Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 17, 2019

Weekly Pricing Pulse: The New Year starts well but for how long?

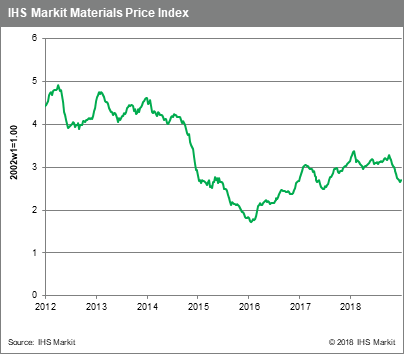

Both commodity and equity markets struck a more positive tone last week, helped in part by a weaker US dollar and positive sentiment coming from US-China trade talks. The net effect was a greater risk appetite in markets, which benefited commodities, sending our Materials Price Index (MPI) up 1.2% w/w.

Indications of an oversold oil market were validated last week as benchmark oil prices rallied 9.5% w/w, with Brent blend crude pushing back above $60 /bbl. Saudi production cuts are supporting prices, though we believe any rebound will tempered by US production growth and concerns about global demand growth. Chemicals prices fell 3.3% last week in a lagged effect of the fourth quarter fall in oil prices. DRAMS prices jumped 4.6% w/w because of technical reweighting in our index to reflect larger sales volumes for higher capacity, higher priced semiconductors. This periodic mix shift was entirely responsible for the index's increase. Rubber prices also showed strength last week, rising 2.7%. Rubber prices have bounced 17.4% since mid-November (from near record lows) on a drop in Chinese inventory and the promise of Thai production cuts by as much as 30%. Most other price moves were fairly muted, showing no clear direction in this uncertain marketplace.

Although commodity markets were

buoyed last week because of optimism around US-China trade

negotiations, hard data on the Chinese economy was not supportive.

Chinese exports in December fell 7.6% m/m and 4.4% y/y, further

reinforcing the picture of a slowing manufacturing sector. China's

trade surplus with the US, however, hit a record $323bn as US

importers pulled forward orders to beat tariff actions. The

question for markets is whether this record 2018 surplus creates an

impediment to on-going trade negotiations and, more importantly,

whether Chinese export orders will slide further in reaction to

last year's "pre-buying" by US customers. The market's better mood

will also be tested by developments in Europe, highlighted this

week by the Brexit vote in Parliament.

Although commodity markets were

buoyed last week because of optimism around US-China trade

negotiations, hard data on the Chinese economy was not supportive.

Chinese exports in December fell 7.6% m/m and 4.4% y/y, further

reinforcing the picture of a slowing manufacturing sector. China's

trade surplus with the US, however, hit a record $323bn as US

importers pulled forward orders to beat tariff actions. The

question for markets is whether this record 2018 surplus creates an

impediment to on-going trade negotiations and, more importantly,

whether Chinese export orders will slide further in reaction to

last year's "pre-buying" by US customers. The market's better mood

will also be tested by developments in Europe, highlighted this

week by the Brexit vote in Parliament.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-new-year-starts-well.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-new-year-starts-well.html&text=Weekly+Pricing+Pulse%3a+The+New+Year+starts+well+but+for+how+long%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-new-year-starts-well.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: The New Year starts well but for how long? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-new-year-starts-well.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+The+New+Year+starts+well+but+for+how+long%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-new-year-starts-well.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}