Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 22, 2021

Weekly Pricing Pulse: Material prices continue their downward slide amid concerns about softening demand

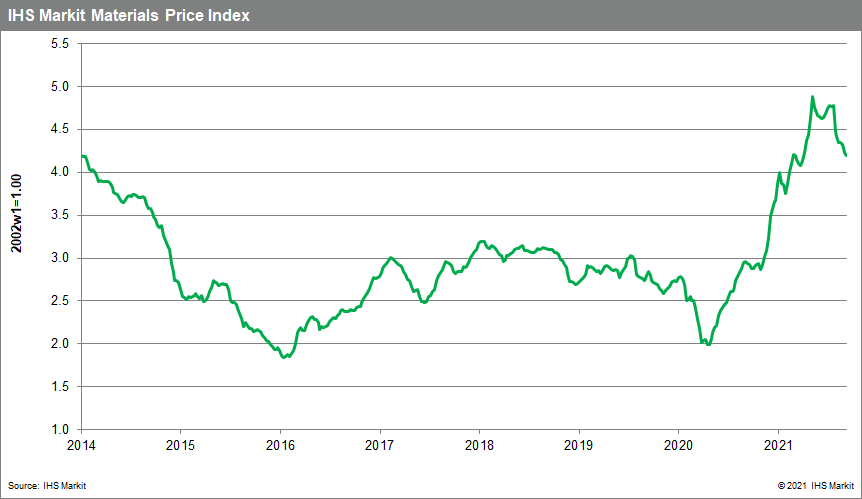

Our Materials Price Index (MPI) fell another 0.8% last week, the seventh consecutive weekly drop. As has been the case in recent weeks, movement in the subcomponents was mixed, with four categories rising and six declining. With last week's drop, the MPI is now down 14.2% since peaking in early May.

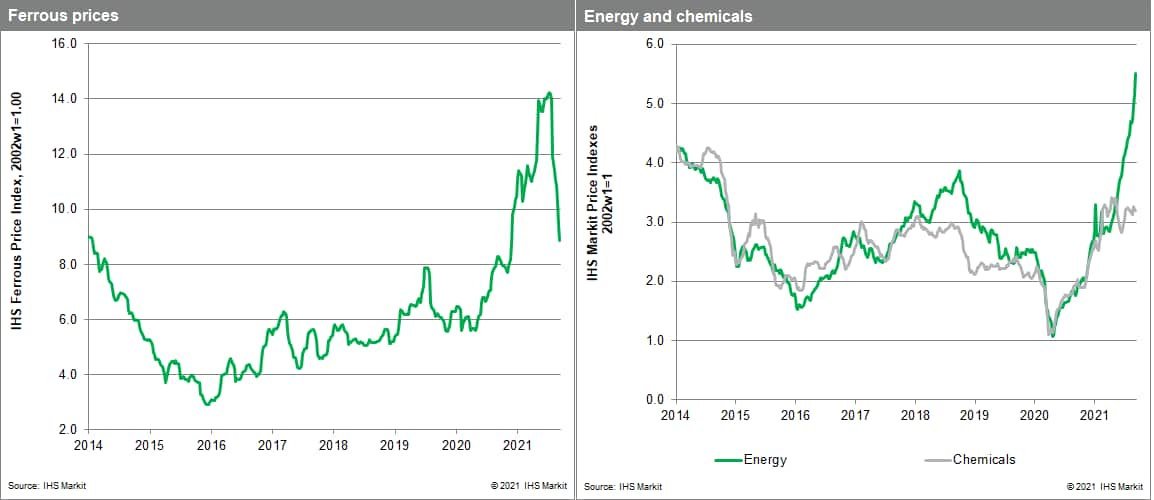

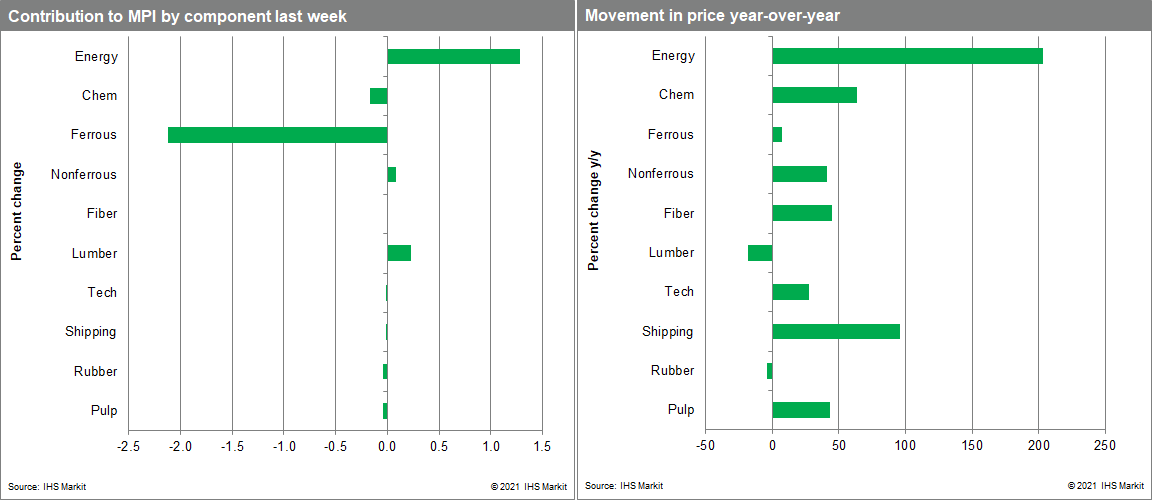

Iron ore prices were once again the catalyst for the drop in the MPI. Production controls in mainland China have increased worries about demand for iron ore. At the same time, major iron ore exporters have increased output in recent months, leading to a market that looks far better supplied in the near-term. The result has been nine consecutive weekly declines in iron ore prices. The third quarter is the seasonal peak for a few of the major exporters, however, so we expect volumes to gradually recede through the end of the year. Natural gas prices again lifted the energy component of the MPI. The 6.8% increase in the energy index was propelled by a 17% weekly climb in natural gas prices. Liquefied natural gas (LNG) import prices have doubled since early July in Europe. With depleted stocks in Europe, weak pipeline imports from Russia, and strong LNG demand in Asia, European traders have pushed prices to record levels. The tight market entering winter suggests elevated prices will last through much of the near term. Lumber was the other notable mover, jumping 11% last week; still, prices remain well below the elevated levels from the first half of the year.

Although we have been expecting a change in commodity markets for some time, our expectation has that this change would emanate from the supply-side of markets as production disruptions and supply chain bottlenecks were resolved. Instead, recent price declines are mostly the result of demand weakness; to date, we have not seen real improvement on the supply-side of markets. While we, therefore, believe commodity markets have more downside potential, this lack of improvement on the supply-side leaves markets with some upside risk as the pandemic recedes next year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-material-prices-continue-slide-softening.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-material-prices-continue-slide-softening.html&text=Weekly+Pricing+Pulse%3a+Material+prices+continue+their+downward+slide+amid+concerns+about+softening+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-material-prices-continue-slide-softening.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Material prices continue their downward slide amid concerns about softening demand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-material-prices-continue-slide-softening.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Material+prices+continue+their+downward+slide+amid+concerns+about+softening+demand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-material-prices-continue-slide-softening.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}