Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2021

Weekly Pricing Pulse: Commodity prices fall once more

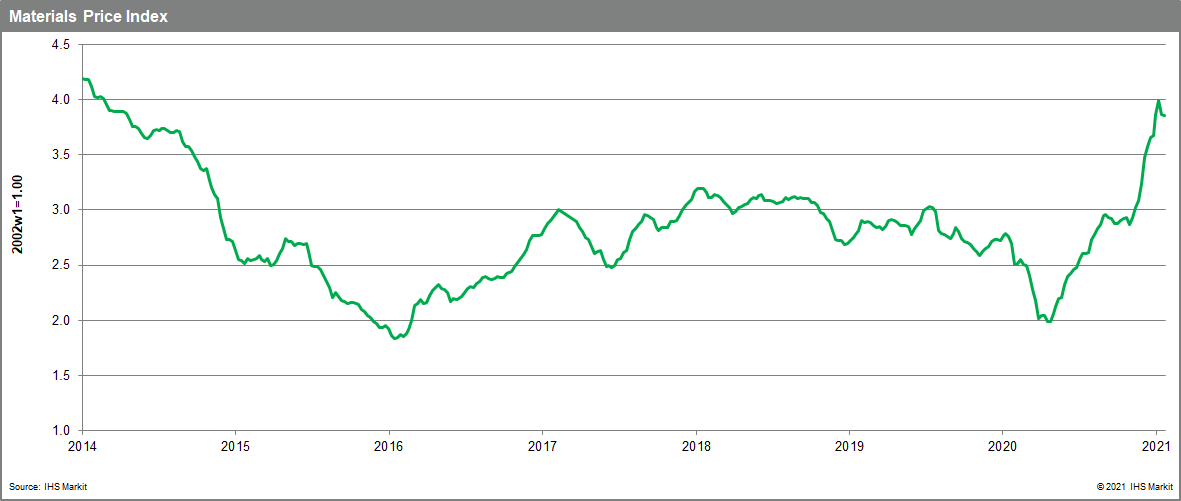

Our Materials Price Index (MPI) fell 0.2% last week, the second consecutive weekly drop since early November. Despite the successive declines the MPI remains at its highest point since April 2014 and still stands 44% higher than in early 2020.

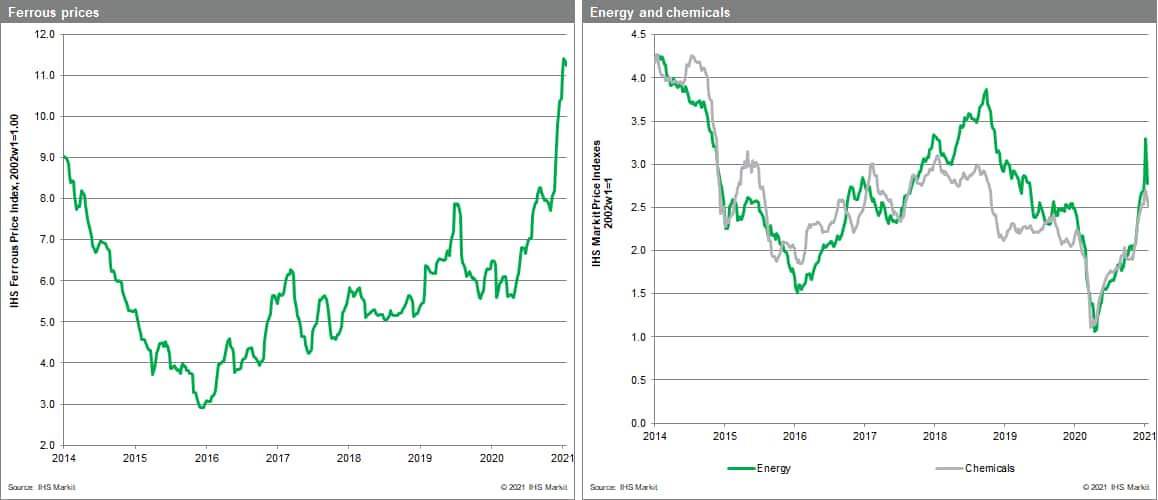

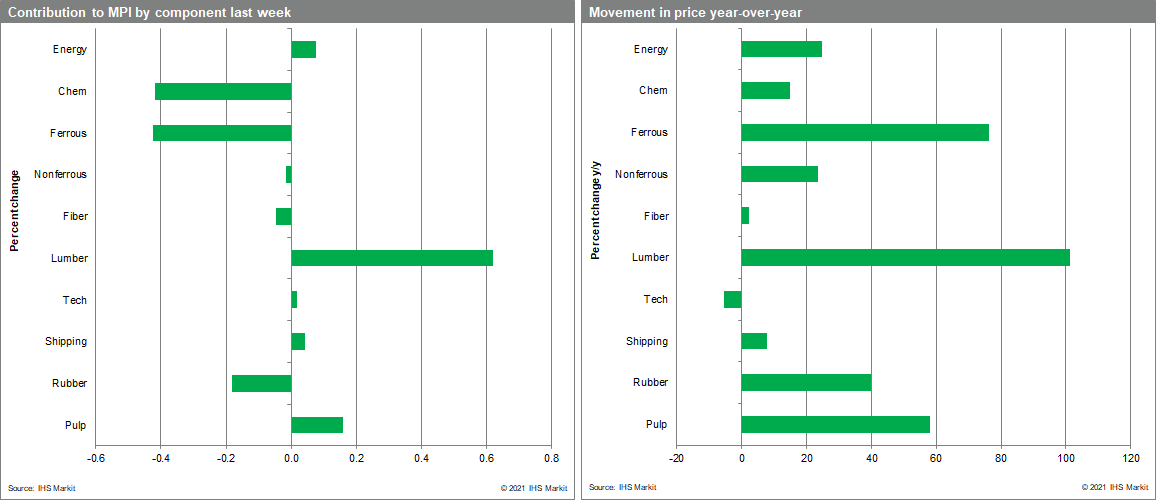

Half of the ten sub-components declined last week as downward moves in metals and chemicals were offset by steep rises in lumber and microchips. The declines in metal markets were broad-based with zinc the most notable, falling 2.4%. Zinc is in oversupply across the globe with inventories at a three-year high and, unlike other metals, Chinese demand has cooled. Copper prices were also down 1% reacting to weaker macroeconomic signals in markets. The chemical index declined 2.5% as the price of global ethylene fell. Several new production lines are now in operation in China and longstanding outages in South Korea resolved to lengthen the supply/demand balance. It was a different story in lumber markets with our sub-index increasing 18.8%, the second highest weekly increase ever recorded. Lumber futures contracts reached a record $855.10/mmbf as residential building in the United States accelerated. January is traditionally a quiet period for the construction industry but low interest rates and a desire for single family homes because of the pandemic has boosted homebuilding rates. The MPI's DRAM price rose 4.9% for the week. Prices are reflecting spot shortages of semiconductors that are disrupting production in several industries, most prominently the auto industry where temporary line closures have been announced in North America and Europe.

It was a volatile five days in markets with the so called "Reddit traders" giving Wall Street its worst week since October. European markets reacted negatively to US volatility and were further shaken by vaccine shortages across EU countries. The tumult in markets sent investors back to the safety of US treasuries, which strengthened the US Dollar. Commodity markets were not immune and have paused over the past two weeks to take in events. Some stability in the US dollar, less positive sentiment, and quiet trading in Asia ahead of the Lunar New Year holiday on 12th February have seen commodity markets pull back. Whether markets see a true correction in the weeks ahead will depend on the supply-side of markets and specifically on clear signs that vendor performance is improving, something that is not yet apparent in the data for backlogs or delivery times.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-fall-once-more.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-fall-once-more.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+fall+once+more+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-fall-once-more.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices fall once more | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-fall-once-more.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+fall+once+more+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-fall-once-more.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}