Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 20, 2018

Weekly Pricing Pulse: Commodity prices sag as Chinese data disappoints and Florence hits demand

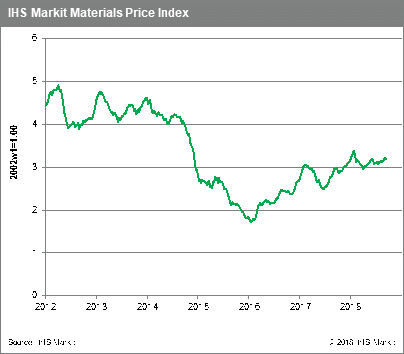

Disappointing mid-month Chinese data releases, further rumblings in the broadening trade war between the US and China and Hurricane Florence all acted to disrupt commodity markets last week, with our Materials Price Index (MPI) retreating 0.6%.

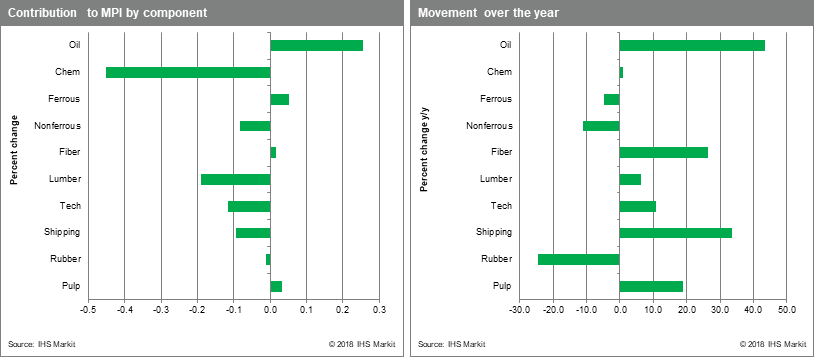

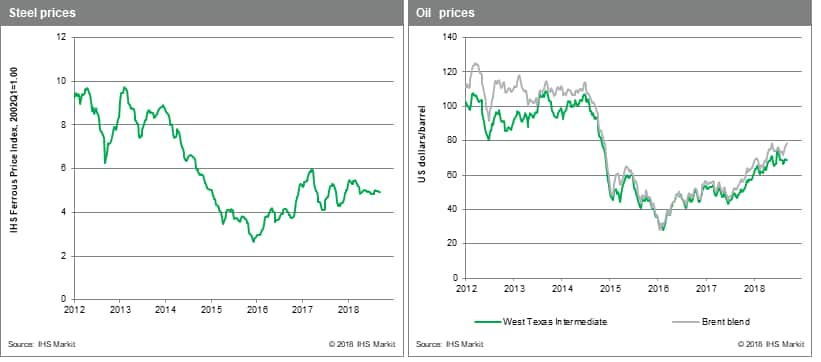

Six of the MPI's ten components recorded declines in a very lacklustre week. Oil was an outlier rising 1.4% due to supply disruptions and panic buying that typically precedes a large storm. Chemicals broke step with oil, dropping 1.8% as industrial demand was hit by trade concerns. Nonferrous metals also struggled, falling 1.4%, as weak China data hit markets. Aluminium prices were soft as sanctions on UC Rusal were eased. Large declines were recorded in lumber and freight, which fell -7.5% and -2.2% respectively. Despite recent falls, lumber is still touted to be overpriced with further Q4 declines expected.

Mid-month Chinese economic data hit base metals in particular, this past week and helped to confirm the China slow-down narrative. Fixed asset investment (FAI) year to date shows growth of just 5.3%y/y, its slowest rate of growth since 1999. Infrastructure investment rose just 4.2% y/y, the weakest since the data series began in 2014. Chinese housing price inflation, in contrast, has accelerated in recent months as officials ease credit restrictions in order to support growth. The bottom-line, however, is that Chinese growth is now visibly slowing and represents a significant headwind for commodity markets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-sag-as-chinese-data-disa.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-sag-as-chinese-data-disa.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+sag+as+Chinese+data+disappoints+and+Florence+hits+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-sag-as-chinese-data-disa.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices sag as Chinese data disappoints and Florence hits demand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-sag-as-chinese-data-disa.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+sag+as+Chinese+data+disappoints+and+Florence+hits+demand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-sag-as-chinese-data-disa.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}