Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 29, 2021

Weekly Pricing Pulse: Commodity prices decline on industrial metal weakness

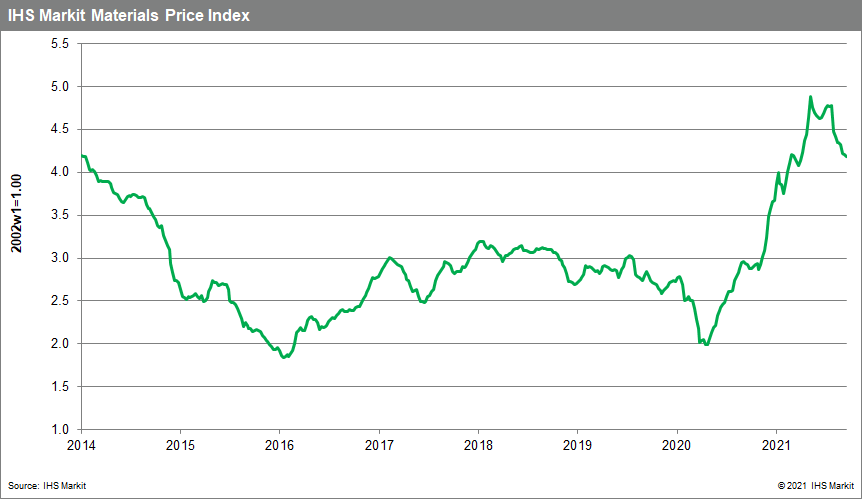

Our Materials Price Index (MPI) fell another 0.4% last week, the eighth consecutive weekly drop. The decline was broad, with seven out of the ten MPI sub-components lower. This latest move means commodity prices have fallen 12.4% since the end of July.

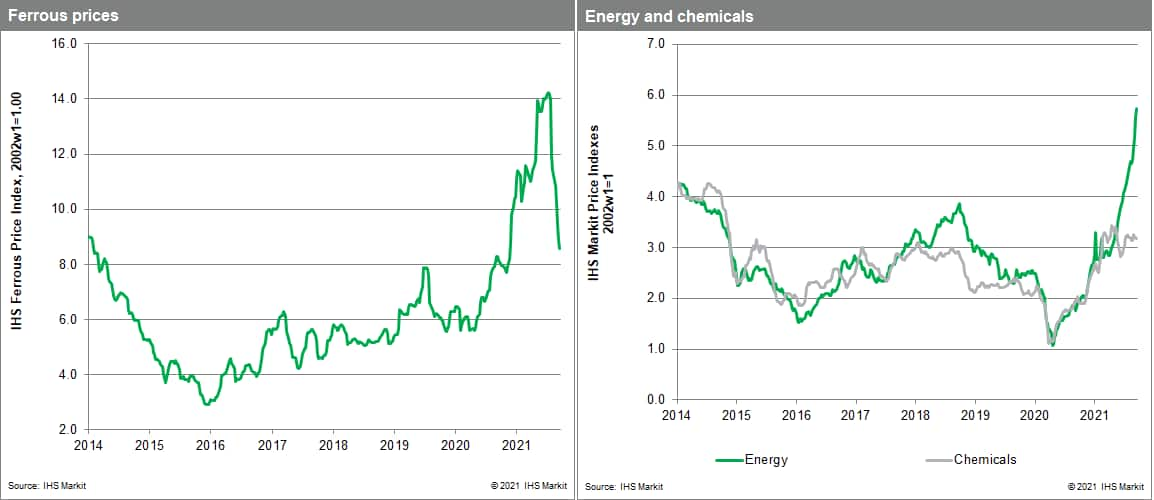

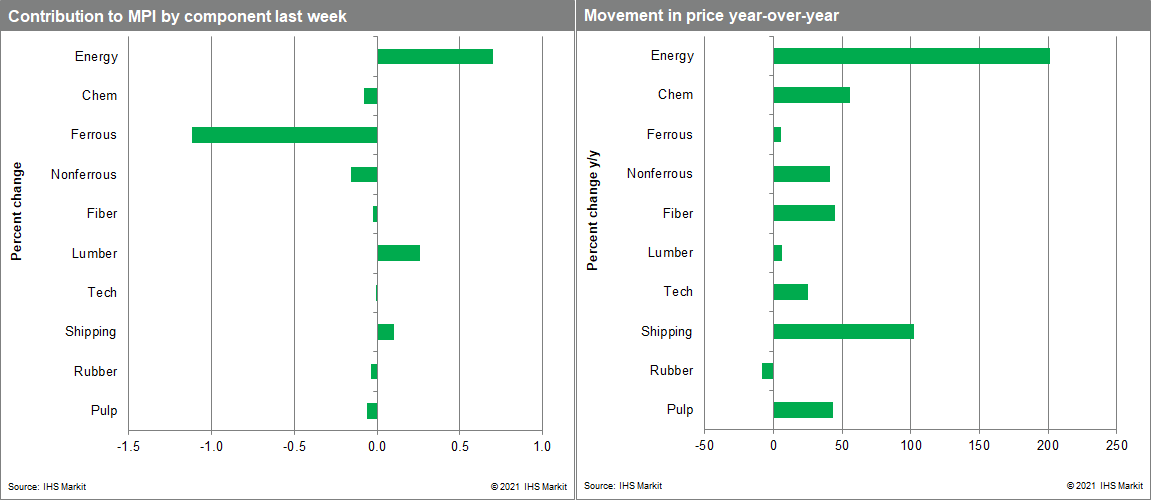

Industrial metals were the main contributor to the MPI's decline last week. Our ferrous sub-index was down 5.5% as iron ore prices fell for the tenth week in a row. Iron ore prices dropped to $117 a tonne, after peaking at over $230 in July. The reason for the price drop is linked to uncertainty over future Chinese steel production. Authorities in mainland China have asked many heavy industries to limit production to help meet emission targets or curb electricity consumption because of power shortages. Chinese markets are also grappling with the fallout from the possible collapse in Evergrande, the huge property developer, which helped to send copper and nickel prices down last week. In contrast to weaker metal prices, energy prices are showing strength with natural gas prices again lifted the energy component of the MPI. The 3.4% increase in the energy index was propelled by an 8.2% weekly climb in natural gas prices. Liquefied natural gas (LNG) import prices have doubled since early July in Europe. With depleted stocks in Europe, weak pipeline imports from Russia, and strong LNG demand in Asia, European traders have pushed prices to record levels. The tight market entering winter suggests elevated prices will last through much of the near term.

While the drop in the MPI since early May meshes with the change we have been expecting to see in commodity markets, the recent string of weekly declines looks to end soon if not next week. The correction in metal markets appears to have run its course - at least for now - while the recent strength in energy markets looks to continue into the fourth quarter with winter approaching in the Northern Hemisphere. Chemical markets have remained quiet in the face of higher energy feedstock costs, a condition that will not persist if energy prices continue to show strength. Strength in these two sectors alone should be enough to lift the MPI absent sharp corrections elsewhere.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-decline-industrial-metal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-decline-industrial-metal.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+decline+on+industrial+metal+weakness+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-decline-industrial-metal.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices decline on industrial metal weakness | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-decline-industrial-metal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+decline+on+industrial+metal+weakness+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-decline-industrial-metal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}