Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2019

Weekly Pricing Pulse: Commodity prices welcome a trade war de-escalation

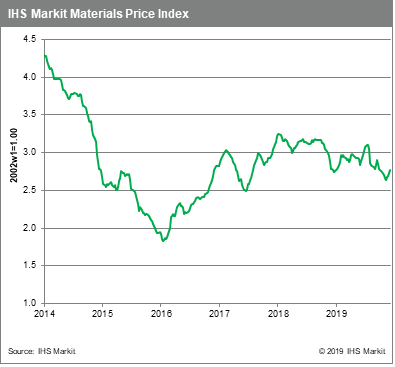

Commodity prices, as measured by our Materials Price Index (MPI), rose 1.6% last week, in response to several pieces of positive news on trade. Most important was a "phase-one" agreement reached between the US and China that promises to at least partially roll-back tariffs. But other good news included agreement on the new US-Mexico-Canada trade pact and clarity on Brexit following Prime Minister Johnson's election victory - even though a quick UK exit from the European Union is now certain.

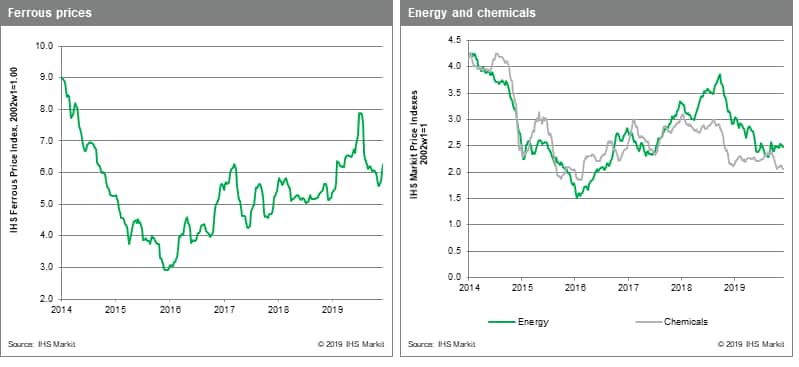

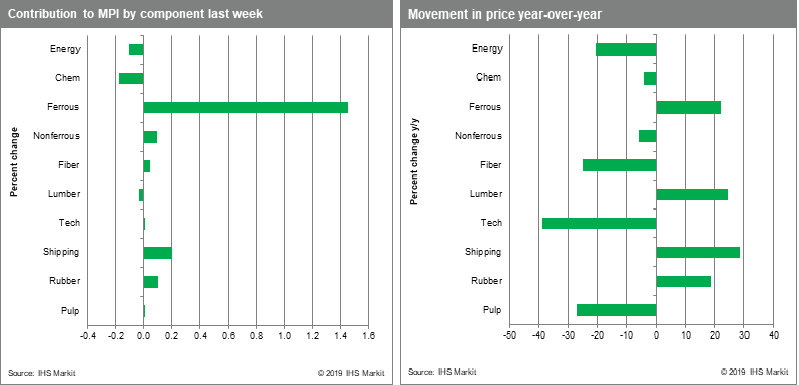

Ferrous metal prices were once again a large contributor to the MPI's increase, rising 4.0%, with iron ore prices breaking back above $90 per ton for the first time in seven weeks. Ocean going charter rates also saw a relative large weekly gain, increasing 4.4%. Reduced capsize capacity and increased demand for iron ore has helped lift charter rates nearly 10% since they stabilized in late November. Rubber continued its recent rally climbing another 3.3% on falling inventory as buyers scramble to acquire stock in the face of a fungal disease that threatens to damage rubber trees in South Asia. Non-ferrous metals prices enjoyed the trade-deal optimism, rallying 1.2% driven by a large 4.0% jump in copper prices and the first rise in nickel prices in six weeks. Chemical and energy prices were again weak sub-categories in the MPI. The MPI's chemical index fell 1.0% on another double-digit drop in US ethylene prices, while the energy sub-index retreated 0.6% due to declines in US and European natural gas prices. Oil rose 2.6% because of announced OPEC and Russian production cuts, though crude price increases were not enough to offset the weakness in natural gas.

Since hitting a 2019 low in

mid-November, the MPI has risen by nearly five percent. While it is

difficult to say if November represented a definitive turning point

for commodities, the mood in markets has certainly improved.

Positive trade developments and data showing manufacturing activity

stabilizing are cause for at least guarded optimism about the

near-future. This good news is tempered, however, by our outlook

for 2020. The rebound forecasted in industrial production is not

particularly strong, while the US dollar will continue to show

strength, a combination that argues against a sustained rally in

commodity prices.

Since hitting a 2019 low in

mid-November, the MPI has risen by nearly five percent. While it is

difficult to say if November represented a definitive turning point

for commodities, the mood in markets has certainly improved.

Positive trade developments and data showing manufacturing activity

stabilizing are cause for at least guarded optimism about the

near-future. This good news is tempered, however, by our outlook

for 2020. The rebound forecasted in industrial production is not

particularly strong, while the US dollar will continue to show

strength, a combination that argues against a sustained rally in

commodity prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-welcome-a-trade-war-dees.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-welcome-a-trade-war-dees.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+welcome+a+trade+war+de-escalation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-welcome-a-trade-war-dees.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices welcome a trade war de-escalation | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-welcome-a-trade-war-dees.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+welcome+a+trade+war+de-escalation+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-welcome-a-trade-war-dees.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}