Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 13, 2019

Weekly Pricing Pulse: More bearish macro data proves too much for commodity prices

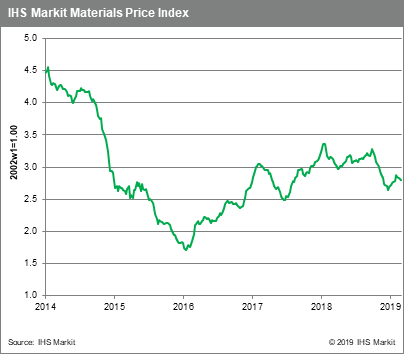

A series of weak macro data points alongside geopolitical developments and a stronger dollar continued to pummel commodity markets in March. Last week's disappointing US jobs numbers and data on Chinese exports, coupled with the European Central Bank's warnings and cautious outlook for the Eurozone, helped undermine sentiment and sent our Materials Price Index (MPI) down 0.4%, its fourth consecutive weekly fall.

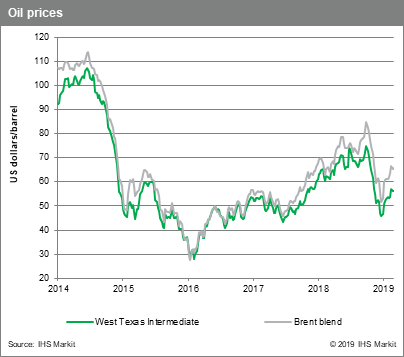

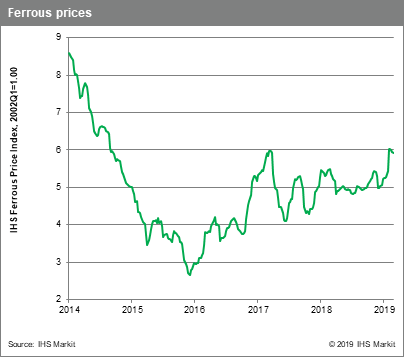

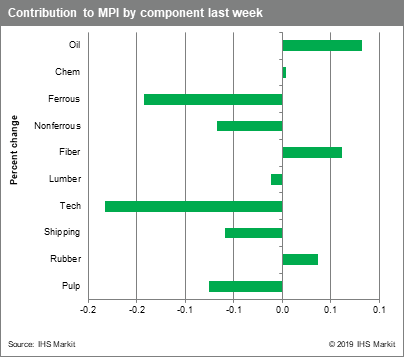

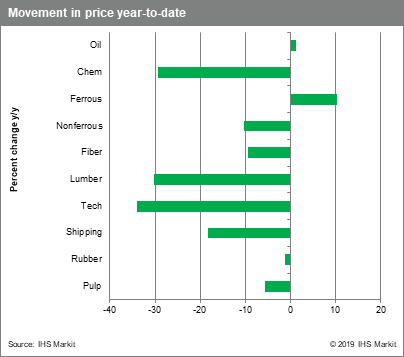

The bearish undercurrent in markets helped to pull six of the MPI's ten components down. After showing strength the previous week, non-ferrous prices pulled back from recent February highs by retreating 0.9%. Oil prices ticked up 0.5% last week, as the drill rig count in the U.S. fell for a third consecutive week and new reports emerged of oil producers trimming budgets in 2019. The ferrous index softened 0.5% w/w, as iron ore prices fell towards $83 /t on soft Chinese data and indications that weak buying recently has driven iron ore inventories to a six-month high, despite disruptions to Brazilian supply. Freight prices fell 2.1% last week, as bulk freight volumes remain tepid. Recently hit by both a Chinese import ban on Australian thermal coal and the Brazilian iron ore accident, charter rates for bulk carriers have fallen 27% since the start of the year.

After enjoying a nice run from early January through mid-February, commodity markets have become uneasy. The early year improvement in sentiment and reduced volatility remained at odds with fundamentals, which have continued to look lackluster, especially in manufacturing. Another dose of reality looms with the Brexit deadline rapidly approaching, promising to continue the recent choppy pattern in markets into the second quarter.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-bearish-macro-data.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-bearish-macro-data.html&text=Weekly+Pricing+Pulse%3a+More+bearish+macro+data+proves+too+much+for+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-bearish-macro-data.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: More bearish macro data proves too much for commodity prices | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-bearish-macro-data.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+More+bearish+macro+data+proves+too+much+for+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-bearish-macro-data.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}