Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2020

Weekly Pricing Pulse: Oil helps drive commodity prices higher

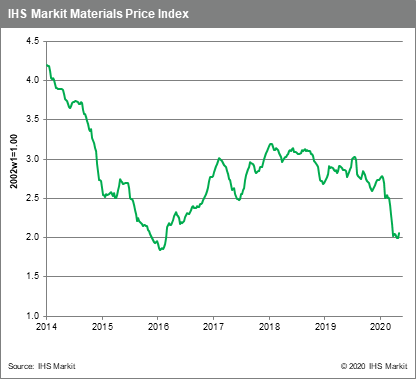

Our Materials Price Index (MPI) rose 3.4% last week even with a backdrop of bearish economic data points. Most of last week's bounce can be tied directly or indirectly to energy markets. Still, the MPI has been relatively stable since late March, a hint, perhaps, that the worst of the COVID-19 pandemic may be over.

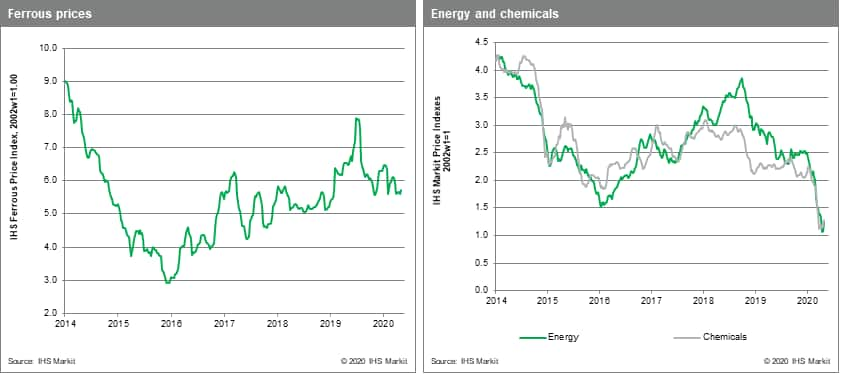

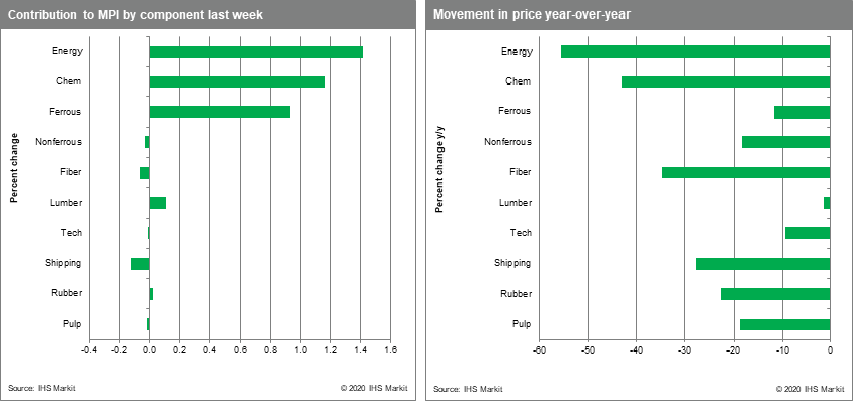

A strong 16.4% rise in the energy sub-index was chiefly responsible for moving the MPI higher last week. The increase in energy prices was driven by a massive 49.9% jump in crude oil prices. Oil markets responded to two data promising lower supply: OPEC+ production cuts are beginning to take effect and a decade low US rig count points to potentially large a reduction in US crude production in the year ahead. Chemical prices also saw a sizeable jump last week with the MPI's chemical sub-index increasing 7.7%. Ethylene prices rose 13.6% and with benzene prices 10.7%. While ethylene and benzene have rallied globally, both are notably strong in the US where higher gas prices have caused prices to increase. Lumber prices rose 3.8% on improved US demand and continuing restricted supply. Ferrous prices rose 2.1% as iron ore inventories in China fell to 111 MMt, below the 2019 low of 114 MMt, as Chinese demand remains firm.

The rise in commodity prices last week came despite more downbeat economic news. In the US, initial claims for unemployment insurance rose another 3.16 million. While this was the smallest figure in seven weeks, it would still have easily set a 50-year record prior to March. The US unemployment rate for April also rose to 14.7%, the worst reading since the Great Depression of the 1930s. Finally, the IHS Markit Global Service Purchasing Manager Index and Global Composite (Manufacturing + Services) index both recorded all-time lows in April, highlighting once again the severity of the contraction in economic activity worldwide. Still, it was selected data from China that shows some improvement in manufacturing activity and the phased re-openings in a handful of European economies last week that lent commodity markets support, giving hope that a true improvement lies ahead this summer.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-helps-drive-commodity-prices-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-helps-drive-commodity-prices-higher.html&text=Weekly+Pricing+Pulse%3a+Oil+helps+drive+commodity+prices+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-helps-drive-commodity-prices-higher.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Oil helps drive commodity prices higher | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-helps-drive-commodity-prices-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Oil+helps+drive+commodity+prices+higher+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-helps-drive-commodity-prices-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}