Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 24, 2020

Weekly Pricing Pulse: Commodity prices continue to surge

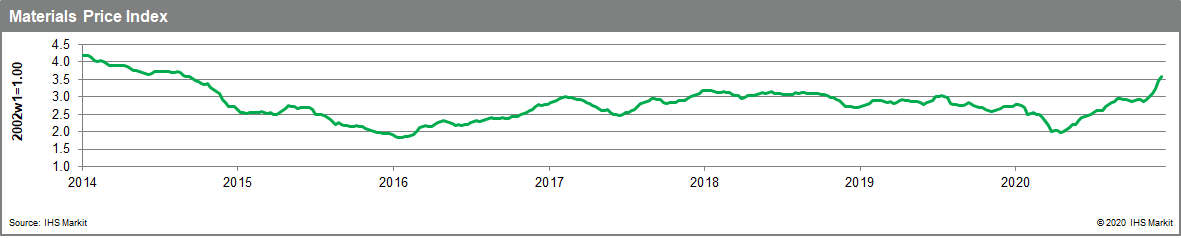

Our Materials Price Index (MPI) rose 2.8% last week, its sixth consecutive increase, though a smaller rise than the robust 7.4% and 5% gains in the previous two weeks. This said, the MPI is up nearly 24% since the start of October and is now at its highest level since early September 2014.

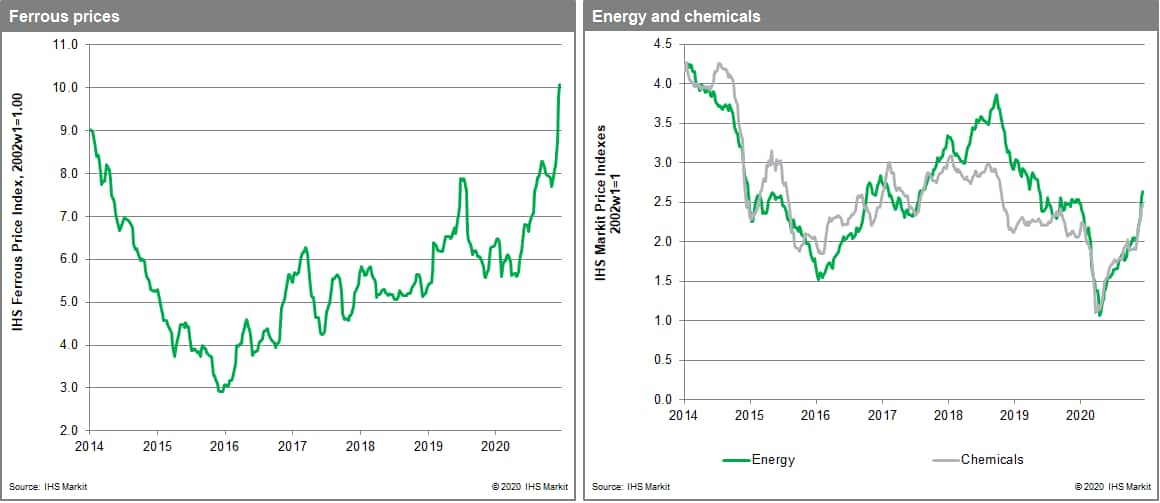

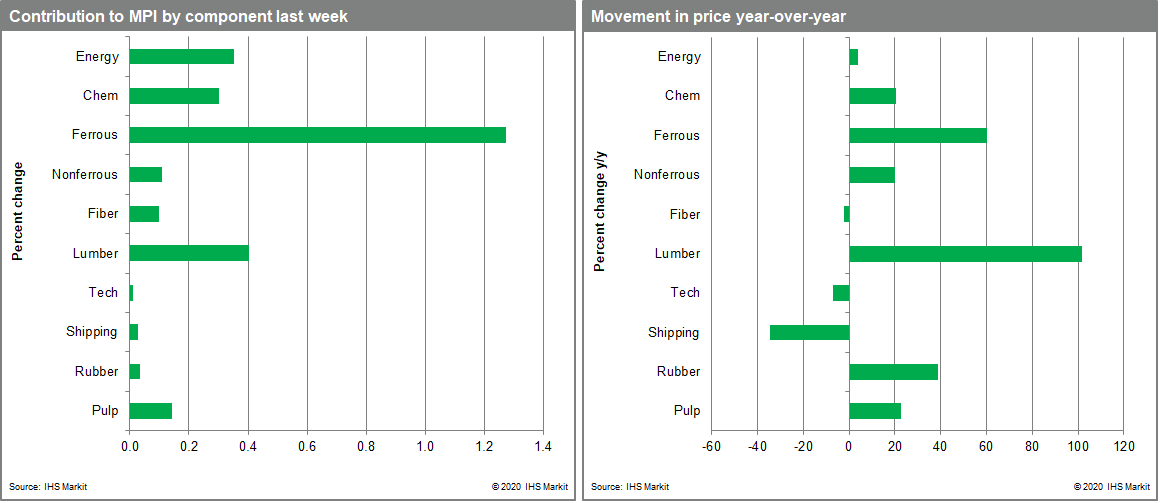

Lumber was the biggest mover last week, jumping 10.4%. Lumber prices are approaching their all-time high, set just three months ago in September, as the North American market remains in short supply. Southeast Asia dominated the narrative in many of the hotter markets. Pulp prices jumped 4% last week as shipping issues constrained cargoes getting into China. The DRAMS index, which had been quiet since September, also increased 4% last week following a 4.4% climb in the week before. Buyers appear to be pulling forward purchases in advance of the Chinese New Year to hedge against any disruptions, either from the holiday itself, or feared from COVID related containment measures. Thermal coal prices also added another strong week with a 7.1% increase, which helped push up the MPI's energy sub-index 2.9%. Higher natural gas prices and tight inventories are the main drivers of the ongoing climb in coal prices.

COVID-19 remains the major focus in markets. The rollout of vaccines has begun in many countries, supporting an upbeat demand outlook. At the same time, supply chains continue to face disruptions that are hampering production and snarling logistics services. The result is higher costs, which are now beginning to migrate downstream. The question for the new year is how quickly will the supply-side of markets react to the rebuild in demand as vaccinations become more widespread. Persistent bottlenecks will result in a burst in goods price inflation that carries beyond 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-surge.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+surge+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-surge.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices continue to surge | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+surge+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}