Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 13, 2018

Weekly Pricing Pulse: MPI moves sideways against a backdrop of uncertain demand

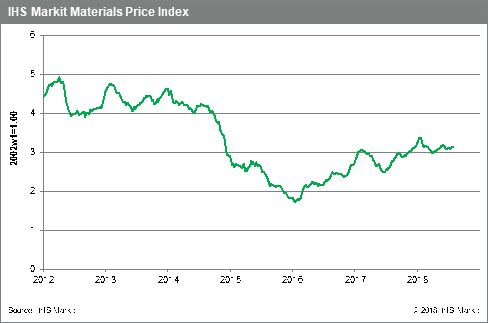

Our Materials Price Index (MPI) was essentially flat last week,

recording only a fractional increase, a lack of change that

accurately mirrored the general mood of uncertainty now hanging

over commodity markets. Seven of the MPI's ten components fell last

week, with a 9.0% plunge in lumber prices standing out. Iron ore,

ocean going freight rates and rubber prices rose, counteracting the

broader decline in the rest of the MPI.

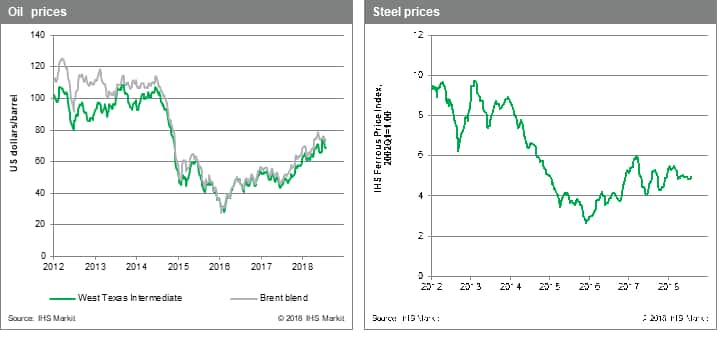

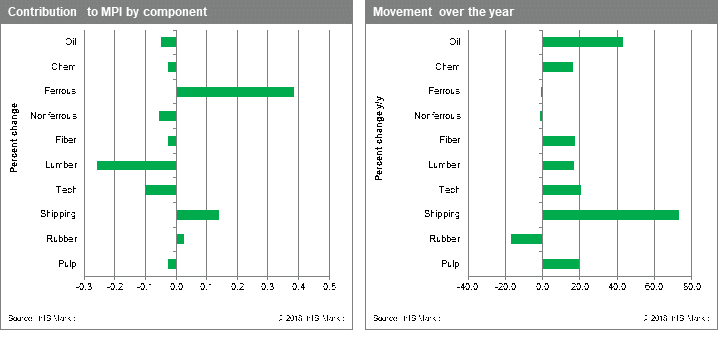

Rising iron ore prices lifted the ferrous price index 1.7%. Ore prices have been strengthening since early July on stronger Chinese steel production and forced consolidation within the sector that has reduced excess steelmaking capacity and closed many lower quality ore mines. Ocean going freight rates are also benefiting from this dynamic as Chinese mills rely more on higher quality imported ore. Charter rates are also seeing a lag effect of high bunker fuel prices. Falling lumber prices were driven by the easing of logistical bottlenecks in British Colombia that has restricted supply in recent weeks.

Data releases last week continue to point to a loss of momentum in global manufacturing. July's headline IHS Markit Manufacturing Purchasing Manager Index, while still showing activity expanding, posted its softest reading since mid-2017. The new orders index the softness since late 2016. Credit markets are also slowly tightening, another change that will act as a headwind to commodity prices going forward. While the Bank of Japan announced last week that it will maintain its policy of extremely low interest rates, and the People's Bank of China is taking steps to provide additional liquidity, yields on US 10-year treasuries touched 3.0% again last week. They are all but certain to push above this threshold in the months ahead given the US Treasury's borrowing needs later this year and the Federal Reserve's anticipated increases in the federal funds rate. Both factors should be supportive of the US Dollar and a negative to commodity prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-moves-sideways-81318.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-moves-sideways-81318.html&text=Weekly+Pricing+Pulse%3a+MPI+moves+sideways+against+a+backdrop+of+uncertain+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-moves-sideways-81318.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: MPI moves sideways against a backdrop of uncertain demand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-moves-sideways-81318.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+MPI+moves+sideways+against+a+backdrop+of+uncertain+demand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-moves-sideways-81318.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}