Commodity prices continue to retreat

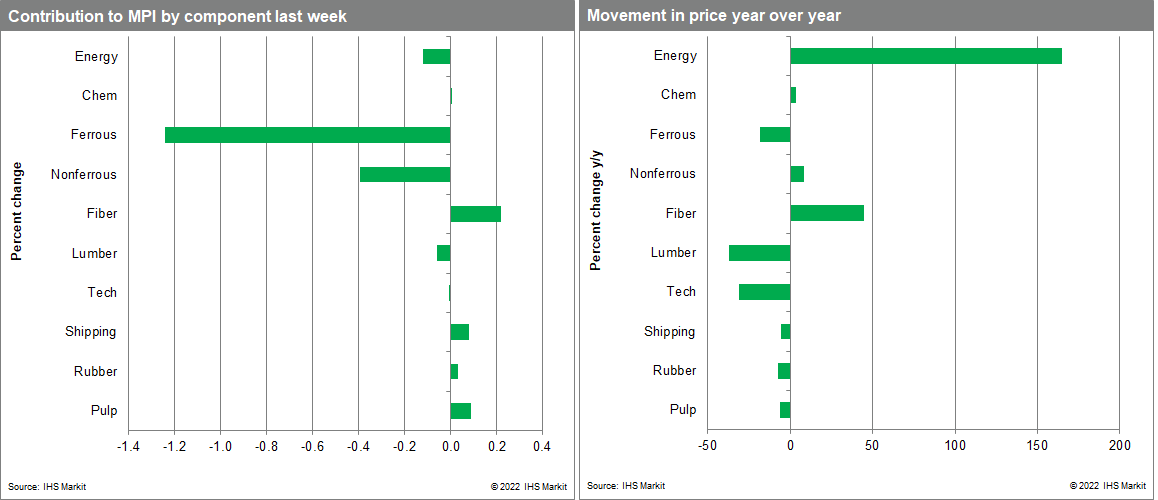

Our Materials Price Index (MPI) decreased 1.4% last week, with half of the index's ten sub-components falling. Markets have been growing increasingly nervous about growth prospects with widening Chinese COVID-19 lockdowns and higher interest rates in recent weeks. This sparked the second consecutive weekly decline in commodity prices with prices now collectively 10.4% lower than the all-time high established in early March.

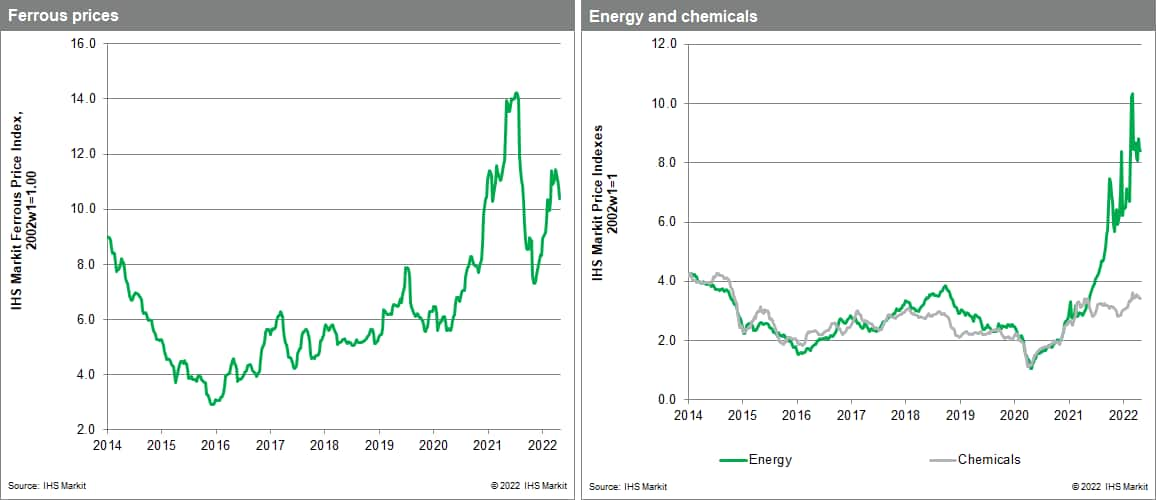

Declining industrial metal prices were the main reason for the drop in the MPI last week. The nonferrous metal index was down 5%, with five of six of the tracked base metals falling (tin proved to be the exception). Aluminum prices were down 6% for the week and dipped below $3,000/metric ton for the first time since January. Copper prices fell to the lowest point in 2022 finishing the week at $9,427/metric ton having been as high as $10,730 in early March. Metals markets were reacting to a variety of factors including weaker demand signals from mainland China, rising US interest rates and the strength of the US dollar. The US dollar rose sharply last week making dollar denominated metals more expensive for buyers using other currencies. The steel making raw materials index declined 3.8% as the price of iron ore ended the week at $136/metric ton. Iron ore traders were particularly gloomy after the Politburo meeting in mainland China confirmed the commitment to using lockdowns to control COVID-19. The expected negative impact on economic growth weighed heavily on the iron ore price.

Another round of commodity price declines added to bearish sentiment across markets last week. As expected, the US Federal Open Market Committee (FOMC) raised the target for the federal funds rate by 50 basis points to a range of 0.75-1.00%. The Bank of England Monetary Policy Committee also announced an interest rate increase of 25 basis points to 1.0% while forecasting that the UK economy would enter recession later this year. Finally, the Central Bank of Brazil raised its policy rate from 11.75% to 12.75%, a full percentage point. This news, coupled with the May Day holiday, dampened buying last week and led to declines in global commodity and equity markets. With consumer inflation remaining high across the globe, further interest rate hikes are expected, which will to put further downward pressure on commodity prices.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-retreat.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-retreat.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+retreat+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-retreat.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices continue to retreat | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-retreat.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+retreat+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-retreat.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}