Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2018

Weekly Pricing Pulse: Iranian crude supply drives oil prices to multi-year highs

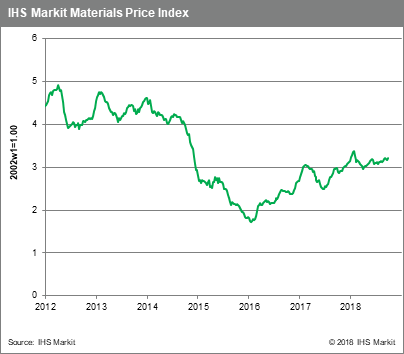

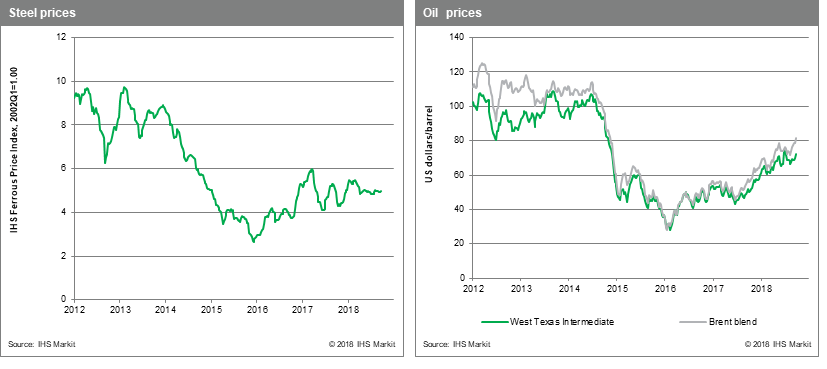

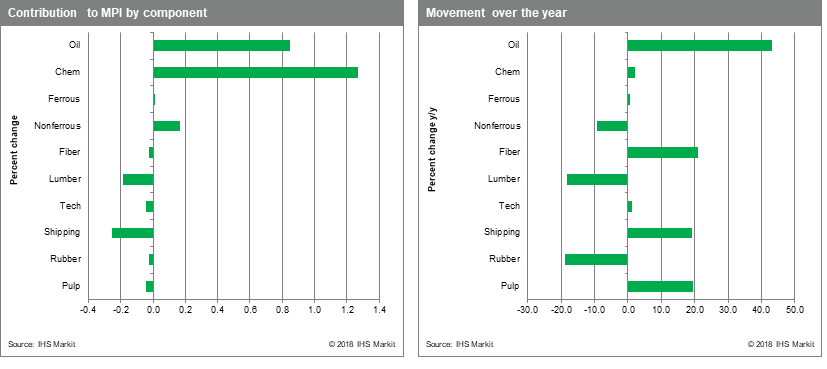

Fear about too little supply has gripped oil markets recently and caused crude prices to surge 4.4% last week. Chemical prices moved in sympathy with oil and rose an even stronger 5.2%. Although more broadly commodity prices continue to be soft, the strength seen in the petro-chemical complex was enough to drive the IHS Markit Materials Price Index (MPI) 1.7% higher for the week.

Apart from oil and chemicals, only the MPI's non-ferrous metal sub-index rose last week. Steel making raw materials showed no change in prices, while the other six components of the MPI all fell. Lumber prices dropped another 9.1% last week after plunging 13% the week before, while dry bulk charter rates declined 5.8%.

Commodity markets for the most part shrugged off the US Federal Reserve's latest increase rate increase last week, even though Chairman Powell's statement at the conclusion of the FOMC's meeting clearly signalled a December rate hike in addition to a series of rate increases in 2019. The end of the week also brought some welcome news on trade with the announcement of a successful renegotiation of NAFTA. The agreement still requires a clarification on the section 232 steel and aluminum tariffs for Mexican and Canadian imports. But the fact that Canada is party to the new agreement was enough to buoy many emerging market currencies and produce a Friday bounce in many commodities. Still, the slow rise in US interest rates and the challenges facing the Chinese economy remain significant headwinds for commodity markets looking into 2019.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-iranian-crude-supply.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-iranian-crude-supply.html&text=Weekly+Pricing+Pulse%3a+Iranian+crude+supply+drives+oil+prices+to+multi-year+highs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-iranian-crude-supply.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Iranian crude supply drives oil prices to multi-year highs | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-iranian-crude-supply.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Iranian+crude+supply+drives+oil+prices+to+multi-year+highs+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-iranian-crude-supply.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}