Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 01, 2023

Weekly Pricing Pulse: Falling energy prices mark the start of a New Lunar Year for commodity markets

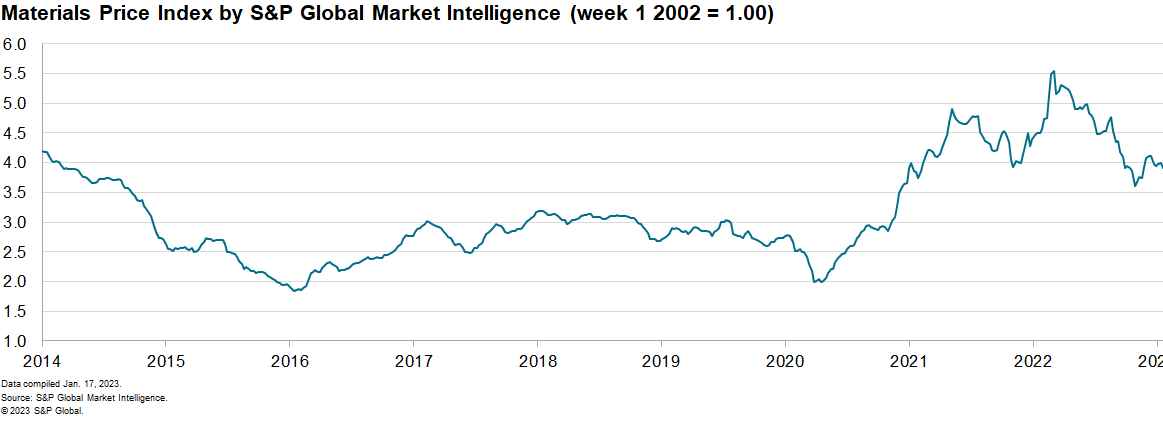

Our Material Price Index (MPI) fell 2% last week. Only three of the ten subcomponents fell, but most increases were marginal. The MPI sits 13% lower year on year (y/y). Prices, however, remain far higher (45%) than the pre-pandemic levels of the fourth quarter 2019.

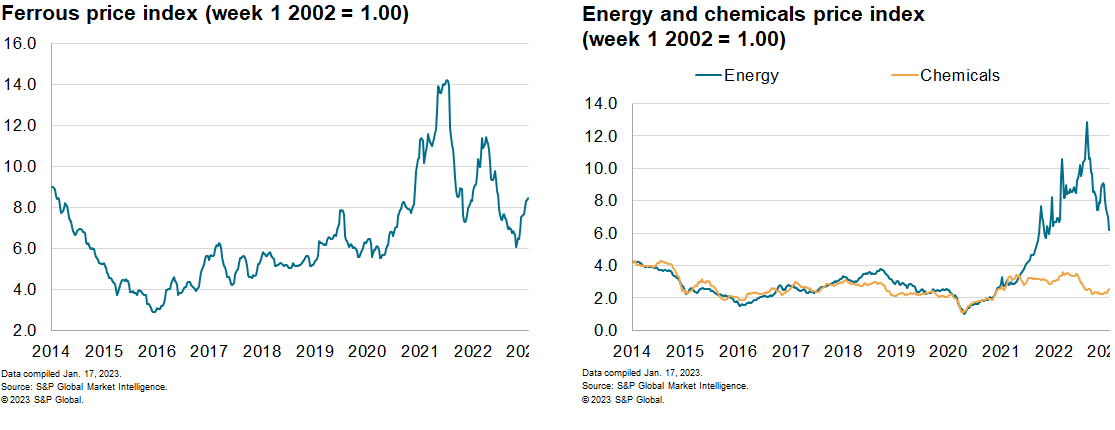

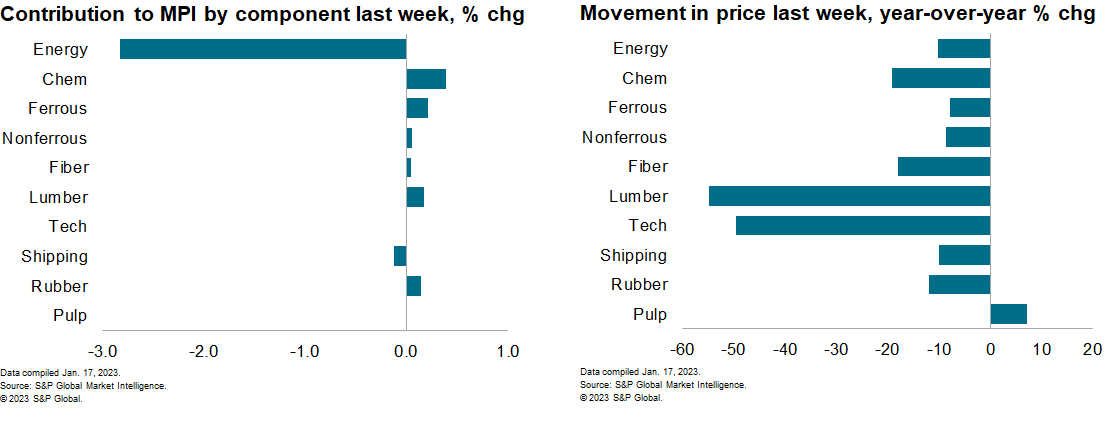

Energy prices continued their dramatic decline last week. Coal led the charge, falling 17% globally as energy demand continues to dwindle. Europe is seeing a warm winter, India's coal imports are near 12-month lows, and mainland Chinese demand is seasonally low as Lunar New Year is celebrated. Natural gas follows a similar trajectory, falling 9% globally. Oil rose a modest 1.5% as markets hold their breath ahead of the February 5th embargo on Russian refined products. Despite falling energy prices, non-energy commodities prices showed strength. Lumber prices rebounded further this week: prices rose a further 8% this week due to supply curtailments by producers seeking higher margins. Chemical prices increased 2.4%, with benzene rising 5% due to increased crude prices and strong styrene demand.

Markets reacted positively to US quarterly growth figures, but a closer look yields cracks. The US reported annualized quarter-on-quarter real GDP growth of 2.9% in the fourth quarter, beating expectations. This figure is, however, inflated by outsized increases to inventories, which account half the growth recorded. Declines in core capital goods shipments and orders as well as consumer spending declines further emphasize underlying weakness. Expect generalized pricing decline as US demand falls off. The outlook is less grim across the Pacific. The prospect of renewed growth out of mainland China is exciting markets. As the Lunar New Year ends and workers return to cities, market optimism follows. Already there has been strong price response, first from metals and now oil in anticipation of renewed growth - expect further strength if hopes of growth are realized. But growth will be no easy task. Industry has been hamstrung for the past few years and restarting is non-trivial. The semiconductor industry is facing increasing international pressure as the US and EU move to limit Chinese access to advanced chips. Expect inefficiencies to put upward price pressure on the sector. With an impending Russian refined products embargo, a coming US and European recession, and a promising China, 2023 is will see tumult and uncertainty. With a weak global economy, though, commodity prices are set to be lower overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-falling-energy-prices-mark-lunar-newyear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-falling-energy-prices-mark-lunar-newyear.html&text=Weekly+Pricing+Pulse%3a+Falling+energy+prices+mark+the+start+of+a+New+Lunar+Year+for+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-falling-energy-prices-mark-lunar-newyear.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Falling energy prices mark the start of a New Lunar Year for commodity markets | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-falling-energy-prices-mark-lunar-newyear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Falling+energy+prices+mark+the+start+of+a+New+Lunar+Year+for+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-falling-energy-prices-mark-lunar-newyear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}