Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 16, 2023

Weekly Pricing Pulse: Commodity prices slide amid weak mainland China demand

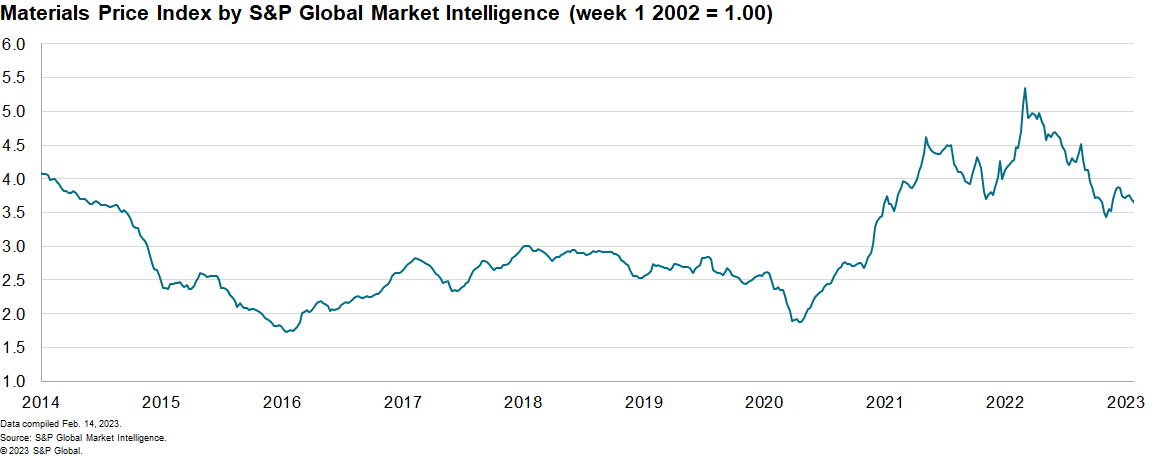

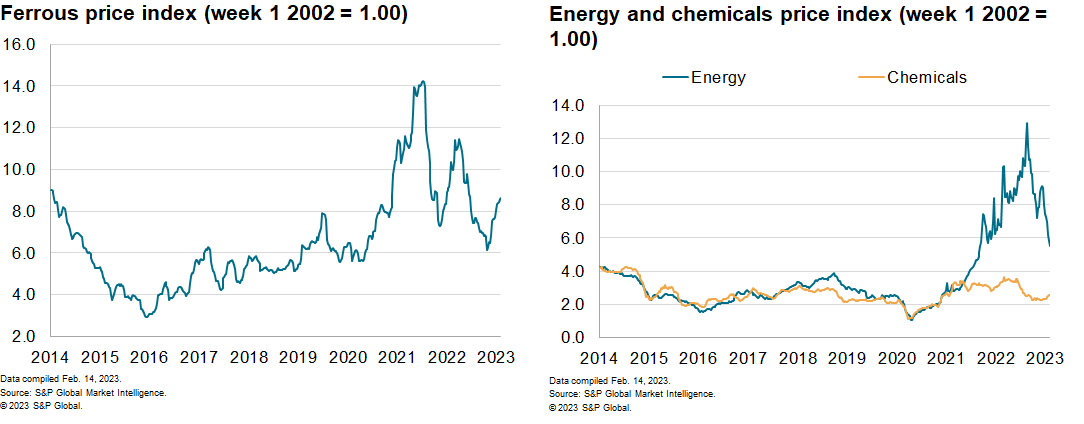

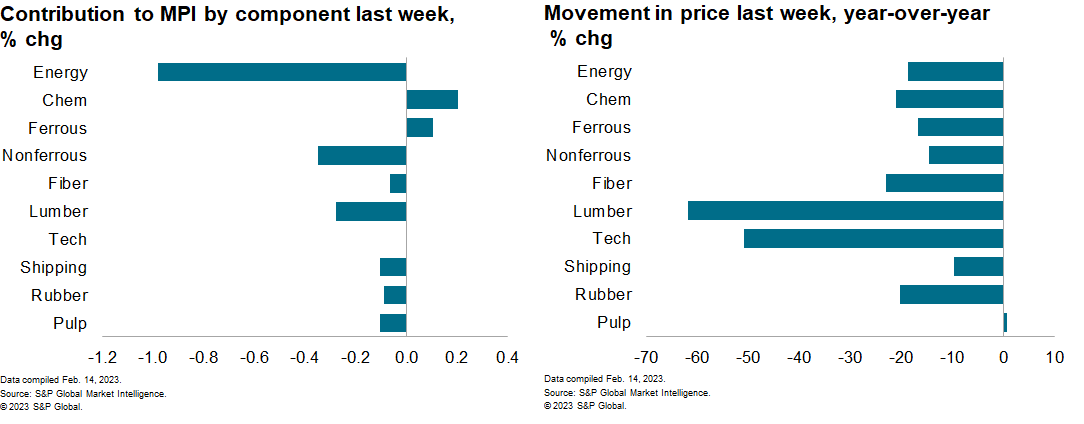

The Material Price Index (MPI) by S&P Global Market Intelligence fell 1.7% last week. The decrease was broad with seven of the ten subcomponents down. The MPI sits 19% lower year on year (y/y). Prices, however, remain far higher (43%) than the pre-pandemic levels of the fourth quarter 2019.

Falling industrial metal prices were the major driver of last week's decline in the MPI. The nonferrous metal sub-index posted a 3.7% decrease, the largest weekly decline for six months. Every metal in the sub-index from aluminum to zinc registered a decrease. Zinc prices experienced a marked drop to $3,118/tonne, down from a high of $3,449/tonne the previous week. Nickel prices on average decreased 7.2% which was the largest seven-day decline since September 2022. Industrial metal prices were reacting to a stronger dollar and concerns about the strength of mainland Chinese demand as Shanghai metal inventories of copper, aluminum and zinc rise. Zinc inventory on the Shanghai Metals Exchange more than doubled since the start of January, according to data released last week. Similar increases occurred for stocks of aluminum and copper. The fall in nonferrous prices was also accompanied by a stronger dollar. Exchange traded metals are priced in Dollars so this is making it more expensive for buyers using other currencies and will weigh on demand.

Markets continue to grapple with mixed signals on global economic growth with traders taking a broadly bearish view last week. Data released did little to clarify future growth trajectory so markets focused on recent central bank interest rate hikes and bet that upcoming inflation figures would come in stronger than consensus. Clarity could arrive this week with inflation updates from both the US and UK. The US also releases official retail sales and industrial production data for January which, following prior soft numbers and weak PMI indications, will be closely watched. In the US, S&P Global Market Intelligence expect two more quarter-point rate hikes to bring the policy rate to a peak of 5.00-5.25% in May. In addition, mainland Chinese growth signals remain weak compared to pre-pandemic levels and this will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-amid-weak-mainland.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-amid-weak-mainland.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+slide+amid+weak+mainland+China+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-amid-weak-mainland.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices slide amid weak mainland China demand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-amid-weak-mainland.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+slide+amid+weak+mainland+China+demand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-amid-weak-mainland.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}