Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 26, 2023

Weekly Pricing Pulse: Commodity prices rise on chemical market strength

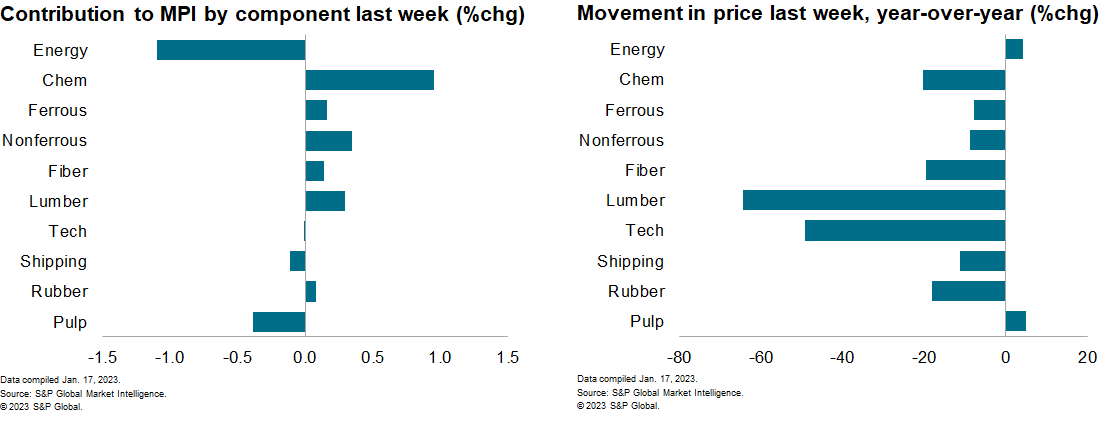

Our Material Price Index (MPI) increased 0.4% last week. The increase was mixed with six out of the ten subcomponents rising. The MPI sits 10% lower year on year (y/y). Prices, however, remain far higher (50%) than the pre-pandemic levels of the fourth quarter 2019.

Chemical prices were the primary driver of last week's gain in commodity prices. Ethylene, benzene and propylene prices all reported significant gains, lifting chemicals prices 6.1%. Benzene was the strongest component, rising 8% due to higher crude oil prices and tight supply conditions in the United States. Ethylene and propylene rose 4.5% and 6% respectively. Lumber also had a strong week, reporting a 17.5% price increase. Weak lumber supply and stronger-than-expected increase in US housing starts contributed to the jump in lumber prices. However, with lumber prices at only $430, this still represents a 66% y/y price decline last week. Energy prices balanced much of the increases from chemicals and lumber. Natural gas and coal prices both declined over 6% as Europe's energy fears are becoming less acute.

Markets reacted to mixed signals last week as softer inflation and slower production in the US coincided with a more optimistic picture of the Chinese economy. The US Producer Price Index (PPI) for final demand fell 0.5% in December, largely due to energy price declines, easing the 12-month-change to 6.2% from 7.3% in November. US industrial production fell 0.7% in December, reflecting decreases in manufacturing (1.3%) and mining (0.9%.) Markets were more optimistic on China; COVID-19 outbreaks appear to have peaked in most major cities, leading to faster recovering mobility and economic activity than expected which ultimately boosts market sentiment. While these latest developments lift some of the gloom for the year ahead there are still plenty of headwinds facing commodity markets in the near term. Shifting market sentiment will cause sporadic commodity price surges, but generally weaker economic growth will lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-chemical-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-chemical-market.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+on+chemical+market+strength+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-chemical-market.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rise on chemical market strength | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-chemical-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+on+chemical+market+strength+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-chemical-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}