Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 28, 2021

Weekly Pricing Pulse: Commodity prices dip

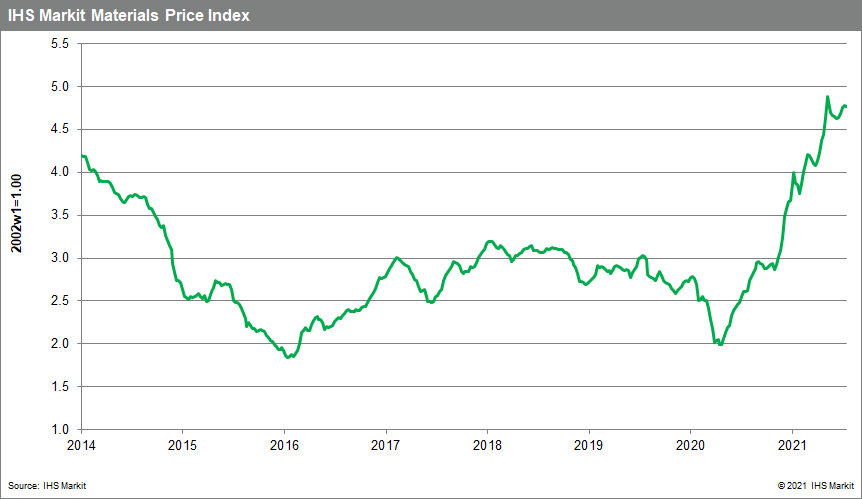

Our Materials Price Index (MPI) decreased 0.2% last week, breaking a string of four consecutive weekly increases. The declines were broad with seven of the ten MPI sub-components down last week. Commodity price inflation as measured by the MPI are 83.7% higher than the corresponding week in 2020. While this is a significant jump, it is much lower than May when annual price increases reached 130%.

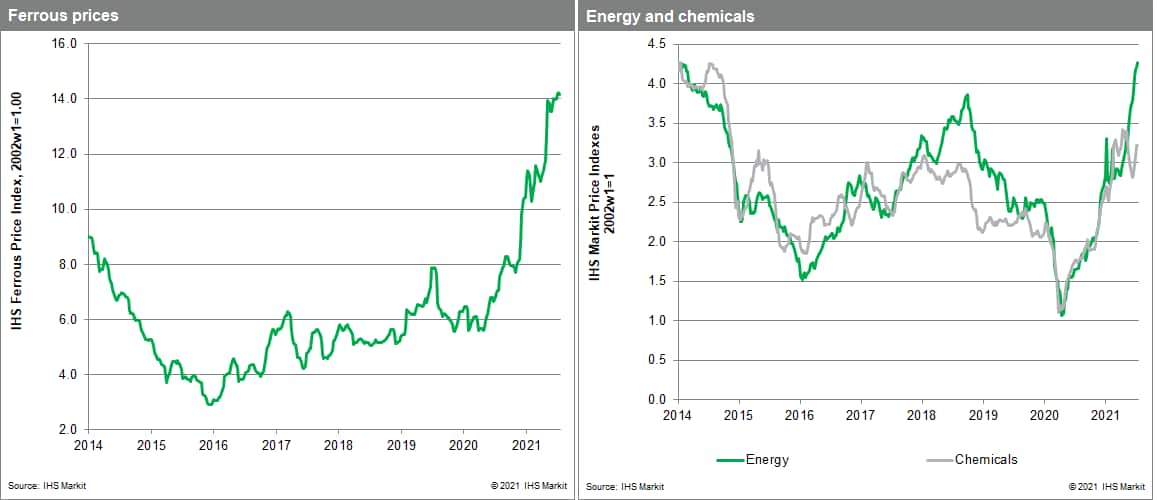

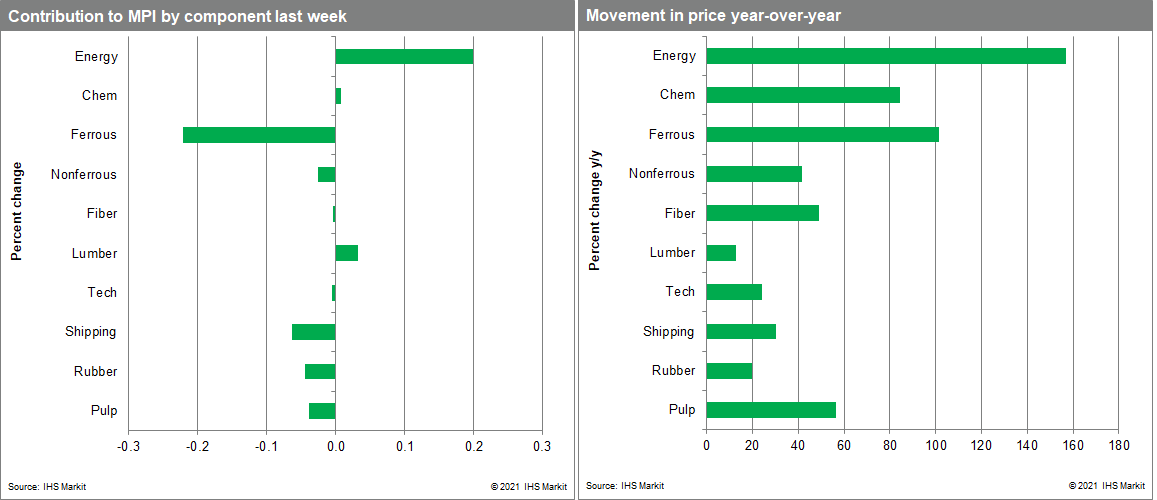

Industrial metal prices were the main contributor to the MPI's decline last week. Our steel-making raw materials index was down 0.5% as authorities in mainland China imposed production limits on domestic steel producers. The government is implementing its promise to reduce the country's carbon emissions and views lower steel production as an essential part of its strategy. It has asked mills to ensure production levels for 2021 do not exceed those recorded in 2020 and will punish any non-compliance. This intervention reduced demand for iron ore and sent prices lower. The nonferrous metals sub-index also fell last week, down 0.3%. This was mainly due to declining aluminum prices which fell for the third consecutive week. Prices have weakened since the first metals auction by the Chinese National Food and Strategic Reserves Administration. It auctioned 50,000 tonnes of aluminum on July 5-6, which has helped partially offset the market's emerging deficit. Elements of the MPI showed strength last week as energy prices increased once more. Despite falling oil prices, the overall energy sub-index rose 1.5%. Intense summer heat in the northern hemisphere has pushed up demand for electricity to run air conditioning units. This increased global natural gas prices by 7.2% last week.

It was a volatile week for markets as initial fears over the impact of the fast-spreading Delta variant of coronavirus were eased by expectations that policymakers will intervene if demand slows. The potential threat to demand growth reduced focus on consumer price inflation but the overall decline in the MPI since May, albeit modest, hints that the year-long rally in commodity prices has run its course. If this change is affirmed in the weeks ahead, downstream goods price inflation will also begin to ease, perhaps as early as this fall. This still leaves the problem of service cost inflation. Service sectors are now experiencing the same kinds of problems manufacturing encountered last year, which means top-line inflation pressures may persist until year-end or even early 2022.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices dip | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}