Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2019

Weekly Pricing Pulse: Commodity prices jump in a narrow rally

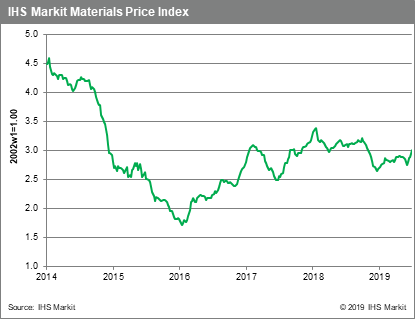

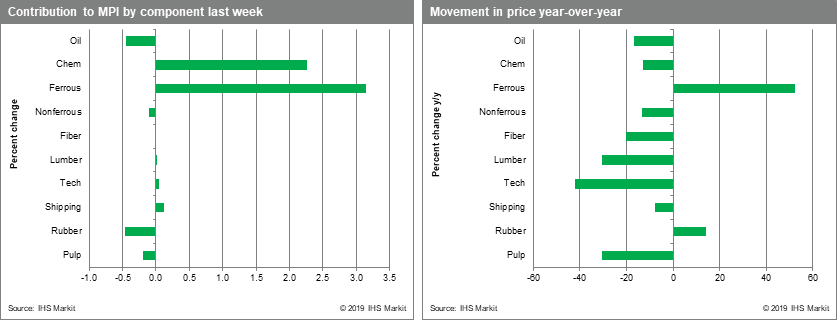

Commodity Prices as measured by the Materials Price Index (MPI) jumped a 4.4% last week, their largest weekly increase since March 2016. While sizeable, the increase was defined largely by increases in just two commodities - ethylene and iron ore. Indeed, five of the MPI's ten subcomponents fell last week, with the entire complex losing momentum at week's end on the good US employment report and as positive sentiment from the G-20 summit dissipated.

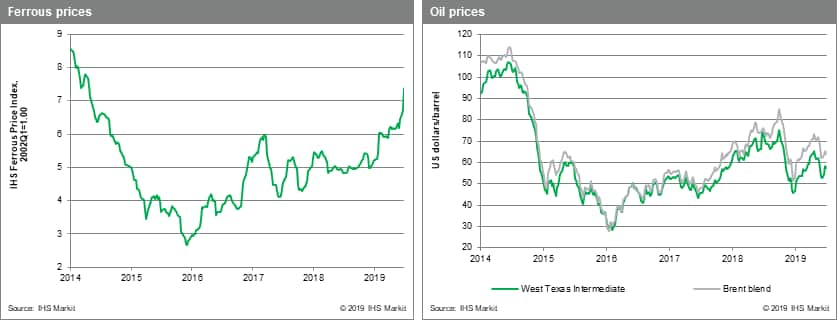

The MPI's chemical index led gains with a massive 12.4% increase. US ethylene prices dominated moves, rising 46%. US ethylene prices hit a 20-year low at the end of May and so some price increase had been anticipated. Still, the market has tightened unexpectedly as new capacity start-ups have struggled to ramp up production while some planned outages have taken longer than expected to return to production. This said, at 19 cents/lb., US ethylene prices remain below their 2018 peak of 22 cents/lb. and around their two-year average price of 19.8 cents. The MPI's ferrous price index also recorded a large increase for the week, shooting up 9.4%. Iron ore prices hit $125 /t (up 89% y/y) as traders continued to worry about ore supply in the face of strong steel production in China.

Despite the MPI's large increase, the mood in commodity markets remains cautious, as highlighted by the fall in oil prices last week. Crude closed down for the week even with the Opec+ agreement to maintain production quotas for another six to nine months because of continuing worries over demand. Looking forward, June's strong US employment report seems to have ended hopes of multiple US interest rate cuts this year. China's manufacturing sector also continues to look fragile, with export orders soft. Together these two factors make last week's jump in the MPI look more like a one-off event and not the start of a real change in commodity markets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-jump-in-a-narrow-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-jump-in-a-narrow-rally.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+jump+in+a+narrow+rally+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-jump-in-a-narrow-rally.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices jump in a narrow rally | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-jump-in-a-narrow-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+jump+in+a+narrow+rally+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-jump-in-a-narrow-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}