Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 28, 2020

Weekly Pricing Pulse: Commodity prices reflect optimism as US stimulus talks continue

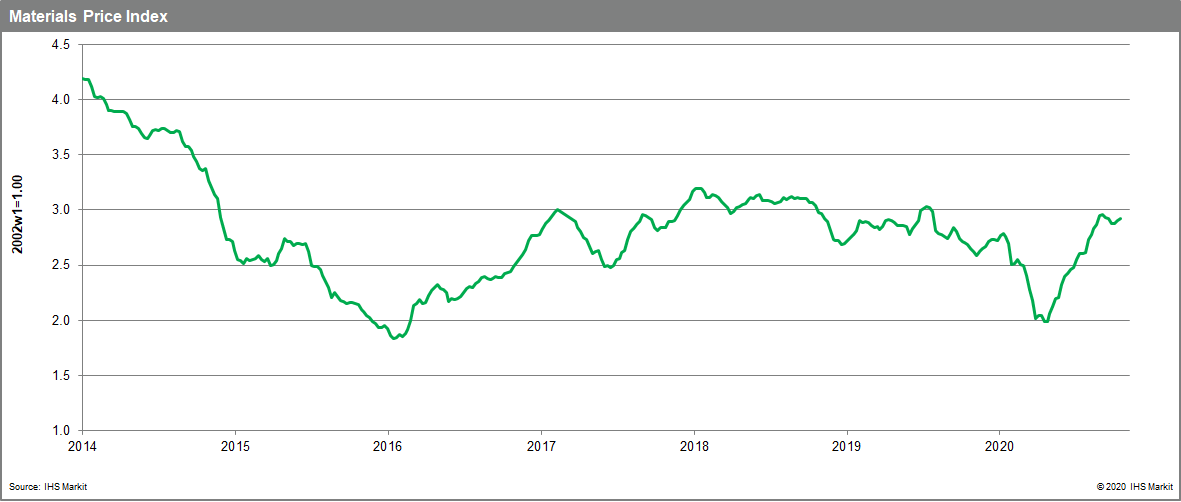

Commodity prices, as measured by our Materials Price Index (MPI), ticked 0.9% higher last week despite the to-and-fro nature of talks in the US senate around a potential stimulus package. Nevertheless, significant hurdles remain and with the US Presidential election looming, uncertainty promises to create volatility in markets later this month.

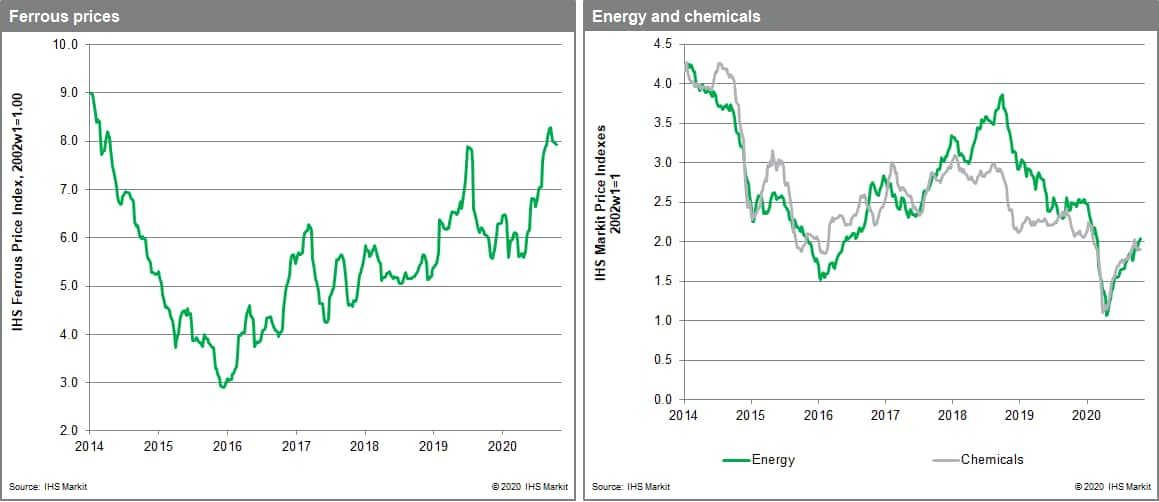

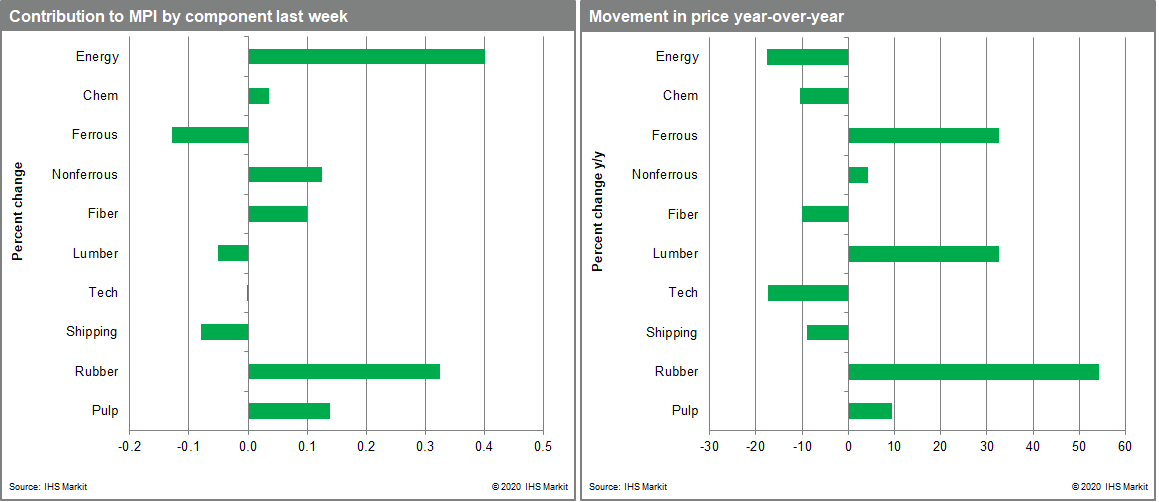

Energy markets enjoyed a good week, with the sub-index in the MPI rising 3.6%. Natural gas index recorded its highest level since February 2019 as weather forecasts portend a colder than usual northern hemisphere winter. Global gas prices are now up 194% since July on improving demand and the slashing of operating capacity. Coal prices have suffered recently because of mainland China's 'ban' on imported Australian coal. However, traders, sensing the 'ban' may eventually be more bark than bite jumped into the market, lifting prices 3.6% last week. Natural rubber prices have been surging in recent weeks and rose a further 8.2%, amid concerns about supply disruption from Thailand due to intensifying political unrest. A steady increase in demand from mainland China has also contributed to rubber's recent strength. Non-ferrous metals rose another 1.4%, to the highest level for the sub-index since March 2019, as the stronger yuan and optimism around EV metals during the industry's LME Week encouraged buying. Copper was a particular beneficiary of improved sentiment, with prices surpassing $7,000 /Mt on an intraday basis for the first time since June 2018. Fiber prices, one of the major laggards of the MPI since the March crash, has jumped 6.1% higher since September. Last week fiber prices rose another 1.9% after improved textile demand in China since September caused polyester staple and filament inventory to plunge. Steel raw materials fell 0.3% on a jump in iron ore port stocks in China, which corelated with the 1.9% fall in bulk freight prices as more Capesize vessels to Brazil become available after a recent pinch.

The closing months of 2020 point to potential volatility for commodities. The US Presidential election and rapidly rising COVID-19 case counts pose immediate questions for markets. Lying ahead in December is also the prospect of a no-deal Brexit. And next year will now bring a constitutional convention in Chile at a time when that country's copper production has been struggling. A potential upside for markets is the targets of China's 14th five-year plan, which will be reviewed during the Fifth Plenum of the Chinese Communist Party this week. An expressed intention for further reforms, more open capital markets and investment plans around developing a low carbon economy could provide an offset to bad news elsewhere.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-reflect-optimism.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-reflect-optimism.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+reflect+optimism+as+US+stimulus+talks+continue+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-reflect-optimism.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices reflect optimism as US stimulus talks continue | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-reflect-optimism.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+reflect+optimism+as+US+stimulus+talks+continue+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-reflect-optimism.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}