Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 04, 2020

Weekly Pricing Pulse: Commodity prices tumble again as markets undergo worst week since 2008

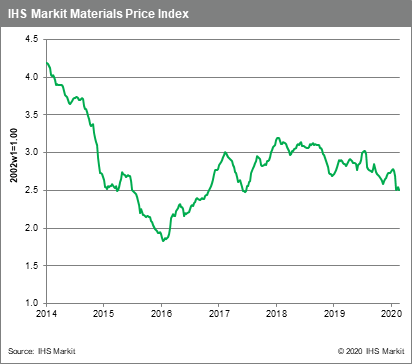

The global spread of COVID-19 spread panic across markets causing an 11% week-on-week drop in the S&P 500, the worst week in equities since 2008. This sentiment spilled over into commodities prices, which fell 1.8% as measured by our Material Price Index (MPI).

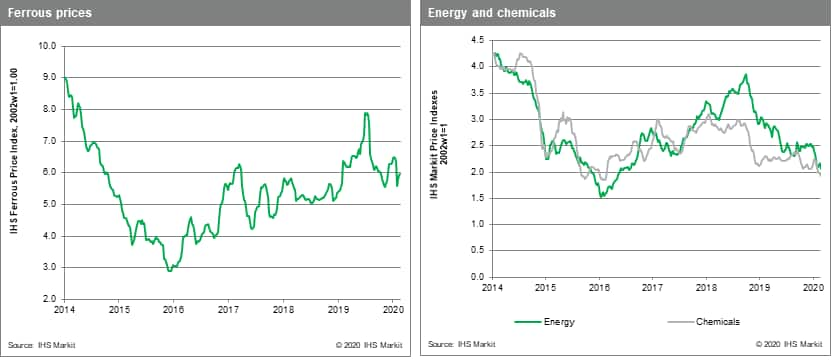

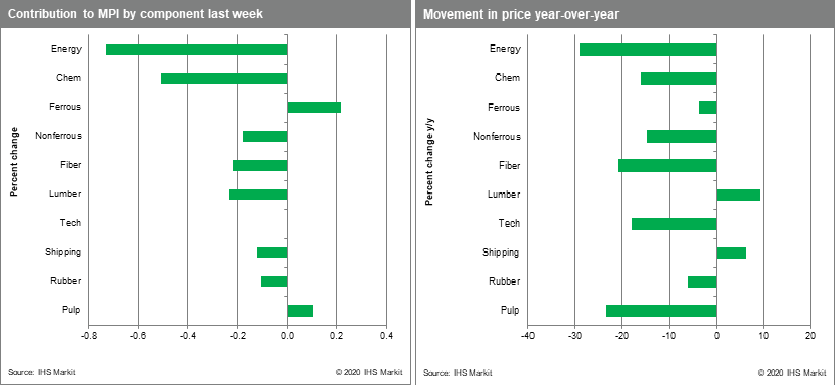

Energy prices led the MPI down for the week, with the energy sub-index falling 5.3%. Oil fell 8.0%, with Brent crude retreating to $53.2 /bbl, its lowest level since April 2019. The drop has prompted the Vienna Alliance of oil producers to call a special meeting this week to discuss cutting production even further. Gas prices fell 4.7%, with large falls in the US and Europe. Asian gas prices, however, jumped 13.0%, their first weekly rise in nine weeks as bargain hunters bought cargoes at record low prices. Lumber prices declined 7.4% from an 18-month high as virus concerns hit expectations for both spring US home sales and building. Freight rates also fell 3.4% continuing a 10-week rout that has seen falling freight volumes outstrip attempts by shippers to reduce capacity. This said, the decline in freight rates may be coming to an end - bulk freight volumes from Australia and Brazil have been moving higher. The MPI's chemical index fell 2.7%, though interestingly Asian ethylene and polypropylene showed some strength, posting gains of 1.4% and 4.0% respectively. Like the rise in Asian natural gas prices, these increases appear to have been tied to opportunistic purchases of cheap cargoes. Non-ferrous prices, already hit hard by a large early sell-off, fell 1.9%, with all six big industrial metals declining. In a sign of supply chain disruptions in China, base metal inventory on the Shanghai Futures Exchange has more than doubled since December, with the China Nonferrous Metal Industry Association calling on the government to stockpile metal to offset the lack of consumption.

The only good news from markets last week was the late Friday rally, which saw US equities cut some of the day's losses in late trading while other safe haven plays such as gold pulled back slightly. Whether these were signs market capitulation with a bottom beginning to form, or simply a pause on an even deeper correction - the proverbial dead cat bounce - remains to be seen. However, we believe the disruptions to production and weakness in consumption is likely to be concentrated in the first and second quarter, which would seem to be what commodity markets have now priced in. A further decline in prices toward the levels seen in late 2015 would be a sign that markets are beginning to perceive an even deeper and more prolonged slowdown in global growth.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tumble-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tumble-again.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+tumble+again+as+markets+undergo+worst+week+since+2008+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tumble-again.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices tumble again as markets undergo worst week since 2008 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tumble-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+tumble+again+as+markets+undergo+worst+week+since+2008+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tumble-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}