Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 06, 2021

Weekly Pricing Pulse: Soaring energy prices send commodities higher

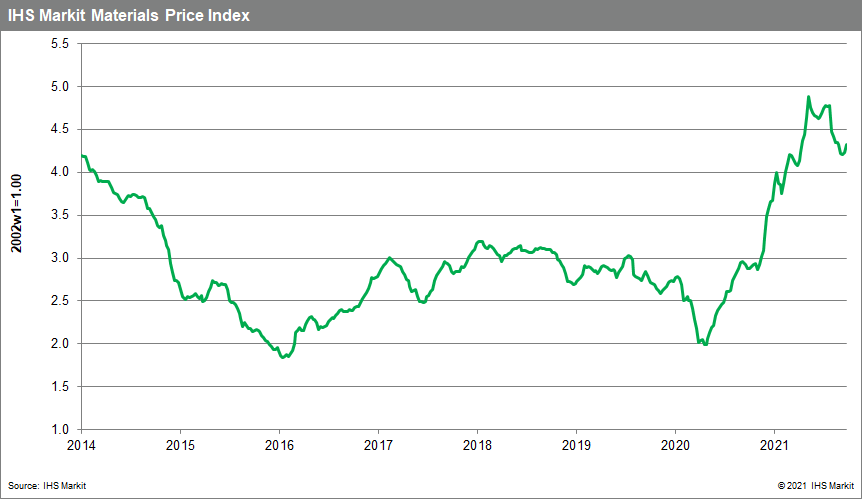

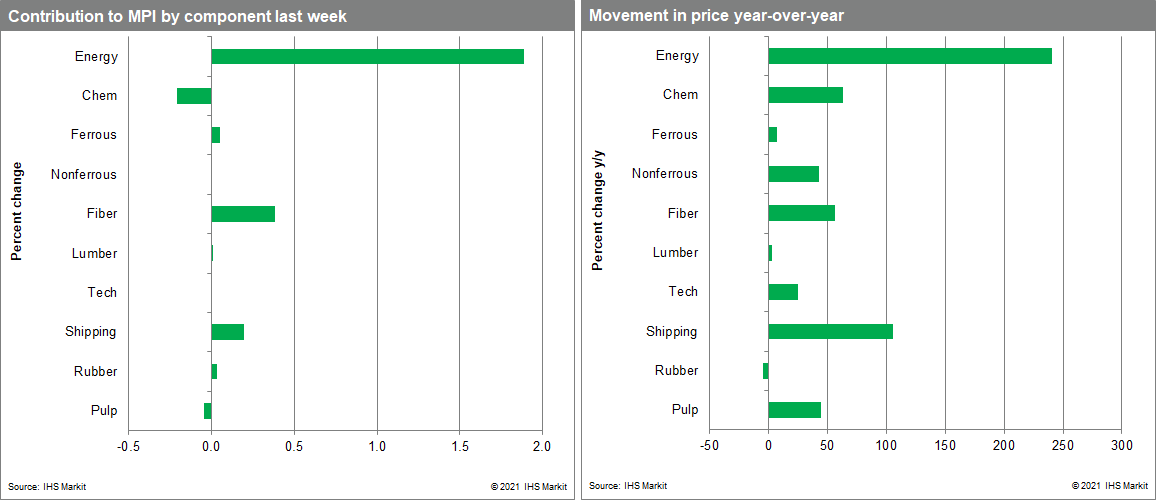

Our Materials Price Index (MPI) increased 2.3% last week, reversing the recent pattern of declines. Price movement was mixed with six of the ten MPI sub-components up last week. This latest move means commodity prices stand 50% higher than this time last year.

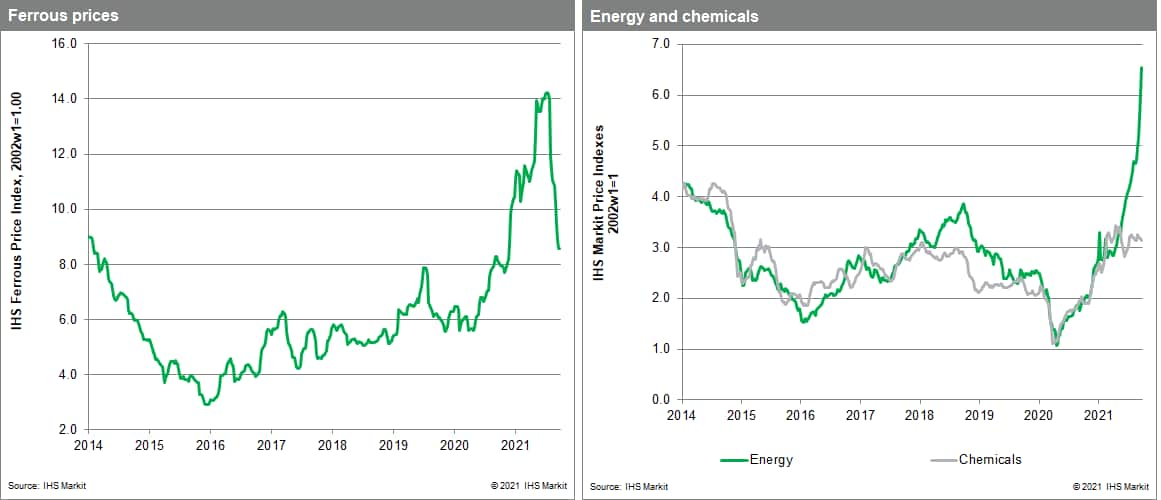

Soaring energy prices firmly halted the downward momentum of commodity prices last week. Coal and natural gas prices have been rising rapidly in recent weeks and have now been joined by rising oil prices. Our energy sub-index climbed 8.6% as a result. The UK spot landed prices of liquefied natural gas (LNG) climbed to $30/MMBtu an historic high while the Japan spot landed price for LNG reached $32/MMBtu, also a record. Rising gas prices have increased buyer interest for oil causing Brent crude, the international benchmark, to breach $80 for the first time in three years. Iron ore prices also appear to have reached a floor - after falling for ten weeks - further easing recent downward pressure on the MPI. The price of iron ore settled at $120 per tonne having been as high as $220 a tonne in July. With metal markets stabilizing and tight conditions in energy markets entering winter elevated prices will last through much of the near term.

The increase in the MPI coincides with fresh concerns over slowing economic growth and higher inflation, i.e., stagflation. September data from IHS Markit's Purchasing Manager Indexes show the global recovery losing some momentum with recent softness in mainland China-related to mandated cuts in electricity consumption of particular concern. It has been mainland China's manufacturing sector that has acted as a reliable as supply base for global goods industries during the pandemic. With disruptions and bottlenecks in supply chains creating much of the inflation pressure in the global economy today, problems in China's manufacturing sector and higher energy prices point toward an uncomfortable fourth quarter for central bankers.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-soaring-energy-prices-commodities-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-soaring-energy-prices-commodities-high.html&text=Weekly+Pricing+Pulse%3a+Soaring+energy+prices+send+commodities+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-soaring-energy-prices-commodities-high.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Soaring energy prices send commodities higher | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-soaring-energy-prices-commodities-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Soaring+energy+prices+send+commodities+higher+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-soaring-energy-prices-commodities-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}