Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 08, 2021

Weekly Pricing Pulse: Commodity prices dip on Omicron concerns

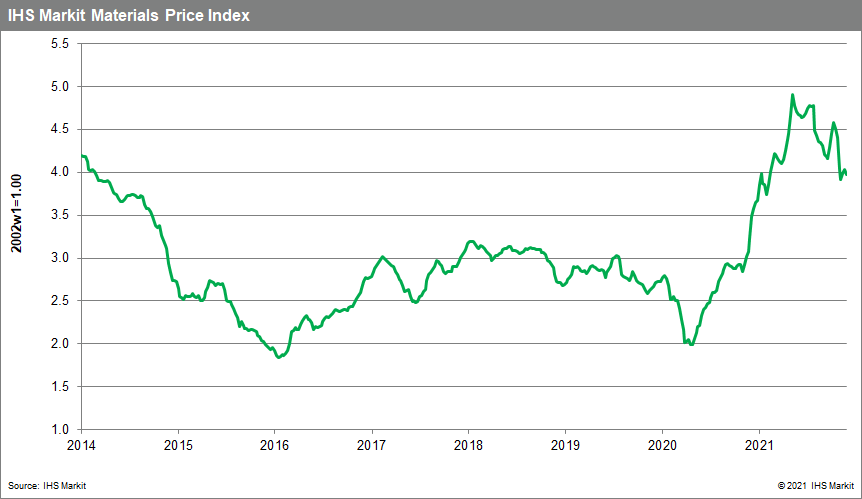

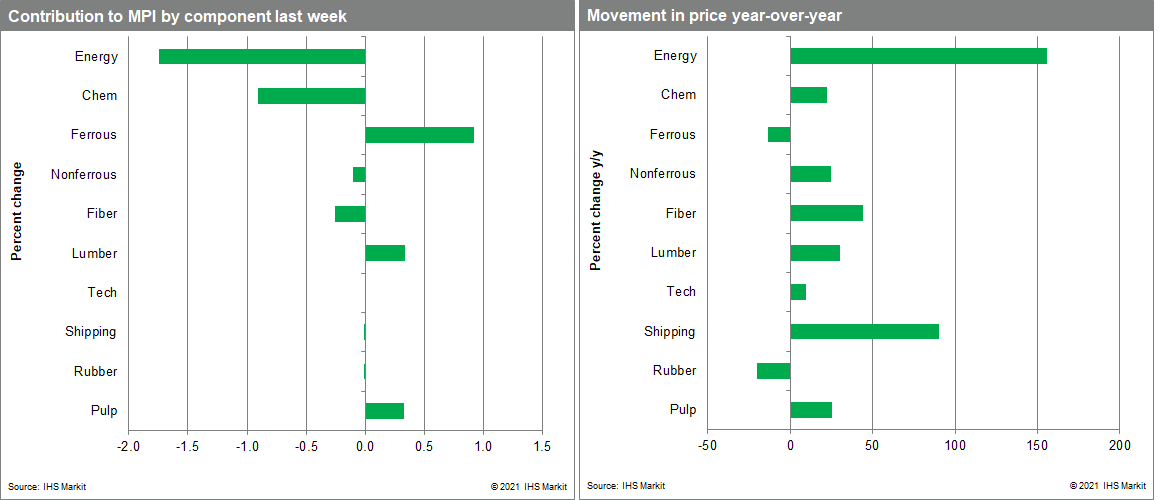

Our Materials Price Index (MPI) declined 1.4% last week, resuming its downward movement after two weeks of increases. Price declines were comparatively narrow with only six of the ten MPI sub-components dropping. While aggregate inflation measures continue to draw justifiable attention, commodity markets have been signaling a change upstream in supply chains as far back as May. The correction has been modest to date, but if it persists (which IHS Markit believes it will), this change points to cost pressures in goods markets ebbing as early as the first half of 2022.

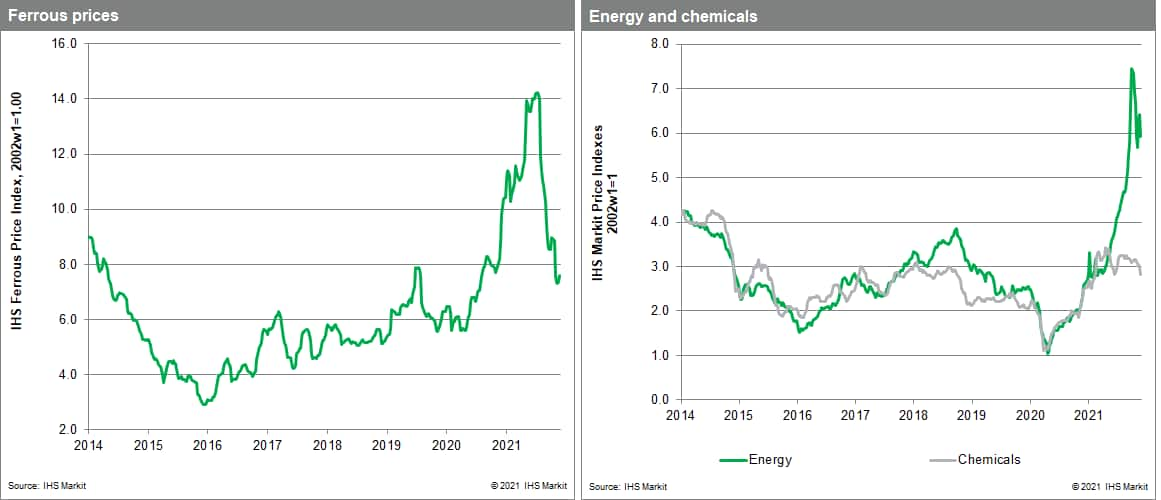

Energy and chemical price declines were the most notable last week. Our energy sub-index was down 7.5% with oil, natural gas, and coal prices all dropping. Crude oil prices plunged to $70/barrel, having been as high as $85 as recently as late October. Prices reacted negatively to the emergence of the Omicron variant of COVID-19 which has the potential to create widespread travel restrictions and severely reduce oil demand. The price correction was given further support by the OPEC+ decision to continue with plans to increase production by 400,000 barrels a day next year. Markets were expecting the group to react to the renewed COVID-19 threat by tightening supply. Confirmation that the cartel would increase production kept prices low. Oil is a major feedstock cost for the chemicals industry so lower prices contributed to a 4.7% drop in the chemical sub-index last week. As well as the feedstock cost decline, chemicals supply is much improved from the first half of the year. The lengthened supply/demand balance has ensured that chemical prices have dropped for five consecutive weeks. Lower oil prices will provide further downward pressure on chemicals in the near term.

Fears over the Omicron variant of COVID-19 and high inflation continued to dominate markets last week. Germany announced social restrictions on unvaccinated individuals and the US toughened its testing regime for visitors signaling a potential hit to global growth. At the same time, the US produced a broadly encouraging employment report which fueled speculation that monetary policy will soon tighten. Civilian employment surged by 1.1 million, outpacing a healthy (594,000) increase in the labor force, driving the unemployment rate down 0.4 percentage point to 4.2%. While this is likely to fuel wage inflation, the good news is that commodity prices look increasingly like they hit their high-water mark some six months ago. This change, combined with tightening US monetary policy and slower growth in mainland China, signal easing cost pressures in 2022. The question is now whether the Omicron variant will also impact the supply-side of markets and negate the downward pressure we see developing on prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-omicron-concerns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-omicron-concerns.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+on+Omicron+concerns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-omicron-concerns.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices dip on Omicron concerns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-omicron-concerns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+on+Omicron+concerns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-omicron-concerns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}