Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 09, 2020

Weekly Pricing Pulse: Sharp sell-off in equities markets not mirrored in commodities

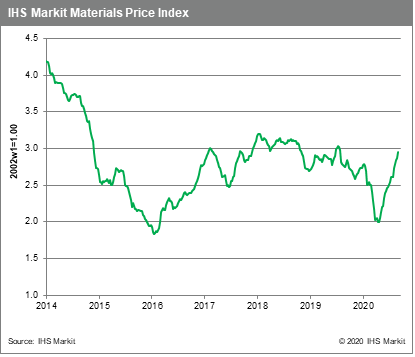

Our Materials Price Index increased 2.6% last week in a broad-based move largely unaffected by a volatile week in other markets. The recent spectacular Tech fuelled rally in equity markets finally underwent a sharp correction after weeks of back-to-back gains. With commodity prices also looking expensive relative to global industrial activity, a correction would seem overdue, but China's demand is currently holding sway.

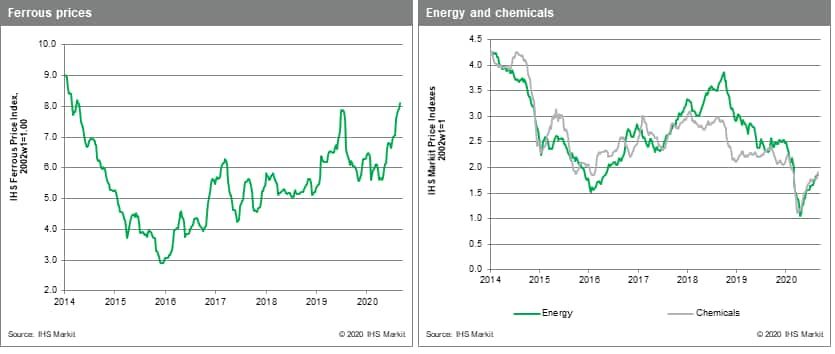

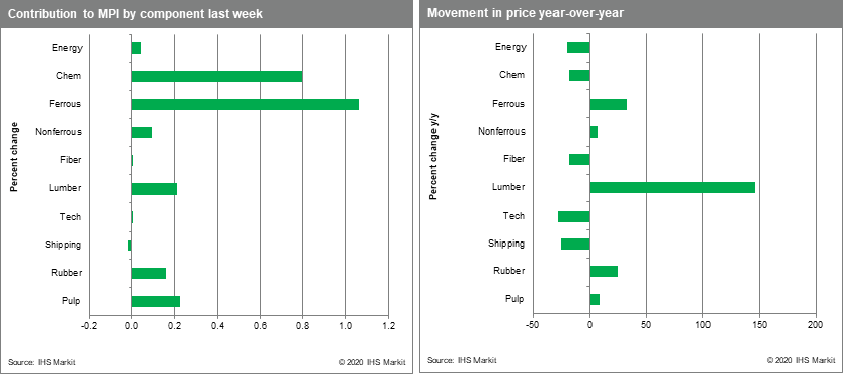

Chemicals prices lead the MPI higher rising 5.0% as US refinery infrastructure recovers from the impact of Hurricane Laura. No major damage was sustained with a number of sites opting to halt production to safeguard assets, which pushed ethylene prices 11.4% higher globally. Propylene also rose but less strongly, increasing 1.6%. Prices in the US actually fell 4.7% on retreating natural gas prices. Energy prices as a group nudged up 0.4%, driven mainly by a 14.3% increase in Asian LNG prices and a 1.3% rise in coal prices. Crude oil fell 2.0% last week on persisting demand fears. Refiners have begun fall maintenance schedules but rising COVID-19 case counts in Europe (and elsewhere) raises the threat of fresh lockdown measures, a red flag for liquids demand. Steel raw materials prices rose 2.6% with iron ore setting another six-year high of $130 /Mt. Scrap prices also rose 1.6% as Turkish prices near January highs once again. Pulp and rubber prices rose 5.8% and 4.7%, respectively, as Chinese demand continues to outperform. Rubber prices are now up 25.3% year-to-date.

Although commodity markets continue to perform robustly, their rebound looks to lose some momentum in the near future. Waning government stimulus, satisfied pent-up demand, the threat of COVID-19 second waves, US-China trade tension and growing uncertainty in Europe due to stagnant Brexit talks, all point to some fading in manufacturing's recent bounce. Still, optimism persists regarding China, where President Xi Jinping last week outlined a part of China's next five-year economic plan. Whether China alone can continue to power commodity markets remains to be seen. For now, markets feel that it can.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-sharp-selloff-equities-markets-commodities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-sharp-selloff-equities-markets-commodities.html&text=Weekly+Pricing+Pulse%3a+Sharp+sell-off+in+equities+markets+not+mirrored+in+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-sharp-selloff-equities-markets-commodities.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Sharp sell-off in equities markets not mirrored in commodities | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-sharp-selloff-equities-markets-commodities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Sharp+sell-off+in+equities+markets+not+mirrored+in+commodities+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-sharp-selloff-equities-markets-commodities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}