Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 20, 2021

Weekly Pricing Pulse: Energy prices fire up commodity prices

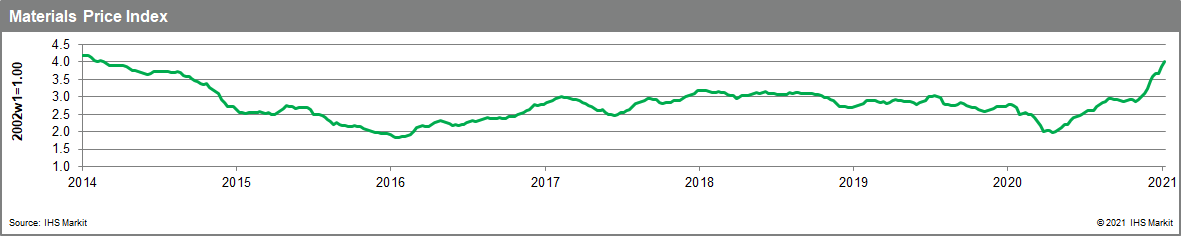

Our Materials Price Index (MPI) rose 3.5% last week, its tenth consecutive increase since early November. As has been the case since late December, commodity prices collectively recorded another significant gain, pushing the MPI to its highest level since February 2014. In the last ten weeks alone the MPI has risen by 39.8%.

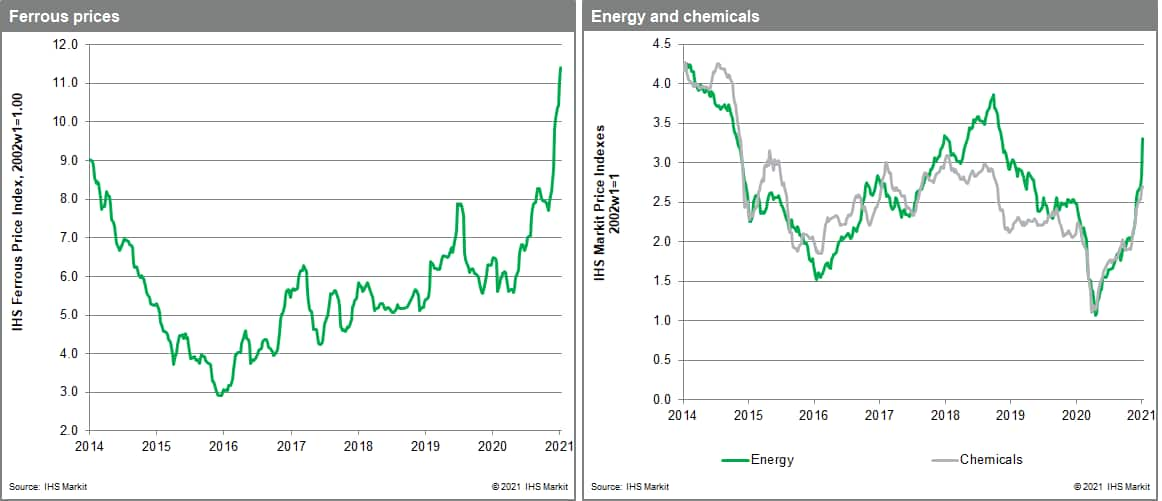

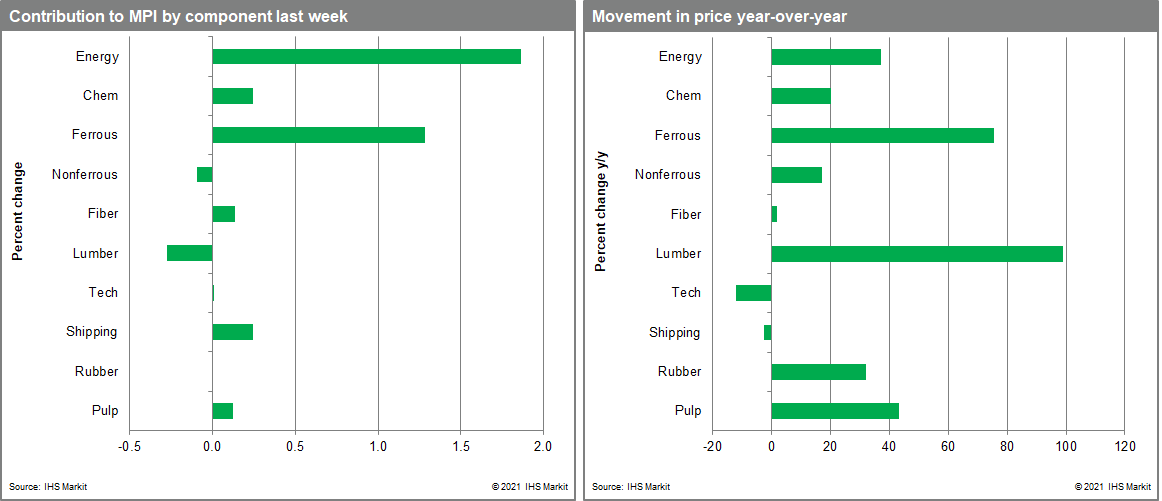

Eight of the MPI's ten sub-components posted increases last week with energy and shipping the biggest movers. The energy index soared 16.1%, the second highest weekly increase ever recorded as natural gas prices continued to surge. Harsh winter weather in China, Japan and South Korea is boosting demand for LNG, leading to gas supplies being rationing in several Asian countries. Transit delays through the Panama Canal are also delaying LNG cargoes bound for Northeast Asia, exacerbating tightness in the spot market. The surge in LNG prices increased demand for coal as buyers sought cheaper available alternatives. Our coal sub-index increased by 10.1% as a result. A global shortage of container space also pushed our shipping subcomponent up by 10.3% last week. Transpacific shipping rates are up to four times higher than they were in January 2020 adding to the general price inflation in commodities. Metals markets provided a slight check to an otherwise strong week in commodity markets, with a broad sell-off early last week sending the nonferrous metals sub-index down by 1.1%.

Market optimism softened last week with the report of weaker than expected December retail sales in the US and the announcement of additional city lockdowns in northern China. Still, COVID-19 vaccine rollouts have created a glass half full view of the near-future in commodity markets. The key for pricing will be how supply chains recover from a challenging winter. An answer may be apparent immediately after the Lunar New Year holidays when Asian markets return from their normal seasonal lull. Spring should also help calm energy markets. Still, the strength in commodity prices over the past six months foretells a rise in goods price inflation during the first half of 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-energy-prices-fire-up-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-energy-prices-fire-up-commodity-prices.html&text=Weekly+Pricing+Pulse%3a+Energy+prices+fire+up+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-energy-prices-fire-up-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Energy prices fire up commodity prices | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-energy-prices-fire-up-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Energy+prices+fire+up+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-energy-prices-fire-up-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}