Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 01, 2023

Weekly Pricing Pulse: A tepid Asian market ushers commodity prices lower

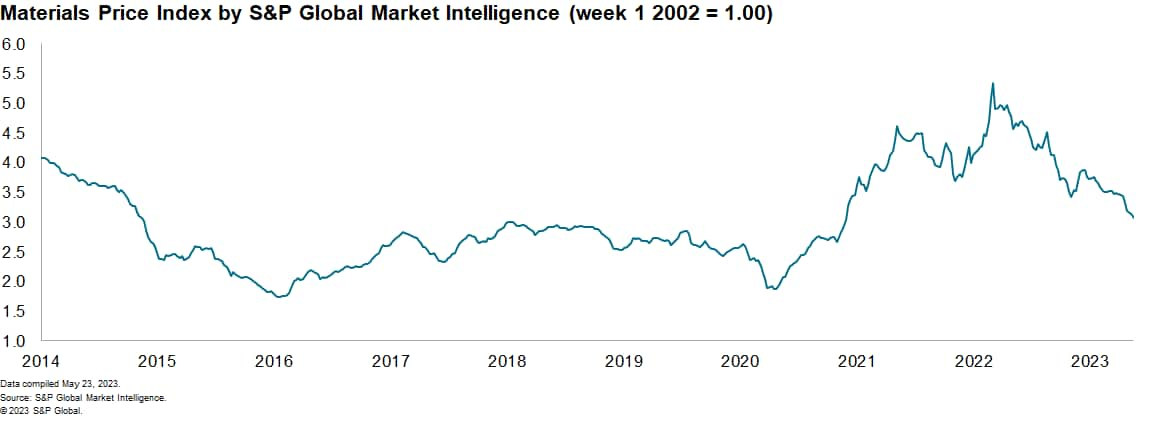

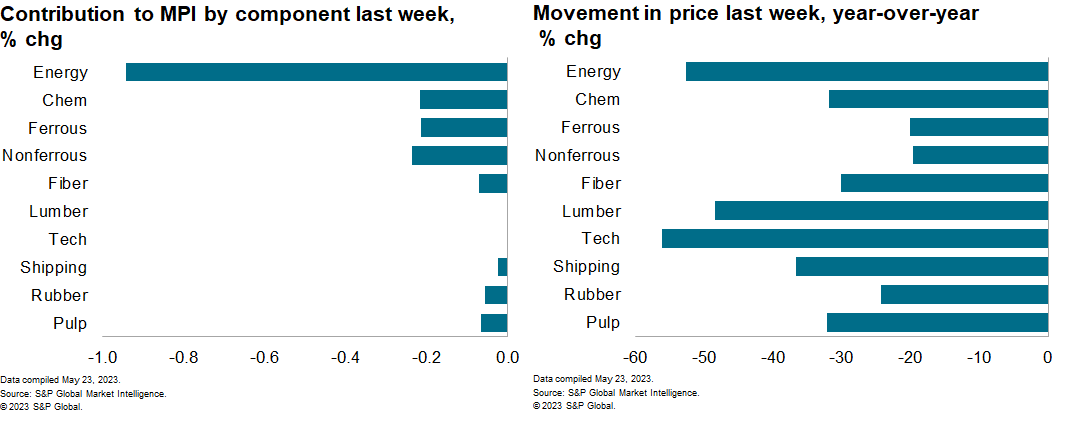

The Materials Price Index (MPI) by S&P Global Market Intelligence decreased 1.8% last week, the eighth consecutive weekly decline and the tenth out of the last twelve weeks. The decrease was broad, as 9 of the ten subcomponents fell. There have now been 16 week-on-week declines in the MPI in 2023, with only 5 weeks seeing increases. The index sits 34% below its year-ago level.

Nonferrous metals fell 2.4% last week. The decline was broad-based, but the standout is zinc, which fell 7%. Last week's sharp fall is part of a broader story for zinc of tepid demand out of mainland China. Zinc inventories have been growing, with the London Metal Exchange now seeing their Singaporean inventories nearly four times their February levels, ending the week at 62,975 tonnes. Both copper and tin fell 2.4%, as well. Compounding this was the strength in the dollar last week, which makes dollar denominated metals more expensive for buyers using other currencies and reduces demand. Energy continues its decline, falling 4.8% last week. Liquefied natural gas (LNG) prices in Europe have slipped below $8/MMBtu for the first time in two years. European storage levels remain more than twice year-ago levels, lessening the need for additional refilling. Natural gas demand remains weak in the region following both government policy and industry cost-saving moves during the 2022 crisis. Coal prices fell just under 10% last week, due both to full European stockpiles and weaker than expected Asian economic performance.

Global economic growth concerns continue to weigh on markets. Inflation remains stubborn and indications of progress regarding the US debt ceiling only came late last week, meaning that markets spent most of the week plagued by concerns. In April, real personal consumption expenditure (PCE) rose 0.5% and durable goods orders rose 1.1%, beating expectations and emphasizing inflation concerns. European inflation may be easing slightly, but year-on-year gains are still high. April saw the UK's CPI increasing 8.7%, above the 8.1% of the Eurozone. These strong numbers in Europe mean that S&P Global Market Intelligence economists expect the region to see further interest rate hikes in the coming month. Higher interest rates, lower Chinese output, and globally weak demand will lead to lower commodity prices through this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tepid-asian-market-commodity-prices-lower.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tepid-asian-market-commodity-prices-lower.html&text=Weekly+Pricing+Pulse%3a+A+tepid+Asian+market+ushers+commodity+prices+lower+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tepid-asian-market-commodity-prices-lower.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A tepid Asian market ushers commodity prices lower | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tepid-asian-market-commodity-prices-lower.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+tepid+Asian+market+ushers+commodity+prices+lower+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tepid-asian-market-commodity-prices-lower.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}