Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 02, 2020

Weekly Pricing Pulse: A relaxed inflation target from the Fed gives commodities fresh boost

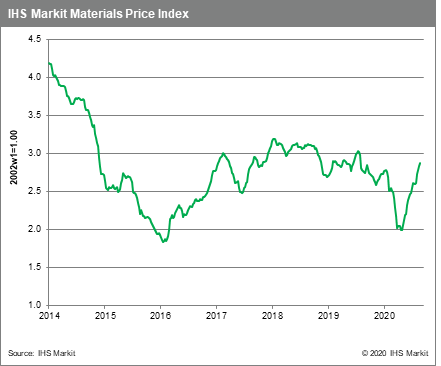

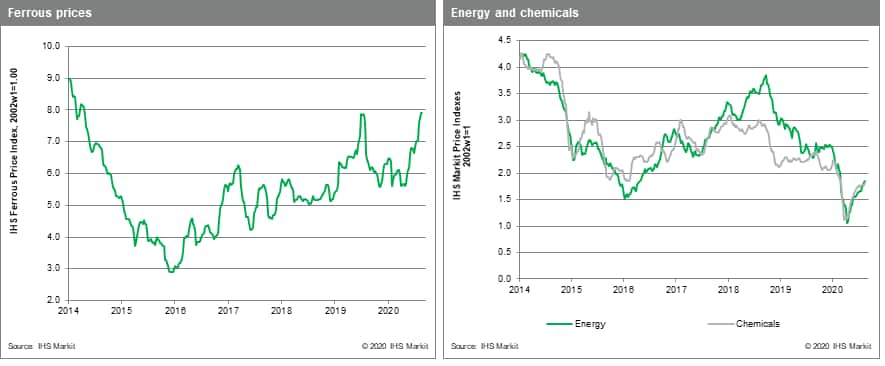

Commodity prices, as measured by our Materials Price index, rose 1.3% last week in another concerted, broad based move. The announcement around targeted inflation rates from the Fed cheered markets but growing second waves of COVID-19 infections around the world and waning government stimulus may have a dampening effect on commodity prices.

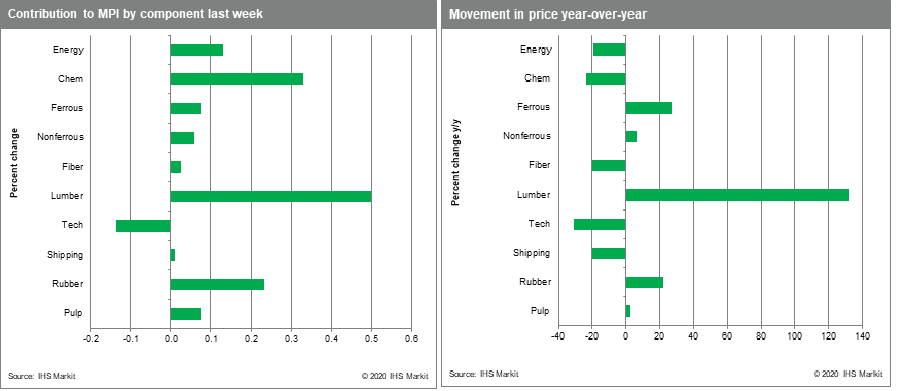

Lumber and rubber stood out last week rising 10.1% and 7.1%, respectively. We have covered Lumber's impressive rally, which continues to mark all-time highs. September lumber futures hit $928 /mbfm last week with no respite in sight as shortages continue to grip the market. The rubber rally accelerated last week, with prices advancing for a tenth consecutive week. Prices have risen strongly due to a combination of supply shortages and expectations around improving global demand. Price rises are, however, expected to remain capped due to reduced auto production. Chemicals prices moved 2.1% higher from strength in polyethylene and benzene, production of which has been knocked off-line temporarily because of Hurricane Laura in the US. Last week's sole decline was in the DRAM index, which fell a massive 27.6% entirely driven by a change in product-mix. Spot prices for 8GB DRAMs (low-volume and high price relative to other 8GB types) have been discontinued, which pulled the average 8GB price down by around 40%.

The rally in the MPI continues to be supported a suite of bullish drivers that have fuelled much of the rebound since end-April: optimism that the worst of the COVID-19 is behind us, a weaker US dollar and optimism surrounding supportive monetary and fiscal policies. Commodity prices responded well to the announcement by the US Federal Reserve, that, due to inflation undershooting targets in recent years, it will permit inflation to run above target, perhaps raising expected average inflation going forward. It also added that if inflation exceeded the 2% target level, it would not necessarily move to tighten immediately over concern about potentially undermining a recovery and to compensate for long periods of below-target inflation. Although this policy change had been telegraphed for some time, the US dollar softened, adding more momentum to the on-going rally in commodity markets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-relaxed-inflation-fed-commodities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-relaxed-inflation-fed-commodities.html&text=Weekly+Pricing+Pulse%3a+A+relaxed+inflation+target+from+the+Fed+gives+commodities+fresh+boost+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-relaxed-inflation-fed-commodities.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A relaxed inflation target from the Fed gives commodities fresh boost | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-relaxed-inflation-fed-commodities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+relaxed+inflation+target+from+the+Fed+gives+commodities+fresh+boost+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-relaxed-inflation-fed-commodities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}