Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 16, 2019

Weekly Pricing Pulse: Commodity prices slide in mixed week

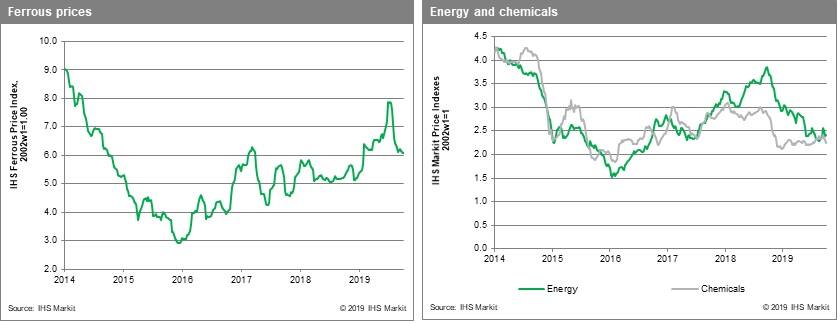

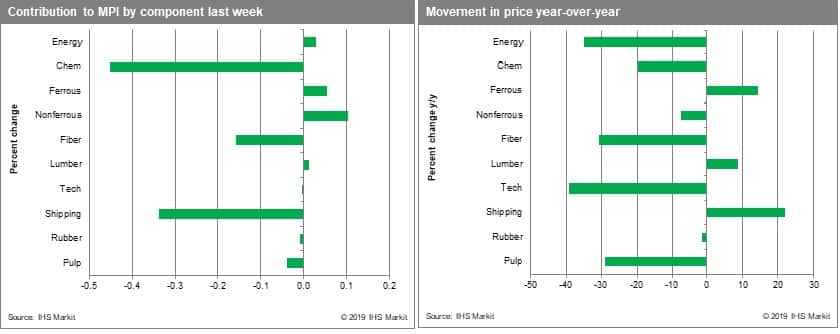

Our Materials Price Index (MPI) fell 0.8% last week, its third consecutive drop despite pronouncements last Friday that trade negotiations between the US and China might yield a “phase one” deal. Six of the MPI’s ten sub-components fell for the week, however, highlighting that whatever optimism might be attached to US-China trade talks, the hard reality of soft demand growth is still weighing on prices.

Chemicals drove the MPI lower last week, falling 2.4% largely because of a 12.8% plunge in US ethylene prices. US ethylene feedstock costs are soft and when coupled with returning capacity from early summer disruptions, prices were pulled lower. Chemical prices were also behind the 2.9% drop in fiber prices. Polyester prices fell 4.8% for the week, more than offsetting a 1.2% increase in cotton prices. Freight prices have shown significant volatility recently, but the 6.1% correction last week continues the dry bulk freight price correction from September's high. Pushing against the broad trend in commodity prices last week, the energy sub-index in the MPI rose 0.2%, largely because of coal prices, which increased 1.9%. Natural gas prices fell 1.9%, while oil prices slipped 0.2%. Even though oil prices fell for the week, the market was rattled on Friday by news that an Iranian tanker had been attacked in the Persian Gulf, a reminder that political tension in the region remains high.

The reaction late last week to the news of a possible US-China trade deal highlights a persistent optimism in markets that some sort of settlement will be reached. Still, the uncertainty facing markets on a number of fronts - Brexit, escalating US-EU trade tension, the broad US-China trade war, conflict in the Middle East - continues to undermine physical demand. It is this overlying softness in physical use that has governed commodity markets since the start of the year and continues to shape a benign view of pricing for 2020.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-mixed-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-mixed-week.html&text=Weekly+Pricing+Pulse+Commodity+prices+slide+in+mixed+week+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-mixed-week.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse Commodity prices slide in mixed week | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-mixed-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse+Commodity+prices+slide+in+mixed+week+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slide-mixed-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}