Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 13, 2021

Weekly Pricing Pulse: Here we go again

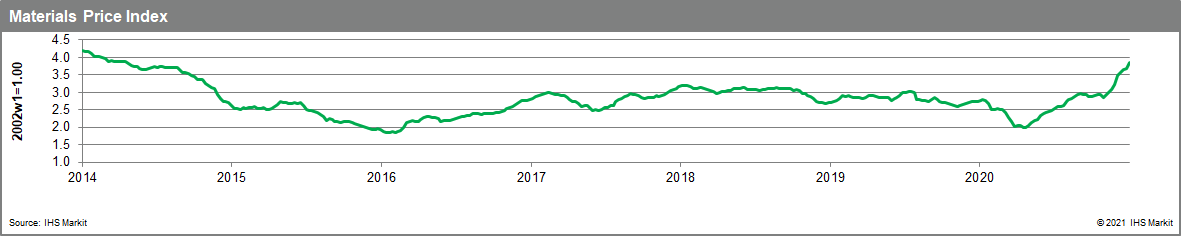

Our Materials Price Index (MPI) rose 5.3% last week, its ninth consecutive increase. This is the fourth largest rise on record and occurs less than a month after the highest ever increase in the series (7.9%), with the MPI now at its highest level since April 2014.

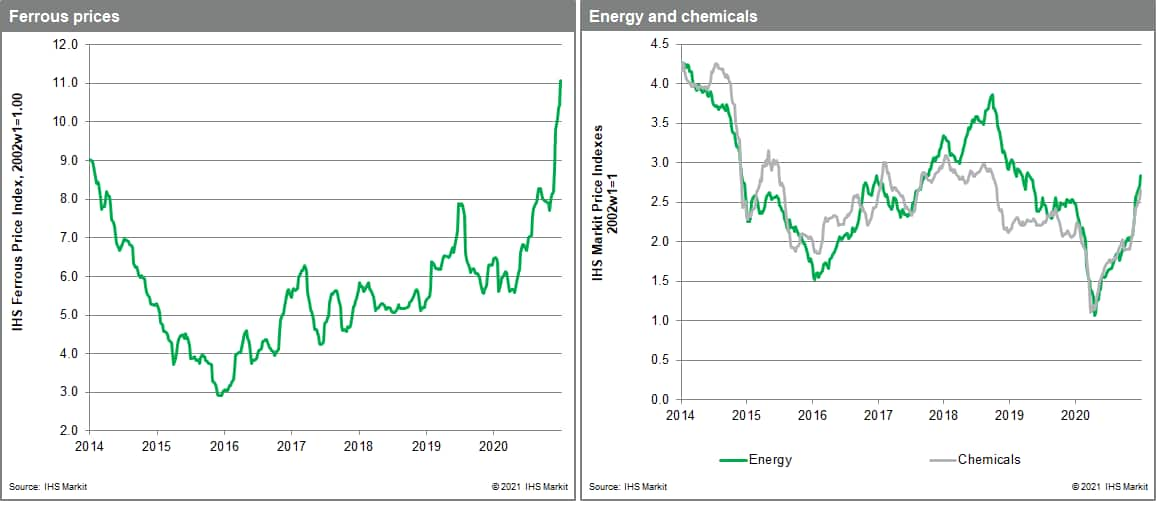

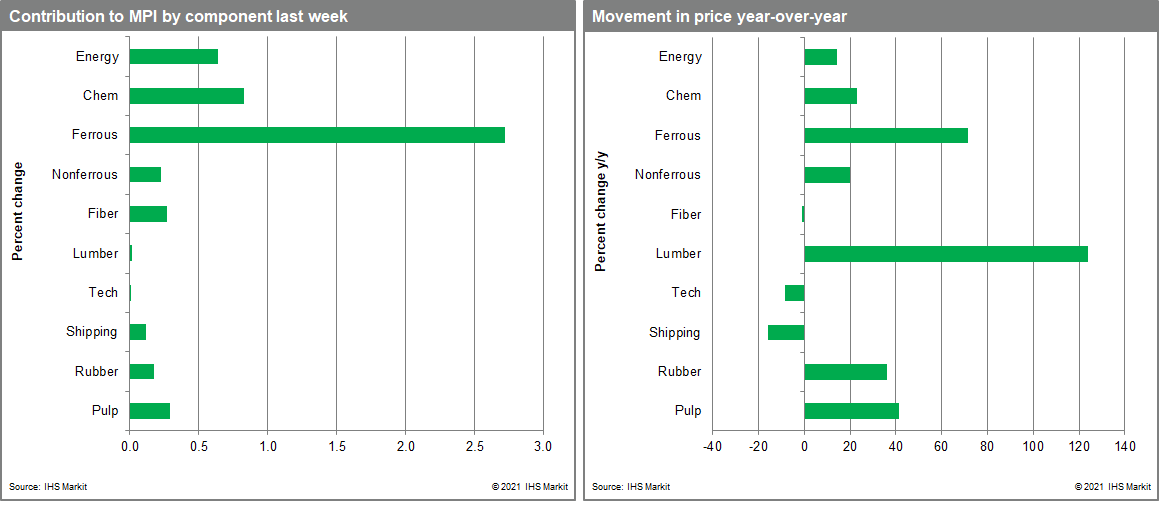

Every major sub-component of the MPI rose last week, with five of the ten posting increases of more than 5.0%. The energy index increased 5.5% as natural gas prices soared to the highest level ever recorded in the index. Asian spot prices reached $21.45/mmBtu having been as low as $1.82/mmBtu last spring. A perfect storm of the coldest Chinese winter since 1966, logistical issues in the Panama Canal and lower production levels at domestic plants caused this latest price surge. Cold weather in Europe, including freak snow blizzards in Madrid, added further upward pressure on global LNG prices. The chemicals index was up by 4.7% as global ethylene markets had a busy start to 2021. US supply outages were high with several plants delaying the restart after Christmas shutdowns. This tightened the supply/demand balance and sent ethylene spot prices to 44 cents/pound, from 31 cents/pound a week earlier. Iron ore continued its recent strong price performance as strong Chinese demand led to a 7.3% weekly increase in our ferrous metals sub index.

Markets were unmoved by the political turbulence in the United States and focused instead on the prospect of a sustained global economic recovery. Despite weaker US non-farm payroll data, COVID-19 vaccine rollouts seemed to dominate trading sentiment. The key for commodity markets in the near term will likely be how supply chains recover from a challenging winter. An answer may be apparent immediately after the Lunar New Year holidays when Asian markets return from their normal seasonal lull. This said, the sustained strength in commodity prices over the past six months foretells a rise in goods price inflation during the first half of 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-here-we-go-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-here-we-go-again.html&text=Weekly+Pricing+Pulse%3a+Here+we+go+again+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-here-we-go-again.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Here we go again | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-here-we-go-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Here+we+go+again+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-here-we-go-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}